by Davide Savarino, Francesco Nardinocchi, and Tommaso Nocchi

Introduction

This article analyzes the increasing volume of acquisitions of Italian Football clubs by foreign Private Equity firms. We will explain and assess the contributing factors which have increased the attractiveness of such investments whilst also breaking down the structural issues firms face as they restructure such clubs.

Once we have commented on the general trend, the article will break down a recent deal involving Atalanta, the latest club to be acquired by a foreign Private Equity firm. We will reason why Atalanta’s acquisition stands out among others, considering the club’s history and its current state.

Finally, possible scenarios and predictions on the development of Italian and European football are discussed, as both relate to Private Equity, from Super League rumors to a reduction in the Italian Serie A’s team count.

The Development of The Serie A

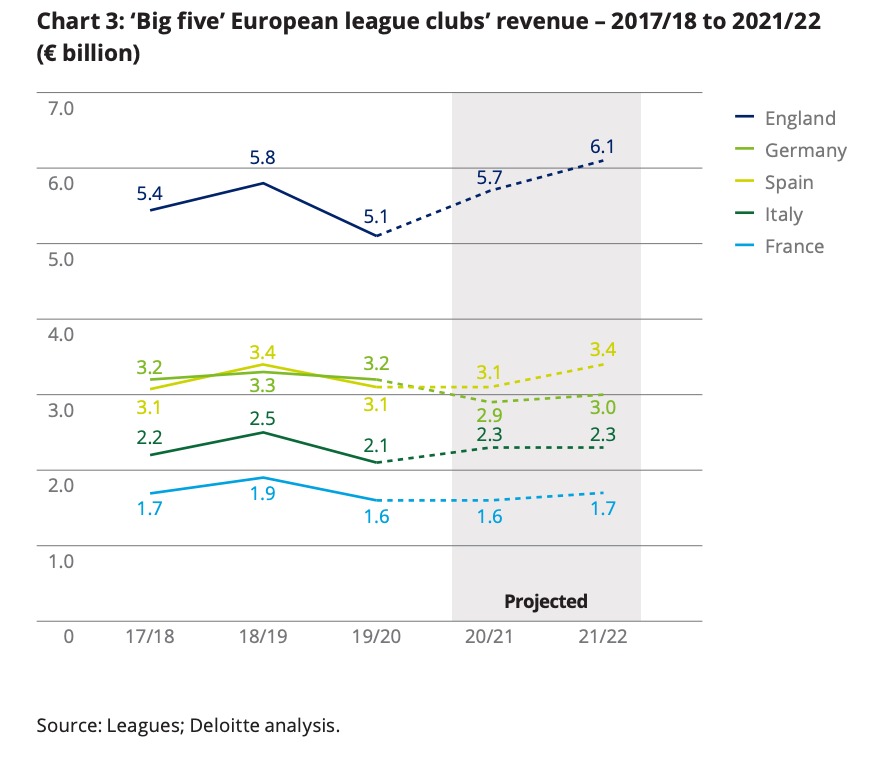

The Serie A, Italy’s premier football league, has experienced an extraordinary increase in foreign investment over the last decade. Out of the Serie A’s 20 clubs currently competing, 7 are owned by American investors, all of which were acquired after 2018. Italian clubs are proving to be attractive investments for Private Equity firms despite the challenges linked to the entrenched bureaucracy of Italian football and the notorious mismanagement of its clubs. Deloitte’s Annual Review on Football Finance, which assesses the financial state of Europe’s five major leagues, found that most Italian clubs experienced operating losses in 8 of the past 10 seasons, lagging the UK’s profitable Premier League, Spain’s La Liga, and Germany’s Bundesliga, with France’s Ligue 1 being the only major league to have performed worse than Italy’s Serie A. The Serie A’s losses have been largely attributed to dwindling matchday revenues and issues surrounding broadcasting contracts.

