By Noah Halbritter and Moritz Gebhardt

Following Germany’s recent federal election, Merkel’s CDU has failed to secure a federal majority in the Bundestag for the first time since Merkel’s election, initiating a process of political change. Thus, we decided to analyse how Angela Merkel’s CDU mandate has impacted Private Equity over the last 16 years, whilst also presenting an outlook on how Germany’s PE sector could develop in the coming years under Olaf Scholz, Germany’s new chancellor. Having been Germany’s chancellor for over 16 years, it also makes sense to look at Angela Merkel and the CDU as an ideological and legislative unit, facilitating the analysis of her coalition government’s effect on PE in Germany. With Germany being the European Union’s strongest economy and most populous nation, it follows that any domestic political shift can initiate distinct economic trends that are felt throughout Europe and much of the world, thus we believe an analysis of the current situation to be of high global relevance.

Merkel and Germany’s Politics

Following German reunification in 1990, Angela Merkel joined the CDU, rapidly establishing herself amongst the party’s upper ranks, obtaining her first ministerial position in 1991. Merkel eventually worked her way up the party’s hierarchy, becoming the CDU’s Chairwoman in 2000, followed by her eventual election as chancellor in 2005, forming a coalition government between the CDU and the SPD, Germany’s left-leaning social democrats.

Before Merkel obtained a legislative majority in the Bundestag, Germany was governed by a coalition government made up of the SPD and The Greens which harboured a negative view of PE. One time, the SPD’s chairman referred to PE firms as “locusts”, and further stated that PE firms “measure success in quarterly intervals, suck off substance [from companies] and let [them] die once they have eaten them bare…” (Die Bundesregierung, 2021). This indicates that the prior administration was not looking to support the PE sector, supporting employees and labour groups instead. Now we will establish a generalised profile of Germany’s economy, leading into an analysis of the PE sector’s recent development during the Merkel era, followed by an introduction to the new coalition taking shape in Germany’s political space.

Source: A Profile Angela Merkel, Die Bundesregierung 2021, Link

Germany’s Economic Profile

Germany’s economy is defined as being a highly developed social market economy. As the world’s fourth-largest economy by nominal GDP, and the largest in Europe, Germany plays a key role in global trade, enterprise, and finance. Germany’s high GDP per capita, one of the largest globally at $45,723.64 as of 2020, is a clear indicator of the country’s wealth, with average incomes being amongst the highest worldwide. At a glance, these economic features suggest why a wide variety of foreign PE firms have entered and established themselves within the German market, one which presents numerous growth opportunities.

Germany’s economic output revolves around the service and manufacturing industries, with the service sector representing 70.4% of GDP, the manufacturing industry representing 22.9%, and construction representing 6% (Statistisches Bundesamt, 2021). In relation to other countries of similar economic calibre, like the United Kingdom and France, Germany still relies heavily on manufacturing, with 26.78% of Germany’s entire workforce being employed directly in manufacturing and production, with an even larger portion being employed in peripheral industries and sectors. With exports making up 46.89% of national GDP, Germany’s reliance on manufacturing ties into its global export leadership, presiding over the world’s second-largest trade surplus, second only to China. This favourable trade surplus, at over $209bn, has ensured Germany’s economic stability over the last decades, simultaneously stabilising the Euro’s value (WTO, 2021).

Germany’s financial services industry, including the private equity and venture capital sectors, accounts for about 4% of GDP, employing over 1.2m people, primarily around Frankfurt, Germany’s primary financial hub (Statistisches Bundesamt, 2021). PE investment as a percentage of GDP lies at 0.38% as of 2019, a small proportion compared to other European players like the United Kingdom, where PE accounts for 1.49% of GDP as of 2019. However, throughout the last few years, Germany’s PE sector has grown at a favourable rate, increasing by 0.22% proportionally from 0.16% in 2014 to the aforementioned 0.38% in 2019 (Statistisches Bundesamt, 2021). This trend can be attributed to positive economic growth, a decreasing trend in the ECB’s fixed interest rates, and the steady expansion of Germany’s technology and software development sectors, with emerging companies like N26 paving the way for PE investment potential, amongst other factors. However, although positive, industry leaders and experts still consider the current growth to be disappointing, blaming Germany’s policymakers for the slow growth in its finance industry, especially as it relates to PE. PE experts suggest that Germany’s uncompetitive capital gains tax, bureaucracy, and lack of effective government incentives have all contributed. With a new coalition set to take power in the coming months, Germany can expect the introduction of new legislation as it relates to financial regulation, taxation, and industry stimulation. This report will assess the new legislation and government policy as it relates to the PE sector, evaluating possibilities that will be used to draft an unbiased outlook.

