by Ngoc Tram (Claudia) Ta and Francesco Puricelli

What is a Carve-out Deal?

Carve-out deals are transactions in which a corporation with multiple business segments sells a minority stake of a specific product line or division in a public offering. As a result, the divested subsidiary is effectively “carved out” from the parent company and becomes a standalone business. Commonly, the partially divested segment is “non-core”, only making up a small fraction of the parent company’s revenues.

As a standalone company, the carved-out business unit is a separate legal entity with its own financial statements and Board of Directors. However, since the divestment of the business unit is only partial (it is rare for more than 20% of the equity stake in the subsidiary to be sold off), the parent company usually retains some control over the divested subsidiary.

In the first six months of 2021, $281.1bn was transacted in carve-out deals in the U.S. alone — an impressive 197% YoY increase — as reported by Dealogic.

The Rise of Private Equity in Carve-outs

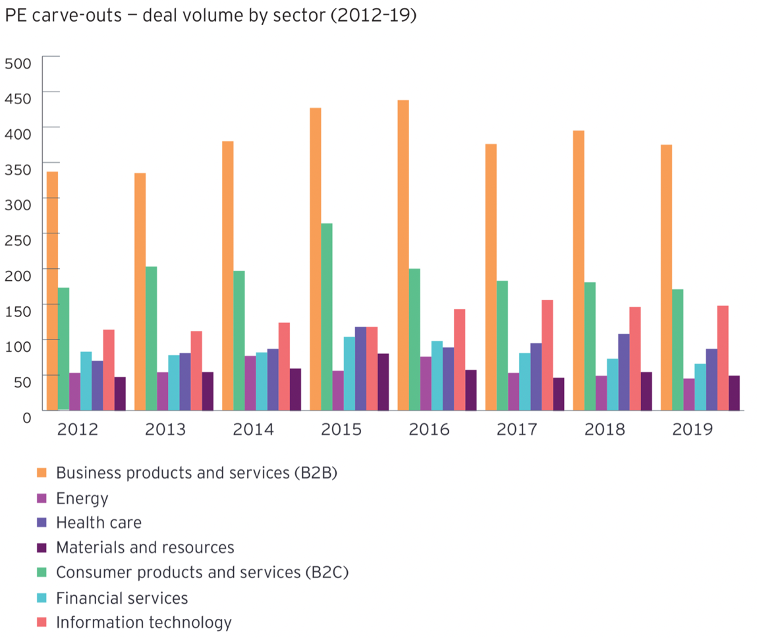

As the graph shows, even before the COVID-19 pandemic, carve-out transactions enjoyed great popularity. They have paved the way to extract value for stakeholders both from the perspective of private equity firms and corporates. Several factors, including higher debt levels, regulatory pressures, and shareholder activism provoked a significant increase in divestment activities in the mid-2010s, which can be seen in the graphic below.

In recent years, unexpected economic turbulence has prompted businesses to reassess long-term strategies. Indeed, even though carve-outs historically have been a good way for companies to create value, when the pandemic hit, economic activity slumped. Therefore, carve-out deals saw increasing interest from PE firms to re-examine their capital allocation and plan strategies for future acquisitions in a market ripe for strategic acquisitions.

According to Matthew Nord, Co-Lead Partner at Apollo, private equity firms are excellent solution providers for carve-out deals because they are quick in providing capital and have a unique and experienced skill set that can help corporate management firms to execute divestments successfully. In addition, private equity firms are attractive partners because they don’t face the same regulatory hurdles as corporates when securing relevant merger control clearances, and they are known for being able to rapidly push through deals, taking advantage of conditions in which a lot of incremental strain weighs down companies, both from an earnings and balance sheet perspectives.

For the reasons already described, it is clear that carve-out deals have formed a trend that is here to stay. That is particularly evident in hot sectors such as healthcare (see below deals involving EQT-Schülke, Cinven-Bayer, and Cinven-Lonza) and TMT, where private equity is able to facilitate divestments that align with and strengthen the companies’ culture.

