By Michele Conte and Leonardo D’Onghia

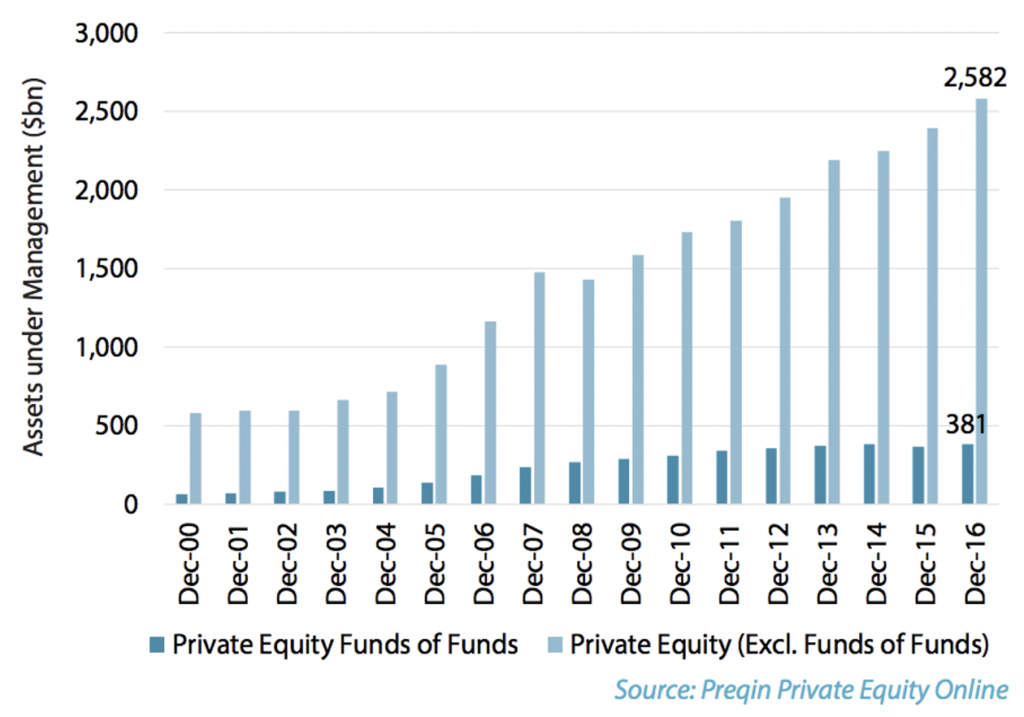

Funds of Funds are PE vehicles that raise funds intending to invest in other PE funds instead of directly targeting investments in private companies. These funds made up 12.9% of total PE assets under management (AuM) in 2016 (Prequin), although this share has been decreasing since 2010 as funds of funds are enjoying a slower growth compared to other types of PE funds. Indeed, this investment vehicle has grown by 50% from 2009 to 2019 which is significantly less than the 150% growth of traditional PE AuM over the same period (Mergers & Inquisitions). To provide some additional background, the main funds of funds include Hamilton Lane, HarbourVest Partners, Pathway Capital Management, Fort Washington Investment Advisors, AlpInvest Partners, and Adams Street Partners. Here, one can notice the dominance of US-based funds.

Figure 1. PE Funds of funds Asset Under Management 2000 – 2016

These types of fund operate in an analogous way to limited partners in PE funds, taking over the whole process of capital allocation and receiving management fees and carried interest. However, the practitioners specialise in fund analysis instead of deal origination and company analysis, intending to choose the best-in-class while providing diversification. Moreover, Private Equity funds of funds focus on three main activities: i) primary investing, that is targeting new private equity funds that are currently raising capital; ii) secondary investing, which deals with buying stakes in existing private equity funds from other LPs willing to sell their stakes; iii) co-investing with another PE firm looking for other sources of capital.

Over time, funds of funds have consistently recorded a lower-than-average IRR to other types of PE funds (Prequin, Figure 2). This is partly due to the added costs that these funds impose on top of their investment returns. Especially in recent years, new trends are appearing in the industry to create a more appealing value proposition.

