by Ginevra Forcellini, Ludovico Bellandi, and Giacomo Suriano

Introduction

Financial risk management has acquired a growing importance for both financial institutions and corporates due to various reasons. First, it is important to distinguish between Limited partner (LPs) and General partner (GPs), although the terminology might vary depending on the fund’s features and the country in which it operates. While the GP is responsible for the fund’s management, LPs are solely investors. The stake is usually 99% LPs and 1% GPs in the USA and 98% and 2% in the EU, where the closed-end fund scheme is mostly adopted. The article will focus on the relationship between the Private equity fund and the Private equity backed company (PEBC) in managing risks. We will first start from a basic formula to understand what the main drivers of performance are, after which we will then determine the steps to hedge risk. A further focus is consequently put on volatility risk, and on the advantages and limitations of derivatives to hedge this type of risk. We will close the article by briefly mentioning how PEBC also reduce PE risk using Blockchain.

IRR and the Steps to Reduce Risk

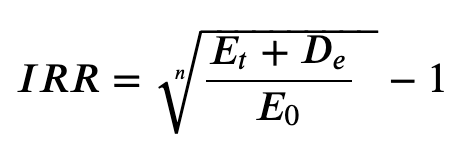

The main objective of a PE fund is to maximise its internal rate of return (IRR). Given the holding period of n years, the IRR is calculated as following:

As can be seen above, the formula shows main 3 elements that influence the IRR, and thus the value of the investment:

- Equity value at the end of investment (exit), Et

- Expected dividends distributed by the PEBC, De

- Equity value at the beginning of the investment (closing), E0

The enterprise value can be estimated through an asset side multiple, in practice often EV/EBITDA. By multiplying the median or average multiple of comparable companies with the expected EBITDA of the company in question and using the enterprise to equity bridge, one eventually obtains the expected Equity value at the end of the investment (Et).

Although PE investors in general pay more attention to upside (capital gain, Et – E0) rather than to the distribution of dividends De, and although the IRR is mainly affected by the expected equity value at the end of the investment, Et, an optimal risk management approach focuses on all the three components of the above-mentioned formula including the entry value and the expected dividends.

The use of hedging instruments like derivatives and the undertaking of managerial actions to prevent unexpected IRR fluctuations are distributed in different phases. Before investing into a company, a due diligence is conducted by the GPs, often assisted by hired consultants. In this phase professionals investigate potential risks that might arise from the investment and the fund managers determine their objectives in terms of expected IRR and maximum exposure to financial risks. An example will clarify the importance of this step. Let us suppose the PEBC operates in a polluting business and has no provision on the environmental remediation. The PEBC is profitable and there is no evident issue. Suddenly, the enterprise is forced to restore the previous situation and must pay a large amount of money. This is undoubtedly a nightmare for the PE investors and upside could be severely impacted. Between signing and closing, the fund may choose the right instruments to manage financial risks associated with the financing transaction of the acquisition. During the holding period all planned hedging procedures are executed and the management of PEBC is responsible for protecting EBITDA, the multiple, net financial position and liquidity. It is important to underline that the managerial actions aimed at protecting IRR are usually implemented by the management of the PEBC, not only by the managers of the PE fund.

What is Volatility Risk and how Does it Affect the IRR?

One of the PEBC’s objective is, in general, the maximisation of its EBITDA. Management’s performance bonus is often anchored to EBITDA rather than to revenues; this fosters efficiency and avoids boosting sales without enhancing profitability, with negative consequences for all shareholders, especially for PE funds. However, protecting EBITDA does not conflict with the PE’s goal, which is IRR maximisation. A higher EBITDA will lead to higher Enterprise value and, ceteris paribus, to a higher Equity value (Et) at the end of the period if the Exit price is identified through an EBITDA multiple.

Volatility can be defined as a movement around the mean, and, in this case, it is measured as the expected EBITDA standard deviation. The higher the EBITDA volatility, the higher the risk. PE fund’s prerogative is the stability of cash flows, as forecasted in the business plan, hence avoiding sharp movements that might have unpleasant effects on the upside is extremely relevant. Adopting a free cash flow from operations valuation (FCFO), a higher risk will be reflected in a higher discount rate that reduces both Enterprise value and Equity value. This clearly highlights why reducing volatility is crucial, for instance using hedging instruments by the portfolio company. But how exactly does hedging volatility risk with derivatives work?

