The market

Most people have played a video game at some point in their life, in one form or another, but it’s the rise of professional gaming and developers publishing revolutionary and visionary games that has been taking over the spotlight in the past decade or two. VC funds realized this fact too, which made them invest a lot of time and money to back potential disruptors. In this rising investment segment, funds often focus on a specific aspect within the gaming industry.

Figure 1: Gaming market map; Source: White Star Capital

From an investor standpoint, the gaming market is extremely diverse. It stretches from software and engines all the way to developers, distributors of video games, monetization, and tournament platforms. In essence, there is an entire ecosystem built around games with multiple parties involved. Funds are usually focusing on a segment of the market, which can be broken down into the following 8 categories, briefly described below:

- Developer Tools

- The software used by developers to make games

- Developers & Publishers

- The game creators and publishers

- Distribution Platforms

- Software/platforms through which consumers can purchase games created by publishers

- Access Point

- Software and hardware on which games can be played (e.g., PlayStation)

- eSports Talent

- Professional teams that compete in tournaments for cash prizes and sponsors

- eSports Platforms

- Organizations/firms hosting eSports competitions

- Event management

- eSports Broadcasting

- Broadcasting services

- Usually big, established firms like ESPN

- Streaming & Social

- Websites, software, and platforms through which players and fans can communicate or stream

For someone that casually plays games, most recognizable are the developers and publishers, such as EA, who create games that are part of the foundation of the gaming ecosystem. The most recognizable publishers often release “AAA Games”, or games expected to be bestsellers with large budgets. However, there are a plethora of small studios with few developers, and small budgets, that can often develop extremely successful games.

The backbone of developers are the developer tools, which are the engines and software used to create games. The developers and publishers use these tools to build their games. The choice of tools often determines the aesthetic of the games and what they are capable of. The better the tools are, the more creative game developers get.

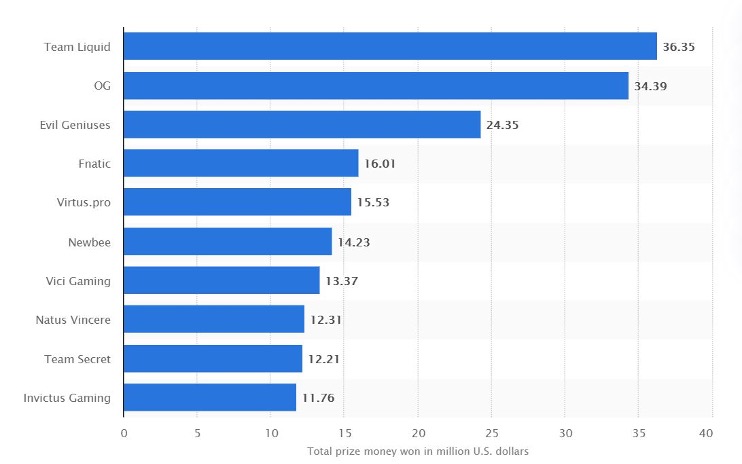

Game developers and their tools are far from the only investment opportunity for funds though. There has been a spectacular rise of eSports, or “Electronic sports”, which focuses on teams that compete in tournaments. This has turned into a big business, with leading teams, such as Team Liquid earning more than $36m over the course of their professional career. VC funds capitalize on this by investing in established teams or assisting in the establishment of new teams/divisions. The teams are further monetized through sponsorships and the sale of merchandise.

Figure 2: Leading eSports teams by prize money; Source: Statista

Another significant revenue stream is the streaming services, where millions of viewers can watch competitions as well as normal games. Twitch, the most well-known of these services also allows viewers to donate money, which provides a significant revenue stream for teams and event organizers. Inarguably without streaming services, the gaming market would not be as large as it is today.

The Players

The funds active in the gaming ecosystem are of a wide variety. Most of the investing, 90%, happens through the general VC network, while the remaining 10% originates from game-specific funds focused on a specific niche. One of the main reasons for this still limited amount of game-specific funding is that up until 2009 game-specific VC funds didn’t exist. Therefore, the gaming market in terms of VC investing in large part is still in its infancy. There are however certain funds that have so far made a name for themselves, such as Galaxy Interactive with $260m AUM, based in New York. Since its inception in mid-2018, Galaxy Interactive has made 28 investments, being the lead investor in 15 of which.

