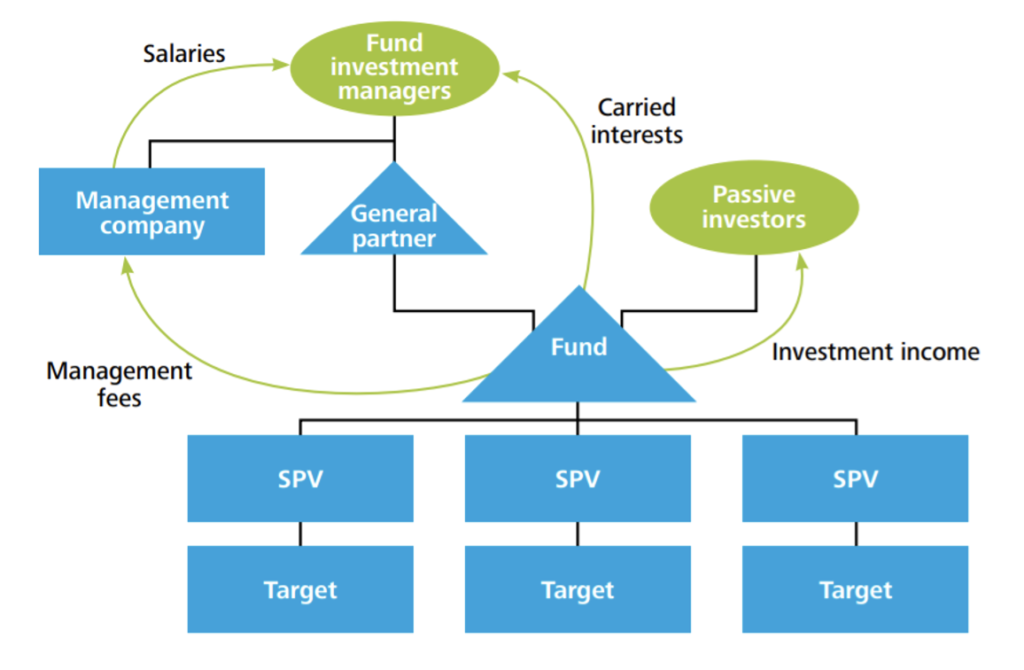

Private Equity is given by the relation between passive investors and the fund’s investment managers. The fund is the instrument that’s used to receive investments and it is used as a budget when investments are made for the benefit of the investors. This is a simple illustration of how a basic PE fund operates:

The PE fund managers contribute a little percentage to the fund’s capital and retain a management fee through a management company (the fee is given by a percentage of the total capital committed) and a carried interest fee on profits given to the investors. The passive investors can be financial institutions, individuals, and pension funds. The management company is set up as an intermediary which act provides consultancy to the fund on an array of operations. Lastly, SPVs (special purpose vehicles) are holding companies that are set up for operational purposes.

Among the private equity funds investing in China, we can identify 3 main types of funds:

- Offshore non-RMB funds: funds that are set up abroad with foreign investors only

- Foreign-invested RMB funds: fund in China with some foreign investors

- Domestic RMB funds: funds in China with no foreign investor

The denomination of an RMB fund (Renmimbi fund) is simply how the Chinese government requires private equity funds to register as to operate having any type of relations with the country.

Depending upon the type of fund set up, different investment structures are used. Here, the main distinction is to be made between offshore and onshore funds.

- Offshore funds: An offshore holding company holding assets in China is set up. A Special Purpose Vehicle then invests in the offshore holding that often has a 100% interest in an intermediary company in Hong Kong which has a 100% interest in a subsidiary in China. PE funds have to follow this complicated route because it’s difficult to invest directly in a Chinese firm and then to conduct its IPO if that’s the intended form of exit for the fund. Hence, the offshore holding is used to be a listing vehicle for a future IPO. Offshore funds are used when the PE investors intend to exit by conducting an overseas IPO which will be listed on a stock exchange different from the PRC one.

- Onshore funds: In this case, the PE fund can directly invest in a PRC (People’s Republic of China) corporate entity through the medium of an offshore SPV. Onshore funds are used if the PE investors intend to exit by conducting the IPO of the target company on a PRC stock exchange.

