By Giacomo Nicoli, Filippo Zocco

Introduction

In this article, we present the concept of impact investing, starting from its origins and how it differentiates from ESG valuation and Socially Responsible Investing (SRI). To better understand the dynamics and the investment strategy of an impact investing fund, we then introduce True North through a coffee chat with Lorenzo Magagnin, analyst at True North.

In the end, we will also provide an internal point of view on the future of impact investing and whether it will become the new normal or not.

Terminology: Impact Investing, ESG Valuation, SRI

The term “impact investing” was first coined in 2007, but the practice was developed in previous years. Impact investing is an investment strategy that aims to generate specific beneficial social or environmental effects in addition to financial gains. Impact investments may take the form of numerous asset classes and may result in many specific outcomes, always with the underlying goal to create positive environmental or social outcomes that add up to financial returns. That is why impact investing may sometimes be considered an extension of philanthropy.

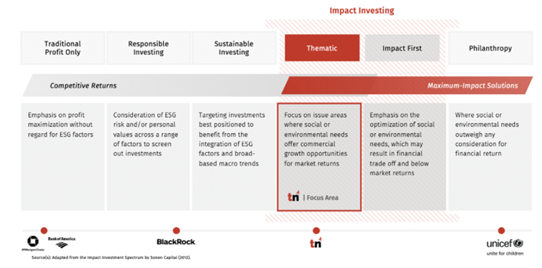

While ESG valuation – the assessment of the environmental, social, and governance practices of an investment – preserves financial performance as the main objective, socially responsible investing (SRI) goes a step further by actively eliminating or selecting investments according to specific ethical guidelines. SRI, sometimes referred to as sustainable or socially conscious investing, when focused on environmental causes (i.e., green investing) is a form of impact investing. However, although the definition of SRI encompasses avoidance of harm, impact investing also suggests positive impact via its investments.

History and Trends of Impact Investing

Back in 2010, JP Morgan and the Rockefeller Foundation, together with the Global Impact Investing Network (GIIN), published a report claiming that impact investment was an emerging asset class that would reach between $400 billion and $1 trillion in assets under management by 2020. Despite the ambitious prediction, in 2020 the market lived up to the 2010 expectations, attaining roughly $715 billion in assets under management, according to GIIN. The logic question to ask now is what to expect for 2030.

To forecast 2030 figures, it is important to remark some important trends that led to the 2020 results and to think about the impact of the current crisis at a global level. Indeed, we know that the climate emergency, economic inequality, gender disparity, racial injustice, and other crises – prime targets of solutions supported by impact investments – were already posing deep challenges on governments around the world at the start of this decade. Moreover, it has been estimated that there is a $2.5 trillion annual gap in the funds needed to deliver the Sustainable Development Goals (SDGs) set out by the UN for 2030. On top of these considerations, the Covid-19 pandemic has devastated and disrupted the lives of people around the world. Thus, making it even harder to achieve the SDGs as governments shifted resources to tackle the ongoing crisis.

To conclude, not only will private impact investment capital be key to funding the SGDs, but it will also play an important role in finding solutions to problems conventionally seen as domain of the public sector, which is struggling with a new and unprecedented crisis.

True North: Mission & Vision

True North is focused on the development of Private Equity, Venture Capital, and Public Equity products, with the objective not only to realize satisfactory financial returns, but also – and mainly –, to have a positive impact on communities and the environment.

True North: Investment Strategy

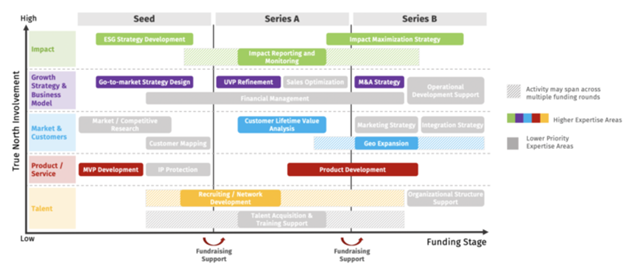

Investment targets are represented by early-stage companies that are impact focused and whose ticket-size is usually around 2 or 3 million USD. True-North invests in a universe of companies having in common the fact of generating above-average returns and being net positive – i.e., a new way of doing business which puts back more in society, the environment, and the global economy than it takes out.