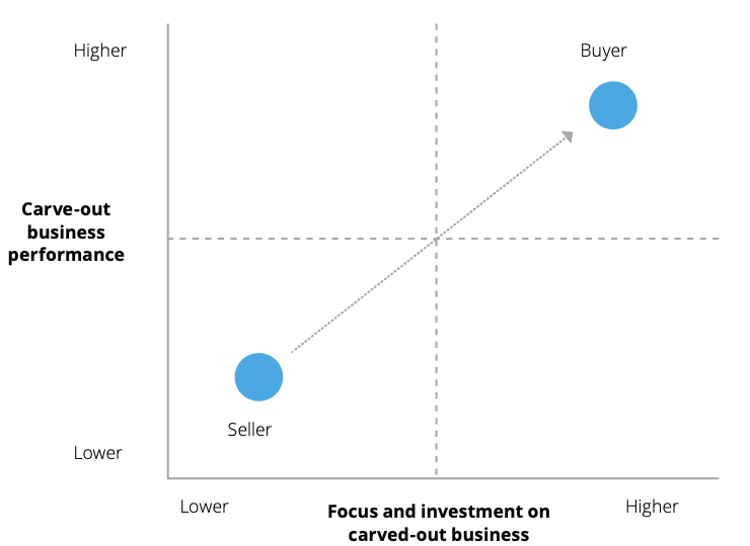

Carve-out deals represent unique opportunities for private equity investors with significant potential for superior returns, particularly when economic turmoil may prompt more companies to review their portfolio mix. Thus, the key to success is differentiation. Even though PE sponsors have historically been at a disadvantage when bidding for spun-off assets, perhaps because they have not been able to offer as much as strategic buyers who are able to effectively mitigate regulatory hurdles with strategies that include creative deal structuring, private equity firms can increase their success rates in carve-outs. To that extent, superior risk-adjusted returns stem from assets that have not received adequate attention or capital infusion as part of a more diversified organization. This may present attractive opportunities for transformative top-line growth and margin improvements. PE buyers, bringing more focused strategies for long-term value creation to these divested assets, can realize generous upsides.

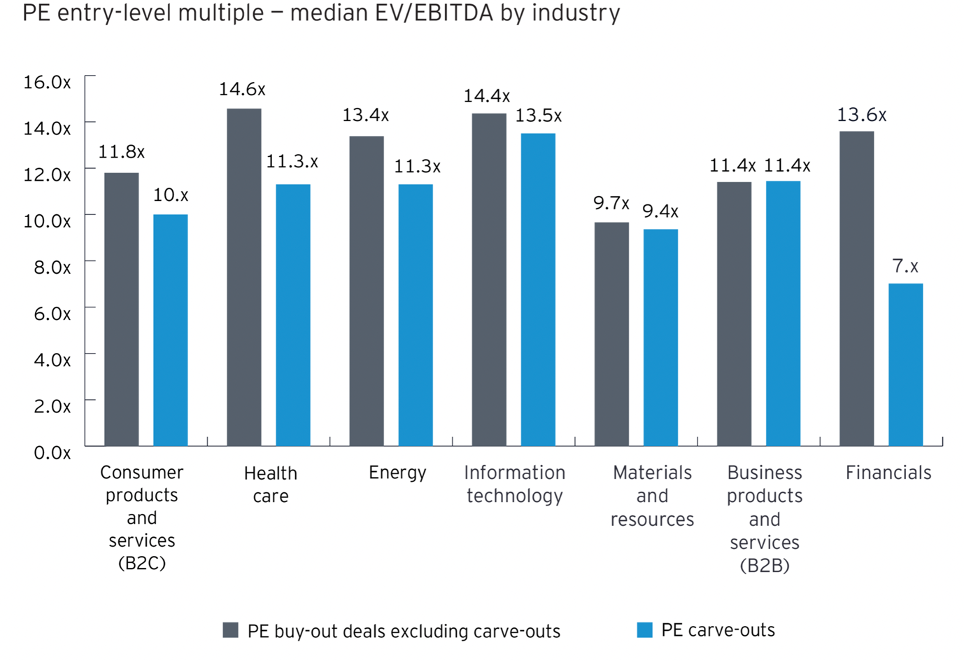

Another interesting feature about carve-outs is their ability to provide a rich seam of transaction flow when more common and less complex deal sources face fluctuations and volatility. As depicted in the graphic of EY below, investments in carve-outs offer lower entry multiples when compared to LBOs, leading to better returns. Indeed, in a sample of 700-PE backed carve-out deals, the returns exceeded the average IRR of 14.1% delivered by the PE industry, with some of them delivering up to 30%-50% IRR.