Increasing interest

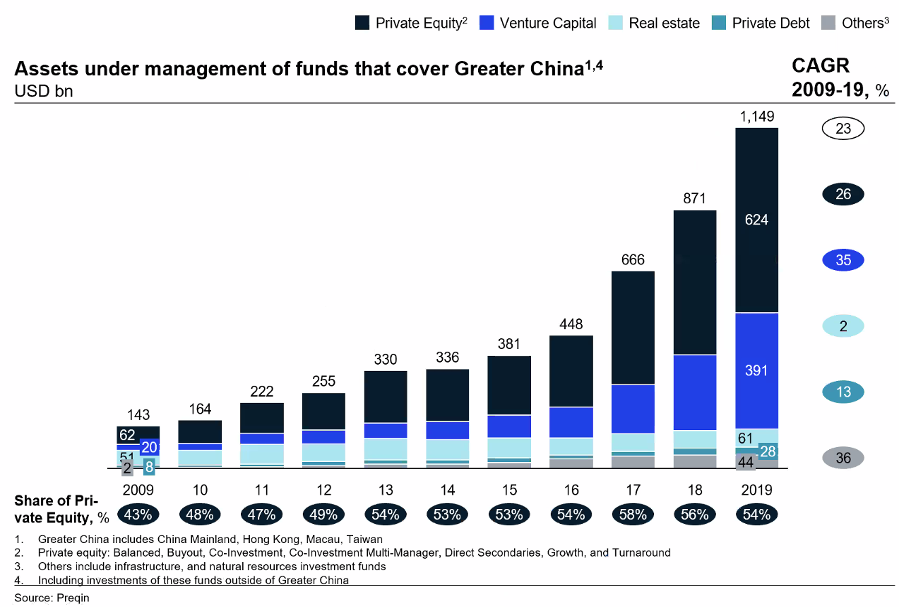

The private equity market of China has matured substantially over the last years. Analysts expect the trend to continue thanks to the rapid growth of the Chinese economy and the increased recognition that private equity can bring to Chinese companies. However, the regulatory challenge for the industry remains.

The increasing interest in the Chinese Private Equity market came as a result of the funds that are being pumped into the industry by the state’s government. Angel investors who set up funds in the south China tech hub are insured for as much as 40% of their losses, according to Wang Wezhong, the Communist Party Secretary of Shenzhen. This is done through government-guided funds of funds (see our article on funds of funds: https://bspeclub.com/private-equity-funds-of-funds/ ), for which the typical angel investment – 3m yuan -, is negligible in comparison to the enormous sum of 62bn yuan which the state-backed funds have under management.

Several Chinese funds have recently launched their largest US dollar funds. Boyu Capital, led by the grandson of a former Chinese president, is raising a $6bn fund. Primavera, led by the former chair for greater China at GS, is targeting a $5bn fund. Baring Private Equity Asia is raising $8.5nb and the Hong Kong-based Hillhouse Capital is targeting $13bn. KKR, an American global investment company, is raising $15bn for another fund to be allocated in the Asia-Pacific market. According to data provided by Preqin, the recent interest in China has increased the average fund size from $415m in 2020 to over $756m in 2021.

Funds seem to be recognizing a hidden potential in the Chinese companies. Needless to say, these massive investments may very well be part of a herding effect which would easily lead to overvaluation and ultimately a devastating economic bubble.

Benefits and challenges

Some of the benefits given by investing in China include:

- Growing investment opportunities: As China continues to grow as an economy, competition and entrepreneurial activity will rise. This certainly implies an increasing number of firms performing at their best in order to receive funding from private equity funds. Besides that, as global private equity funds keep investing in China even slow-growing companies will become potential private equity targets. Hence, the opportunities horizon will grow for PE funds.

- Growing convertibility of the Yuan: The tradability of the RMB has been enhanced by the inclusion of the yuan in the International Monetary Fund’s Special Drawing Rights basket.

- Great returns: Analysts have confirmed how the Chinese PE markets private higher ROIs than most opportunities abroad.

- Growing capacity to scale private equity: A PE fund has many opportunities for expansion in China due to the large size of the economy. This is further enhanced by the diminishing gap between the rich and the poor, the opportunities created by projects such as “Made in China 20205” and the excellent introduction of online sales channels in the market.