Source: Bruttoinlandsprodukt für Deutschland 2020, Statistisches Bundesamt, 2021, Link

Source: WTO, 2021, Link

The Recent Development of Germany’s Private Equity Sector

Despite shifts in the country’s economic and political climates, Germany’s PE sector has grown at a stable rate since the German reunification in 1990. To assess this recent growth, we have chosen to analyse and expand on the information presented by the German state-owned investment bank KfW, also known as the Credit Institute for Reconstruction. As of 2021, the KfW is the world’s third-largest national development bank and Germany’s third-largest bank by assets and market capitalisation. The KfW’s status as a government-owned institution enables us to treat its thorough research as an impartial insight into Germany’s PE sector. To provide a time-relevant analysis, we have chosen to assess the sector’s performance throughout the second quarters of 2018, 2019, and 2021, leaving out 2020 due to the pandemic’s extraordinary impact on the PE sector and the German economy as a whole, one which would have our ability to establish an accurate sector trend. We will also utilise the German Private Equity Barometer to attribute a quantitative value to the development and condition of Germany’s PE market.

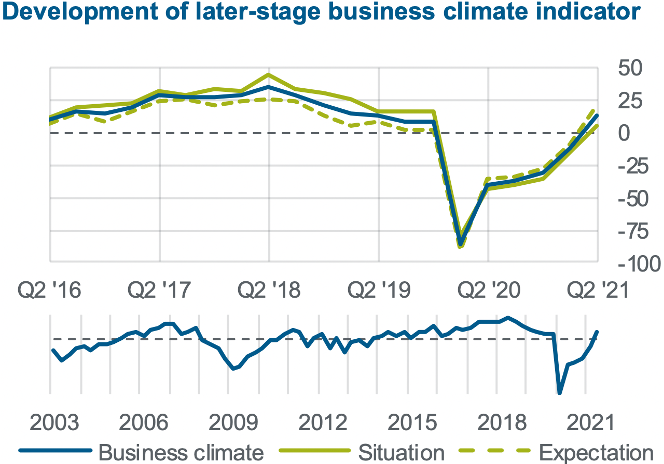

Coming into the second quarter of 2018, the sentiment in Germany’s private equity market reached new heights, carrying the momentum from 2018’s first quarter into early summer. Resulting from partial financial deregulation and general economic growth. This development was established through Germany’s Private Equity Barometer, which’s overall business climate index rose by 10.4 points to 77.1 balance points throughout the first and second quarters, whilst the later-stage business climate index rose by 10.7 points to 80.8 balance points, indicating healthy prospects for the PE sector. Insights into the German market’s PE potential can be found below in the graph showing the trend in business climate indicator for the overall PE market.

The quantity of equity investors’ deal flow rose sharply, with the demand indicator surpassing its previous peak from summer 2011. However, the fundraising climate and exit environment began showing signs of an imminent reversal, having declined from last year’s record levels. This decline was attributed to the unease in the financial markets triggered by the threat of an international trade war. “The incipient escalation of spiralling protectionism between the USA on one side and the EU and China on the other is not leaving the German private equity market unscathed,” said the KfW’s Chief Economist. Dr Zeuner went on to state that major distortions should be mitigated to fortify investor trust in Germany’s PE sector (Invest Europe, 2020).

Previously, the German Private Equity Barometer included assessments of venture capital companies, which are presented separately in the German Venture Capital Barometer as of 2019. This statement clarifies why the later-stage business climate indicator in 2018’s second quarter is at 80.8 compared to 10.1 in the second quarter of 2019. The conversion from 80.8 to the new level gave us a value of over 40 balance points for the later-stage business climate in the second quarter of 2018, as seen in the graph. Looking at the second quarter of 2019, the sentiment in the later stage of the German PE market fell for the fourth consecutive quarter since 2018’s data collection, dipping to 10.1 balance points. At this stage, equity investors were more downbeat about their current situation than before, yet they continued to hold optimistic expectations. Despite the aforementioned climate, most later-stage market assessments remain in the green. PE investors are still satisfied with the industry’s exit opportunities, deal flow, fiscal conditions, and the market’s innovation. This trend was seen as nothing more than an extended breather following the previous record-breaking year of 2018.

