by Sergio Cocca

Introduction

Sovereign Wealth Funds (SWFs) are growing at an astounding rate around the world and today exert enormous influence over capital markets. Assets under management of SWFs have grown exponentially over the last two decades, reaching a total of $10.39tn this year, an increase of 11.2% from last year. This aforementioned capital accumulation was enabled by the stock market rebound and the increase in hydrocarbon prices over the last year. Moreover, 38 new SWFs have been established since 2010, and another 20 countries are contemplating establishing their own SWF. Currently, there are about 100 active SWFs. A particular type of SWF, among the possible classifications, is the Sovereign Development Fund (SDF). Even though nowadays such SWFs are rare, this specific type of SWF drove the development of the domestic market making it one of the original driving forces in the adoption of SWFs.

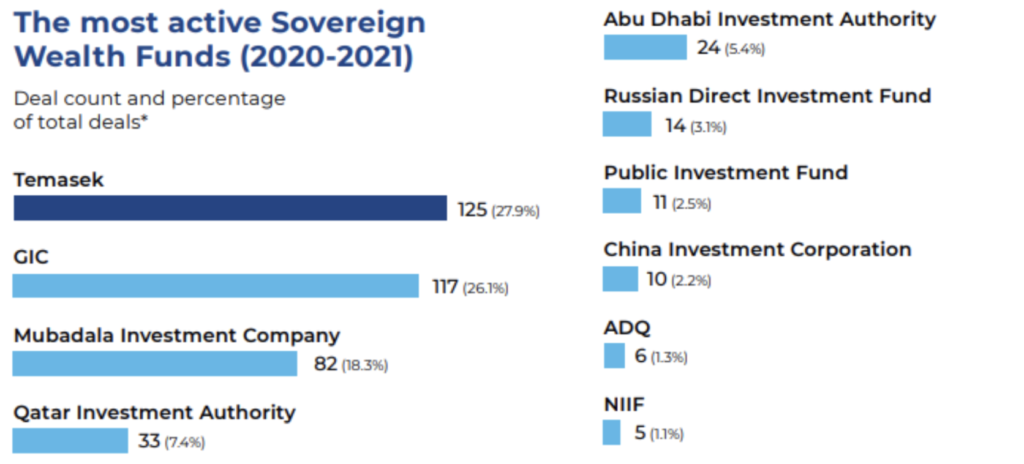

In 2021 the most active SWF was Singapore’s Temasek. Temasek was founded in 1974 with the sole purpose of contributing to the country’s economic development, industrialization, and financial diversification. Over the years, Temasek evolved from a typical (SDF) to a globally diversified investment fund, managing over $381bn in assets.

Analysing Sovereign Development Funds

Sovereign Development Funds (SDFs) can be defined as government-sponsored commercial investment funds that combine financial performance objectives with development objectives. Most SDFs are created by countries with broad economic development agendas and underdeveloped domestic capital markets. However, SDFs do not have fiscal spending purposes.

SDFs act as catalysts of opportunity, identifying and financing promising sectors, businesses, and entrepreneurs in the domestic market. Therefore, SDFs play an active role in economic growth and national development, moving managerial resources and capital to the fastest growing sectors where it is urgently needed.

Most SDFs were created over the last two decades in countries belonging to the Middle East’s oil-rich Gulf Cooperation Council. These countries’ governments were looking to modernise their infrastructure and economies by employing their vast resources made available from the selling of oil. One example is the Saudi Arabian Public Investment Fund (PIF); created in 1971, the PIF initially helped establish companies of strategic importance to the Saudi economy, including many of its “national champions”. Over time, the PIF became an international player, managing over $620bn in assets as of 2022. As was the case with Singapore’s Temasek, today the PIF is globally diversified and positioned to enable Saudi Arabia to achieve its goals related to achieving sustainable economic growth and furthering social change.

Some of the above-mentioned SWFs are present in the ranking of the most active funds of the last year, displayed below.

The Indian National Investment and Infrastructure Fund

The National Investment and Infrastructure Fund (NIIF) is a true example of a SDF, still in its early stages as its orientation towards the domestic market is evident. The NIIF was set up by the Indian government in 2015 with the specific mandate to maximise its economic impact through infrastructure investment in commercially viable projects. The government of India has committed $3bn to the NIIF with the remaining capital flowing from other long-term investors such as SWFs, pension funds, and other national development institutions. Among its investors are entities like the Abu Dhabi Investment Authority and the pension fund Australian Super.