Some of the challenges faced by the PE funds in China include:

- Currency risk: Until 2005, the RMB was pegged to the USD and was considered stable. However, then the Chinese politics set up a managed floating system by allowing the currency to float in a determined range only. This implies that if the RMB breaches the range, the government steps in and stabilizes the currency. Needless to say, the system increases volatility, fails to show the true value of the currency, and ultimately, lets the government devalue or appreciate the currency without warning. Hence, foreign investors face high currency risks when investing in China.

- Country risk: There is a lot of uncertainty related to the regulatory approval process in China as the regulatory decision doesn’t consider just financial/political factors but also cultural factors such as nationalism.

- Exit risk: There is a very high chance that a foreign investment gets trapped in the Chinese PE investments. The scenario is complicated by the fact that investors are usually minority stakeholders in China rather than being majority shareholders (as is usually the case abroad). This certainly sets up barriers for exit flexibility as the minority stakeholders first need to reach an agreement with the management of the target company.

- Legal risks: Target companies often don’t respect the contracts with foreign PE investors as they believe contracts are negotiable long after the execution. The problem is enhanced by the lack of a corporate judicial system in China.

- Corporate governance risks: Foreign investors often face conflict with the existing board members in the structuring phase because of the differences in management style.

- Investment risk: This risk is considerably rising in the Chinese market because of the overvaluation of target firms. This is caused by the fact that several large PE funds are chasing after a small number of target companies.

Government intervention and conflicts of interest

After several years of bumper deal making and loose monetary conditions, new regulations made it harder and harder for banks and insurers to invest in the private Chinese market. Thus, in 2018, liquidity began to dry up. In response, “government-guided” funds set up by local governments and national ministries, began to rise. Local authorities were incentivized to launch such investment vehicles to lure start-ups in their city, along with talent, technology and tax revenues. As a result, state financing is becoming ubiquitous in the country’s Private Equity sector, with some reports suggesting that state backed funds hold more than 90% of the money in Chinese funds of funds. According to the state’s media, learning to deal with government funds is now a “required course” for PE managers.

Some degree of political influence is now inevitable, but whether it is beneficial or not is still up to debate. Some advisers claim that state fund managers often understand local policy objectives and can steer investors in the right direction. However, there have been cases in which it has gone too far: Shenzhen Capital, a huge state fund, posted pictures on its website of a meeting held in December where the 42 companies it had invested in launched a Communist Party committee, as a way to imbue private companies with party ideology. For some on Wall Street, navigating political uncertainty in China isn’t worth the risk. Third Point, a New York-based hedge fund, said that it has sold out nearly all its investments in China on the chance that the government will continue to exercise its power over the financial markets.

Due to a lack of in-house talent, most investors have acted as Limited Partners(LPs) in private-sector funds, and some clear conflicts of interest have surfaced. According to one of China’s top venture-capital investors, government funds are “squeezing out other LPs”. Unlike their American counterparts, for which the main goal is to produce hefty returns for LPs, state investors are mainly trying to engineer a windfall in local tax revenues by attracting new companies, especially tech groups. “Balancing these interests can lead to tensions”, says one China-based investor, and often results in investments hingeing on whether or not a company is willing to move to a specific city. Some even fear such problems could gradually lower overall returns for private-sector investors, with government funds dispensing the middlemen and doing their own direct investing. Several large government funds have been recruiting from private-sector banks and law firms, bolstering their ability to cut deals. “They are started to compete with us directly”, says a venture-capital investor.

Conclusion

For now, accessing the Chinese industry has worked well for many private funds. Many U.S. investors remain bullish on China’s long-term prospects despite what sceptics say is the difficulty of anticipating Chinese President Xi Jinping’s moves. They claim that the market is healthy, as private and state capital is channelled to better fund managers, and they can’t afford to miss out on the growth of an economy on track to overtake the U.S. as the world’s biggest. It will be intriguing to see how the government and investors will be able to navigate this relationship and pursue returns in a mutually beneficial manner, how Beijing’s regulatory crackdown will affect the market, and whether bulls are right or the fear of missing out is clouding their judgement.

Authors : Constantin Popescu , ArshDeep Singh

Editors : Tara Morgan

Sources :

https://bspeclub.com/private-equity-funds-of-funds

Comments are closed.