UK PE Market Overview

Brexit and Covid 19

The UK has been home to a well-established private equity market since the early 1980s, accounting for increasing portions of GDP and being the largest and most active regional market within Europe. In the last few years, a wave of uncertainty caused by the outbreak of COVID-19 and the finalisation of Brexit has hit the country, bringing market opportunities for PE funds. Several companies will become distressed and forced sell assets, while PE funds will be unlikely to rush in selling stabilised firms, given the potential buyer-friendly terms (e.g. adverse change/effect clauses or escrow-backed warranties) that could arise.

ESG

ESG strategies are gaining more attention among PE funds. In fact, they started to implement sustainable strategies both internally and with respect to selected target companies already before the COVID-19 crisis. The pandemic has then further highlighted

Factors such as the importance of continuity planning, social responsibility and employee treatment, not only were highlighted by the pandemic but also are important to ESG investors thus should be really taken into account by PE funds [Practical Law, 2021].

Consortium Deals

The capital volume of PE transactions was $114bn provided by 137 UK funds, in 2019. The main areas of investment were information technology (22%), consumer discretionary (19%), business services (19%), industrials (10%) and health care (9%). The trend of consortium deals has been widely adopted by PE funds in the UK in order to combine expertise, share the transaction risk and increase the collective negotiation strength. Pre-pandemic in 2019, an aggregate deal value of $15bn was recognised to 16 UK consortium deals worth over $100m [Practical Law, 2021].

PE in the UK since Brexit

After it won the referendum in 2016, Brexit came into force on the 31st of January 2020, mere weeks before the COVID outbreak started to garner the world’s attention. In the past two years there has been a flurry of deal activity in the British Isles, with the number of buyouts up almost 60% in 2021 relative to the same period in 2019 (pre-pandemic and Brexit taking effect). There are multiple reasons for the rise in deals, for example: low valuations, low interest rates and the UK’s relatively lenient attitude towards takeovers to name a few [FT, 2021].

Low valuations

Brexit unnerved many investors. Especially the back-and-forth negotiations between the UK and EU, numerous delays etc. seem to have added a level of uncertainty to future business conditions that helped cause an outflow of over £29bn from UK equity funds since 2019.

As can be seen by Figure 1 above, the outflow of capital coincides with a marked decline in valuations of UK equities when compared to its rivals. Further evidence of the lagging performance of UK equities is the fact that the FTSE 100 is still down close to 2% since August 2018 while the STOXX 600 and SPX are up more than 25% and 62% respectively. It is therefore not surprising that we have seen the uptick in deal activity compared to previous years.

Rising Number of Deals and Multiples

2021 has proven to be an immensely successful year for PE funds aiming to take firms private. As of Aug. 31, 39 offers to take UK companies private have been completed or proposed, over half of which was done by PE funds. This is just shy of 2020’s 41 bids/proposals, likely setting 2021 up to surpass that level by a significant amount.

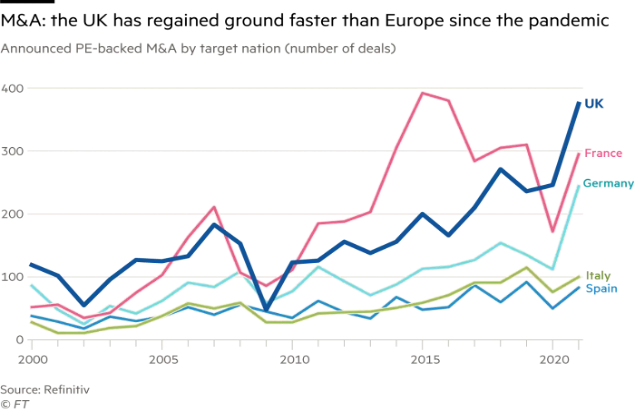

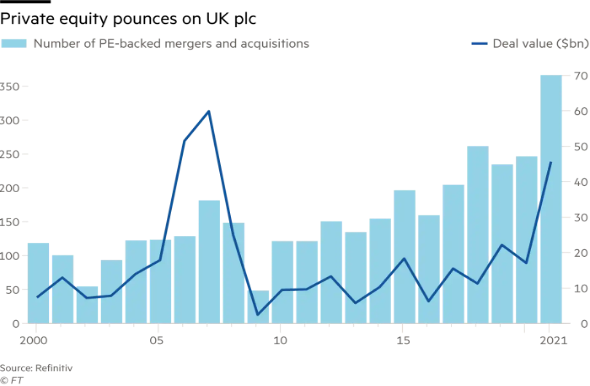

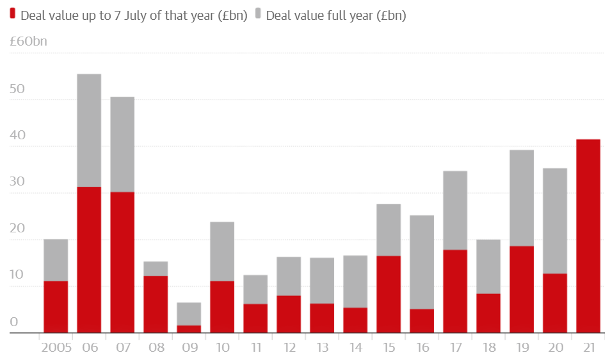

As seen in Figures 2 & 3, the sharp rise in deal activity has put the UK at the forefront of its European peers in terms of the number of deals, while the total value of deals has also reached levels not seen in decades.

