By Mauro Spadaro and Dario Spinelli

Stucture

- The crowded Spanish Telco Market

- Starting the domino: MasMovil going private

- Consolidation: the acquisition of Euskaltel by MasMovil

- Please, don’t stop the music

The crowded Spanish Telco Market

Spain, among other countries in Europe, has been highly regarded as one of the most competitive telecommunication markets in the world. The region – together with Italy and other European countries – is an example of the results of European Commission’s Antitrust policy, whose main aim is to increase competitiveness in the industry. Although impressive outcomes have been achieved, still, EU authorities seem continuing to be sceptical of concentrations and mergers in the name of cost savings and increased innovation. The debate, however, goes on. On the one hand, some scholars argue that EU Antitrust approach should be more welcoming towards mergers, aiming to have fewer, but more innovation-prone operators willing to commit to larger budgets thanks to lower competition. Others, instead, argue that more competition would push for more innovation, thus the more players, the more consumer welfare on the table at the end of the day.

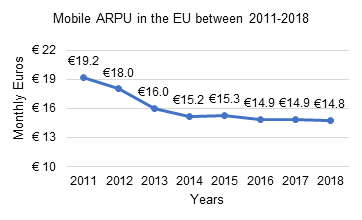

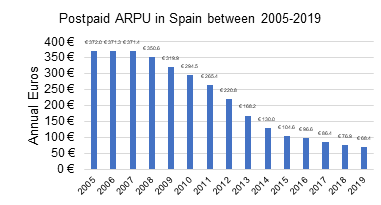

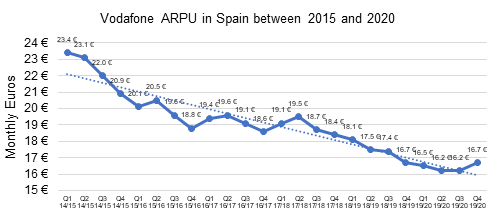

Having a clear view of this policy approach setting, it is almost unquestionable that Spain represents rather a unicum in the European scenario, where Average Revenues Per User (ARPU) are almost inexorably declining, for all types of subscriptions, either mobile, post-paid, or fixed [Exhibit 1].

If revenues are then quickly changing and declining, what has not changed for the players in the industry is capital intensity. Most carriers need to commit to consistent amount of spending for the rollout of the next generation of the network, which is represented by 5G. Accordingly, the European Commission forecasts that reaching EU’s Digital Agenda targets by 2025 will require approximately €500B in investment, primarily coming from the private sector.

Considering such pressures and trends, private equity funds arrived. Many saw the opportunity to play the consolidation tango, due to the inexorably commoditization and declining margins of the industry. In markets where competition is strong and prices are rock-bottom, mergers have been almost inevitable. It has been for instance the case in Italy where in 2016, Wind and Hutchinson’s Three merged, resulting in Wind-Tre, a player capable of competing with Vodafone and TIM (Telecom Italia) in terms of number of users and network coverage.

Not always has it been tickles and hugs though. Before the Wind-Tre merger, EU’s authorities stroke down an important concentration in the UK Telco market between Hutchinson Three UK and O2 (2015) causing major fears among European carriers. Wind-Tre merger case came for many as relief and a signal of European Commission’s more accommodating policy, paving the way for a new wave of consolidation throughout the European continent.

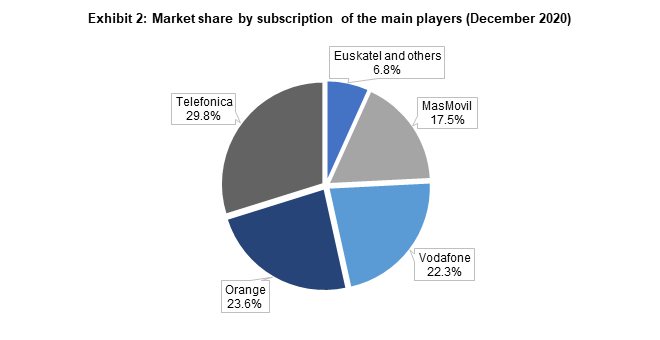

Thus, Spain is an example of these major forces that are going on. On the one hand, European Commission’s Antitrust policy aims and on the other profitability and Capital Expenditure (CapEx) concerns of Mobile Network Operators (MNOs), which are desperately trying to stay afloat. Consolidation in the Spanish market was highly expected by many commentators. As the average number of operators in EU member states is around 3 to 4 in most of the cases, the fact that Spain presented 5 fierce competing players (MasMovil, Euskaltel, Telefonica, Vodafone, Orange) was an initial signal that the situation could not be sustainable in the long-term [Exhibit 2].

