Private equity is one of the largest and fastest growing alternative asset classes out there, with strong growth fundamentals, and investors committed to keep on allocating huge amounts of capital. However, the COVID-19 pandemic has caused an economic slowdown that hampered this rapid growth and left some people wondering about its future, especially in some parts of the world. Fortunately enough, it is believed that this relative slowdown will be temporary, with growth accelerating towards a global private equity & venture capital AUM estimate of $9.11tn in 2025. A considerable part of this growth will be captured by emerging markets (fig 3.1), which is the focus of what we are going to discuss next. In this article, we will try to examine the opportunities and challenges that come with PE in developing economies; starting off with an overview of what generally makes a PE industry successful, and then moving on to a comparison between the private equity realm in advanced versus developing economies, and finally, take a look at what is going to be the future of PE in emerging markets.

What are the building blocks that enable a PE industry to function successfully?

Using a model by the IFC, we can do this by defining three categories of factors: scale, structural factors and motives to sell.

Scale refers to the size of the economy and thus the potential for scalability. The larger the economy, the larger the ability to scale the existing technology or business operations. Many of the developing countries are of considerable size with a big population, making them attractive to private equity funds.

Structural factors, on the other hand can be further broken down into three categories: stock exchange liquidity, bank lending and debt capital market, and lastly, governance, transparency, legal system and taxation. A deep, well-established stock exchange allows for greater liquidity and better exit multiples through an IPO, making the market much more attractive for PE. Bank lending and the existence of a debt capital market, allows to finance part of the investment with debt, thus decreasing the upfront investment size. A market that features transparency and a well-functioning legal system is extremely helpful in that it significantly reduces the risk of investing in a foreign market.

Lastly, under motives to sell, market based, open economies are ideal mainly because they bring along more potential investment opportunities and incentivize companies to meet international standards and competitiveness.

PE in developed vs in emerging markets

Before comparing private equity in developed versus emerging markets, we first need to define the key differences. Wikipedia defines a developed market as “a country that is most developed in terms of its economy and capital markets. The country must be high income, but this also includes openness to foreign ownership, ease of capital movement, and efficiency of market institutions”. This is confronted with the definition of an emerging market which is “a nation with social or business activity in the process of rapid growth and industrialization”.

In this part of the article, we will contrast the two poles defined above based on multiple factors: economic and demographic rates of growth, legal and regulatory frameworks, returns and profits, process differences, and types of investments.

Economic and demographic rates of growth:

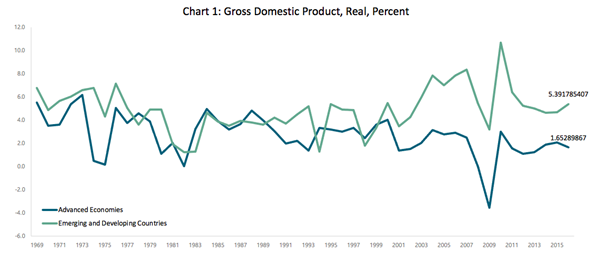

The graph above shows us that GDP in emerging markets has been considerably outgrowing the GDP in developed countries. In fact, in 2016, real GDP growth in advanced economies was 1.6 percent versus 5.4 in developing economies. This growth is expected to continue in the years to come which provides numerous opportunities for PE investors.

Demographically, the UN notes that “essentially all of the growth will take place in less developed countries”, which means that emerging markets will have both a youthful and a growing population, which, in turn leads to higher productivity levels, new business opportunities, increased levels of entrepreneurship, and higher levels of investment.

Legal aspects:

Another point that needs to be addressed when comparing developing and emerging markets is the legal and regulatory framework. We are talking about contract enforcement, bankruptcy laws, property rights and corruption tolerance. Weak legal systems in developing economies shake investors’ trust and make it harder to conduct business with unfamiliar people. That is, they limit deal flow by limiting the number of people with whom a fund manager can do business. However, countries like Russia, China and India have done a great job at improving their situation, and various laws were passed to create private property rights, allowing the formation of corporations and establish a framework for bankruptcy.