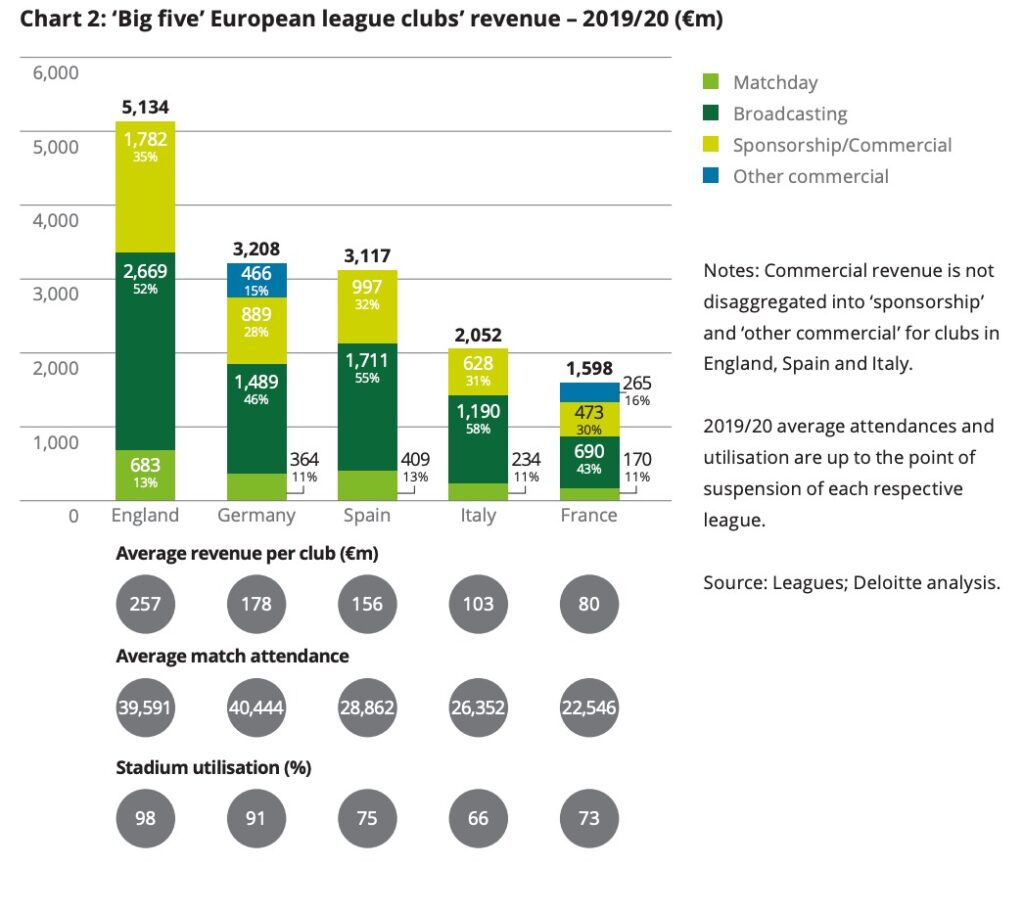

After closer inspection, the Serie A’s stadium-related performance is particularly concerning. The league’s attendance data stands out as the worst among Europe’s 5 main leagues, with Italy’s average match attendance of 28,000 falling just above that of Spain’s at 26,000. The Serie A’s stadium capacity utilization of 66% is also significantly lower than that of the other 4 leagues. This poor attendance has had a detrimental effect on matchday revenues, a vital source of revenue, yet these statistics still fail to provide the full picture.

