by Francesco Pezzuto, Tommaso Antoniazzi

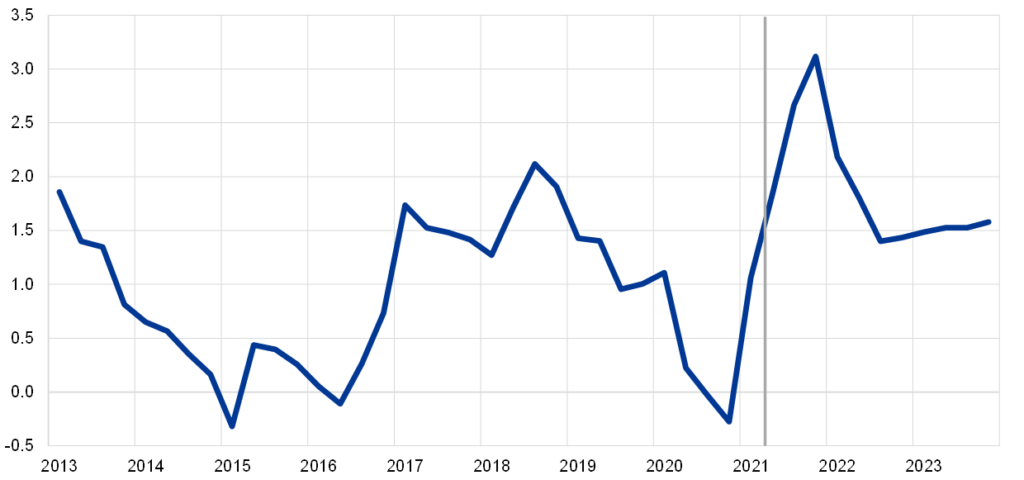

As Jerome Powell announced the intention of the Federal Reserve to start a tapering process to be concluded in the middle of 2022, investors started revising their expectations accordingly on future interest rates and inflation. Indeed, the ultra-expansionary monetary policies implemented to face the COVID-19 crisis inevitably led to an increase in the inflation rate, which rose substantially in 2021. For this reason, and because of the economic improvements reached, the Fed deemed it necessary to gradually reduce the volume of asset purchases.

This article will delve into how higher inflation and higher interest rates will impact the Private Equity (PE) industry and how the latter may adapt to the new macroeconomic conditions. Even though the PE industry deals exclusively with privately held corporations, the increase in inflation may have different effects that must be taken into account.

Impact on firms’ earnings

Firstly, inflation may deteriorate firms’ earnings. Of course, this shall not be generalized to every industry, but the principle is that firms need to pass the higher costs of production to customers.

As prices increase, the prices of factors of production such as wages and raw materials will have upward pressures. The obvious way to deal with this increase in the factor costs is to increase the prices of final goods, thus passing the burden to the final consumers. The main drawback with this practice is an overall lower demand for the goods with higher prices.

However, firms and industries may face the issue heterogeneously.

As Guy Weldon, Bridgepoint’s Chief Investment Officer stated, the fund will pursue target companies enjoying market leadership and markup power to pass on price rises in the case of longer-term inflation.

For instance, market leaders that enjoy pricing power will have an easier life, as they will be able to increase prices without a substantial decline in volumes. For this reason, businesses with strong products and intellectual property will undoubtedly have an advantage. However, those with undifferentiated products and small market share will face major issues in the case of persistent inflation because of little pricing power. Indeed, increasing prices will significantly deteriorate earnings, as the volume of goods sold will decline dramatically. For these reasons, PE funds may consider investing in growth firms with unique products that can flexibly cope and face the market, despite the higher price level.

Impact on Company’s Valuation

Secondly, the increase in inflation and the subsequent tapering may significantly affect companies’ valuation. As the expected interest rates increase, expected dividends will be discounted by higher factors; this may lead to a fall in multiples, decreasing the exit opportunities for PE firms. Growth companies will probably suffer the most in terms of intrinsic valuation because earnings are expected to materialize further down in the future. Therefore, the increase in the discount factors will make them less relevant in the company valuation.

However, Christian Sinding, CEO of the Swedish Private Equity fund EQT Partners, reported that his fund makes long-term investments in non-cyclical industries with strong secular growth trends and, for this reason, is not concerned with the higher level of inflation.

Indeed, he and many other PE investors believe that the high inflation level is only transitory, even though it will be compensated by higher interest rates in the next future.

Moreover, PE can also actively manage the portfolio companies through M&A, better management, geographic expansion, and the time of exit from the investment, thus limiting the negative impact of higher inflation.

Nevertheless, many investors are concerned about a possible recession that high inflation and interest rates may cause. The higher policy rates will contract the economic expansion and decrease GDP in order to bring back total output to its potential level: this would inevitably stabilize inflation on the one hand but trigger a recession on the other. Economic downturns will be challenging for PE funds, as multiples may decline, exit opportunities will be lower, and fundraising will be more problematic. With regards to the latter point, a recession will also create investment opportunities to acquire undervalued firms. The main issue with new acquisitions is that PE firms will often have funding hardships; many investors will shift to lower risk assets and there will be fewer exit opportunities from portfolio investments.

In summary, the ability of PE funds to decide the exit time is important because it allows PE firms to exploit positive economic cycles to sell portfolio companies at the best conditions.