Returns:

A study based on a data set encompassing the cash flows associated with every PE and VC investment made by the IFC, the private equity sector arm of the World Bank, showed that this extremely diversified portfolio (covering 130 economies with a concentration on the poorest countries, and a time period from 1961 to 2019), has outperformed the S&P 500 by 16%. “So long-run returns relative to those in developed markets can be achieved through a global, diversified emerging market strategy and when the aim is to have positive impact alongside financial return.”

Furthermore, the PE strategies in developing and developed markets differ. In emerging economies, the emphasis is on growth and efficiency improvement as source of return, compared to leverage and multiple expansion in developed markets. This PE investment strategy causes investments in emerging markets to be less sensible to cyclical and macroeconomic shocks, allowing PE investments in these economies to outperform investments in developed ones in periods of global macroeconomic shocks.

Process differences:

- Fund structure

Developed markets are characterised by a limited partnership structure which has various advantages. Most notably and as the name suggests, limited partners have limited personal liability, which is not only beneficial to them as they are only responsible for the money they invested, but also to the general partners because it gives them more freedom to run the business. Additionally, through this framework, LPs can avoid paying self-employment taxes. On the other hand, some countries like India and China have managed to put in place a comparable legal structure, but many emerging countries still lack one.

- Screening

In developed markets, there is a huge amount of investment opportunities for PE investors due to two main reasons: a high level of business and entrepreneurial activity, and the wide availability of control positions – large group of company owners that are willing to sell control to third parties. Here the difficulty is to screen and cut down this large number to a more manageable amount.

In contrast, in emerging markets, the “screening” mechanism is quite different because, since the volume of deals is considerably lower, it is mostly personal and professional networks that pave the way for potential investments.

- Valuation:

In developed markets, PE analysts start with the company’s historical financial statements that can easily be checked for accuracy, and the valuation is done through DCF and multiples analysis. In emerging markets, there are various factors and risks to take into account, which make the valuation more challenging: the poor quality of recordkeeping, the difficulty of projecting and forecasting cash flows because of the geopolitical risk (possibility of expropriation of assets), the scarcity of readily available market and macroeconomic data, and finally the difficulty to estimate discount rates that hinders the use of multiples valuation.

- Financial contracting:

In developed markets, contracts include a number of provisions that shelter PE investors and regulate their relationships with the entrepreneurs. These include anti-dilution provisions, enhanced voting rights, liquidation preference etc.

In developing economies, these clauses are rarely found in PE contracts. Third party investors usually hold minority stakes in the companies, which may not be a problem if everything goes as planned, but if the company runs into trouble, “the inability of a PE investor to gain majority control under any condition may substantially increase their downside risk if the venture goes off track.”

- Exit:

In developed markets, a very successful exit strategy is to go public. In emerging markets, on the other hand, IPOs are very rare and their prospects very slim. This thus leaves PE investors with the option of a strategic sale, but then again there aren’t many potential buyers. “The exit challenges presented by emerging markets will diminish over time for several reasons. As developing economies grow and their capital markets improve, so too will the viability of emerging market IPOs and the interest of external M&A acquirers. In addition, the growing number of multinational companies based in emerging markets will increase the number of potential domestic acquirers for PE-backed ventures, ultimately creating more competition and better valuations.”

Types of investments in emerging markets:

- Infrastructure:

In developing economies, there is a considerably high demand for infrastructure. It is forecasted that emerging markets will invest an estimated 3.9% of GDP (USD 2.2 trillion annually) in infrastructure over the next 20 years. The energy sector, in particular renewable energy, smart and resilient infrastructure, and healthcare facilities are expected to attract strong investment. Emerging Asia will invest an estimated USD 1.7 trillion annually, equal to 42% of GDP; China to account for 54% of emerging market spend. All of which makes these countries highly attractive to PE firms investing in infrastructure projects. One of the challenges for investors, though, is reconciling the lower risk/return profile of infrastructure projects with the incentive schemes of PE funds.