Another important factor relates to the current state of stadiums, as Italy’s football infrastructure is largely obsolete, especially when compared to that of other European countries. Aside from being exceptionally old, most infrastructure is owned and managed by rather inefficient government bodies. This has delayed renovations across the board whilst also alienating private developers due to the high level of bureaucracy associated with obtaining the necessary construction permits. The Allianz Stadium, Italy’s most advanced sports facility and one of the country’s few privately owned stadiums, represents a benchmark for all future projects. With an average capacity utilization of 94.5% in 2019, its attendance data is in line with that of Premier League clubs. Due to the poor structural conditions, it’s almost impossible for Serie A clubs to emulate the revenues experienced by its English, Spanish, and German equivalents. The Allianz Stadium presents a stark comparison with other clubs, as it is both small enough to have operated at full capacity throughout most of the games hosted by Juventus since the stadium’s completion in 2011, and modern enough to be attractive to casual fans, who represent an important percentage of the stadium’s visitors. Additionally, as foreign sponsors are often deterred from advertising their brands in neglected structures, Serie A clubs are often forced to raise ticket prices to stabilize revenues, further decreasing the average fan’s experience, reducing attendance further.

Another important factor affecting the league’s decreasing profitability relates to its broadcasting rights and the fall in resulting revenues which account for half of the average Serie A club’s balance sheet. The latest deal, which saw DAZN and Sky acquire the domestic broadcasting rights for around €928m per season from 2021 to 2024, is about 5% smaller than the previous deal. Revenues from the sale of international broadcasting rights are also falling. After a drop of €196m per season and beIN Sports’ exit, the Middle East and North Africa (MENA) region’s previous broadcaster, Serie A sold the corresponding rights to YouTube for a reported €50m per season, a stark decrease. This trend reflects the Covid-19 induced uncertainty; it also confirms the previously discussed trend related to the Italian championship’s underperformance compared to Europe’s other major leagues.

Based on the noted factors and the league’s subsequent decreasing club valuations, currently, Italian clubs seem to be undervalued, and underperforming based on the Serie A’s potential for profitability and growth, fortified by its large fanbase, rich history, and global relevance. Yet, this has induced several investments by part of US firms from Mediacom’s acquisition of Fiorentina in 2019, to the latest deal between Atalanta and Pagliuca. Most of these investors intend to renovate the team’s current stadiums, to employ their full commercial potential. Most investors believe that Italian football is beneath what it could be, and with sufficient investments they believe these clubs fill the financial gap between the Serie A and its rival leagues. Additionally, foreign investors have facilitated the Serie A’s entry into emerging markets, such as the Middle and Far East, as well as the US. To increase visibility, the Italian Supercup, an auxiliary one-game competition between last-year’s league’s and national cup’s winners has also been played for over a decade in different locations, from China to Saudi Arabia.

The Atalanta Deal

On the 19th of February 2022, Atalanta Bergamasca Calcio S.p.A. announced a partnership agreement between the Percassi family and a group of investors led by Stephen Pagliuca, managing partner and co-owner of the Boston Celtics and Co-Chairman of Bain Capital. The agreement provides the new investors with a 55% total stake in La Dea Srl, the Percassi family’s sub-holding, which owns over 86% of Atalanta.

Nevertheless, the Percassi family will retain a 45% stake, making it the single largest shareholder. The club‘s governance will reflect this mutual partnership: Antonio and Luca Percassi will retain their respective roles of chairman and CEO, while Stephen Pagliuca will be appointed co-chairman.

Several reason why Pagliuca and the investors opted for the partnership can be found. First, unlike with most football clubs, Atalanta’s balance sheet recorded minimal losses because of the pandemic. Specifically, Atalanta may have even benefitted,: closing its consolidated financial statement of 2020 with a net increase in revenue, from €118.6m in the previous year to €242m. This result was driven by revenues from trading player registration rights and from the sale of TV rights, thanks to the club’s participation in the UEFA Champions League. Naturally, ticket sales halved to €6.7m due to restrictions on attendance, yet this had a minimal impact on the club’s income statement. Thanks to these results, Atalanta managed to generate a net profit of €51.7m, up €25.2m from €26.5m earned in 2019, the club’s net financial position was also positive at around €42.1m.

