By Donatella Aggazio, Elena Cavallaro, and Matteo Luoni

Introduction: 2022 — a Permacrisis

The year of 2022 can be summed up by the Collins dictionary’s word of the year, ‘permacrisis’, which is defined as an extended period of instability and insecurity.

The present economic deceleration stands apart from the one that resulted from the worldwide financial crisis due to the absence of clear indications about its occurrence: no Lehman collapse, no housing meltdown, no significant decrease in economic operations to indicate a definitive turning point. Instead, the global economy is presenting investors with an unusual set of circumstances that most have never witnessed before.

Key factors include the ongoing effects of the global pandemic, political instability, Brexit, war in Ukraine and supply chain issues. These conditions have led to a cost of living crisis and falling living standards, with double-digit inflation in many parts of the world, unobserved for over 40 years.Against this backdrop, it is not surprising that 2022 was a dismal year for both equities and bonds, with many markets experiencing significant declines.

Investment lows in 2022 were particularly evident in buyouts and growth categories, which have suffered due to macro headwinds in 2022. The global buyout value has declined by 35% compared to 2021, with the overall deal count falling by 10%. While 2022 was still the second-best for buyout value historically, the momentum in the first half is what contributed to that. With central banks tightening down to combat persistently high inflation, the second half of the year saw a sharp drop in activity across all major regions.

The banking industry’s reluctance to lend to large leveraged transactions, combined with rising yields, has resulted in a decline in large, high-leverage deals that have buoyed deal value for years. GPs have turned to direct lenders to finance smaller transactions requiring less debt, leading to a growing trend of add-ons. Add-ons made up 72% of all North American buyouts in 2022 by deal count, and a growing share of them were used to further buy-and-build strategies. Smaller deals requiring less debt are gaining share in the overall totals. Technology continues to account for almost 30% of all buyout deals globally.

Looking forward to 2023, the IMF predicts economic growth of just 2.7%, reflecting the possibility of a recession in the UK and Eurozone, and uncertainty in the US. Central banks will play a critical role in shaping the economic outlook, as they face the challenge of balancing the need to control inflation through interest rate increases, while also supporting economic growth and avoiding a deep and prolonged recession. Commodity prices are likely to remain high, and geopolitical tensions may continue to flare up, with little prospect of quick resolution to conflicts like the war in Ukraine.

Case Study: Partners Group

Partners Group, a global Swiss based private equity firm with over 130 billion in assets under management, similarly to their industry peers, is heavily affected by the industry’s downturn. The company was faced with similar challenges at the beginning of 2022 after the post-pandemic growth momentum faded and new political and inflationary problems arised. Nevertheless, AUM grew by 10% YoY, excluding foreign exchange effects and the company received 22 billion USD in new commitments from its global client base, raising the firm’s total assets under management by 8 billion from the previous year. Now, in 2023 the atmosphere is different. Amidst the dearth of deals, Partners Group had to cut a fifth of their private equity team in the Asia pacific area early in the year. This cut was due to mergers and acquisitions in the area falling by 28% in the first two months of 2023 and the overall appetite for alternative investments diminishing. CEO and Founder Urs Wietlisbach also stated in an interview with Bloomberg referring to the current market conditions: ”All banks are on the sidelines in leveraged buyout financing”, and elaborating: “The CLO market was huge and then it collapsed”. However, despite their rocky start to the year, the firm’s outlook on 2023 sways positive. In an interview with HIC, Wietlisbach stated that Partners group had already predicted these high inflation rates 5 years ago, and therefore prepared their portfolios for it. Primarily, they financed the leverages at low interest rates thanks to interest rate swaps.

High inflation now worked in their favor as it allowed for selling at higher prices and higher margins. Furthermore, seeing the future volatile markets, Partners Group strategically made sure that over 80% of their companies were market leaders selling essential goods. This gives their companies pricing power and the upper hand in an inflation crisis. Wietlisbach does admit that he worries for long-term stagflation, but that as of right now the company has clear investment plans for 2023. The big macro trends the PE firm is planning to play in are digitization, new living and the elderly, and decarbonization. Concluding, Wietlisbach states that he has seen an inflation crisis’ like this earlier in his career, and looks back at what the downturn winners did to move forward with his company.

