Introduction

During the past few years, one of the major trends that has characterized the Private Equity landscape is the exponential growth of investments in infrastructure. Typically, when referring to infrastructure investments we discuss those made by Governments and public entities. However, the role of Private Equity firms and of specialized infrastructure funds in the development of this asset class has significantly grown. The aim of this article is to provide a brief overview regarding the features of infrastructure investments, their advantages, and show how Private Equity firms are contributing to the construction of different kinds of infrastructure projects.

A New Global Trend

Since the Global Financial Crisis of 2008, the private infrastructure market’s size has tripled (overcoming the $3 tn threshold), with investors now owning a large proportion of infrastructure globally. Indeed, this raised questions about the quality and sufficiency of the world’s existing infrastructure. According to a McKinsey and Company study in June 2016, it was estimated that $3.3 tn was needed to be invested yearly until 2030 in order to support current growth rates. Moreover, the World Economic Forum has estimated that an investment of 97 tn dollars into infrastructure projects were needed, much higher than the $79 tn which are actually going to be invested by 2040. This gap, commonly known as the infrastructure gap, clearly shows how, despite the huge amount of resources being allocated, the infrastructure sector still requires an increase in capital flow in the future.

While Europe and the USA (with the aid of the European Green Deal and the US Infrastructure Bill) are pushing towards the aims of decarbonization and fighting climate change, Asia is implementing a different approach, associating infrastructure investments mainly to the urbanization of emerging countries.

Infrastructure investments at current trends and needs:

Features and Size of the Phenomenon

Prior to analyzing the deals orchestrated by Private Equity firms, it is crucial to dissect what infrastructure really is and why investors are increasingly intrigued by this new asset class.

Infrastructure, as an alternative asset class, comprises a very large market with several industries and sectors. On one hand, there is the so-called social infrastructure, which is historically linked to Public Sector’s investments. This includes hospitals, schools, public buildings, offices, prisons and several other facilities which usually have a social impact. On the other hand, we find economic infrastructure which involves different kinds of projects such as:

· transport (roads, airports, ports, underground, railways, …);

· utilities (electricity, energy, oil & gas, renewables, water, …);

· telecoms (satellites, data centers, repeaters, cell towers, …).

Another type of classification within the infrastructure framework can be made based on the risk of the investment strategy. We differentiate the following areas:

- Core Infra: usually comprehends regulated sectors with a very low level of risk (such as utilities) due to high entry barriers and technological stability. In this sense, returns mainly come from dividends.

- Core Plus Infra: in this case, the slightly higher level of risk is given by a stronger exposure to demand and technology, therefore the increase in return originates from capital gain.

- Value Added: concerns telecoms, data centers and other similar projects. The risk is significantly higher and the capital gain becomes the most important part of the investment’s return.

Why are Private Equity Firms Interested in this Asset and What Are its Most Significant Features?

