By Niccolò Quadri Di Cardano, Paul Schappert, and Raffaele Caminiti

Introduction

Recently, the Japanese Private Equity market has been shaken by the biggest leveraged buyout in its history: the $15bn take-private of Toshiba Corporation. The following article is hence aimed at analysing the history of the company and the recent scandals and financial troubles that laid the foundation for the LBO throughout the last years. Secondly, a more detailed summary of the transaction will be provided, with a specific emphasis on the composition of the investing consortium, the financial structure of the deal, and some technicalities of the operation. Lastly, the article will focus on a broader analysis of the financial environment that made the deal possible: the fast-growing Japanese PE industry.

A Giant in the Japanese Market

In most recent years, unfavourable headlines have continuously dominated the news relating to Toshiba, but the company’s current situation is only what remains of a firm that once represented the flagship of the Nipponese manufacturing industry. The history of the well-known Japanese conglomerate dates to 1939, when Tokyo Denki (founded in 1890) and Shibaura Seisaku-Sho (established in 1875) merged to form Tokyo Shibaura Denki, which was renamed to Toshiba Corporation as late as in 1984. With origins in the manufacturing of light bulbs and telegraphic equipment, the company has since then adjusted to the rapid advancement of technology while broadly diversifying its portfolio of business activities.

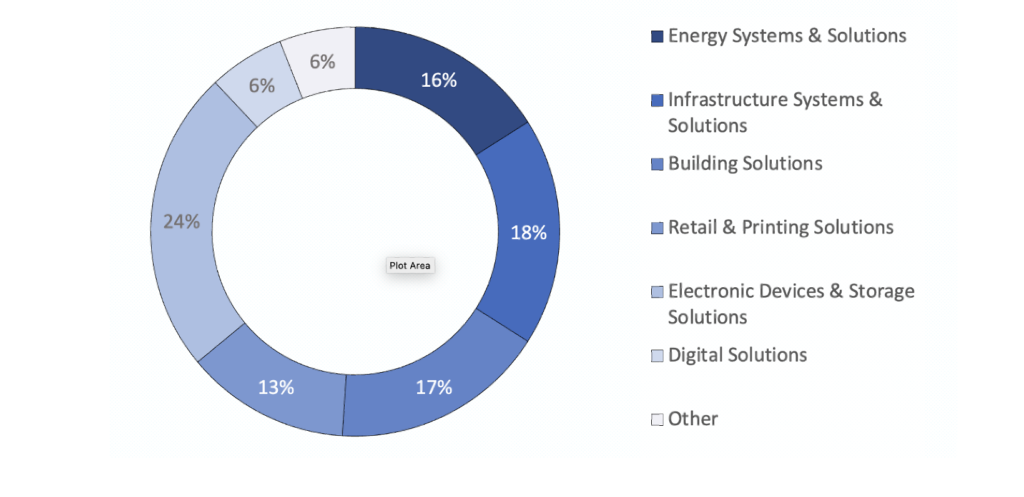

As of FY2021, the major business areas by revenues can be classified as follows:

More in particular, the Energy & Systems Solutions division of Toshiba Corporation is involved in both renewable and nuclear energy generation systems, with a further specific focus on exploring the future potential of hydrogen-based technologies. Infrastructure Systems & Solutions provides water management and traffic control systems, with marginal employment in the security and defence systems industry. The worldwide-exporting Building Solutions division of the firm today is mainly devoted to the production of facilities such as elevators, air conditioning and office lighting, while Retail & Printing Solutions offers both commercial and retail printers to customers. Moreover, the Electronic Devices & Storage Solutions division mainly manufactures semiconductors, microcontrollers and hard disk drives which make up almost one quarter of Toshiba’s total revenues, whereas the Digital Business unit focuses on analytics services, Internet of Things solutions and exploration in the field of quantum-related technologies.

Twilight of a God

Troubles started to arise for the company in 2015, when the firm’s CEO resigned after announcing that the firm overstated profits by $1.2bn during the previous years. This profit padding scandal only marked the beginning of a series of harmful events which followed throughout subsequent years. Furthermore, the collapse of its US nuclear business in early 2017 brought Toshiba Corporation to the brink of bankruptcy, forcing the company’s top management to agree to spin-off its memory business, which was rebranded as Kioxia.