How Volatility Risk Can be Mitigated with Derivatives

Not so many years ago, when there was a regulatory gap with reference to the use of derivatives, companies were somehow “passive buyers”. Enterprises were not so concerned to understand the type of product they were going to buy, but trusted banks to buy hedging derivatives. In some cases, instead of lowering their risks through a hedging derivative, under certain conditions, they were amplifying their opportunities to register losses. This is the case, for example, of an interest rate swap knock out step up spread. Exceeded a threshold, if market conditions get worse, the derivative forces the company to pay more when compared to a condition without derivative. In a nutshell, PEBC and PE fund should come up with a shared risk policy, with a clear definition of objectives and responsibilities. Otherwise, conflicts regarding risk management might arise, shifting the attention from more relevant issues. Due to unpleasant events of the past, several companies tend to avoid the use of derivatives. Fear and absence of solid knowledge towards derivatives have developed a corporate culture driven by misconception. Therefore, mostly big corporates hedge their exposure in such a way. Suppose a company selling most of its products to a foreign country. If the foreign currency devalues, without a derivative the company will face an exchange loss, reducing its earnings. Ceteris paribus, its profit will be lower, and lower also the Equity value; moreover, there will be less dividends. One can easily draw the conclusion that the IRR will not be exciting.

GPs not only provide funding for the PEBC, but also knowledge and mentoring. It will encourage the purchase of hedging derivatives like Currency swaps, IRS, Futures, and Forwards. Very complicated derivatives are in general not necessary; history teaches us that behind complexity there are sometimes unpleasant surprises. If the company doesn’t understand properly the features of the derivative, the instrument is in general not adequate and perhaps it incorporates some speculative purpose. In order to decrease risk, only hedging derivatives should be bought, and this is the case of the so-called plain vanilla, hence avoiding speculative ones.

Constraints in the Use of Derivatives

There are certain constraints in the use of derivatives. First, it is vital to have a very clear definition of the amount and distribution of cash flows through the years. Making inaccurate predictions might lead to wrong derivative choices and therefore might have damaging consequences. Secondly, the endowment of competences is an issue. The use of hedging derivatives presupposes that the company can perform tasks like identifying and quantifying risk factors through risk assessments. Moreover, it must be able to design a hedging strategy for a specific level of risk tolerance and risk appetite, which also implies choosing the right instruments and price them correctly. Most importantly, it must communicate both within the company and with outside stakeholders. Communication is a precondition, albeit not sufficient, for success. Giving incomplete or contradictory information destroys value for all stakeholders involved.

There are three other main reasons why PE funds as a whole rarely use derivatives. Derivatives suffer from high cash absorption, reduce exposure to public equities and it is difficult to use general derivatives to hedge all the PEBC risks.

Firstly, derivatives are very costly. Derivatives use up liquidity in two phases: upfront, when a derivative is bought, and at collateral posting – costs needed to exercise the derivative (if it is exercised). However, PE funds use a large portion of liquidity to repay debt, therefore the liquidity that remains available for the fund to spend in derivatives might not be enough. In turn, the effects of a lack of liquidity to service debt, which can be detrimental, may outweigh the advantages that the derivative grants the fund. If the bank sells a derivative “for free” to an entrepreneur, the company should reflect before buying it. Perhaps mark to market is negative and it will produce losses in the future, instead of limiting them.

Secondly, and quite intuitively, derivatives that some PE funds use, for example S&P 500 put options, reduce risk but also expected returns on stocks investments. Some public equity which funds invest in is intentionally riskier, therefore these put options might decrease the exposure of funds to intentional stocks’ volatility.

Finally, not all PEBC are exposed to the same risk profiles. On the contrary, many PE portfolios are diversified and also made up of firms with different sensitivity to systematic risk. Therefore, it can be hard to find a single derivative to hedge all the PEBC’s risks, while it would be more efficient to handle their volatility risks at firm level. According to risk tolerance and the features of risk faced, only a few types of instruments are adequate: a one size fits all approach is wrong.

New Technologies’ Support in Risk Management

Blockchain technology is becoming more and more popular in different fields, and this is the case of risk management, especially in PE. Starting from a quick definition, Blockchain is a data structure that makes it possible to create a decentralized digital ledger of data and share it among a network of independent parties.

As mentioned before, it is mainly the PEBC that hedges volatility risk and this may also happen with Blockchain technology. However, it can be used in different ways to hedge management risk, therefore protecting the PEBC’s Et and Dt. First, it reduces transaction costs. If other things stay equal, lower transaction costs have a positive impact on PEBC’s cash flows. Moreover, Blockchain is a system based on transparency since all the transactions between two parties are automatically recorded on the general ledger. This implies that everyone can have access to it and therefore it facilitates risk management. Consequently, risk of frauds is largely reduced as well. Blockchain in Private Equity also helps to increase the transparency of the several sectors of investment because of the availability of transactions’ data and due diligence will be highly streamlined, avoiding useless and time-consuming activities typical of an outdated approach.

Nevertheless, the biggest challenge for a risk manager becomes the creation and the adoption of a system of risk hedging based on algorithms to maximize the efficiency, the speed, and the transparency of transactions.

Conclusion

In a world becoming more complex and challenging day-after-day, where new risks arise and others change face, companies can no longer mitigate risks without derivatives. Although they might be reluctant to use such hedging instruments, it is a GP´s responsibility to act as a mentor to display the instruments´ main advantages. Finally, new technologies like Blockchain play a central role and modify risk management approach at the root.

Comments are closed.