Introduction

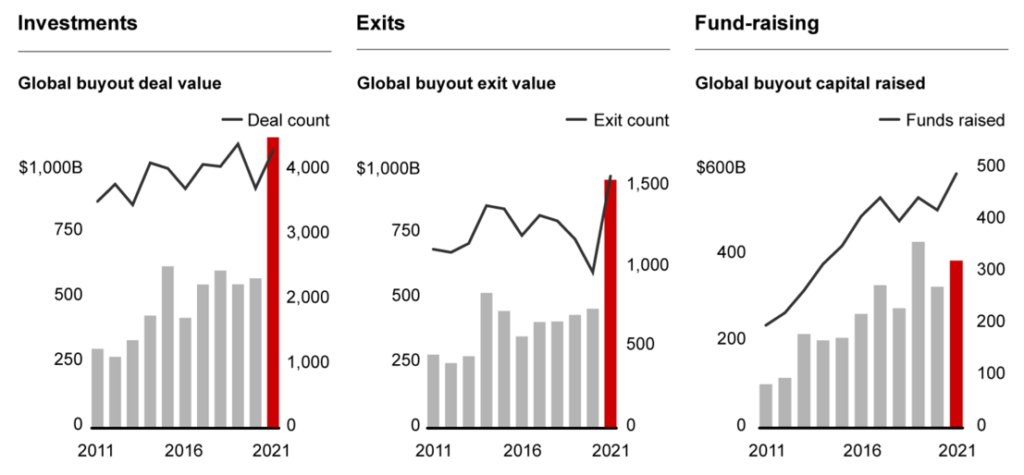

2021 was a record year for private equity by any measure, from deal counts to exit values, all the relevant metrics set new records. Deal-making reached historic heights at $1.1tn and fund raising remained strong, with current estimates indicating $3.4tn of dry powder (i.e. capital raised but yet to be deployed). Abundant liquidity boosted deals count and valuations.

Kings Remain Kings: Buyouts

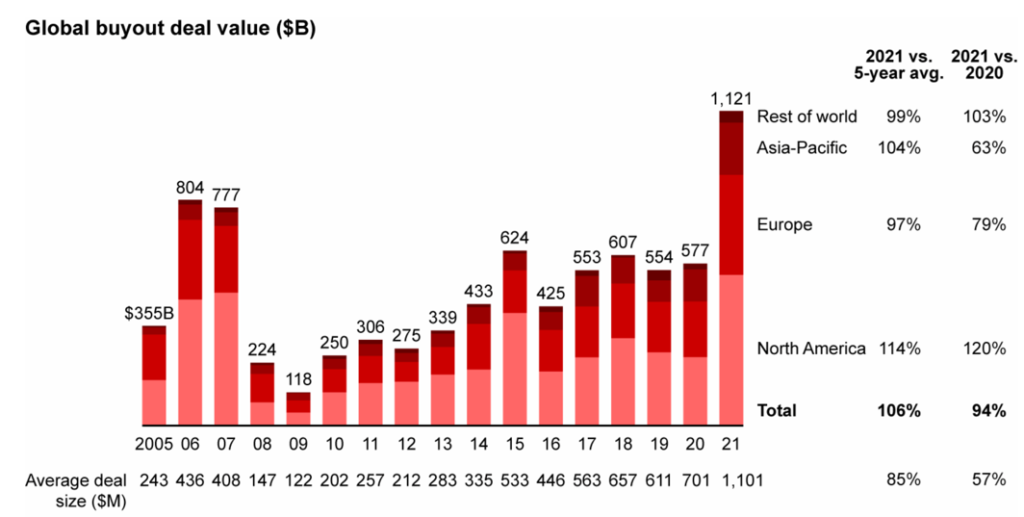

Buyouts doubled from approximately $500B in 2020 to more than $1tn in 2021 – significantly higher than the previous $800bn record set in 2006. Geography-wise, North America is the clear leader; in 2021, this region alone accounted for more than half a trillion in deal value, equating the global 2020 level, at around $500B.

Figure 1, Buyout activity overview, source: Bain & Company.

This growth is largely driven by deals’ valuations. In fact, deals count fell just shy of the 2019 record, at approximately 4000. On the contrary, valuations sky-rocketed to an average deal value of $1.1bn, an increase of 57% compared to the previous years. Deals are getting bigger and bigger deals are getting huge: the 10 largest deals, including the $30bn investment in Medline Industries carried out by Carlyle, Blackstone, Hellman & Friedman, and GIC, accounted for 18% of total value.

Going to Work: P2P Deals.

