Introduction

The healthcare sector has been majorly impacted by the Covid-19 pandemic. As cases surged worldwide, many patients avoided doctor visits to limit their risk of infection. Often, doctors were not able to provide digital healthcare to their patients due to a lack of applications or knowledge. To overcome this problem in the future, there has been a significant rise in digital health start-ups. Exemplary evidence in this regard comes from the DACH region (Germany, Austria, Switzerland). The present article will provide a thorough overview of the digital health sector including an overview, its historic development, and selected financials, before looking at the case of Babylon Health as an exemplary start-up.

The Status Quo

Our healthcare systems are still dependent on in-person care, a fact highlighted by the Covid-19 pandemic. Although digital health technologies have been around for more than a decade, clinicians and health institutions never felt pressured to initiate their universal adoption. However, with Covid-19 regulations limiting the frequency of in-person visits, it’s become apparent that most countries are unprepared in matters of digital healthcare. The concept of digital healthcare relates to telemedicine, teleconsultation, remote monitoring, health-device connection, digital health platforms, and health apps. The term also encompasses the study and application of health data through various data platforms, such as epidemiological research and AI-assisted diagnosis support. These features and practices are designed to streamline healthcare, improving the consumer’s experience whilst relieving the pressure on physical and labour resources which could be applied to cases of higher urgency.

Due to the pandemic and its associated regulations, digital technologies have become increasingly important. Governments have even begun to utilize telemedicine, which, like teleworking and online education, has exposed many clients to a new kind of healthcare. This application has occurred through the introduction of online medical consultations which have facilitated processes like diagnosis, streamlining the treatment process. In the DACH region, where health care systems are amongst the most sophisticated globally, the pandemic has highlighted some problems relating to cost-effectiveness and patient care, with the implementation of medical technology proving to be a key issue. Germany and Switzerland managed to implement the technologies at a rapid pace, however, they’ve pointed out a clear “digital divide” that threatens to leave the elderly and the disadvantaged behind. These groups have struggled to navigate the new digital healthcare experience, and some even lack the means to access features like video consultations due to hardware limitations. Additionally, cyber-attacks on hospital servers have risen, a clear systemic vulnerability that needs to be addressed if personal data is to be kept safe. The collection and transfer of that same personal health data have also ignited a discussion on the control of information, raising concerns about the violation of individual privacy rights. In the DACH region, the digital healthcare system is still in its infancy. However, with a variety of financial incentives now in place, healthcare start-ups of all kinds have emerged, with established healthcare providers also competing to launch their own digital healthcare services. This boost to competition and innovation will help countries overcome the previous challenges, closing the gap between traditional healthcare and digital services in the DACH region.

2021 and the Progress of the Sector

The DACH’s digital health start-ups are progressing at an extraordinary pace. In 2020, start–ups in this sector raised approximately €500bn. With another €1bn of VC funding in 2021 alone, this amount has not only doubled, but it also shows how quickly the start–up ecosystem in the digital health sector is maturing. Consequently, one can clearly state that there is no lack of investor hunger in the digital health sector, although the DACH region typically lags in digitalisation in general.

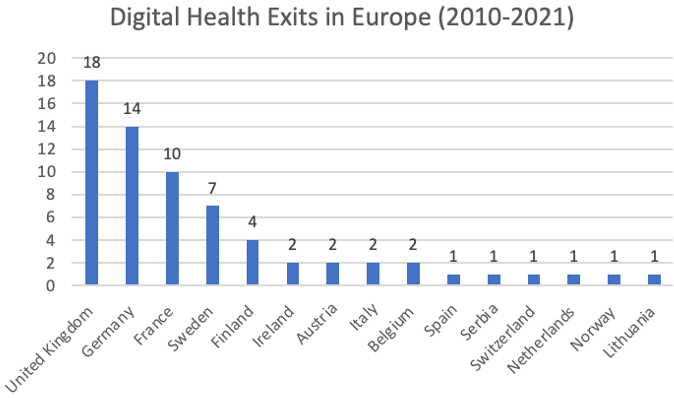

One other crucial point which speaks in favour of the development of the digital healthcare ecosystem is the increase in M&A activity. Since 2010 there were 17 PE exits in the German speaking region, 7 of which took place in 2021. These numbers are still far below the US’ equivalent, but competitive if compared with the United Kingdom.

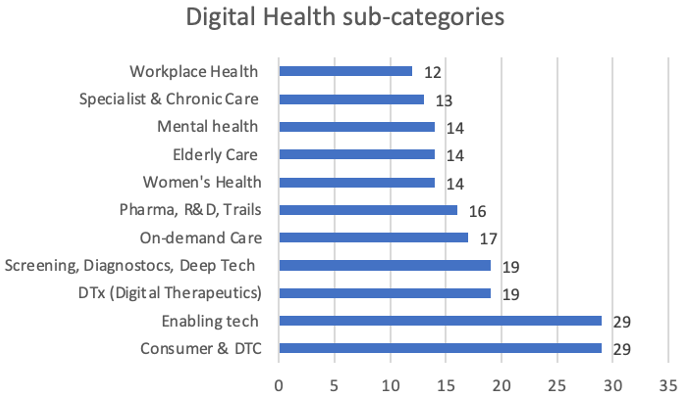

The trends are depicted below:

During the last year, there were a couple of major trends to observe. Firstly, the online market for prescription drugs has grown rapidly, enabling technology has also seen huge advances. The integration of next-generation software tools has provided a vast array of solutions to issues associated with laboratory infrastructure and testing. Now one can note the implementation of compliant software and API/connectivity layering is critical for both legacy players and digital health providers to take patient experience to the next level. Furthermore, the past lockdowns have shifted the focus towards workplace health, both physical and mental. This sector continues to gain pace, increasing the adaptability among firms and organisations of all sizes. The last major trend is personalization: Health and wellness amongst the DACH’s population is becoming increasingly personalised, be it through digital biomarkers, glucose monitors, or pacemakers.