Facing the risk of being delisted, Toshiba had to initiate an emergency capital raise in November 2017, collecting a total of $5.4bn of additional equity. This private placement of common shares arranged by Goldman Sachs mostly attracted hedge funds. Although the goal of meeting listing requirements remained fulfilled, Toshiba Corporation paid a high price for the equity raise in the form of increasing difficulties dealing with more and more demanding shareholders.

Exploiting this situation of distress, CVC Capital Partners submitted a first bid to take Toshiba Corporation private for around $20bn in 2021. In the end, the bid was rejected because of serious shortcomings in terms of a detailed assessment of the target, as Toshiba itself stated publicly. Nevertheless, following the rejection, major activist shareholders started pressuring the management to seek other potential offers. On top of that, a plan to split the company into three separate divisions was turned down by shareholders in late 2021.

As a result, Toshiba Corporation eventually gave in and formed a special committee to assess potential bids starting from April 2022. A total of ten bids were evaluated in the first round, with four offers being passed on to the second stage. At last, the decision fell for a consortium led by Japan Industrial Partners, which prevailed over the proposals by CVC, Brookfield Asset Management and Bain Capital. After conducting even further due diligence based on previously unreleased information, Toshiba received the final bid in early February 2023.

Deal Overview

With regards to the buyout, the tender offer was ultimately fixed at a price of ¥4,620 per share resulting in an aggregate bidding value of around ¥2tn. This last offer stands as the result of a series of downward adjustments starting from CVC Capital’s bid placed at a 30% premium on the share price back in April 2021. As a consequence of repeated reductions in the company’s earnings forecasts, however, the final bid was set at a 10% premium on the stock’s closing price as of the offering date.

The number of shares tendered is 432,630,045, computed as the sum of the total number of issued and outstanding shares as of the closing of the last FY and the total value of any treasury stock held by the firm. The tender offer has then been made conditional upon the verification of a minimum level of acceptance of 66.7%, corresponding to 288,564,300 shares. The offer explicitly states that its ultimate intent is to make Toshiba Corporation a wholly owned subsidiary of the consortium. Therefore, should this goal not be achieved through the initial bidding process, the offeror plans to undertake future actions to become the only shareholder of the company.