Struggle or Opportunity?

Despite the seemingly unfavorable economic landscape, the current situation, characterized by rising rates, inflationary pressures, and economic uncertainty, offer a few unique advantages for private equity investors. The increase in interest rates has caused turmoil in the capital markets but it could be a boom in private ones, volatility creates opportunity, and few can execute better on that opportunity than private equity investors.

Moreover, the very high amount of dry powder, which according to Preqin report accounts to more than US$1 trillion as of August 2022 (table 1), suggests that many companies should continue to have access to funding through a downturn. However, those that struggle, may prove attractive investments for opportunistic or distressed strategies. In short, there is an opportunity as well as the necessary liquidity to catch it.

Strategy

Even if 2022 ended with a record high dry powder and GPs will be eager to put it to work as soon as possible, buyers, sellers, and lenders will look for clearer signals about where GDP is headed and how much further the rate hikes have to go. For this reason, the next 12 to 18 months will be about patient capital and selectivity, as market dynamics continue to shift.

As Bain and Company suggests, the winning strategy for the next 2 to 3 quarters is to be fund looking back at the behaviors of the last downturn winners, as the lessons from the last slump are particularly useful in plotting a course through this time of uncertainty and turbulence. The secret is not to panic and to keep calm in the storm: top achievers, last time around, properly assessed the risk scenarios, created mitigation plans, and set themselves up to accelerate out of the downturn.

This ultimately reduces to a 2-step process: Mitigating the Risk and Preparing the portfolio companies.

As deals have become increasingly specialized over the past cycle, analysts’ teams have developed a keen understanding of how to evaluate the micro forces impacting a target company. But in times of great macro uncertainty, the real challenge is to understand how, and which shifts might impact your company and its industry, and to perform and adapt due diligence accordingly. There may be 10 macro factors out there disrupting global activity, but chances are, only 2 or 3 of them really matter for your deal. The focus shifts to identifying the various scenarios based on the critical macro factors and preparing a mitigation plan for each one. The end goal is to evaluate the spectrum of plausible outcomes and determine if the outcomes are favorable or unfavorable. The winners last time around used this kind of insight to get back in the game as quickly as possible and in doing so they overperformed significantly.

The second step is to Prepare companies to win:

Overreaction has to be prevented at all costs, as it is deadly. A typical behavior in a recession is to sell every non-core asset to portfolio companies to try and reduce costs to the bone, shielding the balance sheet, at least for a while. Such strategy will inevitably cripple performance in the long term. While it is prudent to save money and prepare for economic downturns, it’s equally crucial to seek out ways to remain proactive and seize opportunities. Accelerating out of recession is about plotting how to use the downturn to take market share from competitors.