Increasing Funding Rounds:

In general, Venture Capital rounds are growing in nominal value, and the digital health sector is no exception. To put it into context, in 2021, Germany alone saw 12 rounds where more than €15m euros were invested per firm, more than in the previous five-year averages combined. These top 10 rounds highlighted below accounted for more than two-thirds of total Venture Capital funding in the predefined space.

Funding Rounds: Series A and Growth Stage

- Caresyntax: $130m

- Mindmaze: $125m

- Ada Health: $90m

- Kaia Health: $75m

- PlusDental: €35m

- Wellster Healthtech: €35m

- Formel Skin: €30m

- Avi Medical: $28.5m

- Kenbi: €23.5m

- Clue: €16m

Regulatory Advancements:

The government’s role in the implementation of favourable legislation is not to be underestimated, especially in Germany, where policies aimed at boosting the biotech sector have contributed to the sharp increase in funding. Albeit the current status quo is still far from ideal, in Germany for example, a failed test run led to regulatory bodies postponing the implementation of e-prescriptions in German. However, development, adoption, and regulation are moving in the right direction.

Experts Turned Founders:

Finally, another decisive factor in favour of the DACH’s digital health sector’s positive development is the abundance of talented founders and managers operating within, often experts in certain subfields themselves. An increasing number of serial entrepreneurs from other fields are also entering the digital health space, bringing their valuable experience and expansive networks. Additionally, a growing number of healthcare professionals are starting to consider the start–up ecosystem themselves, challenging the existing projects in an efficiency-boosting and sustainable way.

Babylon’s Exit: An Industry Example

Funding has increased drastically, however, exits have also increased in frequency. The exit-count in the European digital health space increased by 300% from 2020 to 2021, accounting for 34 total exits, with Germany alone being home to 14 of them, four less than in the United Kingdom. Time to exit is increasing in Europe and funding rounds are becoming larger than ever. However, one should note that the DACH’s numbers are still lagging those of the US, where more than 130 exits took place in the first halt of 2021 alone.

UK-based Babylon Health is an excellent example when it comes to embodying this trend. Babylon Health went public via merger, employing a Special Purpose Acquisition Company (SPAC), in a deal worth around $4.2bn, making it the first European digital health company to list on public markets.

Babylon Health’s mission is to make healthcare accessible to everyone, a goal which they’re progressing towards at an astonishing pace. The firm operates by combining AI and other technologies with human medical expertise to create first class healthcare experience on their platform. Their mantra being “bringing together the right people”, excellently illustrated in their team of doctors, nurses, AI engineers, and clinical scientists.

In June 2021, they announced their intent to go public via SPAC, with the Alkuri Global Acquisition Corp., in which they’d be attributed a $4.2bn valuation. 4 months later investors were able to trade its stock on the New York Stock Exchange under the ticker BBLN. The transaction is expected to generate approximately $570m in gross proceeds to fund Babylon Health’s balance sheet, which includes around $340m cash from the SPAC company, and another $230m by private placement, funded through multiple asset managers and Palantir, a leading US data science company, which will function as a strategic partner. Financial advisers include CitiBank, on Babylon Health’s side, and Jefferies, on Alkuri Global’s side.

However, this is only the latest development of an impressive run. Over the last years, stakeholders have observed massive growth and rapid progression in all of Babylon’s business segments. The tip of the iceberg is the 400% revenue growth from 2020 to 2021. Babylon Health has already generated more than 80 billion data points from their users, used to improve their products and services. A final and crucial development is that technology costs as a percentage of revenue declined from over 200% in the first half of 2020, to around 45% in the first half of 2021. Founded in 2013, Babylon is an excellent example of what start-ups in the DACH could achieve in the future. Many similar stories are unfolding in the current ecosystem, with more success to come.

Conclusion

It’s an interesting and exciting time for the DACH’s digital healthcare sector. The current pandemic showed many actors in the field how much room for improvement there still is, but it has also drawn in fresh players to the sector, fuelling the start-up scene with an array of financial and practical resources.

Sources

https://de.statista.com/statistik/studie/id/83385/dokument/gesundheitssysteme-im-dach-raum/

https://www.speedinvest.com/blog-categories/health

https://www.europarl.europa.eu/RegData/etudes/BRIE/2021/690548/EPRS_BRI(2021)690548_EN.pdf

https://www.bvp.com/atlas/2022-healthcare-predictions/?from=feature

https://www.babylonhealth.com/en-us

https://www.bvp.com/atlas/2022-healthcare-predictions/?from=feature

Editor: Noah Halbritter

Comments are closed.