by Luca Venturelli, Riccardo Cela

Brief history of PE & VC in Africa

Private Equity (PE) and Venture Capital (VC) have been the catalyst to the socio-economic development of countries worldwide. Particularly in Africa, PE and VC have gradually evolved over the last three decades, becoming the key to unlocking economic growth and innovation.

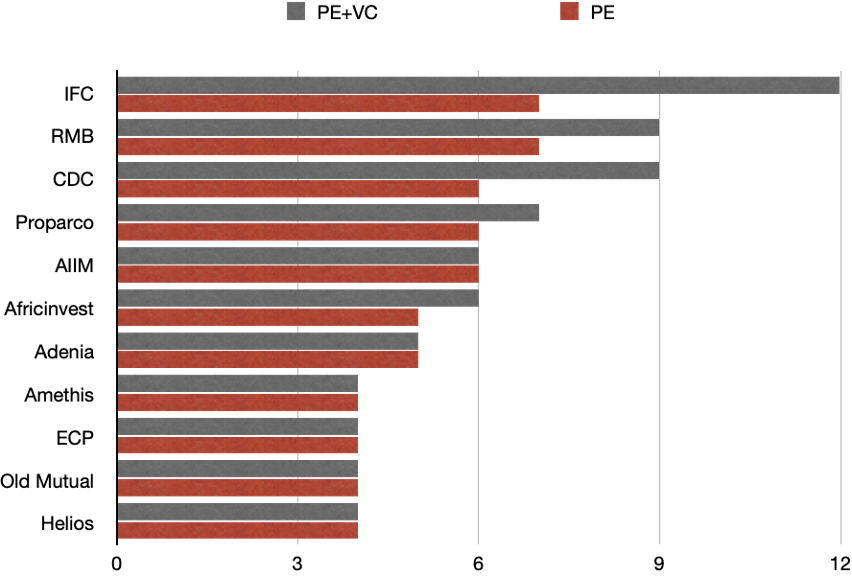

The history of PE in Africa dates to the early 1990s. Over the first decade, South Africa started investing more widely across the continent, with East Africa claiming the largest deals. During the global financial crisis in 2008, development finance institutions turned their attention to Africa, driven by the continent’s robust macroeconomic growth, averaging 4.6% between 2000 and 2016. As we move to 2017, the African PE ecosystem has considerably matured with more than 200 PE companies managing upwards of US$30bn and the emergence of the first billion-dollar Sub-Saharan African funds, Helios Investors III and Equatorial Guinea Co-Investment Fund.

PE and VC funding has developed progressively, thanks to the favorable economic and political outlook, the growing middle-class purchasing power, and the fact that Africa is home to the world’s largest free trade area. In this context, the number of VC deals in Africa has grown significantly in recent years and it has been in an upward trend, from 64 VC deals in 2014 to 139 in 2019.

The upward trend is projected to continue in the future and the African countries will continue to adapt their legislative and policy framework to attract foreign investments.

Current situation and main players

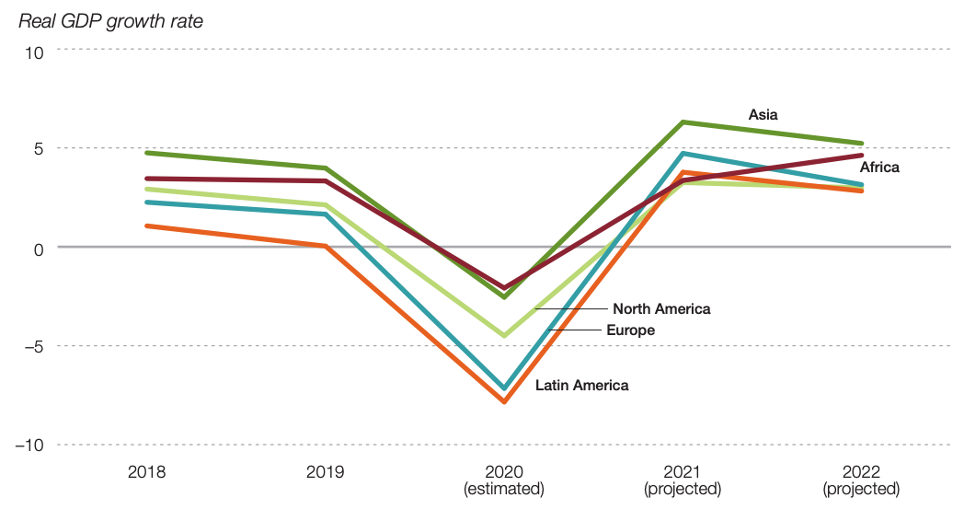

Despite the COVID-19 pandemic, the continent’s GDP growth is expected to rebound in 2022 (see Figure 4). This expectation is supported by the fact that the crisis particularly affected the short-term growth prospects, while economic recovery is supported by improvement in exports, private consumption, rapid urbanization, and accelerated technology uptake.