Secondly, Atalanta is one of only five clubs in Italy that own their own stadiums, with the remaining clubs operating in stadiums owned by their respective city councils. This enabled Atalanta to increase its profit and manage its brand to a higher degree, improving the experience for attending fans through a variety of renovations. The club fortified the synergy between the team and its fans which ultimately boosts attendance, thus increasing fan spending. The project for the acquisition and restructuring of the Bergamo stadium has a total planned investment of approximately €54m. Thanks to a new loan provided by a pool of banks headed by Banca Intesa Sanpaolo and the participation of the Istituto per il Credito Sportivo, Atalanta will have an investment line of €35m at its disposal.

The Evolution of European and Italian Football

European football might evolve to be different from how we know it today, with clubs today playing most of their matches within their respective national competition and a smaller number in international events like the Champions League. The proposed evolution of football backed by the likes of Real Madrid, Juventus, Barcelona, Citibank, and previously J.P. Morgan envisions a continuation of the planned Super League, a proposed international competition of a handful of elite clubs. Naturally, the Super League was immediately hit with criticism from other teams due to participation being limited to its founding teams. The new proposal is open to the inclusion of up to 24 teams whose participation is confirmed through previous international and national championships. National championships would remain unchanged except for a few new entrants. This scenario aims to increase revenues through its spectacular matches between the aforementioned elite teams, increasing viewership and fan attendance. The secondary championships where teams play to qualify for the Super League would keep their club-driven objectives, investing in increasing their domestic supporters. This scenario also aims to attract more investors to football, increasing the volume invested into championships, in turn, increasing returns for the Super League’s founding clubs. Secondary clubs which don’t qualify for the Super League would have to find new ways to attract viewers.

In the second scenario we would see European football remain as it is, emphasizing a club-driven focus with the objective of continuously increasing the participation of foreign investors like Private Equity funds. These investors would keep on funding teams participating in leading championships like the Serie A. Let’s focus on how this scenario relates to the Serie A. First, we’d see more clubs experience an increase in their revenues through secondary streams like documentaries and NFT projects. Some experts also hypothesize that the Serie A might take on the Bundesliga’s 18 team business model. This would increase competition between clubs and thus viewership, increasing returns for the remaining teams’ investors.

Another factor relates to the fact that most of Italy’s stadiums are government-owned. Since when privately held, stadiums have proven to maximize revenues, investors and managers may spend the next few years developing plans to acquire their own stadiums. The majority of clubs that play in publicly held stadiums are looking to build new, privately-owned stadiums, as new and improved stadiums increase attendance, creating communities around their perimeters in the long-term. Furthermore, these clubs would be able to claim a higher percentage of the revenue made through the sale of tickets, suggesting that stadiums could become a sort of cash cow. However, at the same time, there’s a significant risk of the government not being able to eliminate the bureaucracy that already exists in the stadium-construction process, therefore obstructing the development process, increasing the risk that investors lose money. If bureaucracy diminishes, the Serie A can expect a bright and lucrative future.

Conclusion

The Italian Football League is certainly not fulfilling its full potential, especially when compared to other leagues. Due to relatively low valuations and related lack of profitability, compounded by the uncertainty brought by the pandemic, Serie A clubs have been an interesting target for Private Equity investors aiming to develop their infrastructure, operations, and management. Nonetheless, Atalanta has proven to be a virtuous example among the Serie A’s clubs. As one of the few clubs to have their own private stadium and one of the only clubs to report an operating profit during the pandemic.

Looking at the bigger picture, the pandemic has hit European clubs hard, cutting match-day revenues and associated operations, a fundamental part of their balance sheets. This has fueled proposals of competing leagues like the Super League, aimed at bringing in additional revenues. All in all, one can state that there’s an enormous gap to be filled: this has led Private Equity investors to pour money into Italian Football, the league being among the top-five with the largest room for growth.

Sources

https://www.reuters.com/article/serie-a-broadcast-idUSL8N2RB53Z

https://www.atalanta.it/en/news/atalanta-bc-press-release-19-february-2022/

Editor: Noah Halbritter

Comments are closed.