Introduction

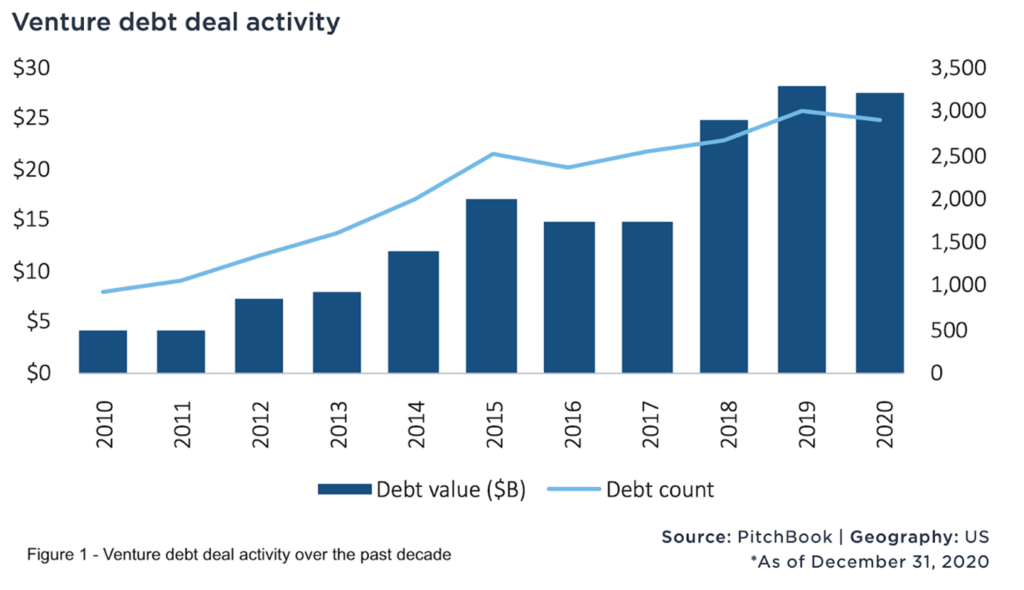

Venture debt is a rapidly increasing form of venture funding for start-ups. Indeed, according to Pitchbook, the venture debt market increased by a factor of five from 2010 to $25bn in 2019, with the asset class accounting for approximately 15 percent of the estimated total aggregate venture funding activity. According to several observers, the growth of this alternative financing option has been fuelled by low interest rates, more accommodating lending terms, the COVID-19 pandemic and increased awareness of its potential.

“Although not a new concept, the venture debt asset class is still in its infancy relative to traditional venture capital,” notes Runway Growth Capital’s’ ‘2020 Runway Venture Debt Review’. Considering the US alone, where the venture debt industry first emerged in the early 1970s, venture debt is estimated to represent about 5% to 15% of total equity financing. “Lack of education and awareness has led many entrepreneurs to have misguided notions about venture debt – how it should be used, and why it can be a valuable option for those looking to finance their business while retaining equity”. Despite this, more and more firms are realizing the potential benefits of venture debt financing and how it can accelerate growth for their businesses.

Simply put, venture debt is a type of loan provided to early and late-stage, high-growth start-ups by specialist institutions usually in between rounds of equity. It can be seen as a cross between traditional loans and equity investments. Many firms benefiting from venture debt funding would not be able to receive conventional bank loans due to their poor and even often negative cash-flows and general lack of real tangible assets. Venture debt acts as a quick injection of working capital for firms without drawing from current reserves. It is important to note that venture debt is not intended to replace equity financing, but to be used in combination so to provide start-ups with a cash runway and both working and growth capital.

On the demand-side, it is evident that venture debt can be an attractive option for firms, specifically young start-ups. Firstly, contrary to equity investments, debt financing can be significantly cheaper as it does not impose a claim on the future value of the firm. This means venture loans are a non-dilutive form of raising finance as they do not require sacrificing board seats or ownership. Hence, venture debt can be a very important aspect for young founders who would rather want to retain control of their firm. Further, venture debt can also be used to extend a firms’ cash runway, thus enabling start-ups to achieve higher valuations in future rounds of equity. However, firms who receive venture debt funding must be careful with repayment timelines and any other conditions imposed by the venture lender, which may substantially differ from equity-based investments.

On the supply-side, financing start-ups in the form of loans through venture loans after the primary stages of funding such as pre-seed and angel investments, can prove to be a rewarding financing method. Despite common misconception, venture lending often carries lower risk than traditional Private Equity investments. In the past few years, venture lending returns have been strong and characterized with low loss rates. Specifically, in cases where the lending institution had a stake in the start-up, venture debt can act as a bridge to future profitability and growth, by enabling the firm to weather unexpected short-term financial troubles or market turbulence.

Rise of Venture Debt

The increasing attractiveness for both start-ups and lenders has propelled substantial growth in the venture debt market over the past 10 years. As shown in Figure 1, according to Pitchbook, in the US alone venture debt deals have increased by a factor of three from 940 loans in 2010 to over 2,900 loans in 2020. This has outpaced the increase in both venture capital and Private Equity deals. Larger loans, given to late-stage firms, have also driven growth in the total value of the venture debt industry. In 2020, only 37 loans represented around 60% of the US’s 2020 total venture debt market. This included extended loans to companies such as Bumble and DoorDash (at the time late-stage firms) who have now gone public. Notably, WeWork received emergency funds from SoftBank while experiencing financial troubles, one of the biggest recent venture debt deals.