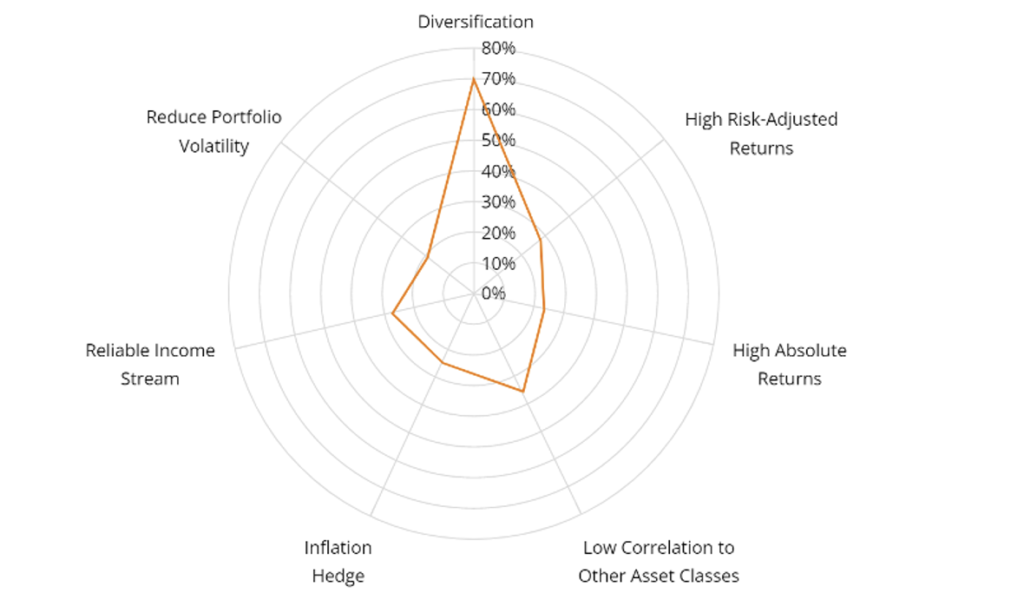

When it comes to infrastructure projects, there are two important factors to consider. Firstly, the stability and predictability of cash flows. Secondly, the low correlation with traditional asset classes (stocks, bonds) and with the economic cycle in general, significantly diversifies investors’ portfolio.

This is due to the fact that infrastructure is a sector characterized by remarkable longevity, very high regulation and high entry barriers (due to the cost and complexity of developing infrastructure assets), which together generate low competition. Moreover, these kinds of projects can also be considered “recession-proof”, given the extremely low demand elasticity, in addition to providing protection against inflation (thanks to regulation, concession agreements or contracts with rates that are set to rise in line with, or above, inflation rates). Finally, investors also give great importance to the fact that infrastructure projects usually require low operating expenses compared to other types of investments, in addition to allowing the use of higher levels of debt (thanks to the predictability of cash flows). However, it must be underlined that infrastructure investments are very capital intensive, due to planning, construction and development costs, and highly illiquid, giving the length of the investment period and the lack of secondary markets.

To summarize, Private Equity firms, together with Infrastructure funds and other types of institutional investors, are truly convinced about the opportunity that infrastructure may give in terms of return, despite the longer period required for the investment to be completed.

Institutional Investors’ main reasons for investing in Infrastructure:

Players and the Main Deals

The infrastructure landscape is currently populated by several well-known traditional Private Equity firms, which have been developing specific Divisions focused on infrastructure deals, and by pure Infrastructure funds, which are only dedicated to these kinds of investments. Both have been protagonists of very large deals in the last decades, contributing to the growth of this sector.

