by Enrico Martinelli and Federico Valla

Introduction

The economic impact caused by the war in Ukraine and the consequent rise in energy prices has led some people to question the state of the green transition. The purpose of this article is to assess whether the private equity and venture capital industry have had an impact during the years, on the development of renewable energy sources. The present article does so by first providing an overview of the current usage of energy throughout the world, with a specific focus on Italy. The identified change in terms of energy sources is then further highlighted by examining two recent transactions with PE involvement within the Italian energy sector.

A Global Outlook on Energy Transition

As stated by the International Energy Agency (IEA), 90% of CO2 emissions are related to the energy sector, making it by far the major cause of the drastic increase in greenhouse gas emissions. However, not all countries contribute to it in the same way, as citizens around the globe have different consumption levels. As shown in the figure below, more developed countries, topped by the United States, tend to consume the highest amount of energy.

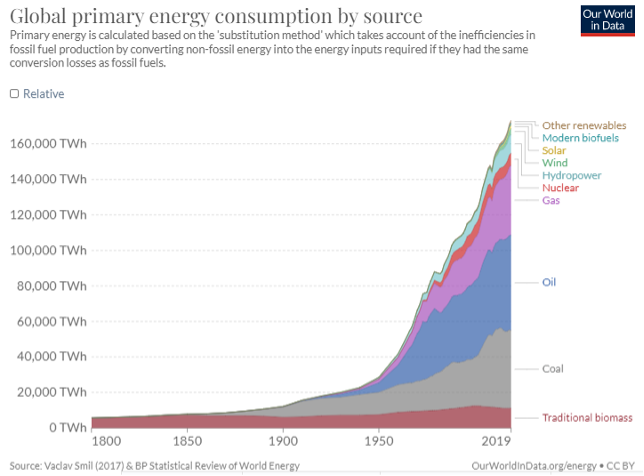

The following charts give an idea about the degree of reliance of different countries on renewable energies, instead of non-renewables. As we can see in the second graph, gas, oil, and coal are by far the three major sources. The amount of energy coming from renewables, such as wind and hydropower, still only represents a very limited percentage, given that the surge in energy demand, which has grown exponentially in the second half of the previous century, has been mainly satisfied by an increase usage of fossil fuels.

Northern European countries, such as Iceland and Norway, are those that get most of their primary energy (i.e., an energy form that can be found in nature and has not been subjected to human processes) through renewable sources. South America has a noticeable usage of renewable energy as well, especially if compared to North America, Africa, or the vast majority of Asia, where the share of renewables is still quite low. Building a map of this type is certainly useful to analyze potential PE deals, given that countries that still rely heavily on fossil fuels could offer some interesting future investment opportunities.

The Role of PE Around the Globe

Following our remarks on the global use of energy and its local disparities, the present article assesses whether Private Equity players are having an impact on the development of renewable energy. In other words, we aim to understand if private equity funds have invested, or are planning to invest, in companies whose business is related to green sources.

It is no surprise that investments in clean energy have been growing throughout the last few years. As public attention has shifted towards climate change in an increasing number of countries, green investments seem to attract an increasing number of investors as well. Indeed, according to the American Investment Council, last year alone as many climate-focused funds were settled as in the last previous five years combined.

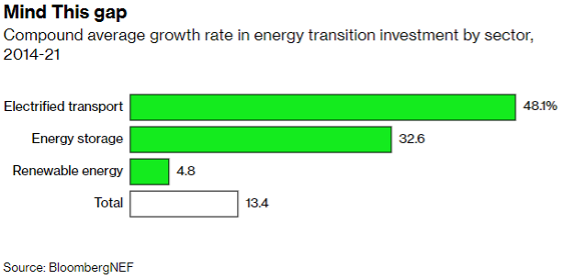

According to Bloomberg, in 2021 investments into energy transition and climate tech amounted to more than $900bn, with an amount invested into energy transition that doubles the total invested amount in the previous six years combined. What must be noticed is that this strong growth is mainly due to investments into electrified transport, with a volume exceeding $270B.