Furthermore, there has been an increase in the variety of options for loans and debt repayments for venture-backed firms. Lenders, for example, have started to offer revenue-based financing which can aid in repaying loans in case firms experience troublesome financial situations with low revenues. Further, companies have been able to negotiate more flexible terms on their borrowing to make the best use of their borrowed funds. This has led to a strong increase in the demand for this type of venture funding.

In recent years, pushed by historically low interest rates, looser monetary policies and the COVID-19 pandemic, the number of venture debt deals has grown dramatically. The COVID-19 crisis alone has led to a massive expansion of the global venture debt market in both 2020 and 2021, pushing the total lending volume to all-time record highs. Start-ups were met with unprecedented challenges, by a combination of supply-chain disruptions, demand shocks and temporary closures. This caused firms’ cash reserves to dry-up, making venture debt a go-to tool to support continued business. Many companies who required emergency financial support during the pandemic decided to opt for venture debt as banks were less willing to give out loans due to the economic situation. General economic uncertainty brought about by the pandemic also impelled firms to strengthen their capital structure to mitigate potential future financial turbulence. Furthermore record low interest rates during the past decade in many of the largest world economies has increased debt across all sectors, especially impacting venture debt, making it a great option for start-ups.

Venture debt around the world and outlook

Venture debt is emerging around the world, especially within the high-growth technology start-up industry. An example is the start-up ecosystem in South-East Asia where firms have been able to drive a stark expansion in venture debt activity. The Singapore government itself introduced a Venture Debt Program, aiming at catalysing over 100 venture debt loans. Following the COVID-19 pandemic, the Venture Debt Program was boosted thanks to an increase of the loan cap being, further fostering venture debt activity in Singapore. According to a PwC report about venture debt in emerging markets, the South-East Asian venture debt market is predicted to grow anywhere between $490m and $980m annually. An additional example of the rise of venture debt in emerging markets is within India. Here, venture debt funding is estimated to have grown from around 4% of total venture funding in 2018/2019 to over 8% in 2020, representing nearly $800m.

Venture debt deals can also vary based on the business growth stage of the firms. The most significant venture debt deals are often carried-out with large, late-stage, pre-IPO firms. Uber, for example, raised over $4bn through several financing strategies, including venture debt, prior to its IPO in 2019. However, overall, early and late-stage firms over the last decade have received a similar level of venture debt funding. The different levels of risk associated with each business stage also affect the type of venture loans firms receive. Late-stage firms are inherently less risky for lenders than earlier stage firms as there is a much lower risk of default. This can be seen in the difference in interest rates and loan size between small early-stage firms and late-stage firms. Further, the number of venture loans for late-stage firms have increased considerably over the last decade. Companies have extended their periods of private funding, entering public markets with much higher valuations. These companies have higher and more stable revenues than the late-stage firms of the past, translating into a greater ability to follow their loan repayment schedules. The anticipated rate hikes by the central banks of the world’s major economies to solve soaring inflation is likely to impact the venture debt market in the future. However, the sentiment around debt funding for start-ups, especially in the early-stage, has been changing with more innovators and lenders turning to this option. Venture debt and the venture capital industry as a whole has been increasing steadily and will probably continue to follow this growth trajectory in the foreseeable future.

Authors: Tom Gray and Lyann Djenabzadeh

Editor: Mauro Spadaro

Sources

Pitchbook. (2021, March 22). Venture debt growth reaching all areas of VC market. News & Analysis. Retrieved from https://pitchbook.com/newsletter/venture-debt-growth-reaching-all-areas-of-vc-market-bzd#:~:text=Debt%20is%20growing%20faster%20than,in%20tandem%20with%20equity%20funding.

Capital idea: The rise of venture debt. Financier Worldwide. (n.d.). Retrieved from https://www.financierworldwide.com/capital-idea-the-rise-of-venture-debt#.Yg4UNZPMJQJ

Year ender 2021: The Rise of Venture Debt as a true growth partner for start-ups. Business Today. (n.d.). Retrieved from https://www.businesstoday.in/latest/in-focus/story/year-ender-2021-the-rise-of-venture-debt-as-a-true-growth-partner-for-start-ups-317263-2021-12-29

Deloite. (2021). Accelerating Growth with Venture Debt. https://doi.org/https://www2.deloitte.com/content/dam/Deloitte/ie/Documents/Finance/IE_FA_Venture%20Debt_0121_Draft13.pdf

de Rassenfosse, G., & Fischer, T. (2016). Venture Debt Financing: Determinants of the lending decision. Strategic Entrepreneurship Journal, 10(3), 235–256. https://doi.org/10.1002/sej.1220

Stanford, Kyle, & Warfel, Alex (2021). Venture Debt a Maturing Market in VC. https://doi.org/https://files.pitchbook.com/website/files/pdf/PitchBook_Analyst_Note_Venture_Debt_a_Maturing_Market_in_VC.pdf

Applied Real Intelligence A.R.I (2021). VENTURE DEBT: 10 THINGS TO KNOW. https://doi.org/https://www.applied-real-intelligence.com/venturedebt/

Szalontay, M. (2021, November 1). Council post: Venture debt: Leverage for enhancing venture capital returns. Forbes. Retrieved February 17, 2022, from https://www.forbes.com/sites/forbesfinancecouncil/2021/11/01/venture-debt-leverage-for-enhancing-venture-capital-returns/?sh=5b79c54f7f46

Comments are closed.