By Ines Mazzola and Manfredas Feiferas

Introduction

Biotechnology can be simply defined as a way of producing goods and services, or knowledge by applying science and technology to living organisms, and their parts and altering living or non-living materials. There are three distinct types of biotech – green, red and white. These three colours differ regarding their applications in different industries. Green is applied for plants, especially when considering their resistance to insects, and droughts. White is applied in the industry – production of bioethanol, hydrogen, and plastics. Lastly, red biotechnology is used in medicine and pharmacy when developing diagnostic tests, biopharmaceuticals, and gene therapy. When we consider red biotechnology acts as a subsector of healthcare. Some of the main players in the industry include Moderna, Biogen, and Amgen.

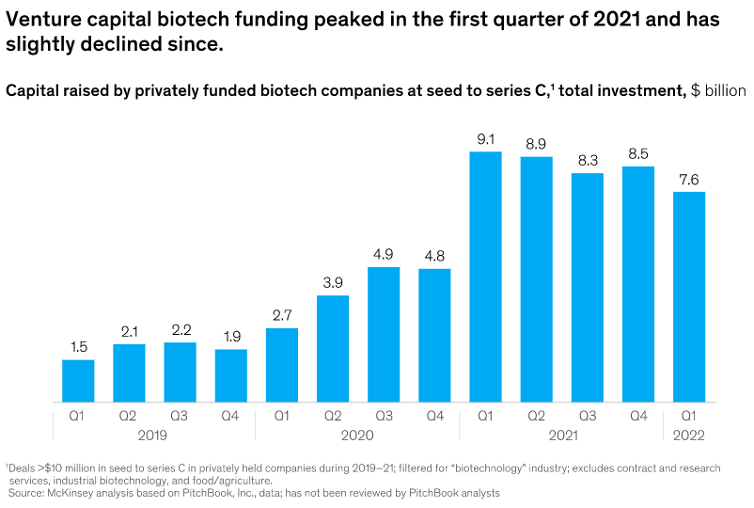

For the last two decades, investments into biotech companies by PE funds have seen a steadily growing trend, but the most rapid growth can be seen in the most recent years. In 2021, it was a record year for the amount raised by biotech companies, which amounted to $34 billion. According to McKinney, the amount raised peaked during the first quarter of 2021 – amounting to $9.1 billion. To understand why biotechnology firms have been a popular choice between PE funds it is crucial to understand what the alternatives for investors are, how the biotechnology industry operates, and what possible risks exist when investing in the industry.

The Case of Illumina

In comparison to other possible investments, Private Equity appears to be the best fit for Biotech startups. Illumina is a telling example. It was founded on April 1st, 1998, and develops, manufactures, and sells integrated solutions for the study of genetic variation and biological function.

Illumina resorted to Private Equity financing several times to accelerate the business development of research and its reach. In January of 2000, Illumina raised $28 million in Private Equity financing to be able to take the next step in the biotechnology market. This financing allowed them to accelerate the development of the Bead Array technology, also known as Microarray technology, that can be used for a variety of purposes in research and clinical studies, such as measuring gene expression and detecting specific DNA sequences. It can help identify abnormalities present in our bodies and resolve them. The Illumina paradigm is valid for many other biotech startups that require Private Equity support in their early phases up until they prove the worthiness of the process or products that they are developing.

In 2015, Illumina Accelerator, a genomics company creation engine, managed to secure $40 million of Boost Capital from Viking Global Investors, a global investment firm. The goal of this contract was to provide promising startups that graduate from Illumina Accelerator with access to seed investment to further increase the genomics innovation environment. Most recently, in 2022, Illumina invested $30m in the genomics Venture Fund in Time Boost Capital to again expand and create a step change in healthcare. According to Private Equity Wire, Time Boost Capital will provide funding to every Illumina Accelerator Cambridge graduate that secures between £500,000 and £4 million in new capital from qualified investors within 18 months of acceptance.

Private Equity can provide better and less correlated returns than public markets and traditional investments. Returns are frequently reliant on the fortunes and skills of an individual company, rather than what is happening in the stock market. Furthermore, they can offer opportunities to be part of a business success story as has been illustrated with Illumina, besides being able to influence the growth of a new firm from the early-stage. Many investors may find it rewarding to assist in the development and nurturing of a young company.

Decision-making in Biotech: An Example

Furthermore, when biotechnology companies make decisions they have to critically consider three aspects: reliability, scientific results and ethical problems. The best way to portray how these criteria must be considered together is to look at one of the key parts of the biotech sector: food modifications.

Firstly, when considering this problem from the scientific research point of view, companies must be 100% sure that any changes in the food are totally safe for consumption and do not have any harmful effects on the health of the consumers but also do not have adverse effects on biodiversity and the environment. Thus, this leads to costly and lengthy testing and research processes before final products can be released to the public.

The challenges in the biotechnology industry do not end with scientific problems, ethical problems arise too. Ethical dilemmas often arise when experimenting can affect the welfare of the animals, environmental sustainability, and social justice. One of the most scandalous ethical dilemmas in biotechnology was related to the cloning of a sheep named Dolly, which was done in 1996. Even though it was considered a major breakthrough in biotechnology and demonstrated great potential, it sparked many debates regarding the ethicality of the decision. People were particularly concerned about the welfare of the cloned animals and the technology being used for human cloning.

These two sides must be carefully considered as a failure to abide by one of these can lead to public protests, fines from the government, and other legal challenges. Lastly, when looking at these sides intrinsically, reliability is crucial when performing research in the biotechnology industry. Without reliability errors might occur, which could lead to dire consequences and great problems.

Private Equity Risk in Biotech

Notably, there are big issues to Private Equity financing for emerging startups. Being an external and limited partner, your influence on where your money will be invested is limited. As PE firms want to keep their strategies secret, startups must trust and believe in their reputation regarding skills and integrity. Not an easy thing to do which can increase exponentially the risk of being associated with Private Equity.

Moreover, limited liquidity and limited number of investors that PE firms can accept makes everything even more difficult. Startups must meet standards set by SEC, have an attractive concept and be successful to be able to secure investment.

Furthermore, the lack of liquidity makes it difficult for you to touch your shares and your money if you want change or get out of the contract. That’s why Private Equity should be considered as a long-term investment, and you should always assume that your money will be tied up for a long time. This could be an issue if you’re in need of urgent funds, you won’t be able to touch this investment and you’ll have to take it from somewhere else.

Even in establish biotech company risk remains a main concern for the investors. For example, Bayer brought Monsanto, an American agrochemical and agricultural biotechnology corporation, which brought enormous liability related to carcinogenic herbicide. This proves that biotech risk is important and even large corporation are not sheltered from such risk.

The funds availability of the PE sector for this segment remains small and still entail high risks. These conditions force companies to also rely on the public market to develop.

Conclusion

In conclusion, biotechnology firms have become one of the targets for PE funds and their popularity has been growing ever since the first investment into the industry. Investments by PE, VC funds are usually the most beneficial at the beginning of the lifecycle of the biotechnology company, which can generate great benefits. With the existence of benefits and opportunities in the biotechnology industry, great risks cannot be avoided either. All in all, PE fund investments into biotech companies allow for more rapid growth and faster-paced development.

Sources

https://www.privateequitywire.co.uk/2022/06/28/315635/illumina-invests-ps30m-venture-fund

Comments are closed.