What is the impact that the PE investments are having on this development? In 2020, PE investments amounted to $5.5bn and $13.4bn in the solar and wind energy respectively, more than the previous ten years combined.

Private equity and venture capital funds are having a noticeable impact on the so-called climate tech sector. As stated by Pwc, climate tech is defined as technologies that are explicitly focused on reducing GHG emissions or addressing the impacts of global warming. In 2021, PE&VC investments into the industry totalled $54bn, out of $165bn, making these funds, with a share of 33% of total investments, the most significant players in the industry, with consistent investments throughout the whole year (in contrast to what happened in the public markets). As seen before, transport was also the main driver here, attracting 41% of the total investments.

What has always kept the PE industry from participating more in sustainable investments has been the lack of reliable measurements and data, something that is being solved by a global consolidation of reporting standards. This process of standardization has led, along with other developments, to a triplication of assets under management in the sector during the last decade, which, according to Preqin, are also expected to double by the first half of this decade.

To overcome measurement uncertainty, PE funds are investing more and more into climate data providers. Last year Blackstone, a colossal American firm involved in multiple green investments during the last few years, announced the acquisition of Sphera, a provider of data, ESG software and consulting services, for $1.4B.

With respect to the US, known for being the geographic core of the PE industry, investments in alternative energy companies from private equity funds totalled $24B in 2020, a 4x increase from the previous year. As a matter of fact, half of the private investments in the US came from private equity.

Summarizing the above, it may be said that while climate change and greenhouse gas emissions have become an increasingly pressing issue in recent years, PE investments have massively increased. This represents the investment and growth opportunities that are inherent to businesses accelerating the change towards renewables.

The Importance of Renewables in Italy

Italy’s government has put energy and climate at the center of its political agenda. The national energy and climate plan sets ambitious targets for renewables to be reached by 2030; with 30% in total energy consumption and 55% in electricity generation that shall stem from renewables. The institutional commitment represented a catalyst also for private investors as PE deals in alternative energy are rising to accelerate the transition. However, it is important to take a step back to analyze the current Italian situation in terms of energy supply.

