Introduction

While the pandemic has hit some sectors hard, it has given other resilient sectors like healthcare a boost. 2021 has so far shown more demand for healthcare investment than ever. The number of closed and announced healthcare deals in the first three quarters at 2,156 already exceeds total deal volume for all of 2020, with ‘medical devices and supplies’ counting for almost 300 of those transactions. Additionally, healthcare deals completed between 2010 and 2021 had a higher median IRR than any other type of private equity deal, with a median IRR of 27.3% compared to 21.9% for all private equity deals in the same period, as found by PE analytics platform DealEdge.

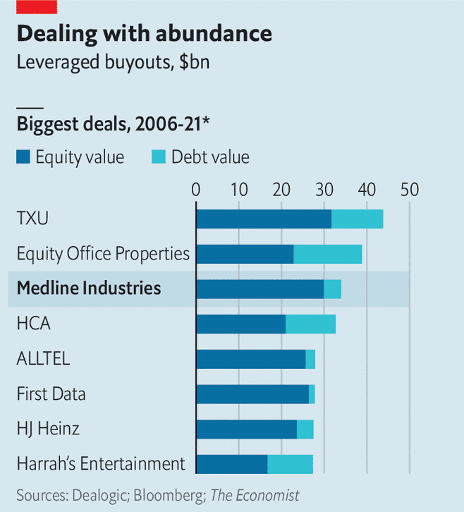

It is against this backdrop that a trio of private equity firms, The Blackstone Group, The Carlyle Group, and Hellman & Friedman, acquired a 79% stake in Medline Industries Inc. for $34 billion, including debt. Singapore’s sovereign wealth fund (GIC) also invested as part of the deal. All three PE firms will contribute around $17 billion in equity from their funds, with the rest being financed with debt— the private equity groups raised approximately $14.77 billion across bond and loan markets in September, with a further $2.1 billion coming from commercial mortgage bonds. This makes it the largest LBO deal since the GFC (global financial crisis) era and the fourth largest leveraged buyout financing of all time.

Around seven of the largest private equity firms had partnered to form 3 separate clubs in their pursuit of acquiring Medline. However, in the end, Blackstone, Carlyle, and Hellman & Friedman emerged victorious, beating Canadian investment firm Brookfield Asset Management in their bid for the healthcare manufacturer. The private equity consortium and the healthcare supplies manufacturer entered a definitive agreement on the 5th of June, with the deal expected to close by the end of 2021. Each firm will gain an equal stake in the company and the Mills family will remain the largest single shareholder retaining 21%. Charlie Mills and Andy Mills will stay in their senior management roles.

Club deals (also called consortium deals) involve two or more private equity firms pooling their capital together to finance a leveraged buyout or other PE investment. Leveraged buyouts refer to the acquisition of a company in which borrowed funds are used to partially meet the cost of acquisition. In 2004, over 40% of all U.S. buyouts were club deals, but by 2018 that number had plummeted to 20%. Why have club deals become less popular in recent years and what might have fueled their comeback in 2021?

One factor behind the decrease in club deals is growing private equity fund sizes, which means individual firms have more spending power than previously. Co-investments with limited partners or sovereign wealth funds have also become more common. Furthermore, previous club deals have also led to large-scale bankruptcies. The $45 billion leveraged buyout of Texan energy company TXU by KKR, Goldman Sachs Capital Partners, and TPG financed by $40 billion of debt ended in a high-profile bankruptcy in 2014. Similarly, in 2017 Toys R Us filed for Chapter 11 bankruptcy after being acquired by KKR, Bain Capital, and Vornado Realty Trust in 2005 for $6.6 bn.

However, this year, with record-low interest rates and an astonishing $1.9 trillion of dry powder as of January 2021, club deals allow bigger equity cheques to be written for larger acquisitions in order to spend that capital thanks to the pooling of assets. Although low interest rates increase access to funds and ease fundraising, they also result in increased competition for deals and capital overabundance, driving deal prices up. This partly counters firms’ spending power, incentivising partnerships between private equity firms.

Overview of Medline Industries (Target)

Founded by the Mills brothers, Jim and Jon Mills, in 1966, Medline is the largest U.S. private manufacturer and distributor of medical supply products, such as surgical masks, gowns, lab kits, or anesthesia, for hospitals and pharmacies. The company primarily operates in North America, where it runs more than 20 manufacturing sites, but is present in over 110 countries worldwide. Medline Industries has averaged 12% annual growth for five years pre-COVID and generated $17.5 billion in revenue in 2020. Earlier this year, Medline finished investing $1.5 bn into distribution centers, manufacturing capabilities, and new IT systems as part of a capital expenditure campaign. The company is still run by the Mills family, with Charlie Mills serving as the CEO.