These figures are, at least partially, the results of record liquidity, that has been growing at steady rate for approximately 10 years, dry powder set a new record at $3.4tn. The trillions of covid-related stimuli simply accelerated this trend. With record high deployable funds, PE is rushing to put money at work. This resulted in a sharp increase in P2P deals (public to private deals), which alone accounted for more than $400bn in 2021, (+57% vs 2020), the last time such values were produced was in 2006/07. Nevertheless, in 2021 they were significantly smaller in size, and often led by consortium rather than a sole fund. At the moment, there is simply too much money to be put at work and P2P deals are the fastest and easiest way to deploy funds. Overall, buyout firms have seen their share of M&A activity globally rise to 19%, its highest level since 2006.

It Is Not Just About Buyouts: Growth Equity – A Rising Star

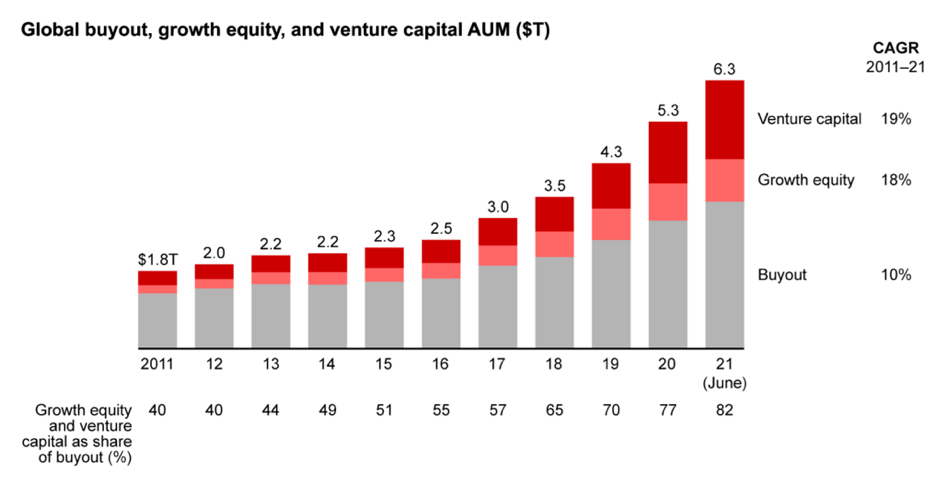

Historically, growth equity was an Asian concept, a few specialized players carrying non-control deals. Today, the situation is completely different, and although buyouts are still the most important asset class, growth equity and late-stage venture financing are becoming more and more relevant, as investors try to take advantage of record-pace technological evolution in an ever-changing environment. The numbers are striking, growth equity funds have increased in size at twice the pace of traditional buyout funds over the past ten years.

This trend is occurring at a global scale being present in America, Europe and Asia. Industry-wise, technology is by far the most sought-after sector, but there is a growing interest for financial services and healthcare.

The expansion of growth equity seems to be based on the assumption that technological disruption is still at its earliest stages on a global level, GPs appear to be willing to accept lower hurdle rates, betting that increased interest and volumes in the sector will make up for it. Several buyout giants, including Blackstone Bain Capital and KKR, are now prominent players in this space.

Historically, growth equity was considered the stage between early-stage venture capital and leveraged buyouts, representing the best of both worlds: fast-growing companies that have passed the most-risky initial phase and that are now becoming market leaders in their industry. Furthermore little-to-no leverage was involved (nor needed, as valuation were more conservative), lowering the risk profile of those investments. Today, the distinction between buyouts and growth is becoming increasingly difficult as deals in this space get larger. Additionally, companies are staying private for longer periods of time, opening up to more and more financing rounds at higher valuations.

Fund Raising

In a year marked by new all-time highs, fund raising lived up to the expectations: $1.2tn raised, up 14% from last year, leading to a record $3.4tn in dry powder. Buyout funds raised around $380B, the second-best year ever (the current record of $431B was set in 2019). Despite such bonanza, the situation is polarized: the bigger and more-experienced funds are raising capital at record pace, with the majority closing above target; smaller players on the contrary are having hard times. The largest funds (i.e. those with AUM in excess of $5B) are capturing more than 50% of the new capital provided by LPs. For top PE companies, the average flagship fund size went from $12bn to $17bn between the last two fund-raising cycles.

Private Equity funds are also tapping the market more and more frequently: large actors used to launch flagship funds every 3-5 years, compared to 1-2 years today. For instance, in 2021 Hellman & Friedman launched its X fund raising $24bn (compared to a target of $20bn), just three years after raising capital for its IX fund in 2018.