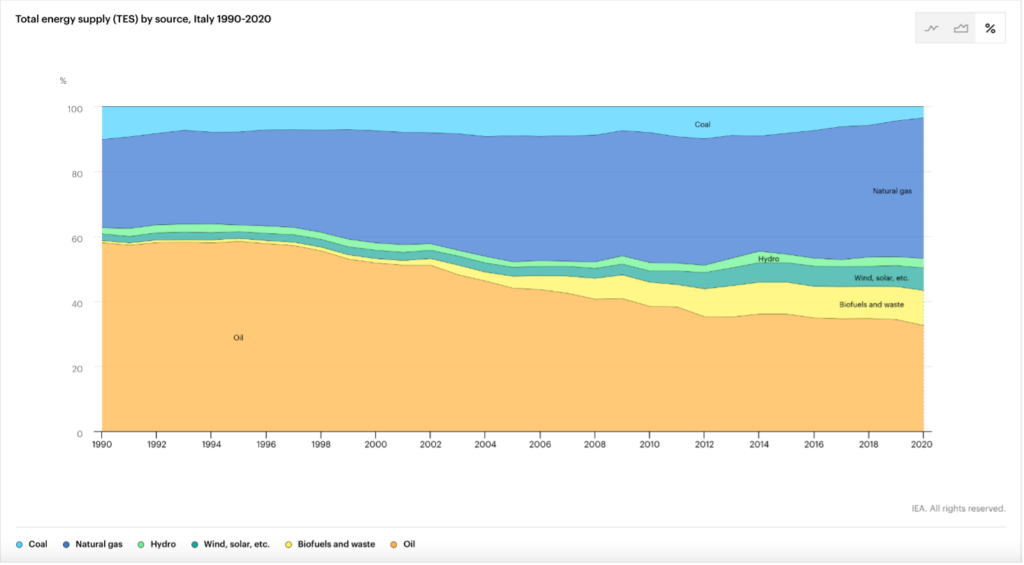

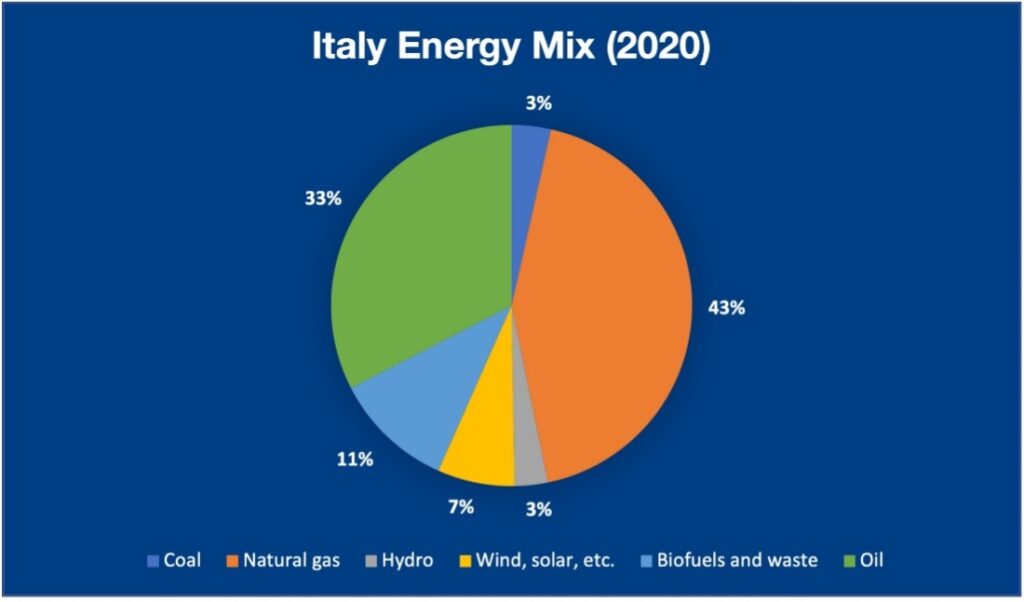

Despite the huge potential for solar and wind energy in the country, such alternative sources represent only 6.5% of the Italian total energy supply as of 2020. Natural gas and oil are still the major energy sources with a solid 43% and 33% of the Italian energy mix respectively, even if oil has been constantly decreasing since the 90s, as shown in the figure below.

As the recent conflict in Ukraine intensifies and western countries are threatened by the risk of Putin stopping gas supplies, the transition to renewables has come back to be a top priority for governments, especially those that are heavily dependent on Russia. Italy imports 46% of its gas supply from Russia, thus being very exposed to the risk of a deterioration of the conflict. To limit its exposure from Russian supply in the long term, the country has already confirmed its commitment to invest and accelerate the usage of green sources in the following years, with solar and wind energy leading the transition. The following section presents two recent deals involving Italian companies that are developing large power plants of solar and wind energy respectively.

The Role of PE Firms in Fostering the Transition in Italy

Tages Capital and NextEnergy Capital

PE firms play a crucial role in acquiring companies that operate power plants, with the aim of scaling the plants’ capacity to make them a potential target to integrate in the public infrastructure.

The recent deal between Tages Capital and NextEnergy Capital represents the biggest Italian acquisition in this sector in 2021, valued at €600M. Tages Capital, through the fund Tages Helios II, acquired the entire solar portfolio of the fund NextPower II, managed by NextEnergy Capital. In detail, Tages’ fund acquired 105 power plants that are distributed nationwide, for a total power of 149 MW. The operation was financed using €240M of debt issued by Intesa San Paolo, Banco Santander and BPER Banca.