Despite the different characteristics that make carve-outs so appealing, they pose specific risks and challenges, such as obstacles in the due diligence process, given the poorer financial data, the competition from strategic buyers, deal structuring complexities, and post-deal planning. Again, findings are coherent with the risky nature of carve-outs: according to a recent survey by TMF Group, over one-third of PE executives said that their most recent cross-border carve-outs have failed because of higher-than-expected costs and because of lack of planning. As a consequence, mismanaged carve-outs can destroy value both for the new company and the company that spawned it.

2022 Outlook

International markets have been wobbly in recent months as inflationary pressures have threatened interest rate hikes by central banks and the economic pressure from the Russian invasion of Ukraine has only exacerbated this.

Carve-outs often occur during periods of macroeconomic instability when firms are forced to reassess their strategic and profitability position. In the current market environment, corporations may feel pressured to divest non-core businesses. The increase in corporate divestment activity over the last twelve months has been driven by the fallout following the pandemic: companies have issued high amounts of debt in 2020 to navigate through the pandemic, and now these businesses are putting non-performing, non-strategic assets on the block to raise cash and pay back these liabilities in order to better focus on their most profitable core operations.

For PE firms, the indirect softening of valuations caused by the outlined geopolitical uncertainty may in a way offset the record-high multiples many private equity firms grappled with in 2021 and consequently create interesting opportunities for buyouts. Based on Pitchbook data, unprecedented capital raising in the last few years (capital raised by European private equity in 2021 exceeded €90bn) coupled with slowed COVID-related M&A activity means PE firms still have large amounts of committed but unallocated capital, known as dry powder, to offload.

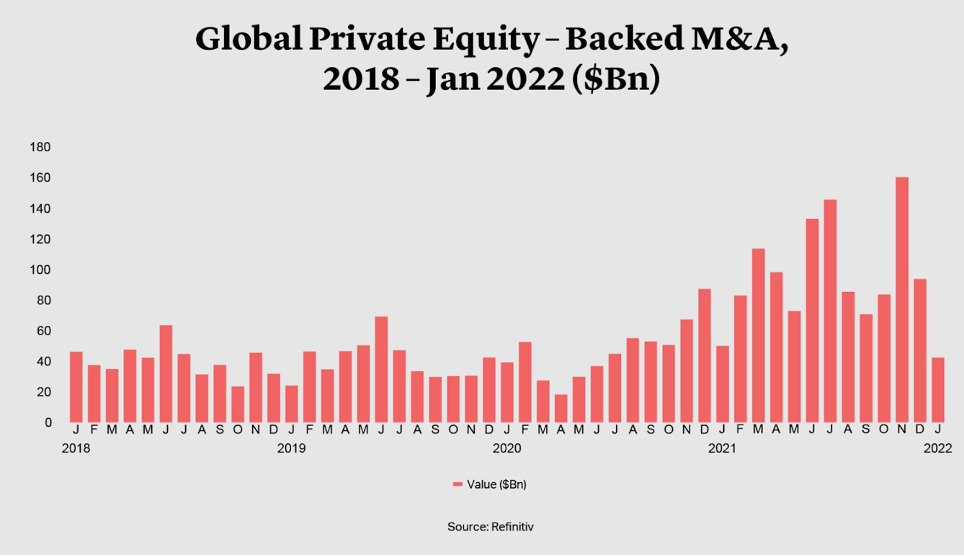

Nevertheless, private equity activity slowed down in January 2022 as public market turbulence, due to the aforementioned factors, created uncertainty on both the buy- and sell-side.