The PE industry is playing an important role in the economic upturn and investment activity is expected to continue to increase over the next 12 months according to Deloitte.

In 2021, 150 PE firms signed in Africa accounted for a total transactions value of around $7bn, including a few deals that are yet to receive regulatory approvals.

In an effort to map Africa’s start-up investment landscape between 2014 and 2019, the African Private Equity and Venture Capital Association concluded that only five countries of the continent accounted for 65% of the total number of VC deals registered.

Analyzing just the top early-stage investment destinations, South Africa represents 21% of the early-stage investments, followed by Kenya at 18% of the total volume.

South Africa’s insight

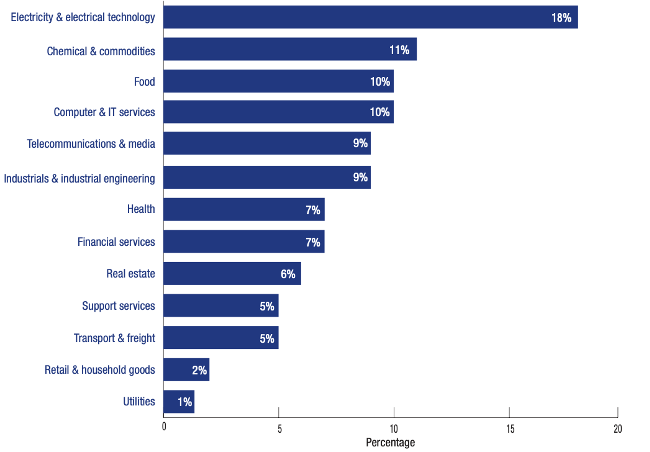

A report in 2019 by the Southern Venture Capital and Private Equity Association (SAVCA) analyses the perceptions of the board of 75 companies of African PE and VC funds regarding the economic and social impact that PE and VE capital industry has on South Africa. The sector taxonomy of the sample is wide: electricity and electrical technology, chemical and commodities, food, computer and IT services, telecommunications and media, industrials and industrial engineering, health, financial services, real estate, support services, transport and freight, retail and household goods, and utilities.

According to the respondents, the sector of electricity and electrical technology attracts 18% of the PE/VC funding, followed by chemicals and commodities, food, telecommunication and media, and industrials and industrial engineering, each absorbing around 10% of the funding.

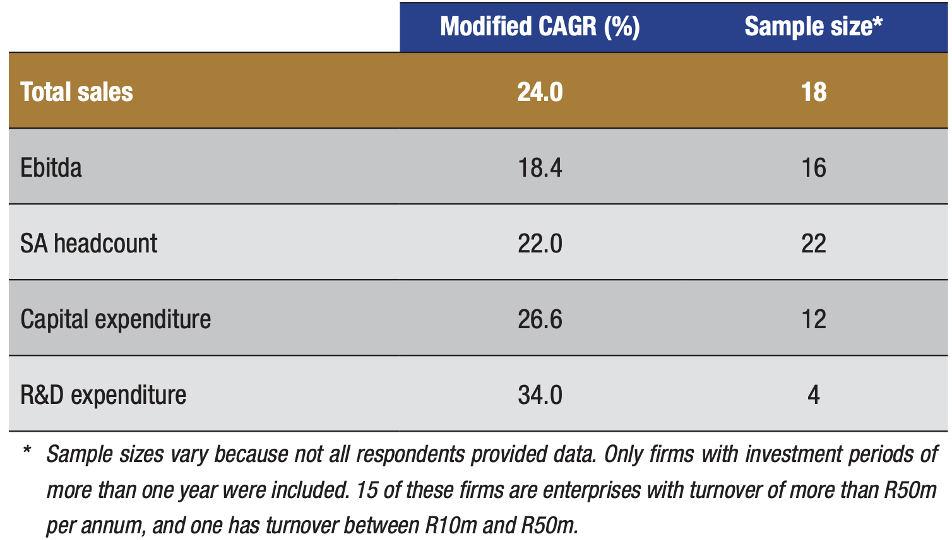

The report also examines the change in performance indicators from the date of the investment to the most recent financial year.

Data by the respondents were used to annualise the changes and calculate a compounded annual growth rate (CAGR) for each metric.

The indicators in the chart below show a positive financial and business performance, driven by an average growth of 24% in sales, 18.4% in Ebitda, 22% in the employment rate, 26.6% increase in CAPEX, and 34% in research and development expenditure.