Certain sectors have received more interest than others, with Business Services and Technology, Media & Telecom (TMT) accounting for 62% of PE investments in the UK mid-market in 2021. The focus of investments on more tech-oriented businesses reveals the greater interest in digitally driven businesses that have seen accelerated demand due to the pandemic. The strong demand for tech related businesses has however also caused deal multiples to rise, despite the low market valuations discussed earlier. This is highlighted by the fact that P/E multiples remained constant in H1 2021 at around 9.4x while the average multiple for PE transactions rose 26% from 8.9x to 11.2x, with PE mid-market multiples hovering at levels not seen in 4 years [Private Equity Wire, 2021]. The overall positive trend in deal activity, deal values and multiples seem to point towards a strong recovery in the UK PE market, having accelerated in recent years.

Recent Deals

As of H1 2021, PE firms announced 120+ deals with UK companies, with a total value of over £40bn, with many more expected in H2. According to Dealogic this is the strongest year on record in over 15 years.

The firms targeted by PE funds have been of a wide variety, however some transactions have been controversial and there has been some pushback from the public and lawmakers alike. An example of this is the Morrisons’ deal, one of the largest supermarket chains in the UK, later reviewed.

PE deal examples in post-Brexit UK

Morrisons

After a prolonged bidding war, numerous negotiations, and headlines in the press, US PE group Clayton, Dubilier & Rice’s (CD&R) £7bn takeover bid, at 285p a share, was accepted by Morrisons’ shareholders. Shareholders rejected an original offer of £5.5bn, leading to a bidding war with SoftBank owned US rival Fortress Investment Group, which culminated in the 61% premium to Morrisons’ share price on June 18th, 2021, offered by CD&R [Sky News, 2021]. Analysts estimate CD&R is paying a full price for the supermarket business, highlighting the strong demand for UK businesses and willingness of PE groups to put their dry powder to use.

The sale of Morrisons had been controversial due to the foreign sale of yet another well-known British firm as well as the potential impact on the workforce/assets. PE takeovers are often viewed with skepticism, with expectations of layoffs, stripping of assets and debt loading. With over 100,000 employees, some anxiety was present regarding potential impacts on them, however CD&R has promised to respect the recent introduction of £10/hour wages and keep most of the management team the same.

G4S

On April 6th, 2021, Allied Universal, a private American provider of security services, bought the UK group G4S, putting an end to nine months of speculation on the truthfulness of the acquisition and its potential bid price. Being traded at historical lows like most of UK public companies, in 2020 G4S became a prime takeover target, attracting the attention of other competitors such as Garda World, whose offer of $4.2bn (a 31% premium over G4S share price) was rejected by the board. This is when Allied Universal entered and ended the game with a $5.3bn bid (a 68% premium over G4S share price as of Sept 1st, 2020), expecting a series of revenue and cost synergies for the following years [Security Info Watch, 2021].

Indeed, the acquisition gave rise to the largest security company in the world with revenues over $18bn generated in 85 countries, twice as large as its first competitor Securitas. The deal permitted the elimination of redundant office leases, increased bargaining power to negotiate better rates on health insurance and workers compensation and granted Allied the generation of higher revenues in the technology offering sector. Being Allied a private company, its primary intention was to delist G4S’s stocks from the London Stock Exchange to avoid the high costs of adherence to reporting requirements, and to then go public again in the future through an IPO, after reorganising the whole combined group.

Outlook

As can be seen by the uptick in deal volume after a short decline in 2015/2016, along with the record deal activity in 2021 so far, the UK private equity market has weathered Brexit and the COVID-19 pandemic relatively well, with the latter arguably having provided some tailwinds for the sector. Despite the short-term uncertainty posed by the new Omicron variant, the UK economy seems to be on track for a robust recovery, which will make its market continuously attractive for further PE deals.

Authors: Allegra Tosti, Justin Aschauer

Editor: Michele Conte

Sources

Practical Law, 2021

Reuters, 2021

https://www.reuters.com/business/uk-sale-britains-year-private-equity-buyouts-2021-08-16/

FT, 2021

https://www.ft.com/content/315a02d1-6606-433e-b6f4-1989f2fad27d

NYT, 2021

https://www.nytimes.com/2021/08/31/business/private-equity-uk.html

Private Equity Wire, 2021

Sky News, 2021

Security Info Watch, 2021

Comments are closed.