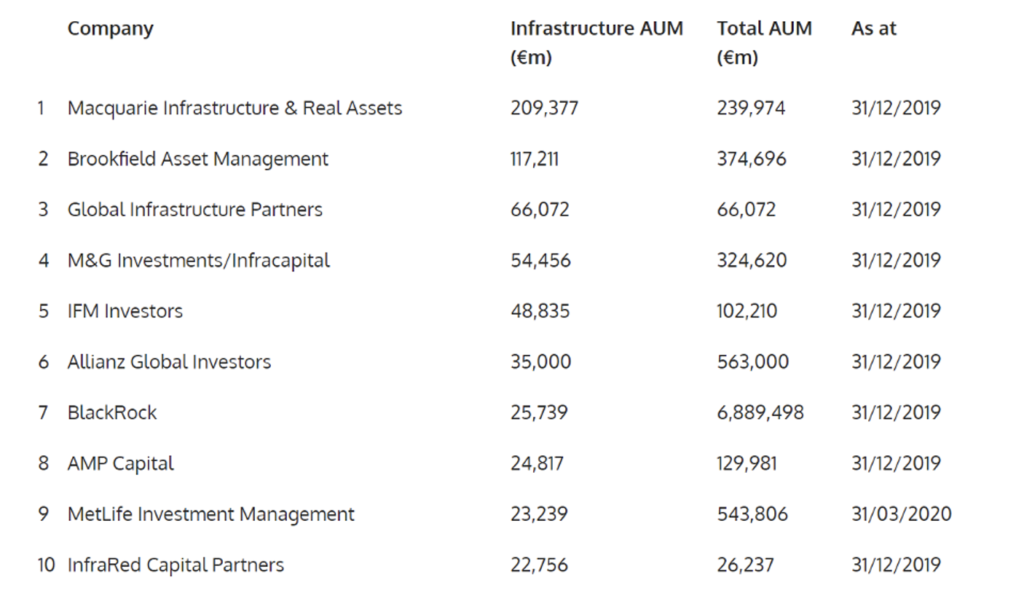

Below, a list of the 10 major players in the field by AUM, led by Macquarie Infrastructure and Real Assets and Brookfield Asset Management:

As previously mentioned, it is evident how large groups like BlackRock, Macquarie and Allianz, are shifting towards this new asset class in order to become the major players in the infrastructure landscape.

In order to give a brief view on how these main players are concretely operating in the infrastructure sector, we’ll see below some examples of recent events that have shaped the industry.

One of the most recent and important news regards KKR & Co., which, in March 2022, raised $17 bn for global infrastructure bets, its largest fund dedicated to this sector.

Named KKR Global Infrastructure Investors IV, it is the fourth-largest infrastructure fund on record, just behind vehicles raised by Global Infrastructure Partners, Brookfield Asset Management, and EQT AB.

Focusing on the Telecommunications segment, Vodafone Group has been recently approached by global infrastructure funds, including Brookfield and Global Infrastructure Partners, which have offered $16 billion for a majority stake in its mobile mast company, Vantage Towers (Vodafone’s tower infrastructure company with over 68,000 towers).

When looking at what’s happening in Italy, it is clear how, together with the entire European continent, it is experiencing the same growth in infrastructure deals. For example, in 2021 JP Morgan’s Infrastructure Investments Fund announced the signing of an agreement for the acquisition of the Falck SpA’s entire stake in the renewable energy platform Falck Renewables, amounting to 60 % of the share capital at a price of € 8.81 per share. Falck Renewables develops, designs, builds and operates power generation plants from renewable energy sources, and is an international player in technical consultancy for renewable energy and in the management of third-party assets. In the end, the enterprise value assigned to Falck Renewables was approximately €3.4 billion.

However, Europe and the US, where major players usually operate, are not the only ones that are participating in this new trend. Asia, together with South America and partly Africa, is allocating numerous resources to the development of infrastructure projects of different kinds. For example, The Asian Development Bank has approved a $150 m loan for a facility to encourage public and private funds to invest in green, financially sustainable infrastructure projects in Indonesia. The new fund, named Sustainable Development Goals Indonesia One-Green Finance Facility (SIO-GFF), will also design financially sustainable projects to attract funding to supplement public expenditure.

On the whole, it is clear how, in basically all the regions of the world, Private Equity firms, but not only, are clearly moving towards this new direction. And in the upcoming years, this trend will be even more evident.

Conclusion

The choice made by many investment firms of allocating significant resources to the infrastructure sector, is substantially influenced by both long-term investment views, and by strategic/opportunistic decisions. As highlighted previously, the need for higher returns and lower risks have clearly pushed investors to increasingly focus on new alternative asset classes, potentially more illiquid, but at the same time decorrelated from traditional asset classes. For what concerns future expectations, the increasing demand for infrastructure projects and the increasing number of players in the field are probably going to cause an increase in costs and therefore a yield-compression of this asset class. This phenomenon will therefore probably align infrastructure to the traditional asset classes in terms of return. Given that the infrastructure gap is still very significant in many areas of the world and that new resources are in constant demand, the trend involving Private Equity firms in this sector will certainly continue to grow in the next decades.

Sources

https://www.partnersgroup.com/en/news-views/perspectives/current/private-markets-outlook-2022/

Editor: Tara Morgan

Comments are closed.