Starting the domino: MasMovil going private

MasMovil Ibercom, S.A. is the fourth largest Spain Telco company, and it is part of the IBEX 35 index, being founded in 2006. Since its birth, it was characterized by an aggressive expansion policy aiming to grow rapidly through acquisitions with the ultimate objective to conquer the market by offering the most competitive market supply, while focusing on customer satisfaction. In 2012 the Company was listed on the MAB (Mercado Alternativo Bursátil). In 2014 a new group was created by the merger of several Spanish operators: the so called, as we know it today, MasMovil Ibercom, S.A. In the following years, the Group has continuously carried out several acquisition transactions (e.g., Pepephone, Yoigo, Llamaya, Lebara…) that enriched its customer base. Therefore, MasMovil quickly became the fourth largest Spanish Telco company, thus representing a rare case of success in an industry characterized by low growth and thin margins.

Private equity funds then came. In June 2020, the Group received a takeover bid by a trio of private equity firms: KKR, Providence Equity Partners and Cinven. The bidders offered to pay a price of €22.50 per share, which implied a 20% premium over MasMovil share price and an EV valuation of almost €5 bn. This deal was one of the largest public-to-private transactions carried out by PE firms in the European Telco market. The offering was welcomed both by the management, which defined it as “beneficial for MasMovil’s shareholders and other stakeholders”, and by the markets, as MasMovil price rose by 23% on the day after the announcement. Such a deal was perceived by a signal of interest in the European Telecommunications market by PE firms. As a matter of fact, analysts believe that MasMovil will be used as an acquisition vehicle in Spain and nearby markets, consistently with the Group’s aggressive expansion policy.

The transaction was completed on November 18th, date on which MasMovil’s ownership structure was profoundly modified, giving birth to a complex pyramidal one. In fact, after the transaction, MasMovil became 100% owned by Lorca Telecom Bidco, S.A.U., in turn owned by Lorca Holdco Limited. The latter is wholly owned by Lorca JVCo Limited, which is 86% participated by Lorca Aggregator Limited, whose members are, indirectly, the previously cited PE firm’s trio (Cinven, KKR and Providence Equity Partners – respectively with 29.87%, 33.33%, 36.79% stakes).

Today, the Group has a customer base of more than 11 million users and its 4G network covers 98.5% of Spanish population.

Consolidation: the acquisition of Euskaltel by MasMovil

On March 28th, MasMovil announced a €2.1 bn public offering aimed at acquiring 100% of Euskaltel shares. Such a deal, combining the fourth and fifth largest Spanish MNOs, would bring MasMovil closer to the podium, dominated up to now by Telefonica, Vodafone and Orange, Spain’s largest MNOs.

Euskaltel

Euskaltel, S.A. is one of the biggest Spanish Telco companies, based in the Basque Country (Derio). It was founded in 1995 by a joint project of the Basque Government and various local banks. Euskaltel operations are divided into three main branches: Residential (fixed and mobile telecommunication, broadband, wireless internet, and digital television services), Business (fixed, mobile telephony and internet services for enterprises), Wholesale and Other (delivery of infrastructure leasing and IT outsourcing, but also digital transformation processes). Having always been a more local player, deeply rooted into the Basque area, the MNO has recently launched a renewed expansion strategy (through a new brand called “Virgin Telco”), whose main aim is to consolidate its competitive position in the broader Spanish market. This strategy has proven to be extremely successful, as Virgin Telco has recently gained more than 70,000 new customers in less than seven months. Because of its expansion, new heights have been touched by the group who hit a new customer base record in 2020 with 823,000 customers in total. The company is largely controlled by Zegona Communication plc (an UK-based investment company that buys and sells businesses in the European Telecommunications, Media, and Technology – TMT – industry), which owns 21% equity stake in Euskaltel – valued £428M after the takeover bid.

The Deal

Starting from the acquisition process, it is noticeable how the transaction is characterized by an unusual feature as MasMovil is not the “formal” bidder. Consistently with its pyramidal structure and ownership, the bidding company is Kaixo Telecom S.A.U., a wholly owned subsidiary of MasMovil.