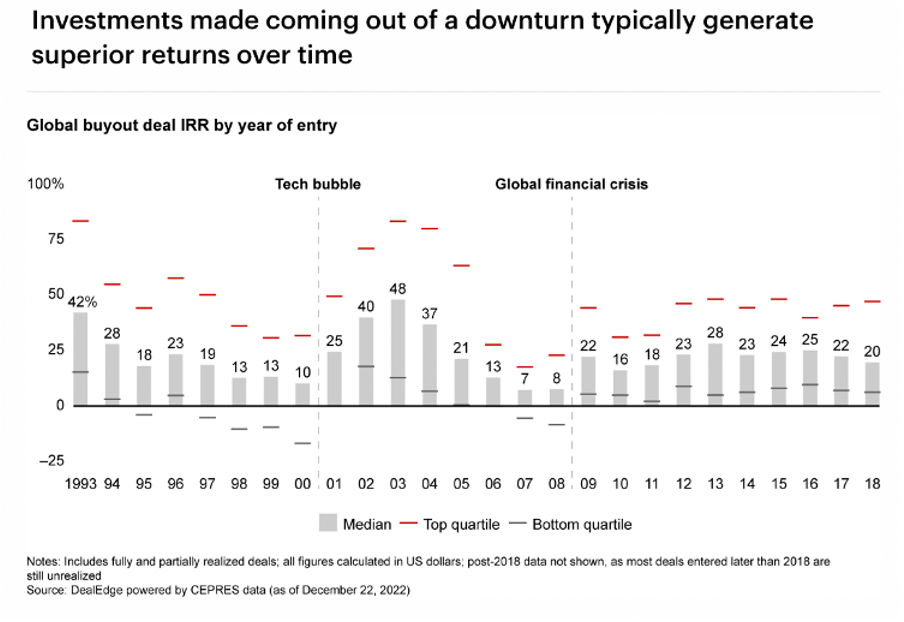

The data is clear, deals done through a downturn generate superior returns over time (Table 2). Leaders find deals that align with their investment strategy and underwrite them confidently by making sure the macro factors are accounted for. They stay aggressive and don’t allow challenging capital market conditions to discourage them, even when this means taking a deal done with more equity or a higher price on the debt, as they can always fix the balance sheet when conditions improve, but delaying or waiting for better terms may result in missing out on a valuable opportunity to capitalize on the market recovery

Interesting Sectors

It’s also clear that there are plenty of places to put the money. As technology continues to transform sectors like healthcare and finance; as innovation builds in areas like artificial intelligence, web3, and big data; and as the energy transition accelerates, the demand for private investment capital stands to grow exponentially over the next 20 years. The coming year will likely turn out to be a pause in the action, but private equity’s long-term appeal to investors is secure.

Despite the macro headwinds faced in 2022, private equity investment in the technology sector has remained a strong and resilient trend over the past decade. Investors continue to see tech as a long term trend, despite near-term growth expectation being reduced in many areas. Valuations in the space are on average lower, giving firms the opportunity to purchase companies in the SaaS and cyberspace at bargain prices. Tech represented 26% of the industry’s total deal value last year, amounting to more that US 180b in PE deployment.

In recent years, the energy sector has experienced a decline in popularity. However, due to recent geopolitical events and a long-term shift towards renewable energy sources, the sector has become increasingly attractive. Private equity firms invested approximately US$53 billion in energy and energy-related areas last year, and this positive momentum is expected to continue throughout much of 2023.

In 2023, private equity firms are expected to encounter significant opportunities in the infrastructure sector. Specifically, they will seek innovative collaborations with corporate entities that can offer long-term funding for capital-intensive projects. In 2022, a limited number of these landmark deals took place, such as the notable partnership between Brookstone and Intel to construct new semiconductor capacity. For private equity firms, these transactions provide an avenue to offer low-risk financing with attractive rates of return, all without requiring costly operational interventions. Meanwhile, for corporations, these transactions present an opportunity to reduce their cost of capital while preserving cash and debt capacity for future investments. Verticals like semiconductors, telecommunications, transportation, renewables, digital infrastructure, and mobility are among those where these types of transactions could occur more frequently.

Conclusion

This period will serve as a test to determine whether private equity fund managers have learned from their experience navigating the global financial crisis and understand the importance of constructing resilient portfolios during downturns. It will also challenge them to maintain superior returns without relying solely on multiple expansion, which has been a key driver of industry growth for years. As inflation and rising interest rates continue to impact the global economy, there will likely be downward pressure on valuation multiples in the coming months and years. The most successful firms will be those capable of generating alpha from within by implementing value-creation strategies that enhance profit margins and drive revenue growth. Nevertheless, it remains evident that the private equity industry is well positioned for long-term growth and prosperity. Despite the recent decline in deal activity, exits, and fundraising, 2022 still ranked as the second-best year in history, and the underlying fundamentals of the industry remain solid. While the current slowdown and the macroeconomic factors contributing to it pose significant challenges, the situation differs from the 2007-2008 period when the global banking system was on the verge of collapse. This time, there are no fundamental issues that appear to be broken. Although there are indications of an economic shift, the private equity industry has successfully navigated similar situations in the past.

Comments are closed.