Klaus Hessberger, Co-Head of Strategic Investors and Financial Sponsors Group in EMEA for JP Morgan, agrees with Matthew Nord from Apollo — he is confident current market conditions are the most favorable ones for carve-outs in more than a decade and sees the biggest wave of divestitures since the last financial crisis. The enormous amount of liquidity in the markets (investors are currently sitting on a record $1.5 trillion in cash, the global supply of dry powder that has more than doubled in less than five years), the record levels of fundraising for PE funds and the generous debt market can boost the buying power of large investment firms. In addition, the promise to delever balance sheets, the pressure from rating agencies, and the push to invest in growth and the technology transition are further catalysts for a steep increase in carve-out activity in the next months.

These findings are supported by empirical evidence: Corporate divestitures to PE firms have boomed over the last years: the first half of 2020, according to Dealogic, was an exceptional period for carve-outs, with more than $250bn in global volume and the momentum carried over into 2021. Interestingly, despite the increase in the total volume, the number of transactions dropped by approximately 20%, revealing a rise in deals at the top end of the market.

Recent Carve-out Deals

To further illustrate the case of carve-outs in the recent past, the following section is building on the outlined theory by providing insights into two deals.

KKR – VIRIDOR

Announced date: 18/03/2020

Completed date: 08/07/2020

Acquirers: Kohlberg Kravis Roberts & Co. L.P. (KKR), Hermes Infrastructure

Target: Viridor Waste Management Limited

Seller: Pennon Group Plc

Enterprise Value: £4.2bn

EV/EBITDA multiple: 18.5x

EV/Revenues multiple: 4.9x

Deal Summary:

In July 2020, environmental and water utility company Pennon Group Plc (FTSE 250 member) sold its recycling and residual waste business unit, Viridor Waste Management Ltd, via auction to a consortium led by KKR’s newly formed company Planets UK Bidco in a debt-free, cash-free deal valued at £4.2bn. These figures denote an EV/EBITDA multiple of 18.5x. KKR alongside other investors acquired a 90% stake in the company while Hermes Infrastructure acquired the remaining 9.45% equity. An additional amount of £200m is payable in the next six years depending on certain contingent matters. The Pennon Group Plc received £3.7bn in net cash proceeds as a result of the deal.

Opportunities:

Viridor has positioned itself as a market leader in the recycling and waste management sectors in the UK, with its business model supported by government policy as the UK partner of choice for waste management. Having operated in the waste sector since the 90s, its strategic position is strong with a deep understanding of the sector, complementarity, and priority from suppliers across its value chain, brand recognition, and large-scale investment making up its competitive advantage that may aid future growth.

Acquirer KKR is a leading global investment firm with over $200bn in AUM that manages multiple alternative asset classes, including private equity and infrastructure. As put by Tara Courtney Davies, KKR’s Head of European Infrastructure, “We see enormous potential for Viridor as a standalone business. The company is already a sector leader with a strong platform and an experienced management team. With KKR’s support, Viridor is uniquely positioned to invest further and continue to build critical infrastructure, helping the UK meet long-term sustainability and environmental goals.”

Viridor will also diversify Hermes Infrastructure’s Value-Added portfolio, providing the investment manager exposure to the UK recycling and waste management sector. As part of the carve-out, Pennon Group has received net cash proceeds of £3.7bn, which it intends to in part retain for investment in future opportunities but mainly use to lower Pennon Group’s company borrowings and make a return to shareholders. Selling off Viridor means the parent company will now be able to focus on its water and wastewater business, its core business.

EQT – SCHÜLKE & MAYR

Announced date: 07/04/2020

Completed date: 03/08/2020

Acquirer: EQT Partners AB

Target: Schülke & Mayr GmbH

Seller: Air Liquide SA

Enterprise Value: €925m – €1bn (earn-out provision)

EV/EBITDA multiple: 12.33x

EV/Revenues multiple: 2.8x

Deal Summary:

In summer 2020, EQT Partners AB, a global investment organization, announced the acquisition of Germany-based hygiene products manufacturer Schülke & Mayr, from Air Liquide SA, a CAC 40 and EuroStoxx 50 constituent. The total value of the transaction, which is subject to an earn-out provision, is approximately equal to €1bn, with an implied EBITDA multiple of 12.33x. Schülke was mandated off an EBITDA within €50m – €70m range, aiming for a 13x EV/EBITDA multiple, implying an EV of €750m – €1bn. However, the trailing 12-month EBITDA increased as Schülke performed extremely well during lockdowns, in the first months of 2020.