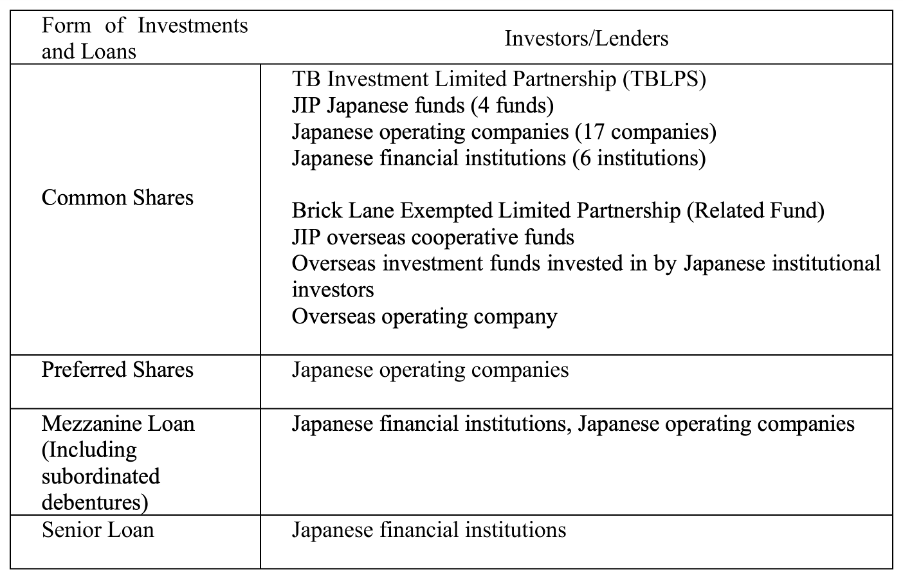

Looking at the composition of the bidding consortium, it is particularly noticeable that the investors are predominantly of Japanese origin. As a matter of fact, the key players in the Toshiba LBO are financial players domestic to the Nipponese market, with TB Investment Limited Partnership (TBLPS) taking the lead. Within the mentioned partnership, a crucial role is covered by Japan Industrial Partners (JIP), a Private Equity firm established in 2002 focusing mainly on company restructurings in Japan. JIP’s team is expected to provide its seasoned experience in the region to revitalize Toshiba Corporation’s business and exploit any growth opportunities by providing capital and managerial support. On top of that, quite a relevant portion of the investors are not financial firms but operating companies, contributing through the subscription of both equity and debt instruments. The notable presence of non-financial players within the consortium hints at potential operating synergies to be exploited through the rationalization of business processes and an improvement of the firm’s workflows.

Lastly, from a more financial perspective, it is interesting to evaluate the investment structure of the buyout in analysis. The transaction is planned to be financed through a large amount of debt, with JIP proposing to raise nearly ¥1tn in total borrowings. A debt infusion of that extent would lead to an aggregate amount of debt outstanding of around ¥1.3trn for the company, risking further destabilization of its financial situation. Consequently, analysts from S&P Global Ratings have already started questioning the rationale of the buyout, forecasting that the target’s financial situation will “materially deteriorate” because of the deal.

Evidently, many uncertainties persist regarding the nature of the bidding process for Toshiba Corporation, both from a financial and an operating standpoint. For instance, current shareholders appear doubtful about the relatively small premium implied by the offer, also considering the negative effects that a possible change in the ¥/$ exchange ratio could have on the net capital gain for foreign investors. In addition, further doubts from the operational side concern the ability of the bidder to bring new life to a business that, as of now, seems to be well beyond its maturity stage.

Rapid Rise of an Industry

The deal has already been labelled as the biggest LBO ever in the Japanese market, leading one of the most well-known names of corporate Japan to be taken off the Tokyo Stock Exchange. Starting out in the early 2000s, the Japanese Private Equity market underwent a period of strong growth abruptly ending in 2007. After a steep decline in activity during the financial crisis, there followed a prolonged period of stagnation, with low inflows from international investors that were instead taking advantage of low interest rates in western countries.

Things started to change in 2017, when investors’ interest in the growth potential of the relatively small Japanese PE market started to explode. As a result, it reached $28bn in 2021 and the data for 2022 is forecasted to be as high as $35bn, demonstrating that the market is still active despite a multitude of negative macroeconomic conditions. The official report, however, is to be published in May 2023 and will provide more clarity regarding most recent developments.

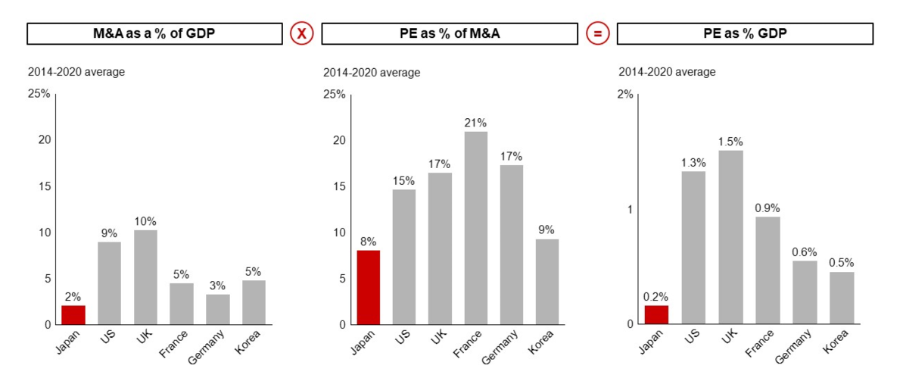

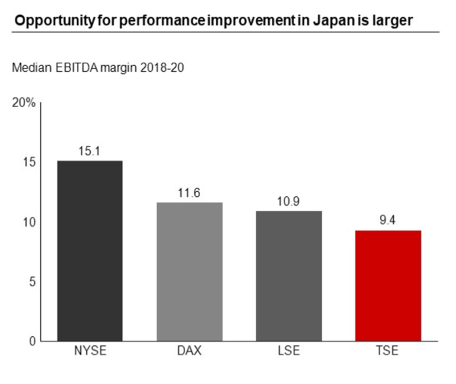

In addition, although Japan’s market is one of the smallest among developed countries, deals were dominated by LBOs. Considering the Asian buyout market, 75% of total transactions took place in Japan, pointing at the importance of the island for the Asian Private Equity industry. For global investors the buyout market is indeed attractive not only because of the high growth since 2017, but especially due to the many opportunities to acquire companies at low valuations, signalling room for substantial improvements through active operational development.