First, funds are increasingly targeting new funds and first-time fund managers who are betting on high (unexpected) returns while building good relationships with successful managers and leveraging their diversified position. Second, funds of funds target smaller investors which have limited budgets to spend on alternative investments and thus cannot diversify themselves due to the high entry volumes that are required by traditional PE funds. In this context, funds provide added value compared to consulting companies that just deliver investment advice because they pool investor money together. Third, the market is concentrating in the hands of larger funds that can better exploit the key economies of scale including relationships and expertise pooling.

Figure 2. Private Equity – Horizon IRRs by Fund Type (As of December 2016)

Furthermore, a compelling reply to the scepticism some callow investors may raise about these vehicles and their apparent redundancy can be formulated referring to the benefits they aim to leverage. The cornerstone is surely represented by diversification and the problem it addresses. Large institutional funds, be they in the form of limited partnerships or closed-end funds, may not have enough in-house expertise and capability to research firms in some specific sector or geographical area. Through a fund of funds, diversification is achieved since the investor acquires relatively small interests in several underlying PE funds. Even a single commitment may provide exposure to multiple strategies and businesses. On top of this, it is clear how the experience of professional teams is fundamental in accessing top-performing opportunities, as well as creating partnerships leading to superior returns for the private equity asset class. Finally, as mentioned in the previous paragraph, it is worth highlighting the potentials of economies of scale allowing, for instance, an in-depth business and legal review of prospective investment that otherwise would be burdensome for a single investor.

On the contrary, the reasons why this industry is not getting off the ground relies on a series of downsides, squeezing out any eventual high-growth scenario. First of all, the double-layer of fees and carried interests makes them cost-intensive, consequently reducing the investor’s profits and total returns compared to what could be achieved through mutual funds or ETFs. Indeed, on top of the usual 2-20 scheme typical of PE firms, a PE fund of funds also charges additional management fees and carries, respectively in the range of 0.5-1% and 5-10%. Another drawback is represented by the longer lifetime of the vehicles. This is a crucial point influencing their illiquidity and low attractivity: investors could potentially lock up their money for more than 15 years with the relative opportunity cost of missing other profitable investments. Just to give the idea, of a sample of 40 funds from PitchBook’s database raised in 2000, as of December 13, 2019, only 12 have been fully liquidated 19 years later. Finally, it’s worth pointing out a big problem called “blind pool”. This does not fall in the area of the hands-off approach, but it’s far more extreme. If on one side hands-off PE investors work with the management to set up the key functions – administration, finance and control – useful to monitor the company, on the other side investors putting their money in funds of fund don’t know which PE firms the fund will invest in, or even how decisions will be made.

To conclude, in today’s market, which is characterised by high multiples and low interest rates, PE is losing its share of global M&A transactions. This is related to two facts. First, multiple arbitrages are harder to accomplish as most sectors are fairly high priced. Second, the economics of added value through debt repayment are damaged by the low interests and tight debt covenants which drive down tax shields while not increasing levels of leverage. This context can be described as the situation where “too much money is chasing too few deals”. However, this has not affected the capacity of PE funds to fundraising successfully. The sector is growing despite the rising unemployed capital (dry powder) and some funds are even raising their fees from the famous 2-20 towards 3-30. Can funds of funds thrive in this environment? As long as return-hungry investors will be interested in the higher-than-average returns offered by the PE sector, these vehicles will remain attractive for smaller-scale investors. On the other hand, the increasing costs of the underlying funds and the worrying levels of dry powder might have the effect of creating the threat of a bubble. In fact, given the finite life of these funds and the even shorter investment period available, there is the risk of employing dry powder to overpay deals dragging down IRR and making the overall sector less attractive. In this situation, the first suffering the blow will be funds of funds whose smaller investors will most likely reduce their exposure to the asset class to concentrate on the sectors they know best, turning their backs on these blind pool vehicles.

Authors: By Michele Conte and Leonardo D’Onghia

Editor: Florian Kramer

References:

https://www.mergersandinquisitions.com/private-equity-fund-of-funds/

https://www.privateequityuk.com/private-equity-fund-of-funds/

https://www.canterburyconsulting.com/blog/why-do-investors-choose-fund-of-funds/

Photo by Markus Spiske on Unsplash

Comments are closed.