Investors seem to have a preference towards experience, size and specialization when allocating their capital. This is clearly benefitting large funds that can easily set up new vehicles to capture market trends, and specialized players operating in the hot sectors, such as Thomas Bravo within the software arena or L Catterton with the consumer space.

Exits

In 2021, exits were as good as they can get. Private Equity funds unloaded almost $1tn in assets, more than double the amount of 2020. Such a performance was possible thanks to alignment of several factors who boosted exits across the three main categories: sponsor-to-sponsor, sponsor-to-strategic and public markets (IPOs and SPACs).

Indeed, on one hand, record high stock markets constituted an attractive environment for listing. On the other, they gave strategic buyers room to maneuver, as record high valuations gave them ample currency for M&A activities.

Sponsor-to-strategic deals accounted for approximately $450B, nearly half of the deals; followed by sponsor-to-sponsor at $220. SPACs and IPOs came third and fourth, at approximately $150B and $100B.

Returns

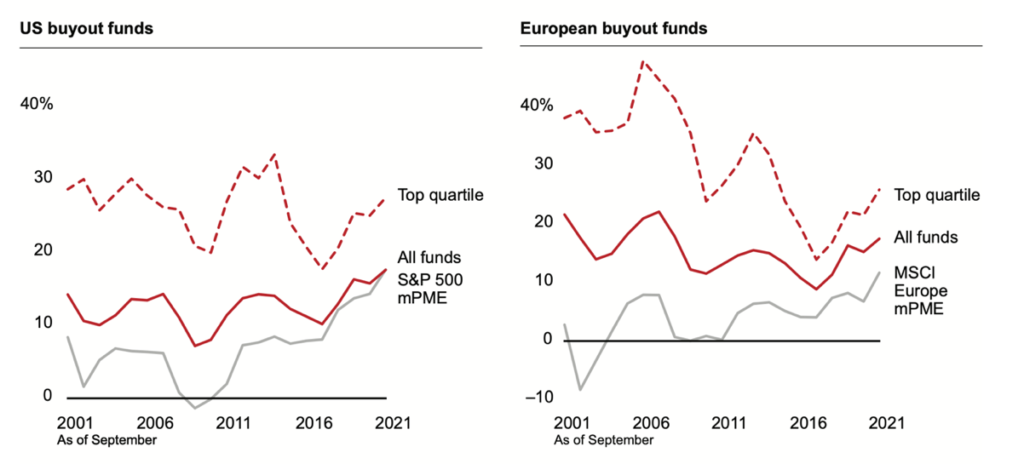

Private equity funds continued to deliver strong returns in 2021, with net IRR varying between 20% to 30% across all sectors and geographies. The lack of liquidity of private markets is not frightening investors, investors’ appetite is stronger than ever, driven by low volatility and portfolio diversification. While public markets have been closing the gap recently, this does not seem to represent a threat to the sector, as many sophisticated investors do believe that the current performance of public markets is not currently reflecting its fundamental one and will revert towards more reasonable levels the future.

As already mentioned, increasingly advantageous big funds are raising record funds and delivering the strongest performance, both in Europe and in the US.

Figure 5, 10-year horizon net IRR, source: Bain & Company

Looking Ahead

Fundamentals for 2022 remain strong, however, monetary policy changes, tax and anti-trust reforms and the Ukrainian war represent credible threats to the industry.

The era of free money is coming to an end, the FED has recently announced the first interest rate increase since 2018 and expectations of further increases at each of the next policy meeting are credible. The Bank of England and the ECB are following as well, the former announced a third consecutive increase, while the latter is preparing a faster than expected stimulus withdrawal.

On the legislative side, specifically in the US, prospects are not that bright. The SEC is increasing its oversight on the industry, setting higher disclosure standards for private equity funds. Antitrust rules on merger enforcement could represent a further threat; Lisa Khan, the FTC’s new chair, in the September 2021 Visions and Priorities for the FTC stated that regulators must consider how “the growing role of private equity and other investment vehicles…may distort ordinary incentives in ways that strip productive capacity and may facilitate unfair methods of competition and consumer protection violations”, signaling stricter reviews on M&A activity.

Sources

https://www.blackstone.com/our-businesses/blackstone-growth-bxg/

https://www.kkr.com/businesses/tech-growth

https://www.kkr.com/businesses/health-care-growth

https://www.baincapitalventures.com

https://www.wsj.com/articles/l-catterton-seeks-nearly-7-8-billion-for-new-funds-11638914599

Editor: Tara Morgan

Comments are closed.