Main challenges faced today

Private equity investors in Africa face substantial challenges when acquiring targets in the continent. There are both macroeconomic and operational challenges to overcome before getting access to the increased returns African firms provide due to their higher operational improvement potential.

From a macro perspective, a significant decline in commodity prices over the last decade interfered with investors’ plans. In addition, political uncertainties, corruption, and legal systems with low enforceability cause inefficiencies that can quickly and unexpectedly dry out positive cash flow streams.

From an operational point of view, four main challenges arise. First, Africa has a limited talent pool with limited depth to management skills and capabilities. This is particularly true at the lower than top management level and for skilled blue-collar workers that more sophisticated firms rely on. Second, investors may encounter opaque business practices that differ from those found in developed countries. For instance, businesses sometimes still rely on informal practices such as providing “gifts” to obtain import licenses. Third, many African governments limit foreign ownership and thus make it difficult for non-resident investors to obtain control over African companies. South Africa, for instance, proposed a bill for 51% local ownership of private security companies, thus substantially limiting the amount of potential FDIs. Last, it is often not easy for international private equity investors to collaborate with founders and owners. Founders and owners of long-standing family-run businesses in Africa find it difficult to give up control to new investors. This is detrimental for private equity firms, which often rely on the expertise, skills, and network of founders and owners to run a business.

Legal challenges deserve particular attention due to their paramount importance on the positive outcome of a successful PE investment. Generally, in many African jurisdictions, markets are not ready for the sophistication required for a private equity transaction.

The different legal systems, language, cultural and religious backgrounds, and the effect of decades of colonization created highly distinct legal systems. Africa has countries with standard law systems, civil law systems, and hybrid law systems. As a result, a legal approach that would fit the whole continent would be difficult to implement. For instance, regular changes to the tax and legal regimes, such as in dividend and capital gains tax rates, create uncertainties. The latter is often paired with low availability of reliable service providers. In such high-risk investment environments, it is critical to have expert legal, financial, tax, and accounting advisors who can make sound investment and operational decisions. In many African countries, such advisors, however, are relatively scarce. The few that exist have little understanding about the investment cycle in private equity and all the legal and financial difficulties and risks that come with it.

Future outlook

Even though Africa’s private capital market is still comparably small, it is expected to grow significantly in the upcoming years. Fund managers are developing a more favorable view of the region. In a large-scale Preqin survey, over one-fourth of managers stated that Africa will provide the best investment opportunities in five years. Additionally, while institutional investors rarely invested in Africa in the past, they have recently been increasing their investments in the region. The same Preqin survey notes that many investors plan to increase their investments by 2025, citing positive expected GDP growth in Africa as the main fueling factor. However, the survey was conducted before COVID-19. The pandemic had detrimental effects on Africa’s GDP, which shrank by 2.1% in 2020, causing the worst recession on the continent in the last 50 years. However, Africa’s economy proved to be resilient and is expected to bounce back with around 5% GDP growth until the end of 2022, surpassing recovery expectations of North American-, European-, and Latin American economies.

Another important factor leading to positive market sentiment in Africa is the growing population. Africa’s population is among the fastest-growing in the world. In fact, according to UN’s projections in 2019, the population of Sub-Saharan Africa is expected to double over the next thirty years. In addition, foreign direct investments in the country are increasing, spurred by policy changes and increasing activity in the African Continental Free Trade Area (AfCFTA). The sources of FDI and trade are also changing, with China taking a decisive role. China has been Africa’s largest trading partner in the past, and Chinese investment in Africa has been rising steadily over the past 15 years.

Authors: Luca Venturelli, Riccardo Cela

Editors: Stefanos Ymeri

Sources

https://www2.deloitte.com/content/dam/Deloitte/za/Documents/za_PECS_Survey_Final%20.pdf

https://www.avca-africa.org/media/2603/01746-avca-venture-capital-report_4.pdf

https://www.whitecase.com/publications/insight/private-equity-africa

https://thecapitalquest.com/2022/01/14/meet-the-most-active-private-equity-investors-in-africa/

https://media.bain.com/Images/BAIN_BRIEF_Private_Equity_Value_Creation_in_Africa.pdf

https://www.jstor.org/stable/43503734?seq=1#metadata_info_tab_contents

https://www.tamimi.com/law-update-articles/the-legal-challenges-for-private-equity-in-africa/

https://www.afdb.org/sites/default/files/2021/03/09/aeo_2021_-_chap1_-_en.pdf

https://www.privateequityinternational.com/key-trends-in-african-private-equity/

https://www.un.org/en/development/desa/population/publications/pdf/popfacts/PopFacts_2019-6.pdf

Comments are closed.