The deal aims both at expanding the Group’s customer base and increase cost savings, reducing capital intensity of the 5G investments needed for the rollout of the new network. The transaction also aims at bridging the gap between Spain’s three main MNOs (i.e., Telefonica, Vodafone, and Orange), further strengthening MasMovil’s competitive positioning.

MasMovil’s offering price is set at €11.17, implying a 26.8% premium over the average Euskaltel stock price over the previous six months. The offering, financed by a syndicated loan, is subject to the achievement of a 75% equity stake and to regulators’ approval. However, this does not seem to be a serious obstacle for the deal, as the bid has been subscribed by more a consistent number of shareholders, reaching 50% of Euskaltel’s capital on the announcement date. Moreover, according to analysts, regulators will allow the finalization of the transaction, as the European Telco industry – and especially the Spanish one – is an extremely fragmented sector characterized by fierce competition and low returns.

Euskaltel’s Board of Directors approved the appointment of Citigroup Global Markets Europe AG as financial advisor and Uría Menéndez as legal advisor.

The bid has been positively greeted by Euskaltel major shareholders (Zegona, Kutxabank and Alba Europe), who have already given their binding approval to the transaction. Particularly, Zegona’s CEO Eamonn O’Hare, defined it as a “nice clean exit on our Spanish adventure”, since it would provide Zegona’s investors an almost 90% return over the 6 years old investment. He also added that such a transaction was already considered by Euskaltel’s expansion plan, as it would allow the Company to further expand to the entire Spanish market.

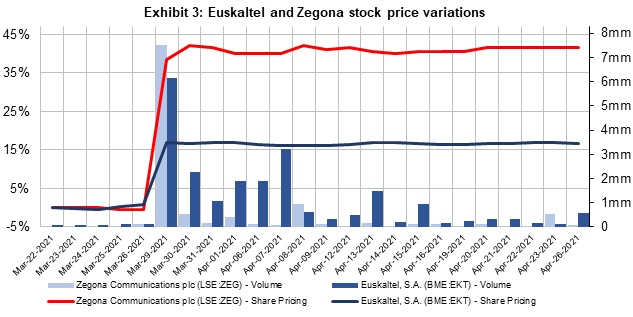

Not only Euskaltel’s shareholders, but also capital markets welcomed the transaction, as the company stock price rose by 16% [Exhibit 3] on the day of the announcement, reaching €11.12 per share, its highest level in five years-time (similarly, Zegona’s share price gained 30% on the date of the announcement).

According to O’Hare, Chief Executive of Zegona, the deal is expected to close within the fourth quarter. A similar optimistic view is shared by Canaccord Genuity, whose analysts believe the transaction will be finalized in 6 months and will face low regulatory risk.

Please, don’t stop the music

It takes two tangos, maybe more if the dance does not stop. According to O’Hare, in Europe “there are more than 150 companies in the TMT sector with enterprise value in the “sweet spot” of approximately €3bn for the next up-coming deal. Those ranged from non-core assets owned by the “big mother ships” in the industry, to small or regional players such as Euskaltel”.

With profitability dropping and the industry shifting from its traditional revenue stream model to other ones, additional deals are naturally expected. Many players are trying to diversify, moving into more lucrative market niches for instance in the so-called “Over-The-Top” (OTT) services sector. Other important trends include the further convergence of the telco industry into the video/music streaming one. Thus, we may also expect deal and private equity activity to that regard, also given the increased usage of devices by the large population due to the recent pandemic. If the dance will not stop, let it go on, until the sun goes up.

Authors: Mauro Spadaro and Dario Spinelli

Editor: Tiago Guardão

References

Fildes N. (2021), MasMovil offers €2bn for Basque rival Euskaltel, Financial Times, https://www.ft.com/content/33170195-fa2e-411f-be3d-295c9fa7782c, Accessed 29 April 2021

Commission of the European Union (2016), 5G for Europe: an Action Plan. Communication from the Commission to the European Parliament, the Council, the European social and economic committee and the committee of regions. 14/09/2016.

Euskaltel Company Documents and Press Releases

MasMovil Company Documents and Press Releases

Reuters

Vodafone PLC Financial Statements

Statista Data

Comments are closed.