- Low-penetration consumer markets:

In 2011, the market capitalization of consumer product stocks in emerging markets was approximately $500 billion, whereas in the US, Europe and Japan, it was $4.7 trillion. This huge gap is getting narrower over the years as emerging markets are getting wealthier, and it is going to continue over the future, but the success of this depends highly on how developing countries capitalize on it and recognize the opportunities that multinational consumer product companies miss. With low penetration rates across a wide range of consumer products and services, these opportunities abound in emerging markets and represent a fertile ground for a PE investment. Other opportunities to create value for consumers may exist due to the alternative retail channels, varied distribution networks, and infrastructure challenges found in emerging markets.’’

- Privatization/Restructuring:

In developed markets, especially in the US, most “public services” companies are privately owned. In emerging markets on the other hand, there is a far higher degree of nationalization with productive assets mostly under public management. This represents an opportunity for PE investors because these countries are moving more towards the privatization trend that developed markets have been through many years ago as this drives more efficiency, product quality, cost-reducing and competitiveness. Through restructuring, PE investors can bring significant improvements in efficiency and product quality, while reducing costs at the same time. The restructured company will be more efficient, have a sustainable cost structure, and be competitive not only domestically, but potentially in export markets. A notable example highlighting this phenomenon is the Saudi 2030 vision that announced the privatization of 38 government agencies in order to diversify its economic landscape and to avoid being solely dependent on oil.

- ESG investing:

Investors, now more than ever, are dedicated to deploying capital to ESG- (environmental, social, and governance) committed funds. Impact investing is increasingly detrimental for the alternative assets industry, and as more capital is moving towards this direction, spotting opportunities in various promising markets is of paramount importance.

- Digital transformation:

Innovative and ground-breaking technologies have been on the headlines quite frequently in the past few years. Offering a broad range of services and facilitating the improvement of operational efficiencies in many industries, they have created countless opportunities for investors across the globe.

What does the future of PE in developing markets look like?

The global crisis caused by the pandemic, resulted in continued rate cuts during 2020 with rates expected to be lowered even more throughout the rest of 2021. With most emerging markets having interest rates of around 4% before the covid crisis, there is and continues to be considerable margin for rate cuts as a countercyclical measure with most of these countries announcing to keep this stance . With this accommodative policy and the optimism deriving from the covid vaccine, also in the future, promising returns are to be expected from PE investments in emerging markets.

These estimates should be taken with a grain of salt however as there are some possible caveats. Political turmoil, the vaccination campaign turning out to be slower than expected and the risk that some countries may end up in situations of excess inflation, could result in high inflationary pressure. Another factor that needs to be considered is that many of the emerging economies still heavily rely on the export of commodities and are thus very sensitive to global commodity price changes. Fluctuations in these prices can have big effects on their current account, with indirect effects on their economies.

The trend in developing markets according to the MSCI‑emerging‑market Index indicates however that traditional and more cyclical sectors have become less important over the last two decades. This is reducing the effect of commodity prices on developing countries and indicates a promising path.

In conclusion, emerging markets present many PE opportunities, mainly in the form of higher growth rates than their developed counterparts and in smaller minimum investment requirements, which makes it easier to diversify. It comes with some risks and challenges however such as: a less developed capital market, making leverage more difficult, sudden and unexpected changes in fiscal policy or tax laws, conflicts and political unrest. This requires investors with a flexible mindset and a prudent and diligent approach. With the development of these markets however and the experience gained by investors, these challenges will be reduced and become easier to tackle.

References

https://web-cms.cigp.app/insights/another-year-for-emerging-markets-to-outperform

Comments are closed.