However, delays in exit could lead to a lower ability of PE firms to raise new funds for further investments.

Impact on Funding

Issues in fundraising lead us to the next topic of our discussion.

One relevant consequence of inflation is the change in the cost of debt, which is calculated as the total interest expense for one year divided by the total outstanding debt of a firm.

In the first stages of inflationary pressures, before Central Banks adjust the interest rates, inflation may be beneficial to PE funds, as they will pay a smaller share of real interest rates.

However, as Central Banks revise the policy rate in order to stabilize the rate of inflation, PE firms will necessarily see their cost of borrowing increase.

This is an important issue for two reasons.

Firstly, firms will be able to raise funds at a considerably higher cost.

Secondly, as pointed out previously, the many investment opportunities that higher rates may bring could not be fully exploited; in fact, higher rates are likely to reduce the valuations of possible target companies, which PE funds may have difficulty acquiring because of lack of funding.

Certainly, funds that rely little on debt capital will not face the issues caused by the increased cost of debt. However, small funds will face major issues in carrying out acquisitions because of difficulties in gathering funds.

LBOs and Dry Powder

Widely employed practices such as Leveraged-Buyouts (LBOs) will decline sharply as interest rates will continue to increase. In 2020, since interest rates hit the zero-lower-bound and sometimes moved to negative areas, LBOs increased dramatically in volume, eyeing the 2007 all-time high. In fact, PE funds took advantage of the low-interest-rate environment by financing acquisitions with low-cost debt capital.

However, as interest rates pick up steam, PE funds will face problems funding LBOs with debt for two main reasons.

To begin with, acquired firms will be required to produce enough cash flows to repay the debt contracted during the acquisition and manage the interest rate expenses, which will inevitably rise.

Secondly, PE funds will have to write larger equity checks to pursue the acquisitions.

Contrary to what was happening in 2007, when financial institutions used up to 90% leverage to acquire an asset, they will now be less disposed to finance such a large share, thus forcing PE funds to insert more equity capital. Therefore, funds that have kept more Dry Powder due to better exploitation of the low-interest-rate environment or that have recently exited portfolio investments rather successfully, will be keener to carry out LBOs. On the other hand, illiquid funds that have issues with fundraising from institutional investors or are unable to exit portfolio investments on good terms, are less likely to implement LBO operations.

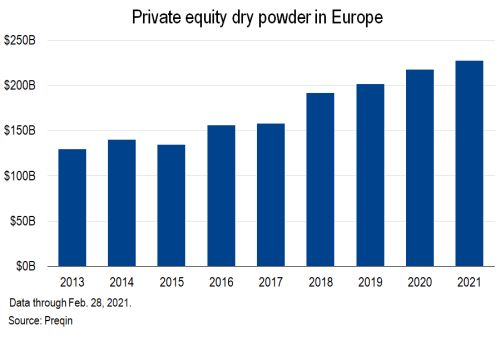

Dry Powder refers to all the cash and cash-like resources that PE funds retain and have not invested yet. Overall, in the European Market, the amount of Dry Powder has increased considerably throughout 2021 to the highest level on record. That is mainly due to the still highly accessible financial markets and the profitable exit from investments, fostered by an increased appetite for IPOs.

Nonetheless, low-interest rates in Europe and the high amount of Dry Powder do not necessarily mean good investment opportunities for PE firms; indeed, companies are overvalued because of lower discount rates and because funds have greater availability of capital, driving up acquisition multiples.

Therefore, many funds may retain their Dry Powder and wait for better investment opportunities in a higher interest rates environment, which according to Fitch Ratings, is not expected until 2025.

Conclusion

With the increasing rate of inflation and the subsequent tapering by the Federal Reserve, PE firms will have to adapt their strategy in order to face the new market conditions. They will face issues mainly on three fronts: deterioration in earnings, the fall in valuation, and increasing issues in obtaining funds. Obviously, these three forces will have an uneven impact on the industry as a whole due to intrinsic differences among funds.

Firstly, the deterioration of firms’ earnings will depend mainly on the firms’ markup power, thus favoring those that best differentiate their products or services from competitors. For instance, Adam Howarth, Managing Director and Head of Portfolio Management Americas at Partners Group, stated that his fund is focusing on investing in growing, market leaders who have the pricing power to offset some of the rising costs due to inflation.

Secondly, firms’ valuation will decrease because of higher discount rates. This will create issues in exiting investments, as multiples will fall, but also new opportunities for liquid funds to invest their assets in undervalued companies.

Lastly, PE firms will have hardships in gathering funds for two main reasons.

The first is the difficulty in liquidating portfolio investments, creating shortages in Dry Powder.

The second is the increase in the cost of debt. The latter is particularly important as it will alter the capital structure of the acquired firms; less debt will be used for buyouts, and PE funds will inevitably have to write larger equity checks.

Authors: Francesco Pezzuto, Tommaso Antoniazzi

Editor: Stefanos Ymeri

Sources:

https://www.allianzgi.com/en/insights/outlook-and-commentary/private-markets-inflation

https://validusrm.com/five-ways-inflation-could-impact-private-equity/

https://iqeq.com/sites/default/files/2021-08/IQEQ_CE_Inflation_300721_02.pdf

https://blog.benchmarkcorporate.com/why-leveraged-buyouts-are-making-a-huge-comeback

Comments are closed.