NextEnergy Capital launched the fund NextPower II in 2016 with the purpose of consolidating the fragmented Italian market of operating solar projects, and using its technical, operational, and financial expertise to improve the performance across the whole portfolio. Besides, NextPower II is the precursor to NextPower III, a private fund of solar infrastructures focused on Ocse markets, which recently surpassed its fundraising goal of $750M.

On the other side, Tages Capital currently has 177 power plants distributed between its two funds Helios and Helios II, and in 2021 raised more than €730M. Tages Capital holds power plants for a total power of 536 MW, and an additional 76 MW of wind power for a total of 612 MW.

The acquisition shows how the energy transition is the result of a common effort between companies that develop innovative solutions in terms of alternative energy, the public sector, and the private funds, which act as the connective tissue in this industry. As a matter of fact, PE firms play a crucial role in accelerating the transition, by integrating their operational and financial expertise in target companies to scale their capacity and drive the Italian (and European) economy toward a greener future.

Renvico s.r.l.

Another interesting deal in the country was the acquisition of Renvico s.r.l. by ENGIE SA, in a deal valued €400M. Before the acquisition, Renvico was held by Macquarie and KKR.

Renvico is an Italian company active in the wind energy business, with wind farms both in Italy and France. The installed capacity of the company amounts to 329 MW of operating wind farms. The acquisition is among the top five biggest ones in the country and signals the growing attention that the sector has been attracting. The French company ENGIE, on the other hand, is the first operator for energy efficiency services in Italy and the leading producer of wind and solar power in its own country. Indeed, the acquisition had the scope to further develop the wind business in which ENGIE is already operating, in the hope to expand its already leading position in Italy.

Renvico was founded in 2015 after the acquisition of Sorgenia Green by Macquarie. In France, it started to develop wind farms along with KKR, operating via a joint venture. In detail, the acquisition involved two different legal entities. On one hand, ENGIE acquired Renvico Holding, which was owned by MEIF4, a closed-end PE fund (a typical structure based on which funds in Europe are managed) of Macquarie Infrastructure and Real Assets. On the other hand, it also acquired 50% Renvico France from Washington Bidco Investment Luxembourg, owned by KKR.

This deal shows the impact that colossal private equity firms can have on the development of sustainable energy companies. The future hope is that more and more PE/VC funds will invest in these kinds of companies. Such investments would help the companies to grow their business and build the required infrastructures. Eventually, the portfolio companies could be sold to strategic buyers, leading to the further development of the sector.

Conclusion

The aim of this article was to provide a first overview of the energy transition standpoint in different countries across the globe, then focusing on the contribute given by the PE industry in the Italian scenario through the analysis of recent deals. We found an intensive activity in the Italian landscape, especially focusing on solar and wind power, involving a variety of national and international players, from the public sector to institutional investors, banks, and private funds.

The article further highlighted how the energy transition is the result of a common effort between companies that develop innovative solutions in terms of alternative energy, the public sector, and the private funds, which act as the connective tissue in this industry. As a matter of fact, PE firms have been playing a crucial role in accelerating the transition, by integrating their operational and financial expertise in target companies to scale their capacity and drive the Italian (and European) economy towards a greener future.

Looking into the future, it is reasonable to believe that the growing amount of government funds pouring into the energy transition will promote an increasing number of companies involved in the renewable energy industry. Therefore, we are likely to see more and more private equity funds allocating resources into these businesses, strengthening their commitment to build a solid infrastructure that will support the Italian and global clean energy supply.

Sources

https://www.iea.org/articles/energy-transitions-indicators

https://www.iea.org/countries/italy

https://ourworldindata.org/energy

https://www.greenbiz.com/article/private-equity-stakes-its-claim-sustainable-investing

https://bebeez.it/private-equity/la-francese-engie-si-aggiudica-gli-impianti-italiani-renvico/

https://www.engie.com/en/renvico-growth-wind-energy-italy-france

https://www.energiamercato.it/project-finance/engie-acquisisce-gli-impianti-eolici-di-renvico

Comments are closed.