Recently, there has been a meaningful change in the strategic priorities of the company. Initially, True North invested into firms focused on sustainability but operating in various and different industries. However, it has now decided to narrow its horizons and, consequently, to focus its attention on the Digital Healthcare sector. The reason is that the latter experienced a growth acceleration because of Covid-19 spread. True North identified three main areas for investment: Mental Healthcare, Aging Population, and Female Healthcare.

Finally, the company’s decision to invest in public equity companies derives from the belief that you cannot have an impact through VC investments only, but you also need to inject money into listed companies in the long-term, with the main objective of influencing the overall market.

“Can investors achieve both positive impact for the planet and society while also outperforming the market? At True North, we believe Yes.”

By definition, impact investing should focus on areas where social or environmental needs, offer commercial growth opportunities for market returns.

Indeed, from day one of the investment lifecycle, both impact and financial soundness are the core of conversations and analysis. The main consideration when setting impact targets is to define an approach to measure and compare impact in a transparent way. Indeed, to achieve this, True North deploys the so-called impact ROI. Just as every dollar invested has a projected financial ROI, True North tries to quantify the impact of every dollar invested and to incorporate this into the due diligence process of all candidate companies. Hence, starting with the impact findings of the due diligence process, the goal is to focus not only on development of ESG strategies and plans, but also on how to realize, monitor, and report the progress. The rationale, of course, is that impact that is not effectively communicated loses its value as a growth driver for ventures.

It is crucial to note that a key element is disclosure: for an impact fund to succeed in its aim, it is essential that it provides transparency in measuring, monitoring, and reporting the impact achieved by its portfolio companies in the same way in which financial performance is disclosed. Indeed, once Peter Drucker said: “You can’t manage what you can’t measure” and True North accordingly fulfils such requirement through its proprietary impact scoring. The latter is used not only as a snapshot during the due diligence, but as a continuous monitoring tool with quarterly reporting, in order to flag trends early on and collaborate with ventures to course-correct as needed. At the same time, a complete and transparent approach is crucial to achieve a long-lasting impact on the environment and society.

Zoom in: Impact score at True North

The impact score measures the level of impact a company has on society, communities, and the environment, based on several different parameters. Regarding public equities, True North uses proprietary techniques while (at the same time) cooperating with major providers of ESG information on corporations and markets to calculate the score. However, when speaking about private equity, the process becomes more complex, and it is articulated in three main phases:

- Vision completeness: True North looks at the completeness of the company’s vision, taking into consideration factors like employees’ impact, supply chain characteristics, and the founder’s motivations.

- Ability to execute: how the company will operate according to its own mission & vision. This is a qualitative assessment which is conducted internally.

- Impact IRR: True North expects to generate at least a minimum internal rate of return, both from a financial and “impact” point of view.

Concluding Remarks

Notwithstanding the disruptive consequences deriving from Covid-19, in addition to the preexisting problems affecting the global economy, achieving the SDGs set by the UN still represents a priority. In this regard, the increase in transparency and disclosure requirements fostered by entities such as S&P and IFRS in relation to societal and environmental impact, is transforming the business ecosystem. Hence, phenomena like ESG valuation, SRI, and Impact Investing will be the next normal. Indeed, large funds are already moving in this direction, requiring more and more from their portfolio companies to disclose data related to their ESG impact.

Finally, as digital transformed from being a niche investment area to representing a common denominator for funds’ strategies, the same is likely to happen when considering ESG principles. These will become a default factor to take into consideration when evaluating firms for potential investments.

Editor: Tiago Guardão

References

https://truenorthimpact.com/our-work/defining-impact-investing-fund

https://truenorthimpact.com/our-work/the-proliferation-of-digital-health-in-a-post-pandemic-era

https://truenorthimpact.com/our-work/private-investors-and-impact-investing

https://ssir.org/articles/entry/the_next_10_years_of_impact_investment

https://thegiin.org/research/publication/impact-investments-an-emerging-asset-class

https://www.privateequityinternational.com/six-trends-in-impact-investing/

https://0-www-statista-com.lib.unibocconi.it/statistics/1197565/reasons-for-impact-investments-worldwide/

https://www.ifrs.org/projects/work-plan/sustainability-reporting/#published-documents

https://www.accountingtoday.com/news/ifrs-foundation-sets-up-working-group-to-converge-sustainability-reporting

Comments are closed.