The NIIF vehicle consists of three major investment strategies. The first strategy is that of a master fund that has raised capital from outside investors to be invested in specific companies in the public infrastructure sector, improving India’s roads, airports, railways, and waterways. The NIIF’s second strategy consists of a fund-of-fund vehicle focused on building a portfolio of private equity funds across diversified sectors and investment strategies. The Fund of Funds (FoF) makes significant commitments and provides anchor capital to managers who have a good track record in infrastructure and associated sectors in India. The FoF aims to provide its investors with a well-diversified exposure to India’s growing sectors. The assessment of the fund managers’ track record is conducted by evaluating the financial performance of the companies they have previously managed, but also how this performance was enabled through effective governance. In fact, the NIIF is strongly committed to Environmental, Social, and Governance (ESG) standards. Therefore, the FoF also considers (ESG) scores when planning its investments. Finally, the NIIF’s third strategy includes a direct private equity fund with the objective to provide long-term capital to high growth businesses in India, through a portfolio of domestic champions and unicorn companies.

This strategic structure is pretty common in SDFs; hence, it was useful to explore the NIIF’s structure. However, other SDFs may have a different focus and scope; for example, the Moroccan SDF emphasises the growth of the country’s tourism sector, with aspirations to turn Morocco into one of the world’s top tourism destinations.

Social Development Goals

The Sustainable Development Goals (SDGs) are a set of 17 interlinked global goals set up in 2015 by the United Nations General Assembly as a “blueprint to achieve a better and more sustainable future for all”, to be achieved by 2030.

To achieve the SDGs a large amount of long-term investment capital must be deployed into sectors that can help catalyse improvements in areas where a need has been identified. It is clear that SWFs are the perfect fit to carry out such long-term investments in sectors that would be helpful to achieving these SDGs; sectors like infrastructure, real estate, waterways, and agriculture. SWFs typically have a long-term horizon and a well-defined liabilities structure, enabling them to invest in illiquid assets; however, some SWFs are a better fit than others. For example, while stabilisation funds (a type of SWF) have a more conservative risk appetite, SDFs have a more flexible mandate and a long-term horizon that can bolster domestic industries whilst simultaneously achieving SDGs.

The Indian NIIF is a perfect example of a SDF that can better integrate the SDGs in its investment strategy in infrastructure. Indeed, it is rare one identifies a SWF with a formal programme to address these SDGs and other impact-investing allocations, since a SWF’s mandate is often focused exclusively on achieving financial returns or on developing the local economy. Moreover, for most SWFs, constraints in furthering the SDGs are driven by limited staff and investment opportunities, while capital resources are usually available. Most of the capital currently invested in SDG-related assets and companies is thus achieved through passive investing in private equity or venture capital funds, which have a secondary impact on achieving these SDGs, usually through infrastructure investments.

Direct and enabling investments in SDG-related assets are still limited and pertain to few exceptions like the Indian NIIF. This is because direct investment entails additional risk, since it usually requires complete ownership of a target company, an obstacle to diversification. On a goal-by-goal basis, there are some SDGs which are more accessible in terms of investment. Examples of highly investible SDGs are; “3 – Good health and well-being”, “12 – Responsible consumption and production”, and “7 – Affordable and clean energy”. On the other hand, goals such as “5 – Gender Equality” and “16 – Peace, justice and strong institutions” are difficult for a SWF to achieve alone.

Given their role and unique characteristics, SWFs (and SDFs in particular) should increase their commitment to the achievement of SDGs, enhancing their direct investments in particular, since they have a stronger impact compared to investments through the portfolio approach (passive investments).

Conclusion

SDFs can play a crucial role in the development of emerging economies, investing in promising businesses whilst enabling access to important technical competencies. Given their capital resources, long-term horizon and domestic focus, SDFs are the perfect investors for infrastructure and housing projects. Furthermore, their role in achieving the SDGs may be essential and the hope is that more SDFs will be established in the near future with the specific mandate of direct investing in the SDGs.

Sources

https://www.swfinstitute.org/fund-rankings/sovereign-wealth-fund?utm_source=pocket_mylist

https://en.wikipedia.org/wiki/Sustainable_Development_Goals?utm_source=pocket_mylist

https://en.wikipedia.org/wiki/Sovereign_wealth_fund

https://www.pif.gov.sa/en/Pages/Homepage.aspx

Editor: Noah Halbritter

Comments are closed.