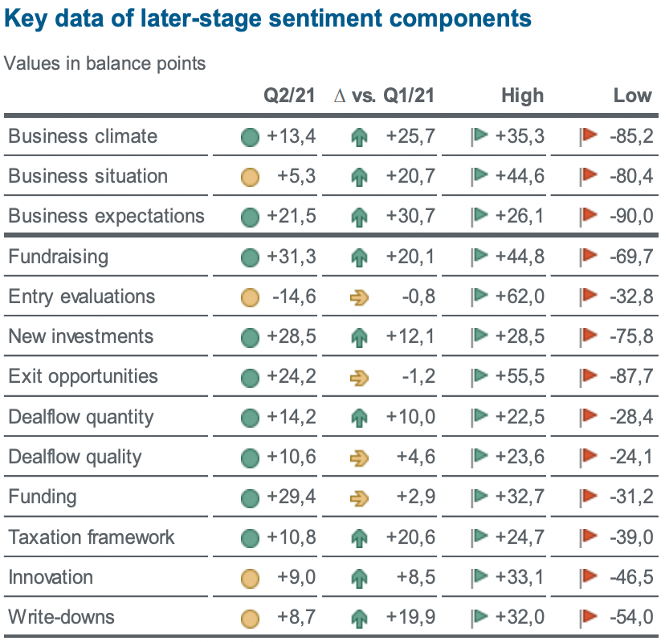

Finally, we can assess conditions as they stand as of 2021. Business sentiment in the German PE sector has grown positively in the second quarter of 2021, back above the long-term average for the first time since the sharp decline brought upon by the global pandemic in early 2020. The sentiment indicator of the late-stage segment rose by 25.7 points to 13.4 balance points, surpassing the pre-pandemic value of 10.1 recorded in the second quarter of 2019. The German PE market’s sentiment components paint a rare picture, with a lack of ‘red’ components despite tough market conditions, as displayed in the following table. Valuation is the only indicator to exhibit negative values, with entry-price satisfaction being within the normal range. Two-digit improvements can be observed throughout the fundraising, investment appetite, deal flow, and fiscal condition metrics, with investment appetite marking a new high. The sentiment in Germany’s PE market is back in positive territory after being stuck in pandemic uncertainty across four quarters. The current trend can be attributed to a variety of factors—yet low-interest rates appear to be the largest source of this trend, especially considering the PE sector’s reliance on financial leverage. From here on out, the shift in Germany’s political climate will likely dictate how the business climate evolves, shaping the PE sector’s future.

Source: 2019 European Private Equity Activity, Invest Europe, 2020, Link

Source: GPEB 2nd Quarter 2018, KfW, 2018, Link

Source: GPEB 2nd Quarter 2019, KfW, 2019, Link

Source: GPEB 2nd Quarter 2021, KfW, 2021, Link

Germany’s New Coalition and Private Equity

As of Wednesday 08/12/2021, the SPD’s Olaf Scholz is Germany’s new chancellor, with the Traffic-light coalition “Ampelkoalition” taking legislative power in Germany’s Bundestag. The aforementioned is the first coalition in Germany to be formed by three distinct parties, giving the new government more exposure to different political ideologies than ever before. The name derives from the three parties that form that coalition, red coming from the social democrats (SPD), yellow from the liberals (FDP), and green from The Greens. All of the aforementioned parties represent a distinct political ideology, together spanning the political spectrum when it comes to matters such as fiscal policy, social affairs, spending, and the environment. Each party also presents a distinct view on how to approach Germany’s emerging PE sector.

As previously mentioned, the SPD emphasises the labourer, fostering the belief that PE firms place profit maximisation above the needs of the employees in the companies they acquire. This view is emphasised in their electoral program, with an increase in public and social investment being a stated priority, whilst PE was never mentioned directly, only including provisions for the possibility of a public VC fund. The Greens have also failed to mention PE in their electoral program, only including a funding proposal for start-ups trying to solve UN sustainable development goals. To the Greens and the SPD, increasing funding for public services and expanding the federal government’s role in the economy, are more important than the prospects of Germany’s PE sector. Known for its liberal ideology, the FDP wants to provide PE firms with more opportunities, to foster growth in the sector. Under the slogan “Invest in Germany”, the FDP seeks to implement legislation aimed at diversifying Germany’s economy, with its goal being to expand Germany’s finance industry to encompass over 2.5% of GDP. The FDP wants to make it attractive for private companies to invest in Germany by implementing a business-friendly fiscal policy combined with other economic incentives, as opposed to using public funds. This intended approach is good news for PE firms operating in Germany, as it could simplify investment, making it easier, and more importantly cheaper, to navigate Germany’s PE market.