The investment is in line with EQT’s thematic approach guided by the United Nations Sustainable Development Goals, specifically SDG 3, related to Good Health and Well-being. Thus, this deal proves that carve-outs are an important lever for companies to realign their organizations in line with global ambitions to achieve SDGs goals by 2050.

Opportunities:

Schülke & Mayr is one of the leading manufacturers in the field of infection prevention and hygiene. Developing, producing, and distributing antiseptics for wound care, disinfectants, medical and cosmetic skincare products since 1889, the company is extremely well-positioned to take advantage of the momentum in the industry, strengthening its presence in existing markets and focusing on R&D for new products, especially in the clean beauty field, which represents an increasingly attractive sector given the demand by the new generation of consumers seeking products with milder ingredients.

Acquirer EQT is a purpose-driven global investment organization with more than €75bn in raised capital and currently more than €46bn in AUM across 16 active funds. EQT funds have portfolio companies in Europe, Asia-Pacific, and North America. Matthias Wittkowsky, Partner at EQT, commented the deal “Schülke is a very impressive company with a long track record of developing innovative hygiene solutions to help protect people’s health. The dedication and hard work of the entire team during the current pandemic has underlined this once again. EQT is now looking forward to supporting Schülke’s management team as the company enters the next chapter of its long growth history”.

The transaction will support Air Liquide’s ambition to become a leader in its industry, delivering long-term performances by contributing to sustainability and promoting regular and responsible growth over the long term.

As stated above, Healthcare is one of the hottest sectors for carve-outs. Figures demonstrate that investors consider the sector’s high-profit margin, resilience, and recession-resistant characteristics likely to persist, and this has supported the investment activity in healthcare and MedTech in the last years.

Indeed, in July 2021 the closing of the carve-out of Lonza Specialty Ingredients (LSI) through Herens HoldCo, an entity controlled by private equity firms Bain Capital and Cinven, was announced for an EV of CHF 4.2bn. The transaction is part of Lonza’s divestment strategy and will allow the firm to refocus on its core business, becoming a pure-player partner to the healthcare industry. Notably, Cinven is one of the most active firms in the PE carve-outs space, recently announcing on March 10th it has signed an agreement with Bayer AG to acquire its Environmental Science Professional business unit for an enterprise value of $2.6 bn USD in a carve-out.

Conclusive Outlook

As multi-national companies strive to extract value and innovate under macroeconomic disruptions such as the pandemic, the Russia-Ukraine conflict, and the disruption in the global supply chain, carve-outs seem to offer a solution. Although such transactions involve specific challenges and risks, they can lead to strong returns for PE buyers that have a well-developed playbook and have the right execution and management skills.

Sources

https://channels.ft.com/en/bigdeal/the-rise-of-private-equity-in-the-complex-carve-out/

https://channels.ft.com/en/bigdeal/the-rise-of-private-equity-in-the-complex-carve-out/

https://www.privateequityinternational.com/baker-mckenzie-carve-outs-continue-to-fly/

https://www.ft.com/content/60ac8bbe-693a-11ea-800d-da70cff6e4d3

https://www.jdsupra.com/legalnews/private-equity-carve-outs-ride-post-2947351/

https://www.pwc.com/ca/en/services/deals/value-creation/carve-outs.html

https://www.mergermarket.com/deals/view/1051366?currency=EUR&lang=en

https://www.packagingnews.co.uk/news/kkr-completes-4-2bn-acquisition-viridor-10-07-2020

https://www.cinven.com/media/news/cinven-agrees-to-acquire-bayer-environmental-science-professional/

https://www.marcumllp.com/insights/carve-out-deals-are-thriving-in-post-covid-economy

https://www.privateequityinternational.com/meet-the-deals-likely-to-shape-2022/

https://www.ardian.com/news-insights/inside-carve-out-expleo

Editor: Stefanos Ymeri

Comments are closed.