Overview of The Blackstone Group (Acquirer)

Blackstone is a leading alternative asset manager founded in 1985 by Stephen Schwarzman, the current CEO and chairman, and Peter Peterson. As of Q3 2021, the firm has around $731 billion in assets under management, with investment vehicles centered around private equity, real estate, growth equity, life sciences and secondary funds. The 2019 Blackstone Capital Partners VIII fund is the largest ever private equity fund, having raised $26 bn.

Overview of The Carlyle Group (Acquirer)

Carlyle is a global investment firm with $293 billion in assets under management. The firm specialises in three business segments: private equity, credit, and investment solutions. It is one of the largest healthcare investors in the world. In December 2020, Rede D’or, Brazil’s biggest hospital chain in which it invested heavily, was listed at a $22 billion valuation. The Carlyle Group totals over 1,800 employees spanning five continents and is managed by Kewson Lee, the CEO.

Overview of Hellman & Friedman (Acquirer)

Hellman & Friedman is a private equity firm with a focus on large equity investments in select industries, including financial services, software, media, healthcare, and professional services. It has invested in over 100 companies over its 37 years of existence, investing mostly through growth capital and leveraged buyouts. Hellman & Friedman has previously partnered with The Carlyle Group to acquire Pharmaceutical Product Development for $3.9 billion in 2011, selling the company to Thermo Fisher in 2021 for $17.4 billion. Currently, the firm manages $95 billion in assets.

Target advisors: Goldman Sachs (lead financial advisor), BDT & Company (financial advisor), and Wachtell, Lipton, Rosen & Katz (legal advisor)

Acquirer advisors: BoA Securities Inc., J.P. Morgan, Barclays, Morgan Stanley, Centerview Partners (financial advisors), and Simpson Thacher & Bartlett LLP (legal advisor)

Synergies and opportunities

For the private equity consortium, a motivation behind the buyout is the opportunity to capture the potential of Medline’s global expansion linked to top-line growth and to help the firm increase it with their combined support and expertise. Medline supplied 45% of the top 150 hospital systems in the U.S. and saw sales rise by 25% during the pandemic. With booster vaccinations as well as the Omnicron variant around the corner, its future growth and profitability look promising. Although it operates in more than 110 countries, its global sales make up only a small portion of total revenues, so the private equity firms could be the key to widening and diversifying its revenue base.

With its new resources, Medline Industries plans to advance its geographic expansion, increase its product offering and strengthen its global supply chain through infrastructure investments, according to the press release. Blackstone offers expert capabilities in logistics and transporting equipment due to its ownership of around a billion square feet of logistics space around the world. Meanwhile, Hellman & Friedman and Carlyle with their extensive investment in healthcare, offer deep expertise in the sector and managing medical supply chains specifically. Additionally, Blackstone’s experience in partnering with family-led companies and Hellman & Friedman’s experience in people-based businesses can help leverage their family-led culture, an underlying strength of Medline’s business, to strengthen operations.

Risks and uncertainties

One clear risk is a high leverage profile due to the nature of the buyout. Medline’s post-deal debt-to-earnings ratio of above 7.0x is quite high, resulting in a long-term rating of B+ by rating agency Fitch. As a market leader with a strong customer base, however, Medline benefits from consistently solid cash flows, helping it to maintain its FCF/debt ratio at around 10% in the short to medium term.

Although the Mills will retain all senior management positions and will continue to be the single largest Medline shareholder, they will no longer have full control and will need to consult with the private equity firms in the case of issuing debt or equity, paying dividends, or entering M&A transactions. However, if the Mills family and the private equity club are able to effectively combine their respective scale and capabilities, the expansion and growth ambitions alongside debt reduction may be accomplished moving forward.

Another concern is the persistence of supply-chain bottlenecks that may obstruct globalizing the business and overall operations.

Author: Claudia Ngoc Tram Ta

Editor: Stefanos Ymeri

Sources

https://www.blackstone.com/the-firm/

https://www.carlyle.com/our-firm

https://abcnews.go.com/Health/wireStory/private-equity-firms-buy-medical-equipment-giant-medline-78108825https://www.pehub.com/why-irrs-for-healthcare-deals-are-better-than-the-rest/

https://www.pehub.com/why-irrs-for-healthcare-deals-are-better-than-the-rest/

Comments are closed.