Looking at each political position holistically, one can observe that the liberals are the most supportive of Germany’s PE sector, thus, it’s also of utmost importance for the sector that the FDP be the political entity to head Germany’s Ministry of Finance. In fact, it is more likely that fiscal factors like taxation will be favourable and that retirement funds will be redirected into diversified sectors like PE, following the proposed plan to devote a larger portion of public pensions to private investments (Koalitionsvertrag Zwischen SPD, 2021). Although some of these factors don’t relate directly to PE, they will all likely improve Germany’s investment and business climates, from which the PE sector will naturally benefit.

After having analyzed the 178 portions of the mutual coalition contract, signed by the three parties recently, we found lack any direct reference to Germany’s PE sector. VC however, was mentioned, presented as a potential area of public funding, with proposed measures to improve Germany’s entrepreneurial environment through the simplification of funding and startup processes. One notable aspect of the contract revolves around IPOs and Dual Class Shares. The idea is to make both processes easier and cheaper, enabling start-ups to raise capital (Koalitionsvertrag Zwischen SPD, 2021). Although tailored towards start-ups and the VC space, PE firms will also benefit from this proposal, particularly if they intend to exit a position through an IPO .

Despite partisan and ideological differences, ranging from social democratic ideas to liberal approaches, the new government won’t have much of an effect on PE, as the coalition creates an ideological equilibrium similar to that of the previous government. However, through mutual collaboration, the new government may successfully reduce bureaucracy whilst imposing a larger array of climate-related restrictions. The future will tell us what effect this will have on Germany’s PE sector.

Source: Kapital für Rentner und Start-ups, Paul Achleitner Handelsblatt, 2021, Link

Source: Election Program, Bündnis 90/Die Grünen, 2021, Link

Source: Koalitionsvertrag Zwischen SPD, Die Grünen, Und FDP, SPD, 2021, Link

Source: Warum Das Bild Der Bösen Heuschrecke…, Tagespiegel, 2019, Link

Source: SPD Programmheft, SPD, 2005, Link

Source: Viel Zu Tun, Wahlprogramm FDP, FDP, 2021, Link

Conclusive Outlook

Expected shifts in Germany’s fiscal policy and approach to the financial markets combined with the positive development of the latter-stage business climate throughout recent quarters provides the basis for a favourable extrapolation. One can assume that if the new coalition successfully implements and furthers progressive measures designed to stimulate Germany’s finance industry, like a simplification of the IPO process and the changes to the Dual Share Class system, then PE will benefit across the board. The proposal of a capital-based pension scheme, for example, presents an extraordinary opportunity for the German PE sector, especially since a portion of these pensions are to be invested in the early-stage business space. However, a sizeable proportion of Germany’s PEVC funding volume still originates from foreign firms, with Advent International, Blackstone, and CVC overshadowing smaller German PE firms. Thus, the new coalition needs to promote growth amongst domestic PE firms if the German PE sector is to truly develop. With the FDP’s Chairman Christian Linder as Minister of Finance, we expect some of these issues will be addressed effectively, largely due to his party’s business-friendly position on taxation and financial regulation. However, Linder will have to operate within the boundaries of the coalition’s contract, indicating that some of the FDP’s intentions may not come to fruition.

Author: Noah Halbritter, Moritz Gebhardt

Editor: Michele Conte

Sources:

Source: A Profile Angela Merkel, Die Bundesregierung 2021, Link

Source: Bruttoinlandsprodukt für Deutschland 2020, Statistisches Bundesamt, 2021, Link

Source: WTO, 2021, Link

Source: 2019 European Private Equity Activity, Invest Europe, 2020, Link

Source: GPEB 2nd Quarter 2018, KfW, 2018, Link

Source: GPEB 2nd Quarter 2019, KfW, 2019, Link

Source: GPEB 2nd Quarter 2021, KfW, 2021, Link

Source: Kapital für Rentner und Start-ups, Paul Achleitner Handelsblatt, 2021, Link

Source: Election Program, Bündnis 90/Die Grünen, 2021, Link

Source: Koalitionsvertrag Zwischen SPD, Die Grünen, Und FDP, SPD, 2021, Link

Source: Warum Das Bild Der Bösen Heuschrecke…, Tagespiegel, 2019, Link

Source: SPD Programmheft, SPD, 2005, Link

Source: Viel Zu Tun, Wahlprogramm FDP, FDP, 2021, Link

Photo by Leandra Bischofberger on Unsplash

Comments are closed.