Japan’s Response to a Shifting Market

Despite a frenzied 2021, worldwide Private Equity deal volume decreased by 26% in 2022. The total value of inflows across the globe dropped by more than 60%, with the number of buyout and growth deals greater than $500m in value decreasing by 33%. As a matter of fact, in all markets where buyouts are dominating, the rising cost of deal financing was a key factor reducing the number of deals as central banks started raising interest rates which in turn tightened credit – thus shrinking liquidity.

In Asia, deal count plunged by 44% in 2022 while the deal value fell between 25% and 53% varying by region, with China and Southeast Asia experiencing the greatest declines at 53% and 52%, respectively. Obviously, many macroeconomic factors have collectively contributed to this big decrease: inflation driven by the war in Ukraine, rising interest rates making leverage more expensive, and the scepticism of investors reacting to the uncertain environment leading to an unprecedented accumulation of dry powder by buy-side actors. On top of that, Private Equity investors are typically targeting an internal rate of return (IRR) as high as 20%, which is the reason why deals only draw the interest of funds if conservative modelling suggests the possibility of such a return. Under the prevailing circumstances, PE funds had to either wait or accept the possibility of a lower exit multiple due to higher borrowing costs, with many investors deciding not to not employ their capital throughout 2022.

Nonetheless, this wrapped situation did not particularly affect Japan’s market, which in contrast experienced an increase in capital inflows from western countries, especially the US. The reasons why the crisis did not have a substantial impact on Japan are mainly connected to the advantages of investing in the country compared to other regions worldwide. First of all, the Bank of Japan’s monetary policy was committed to maintaining zero percent interest rates and the cooperative approach of the banking system further encouraged funds to leverage their investments, generating strong returns. Moreover, Japan’s legal and accounting systems are designed based on western standards and therefore prevented scaring off investors who are afraid of the typical emerging market risks pertaining to many other Asian countries. In addition, compared to other emerging PE markets, it is not uncommon for investors in the Japanese market to receive some part of their returns before investments are cashed out, thus luring investors to increase their allocations.

Lastly, another factor preventing the decline in PE activity was closely related to the structural characteristics of the Nipponese industry ecosystem. Japan’s economy is indeed dominated by small and medium-sized enterprises, 60% of which are family-owned and without successors. As a result, Private Equity has recently been identified by investors as a potential solution to their issues. As most owners are more interested in the future of their businesses than in plain monetary returns, PE funds are convincing with their know-how and the promise to increase value and ensure further development. On top of that, the Japanese government actively encouraged greater transparency in corporate governance by introducing a new corporate governance code, making sure that investors navigate a safe environment of well-managed companies when investing in the region.

Conclusion

On the whole, it is evident how the buyout of Toshiba Corporation has been the final result of a long-standing series of internal wrongdoings and external pressures. As observed, the Japanese market in fact provided fertile soil for investors to approach deals with a positive outlook towards the future, while shareholders of Toshiba were waiting for an opportunity to monetise their investment in a company that appeared doomed to fail. The future of the conglomerate is hence written in the stars, with a multiplicity of challenges, uncertainties and opportunities aligned at the horizon.

Sources:

https://www.global.toshiba/content/dam/toshiba/ww/ir/corporate/news/20230323_2.pdf

https://www.ft.com/content/158d7385-954a-42fc-93da-74cf58dabe47

https://www.ft.com/content/8083091c-f8b3-41d3-a4f5-0da8af803cb1

https://jpea.group/english/private-equity/private-equity-market-in-japan/

https://www.iflr.com/article/2bfdwqos2afko380buo00/sponsored/m-a-report-2023-japan

Comments are closed.