Figure 3: Overview of game investing funds; Source: Game One

Market analysis

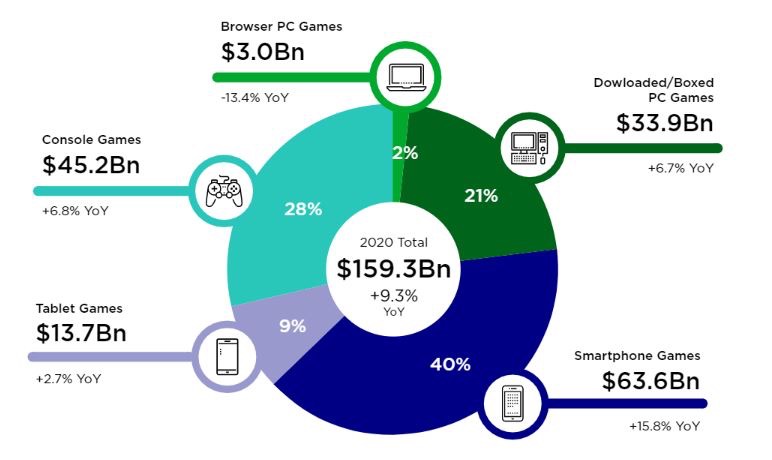

While many are unfamiliar with the scope of the gaming market, it has managed to grow into a behemoth, valued at more than the music and video streaming markets combined. The $159bn+ size put into another perspective, is larger than Kuwait’s GDP. It can be broken down into several categories: console, mobile and PC. The mobile game segment saw rapid growth over the past years and currently has the largest market share at 40% and 15.8% YoY growth. The PC game segment has seen smaller growth in comparison, taking the smallest market share at 21%. Console gaming is currently increasing at %13.4 YoY and is set to continue that trend with the new console cycle of Sony and Microsoft spurring a flurry of new game developments. The numbers underline a trend wherein gaming is shifting away from the PC market.

Figure 4: Gaming market size; Source: Newzoo

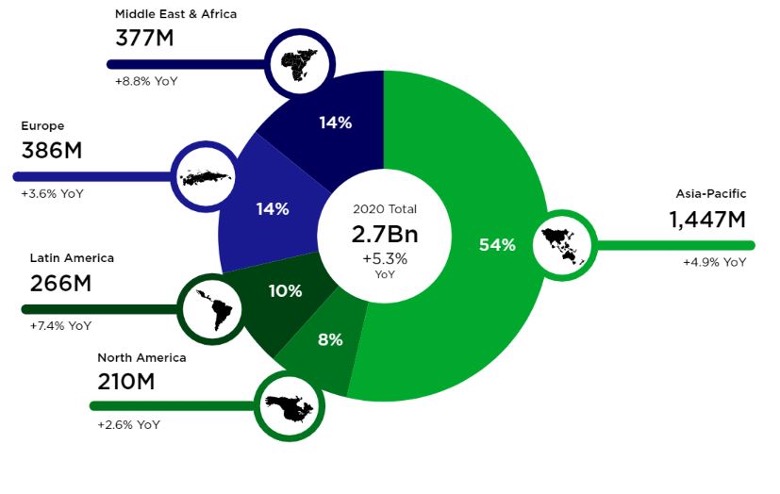

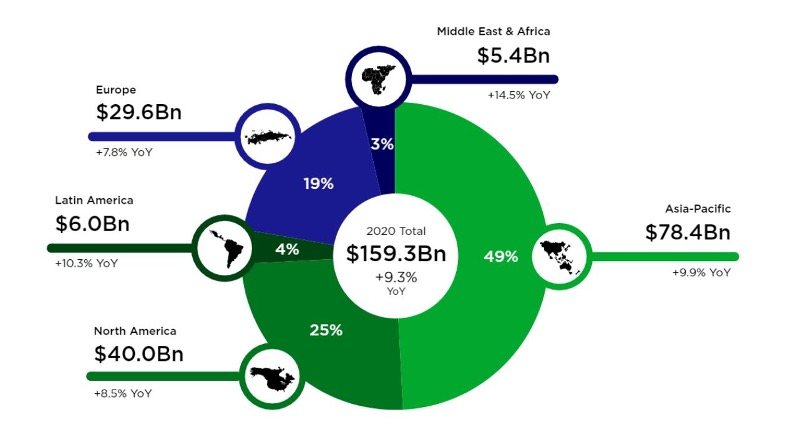

Over the past decade, the APAC region was in large part the engine that propelled the gaming market into the big industry it is today. In 2020 the total number of people playing video games stood at around 2.7bn or 34.6% of the world population. The APAC player count alone was larger than all other regions combined, yet at a 4.9% YoY growth rate, Asia has become quite mature, with growth shifting primarily to Africa, which grew at 8.8% YoY. This trend is predicted to continue, which is further highlighted by the fact that in terms of game revenue, Africa is the fastest-growing market at 14.5%, greatly outpacing APAC’s 4.9%. High view numbers and strong growth metrics provide a mature investment environment, where game developers have a broad audience and service providers like Twitch can collect even larger fees.

Figure 5: Player counts; Source: Newzoo

Figure 6: Game revenue regional breakdown; Source: Newzoo

VC funding in the gaming market has seen some volatility over the past years, with a defined spike in the mid/late 2010s. In 2018, the funding amount, $4.7bn, was more than 5x the amount of funding that was achieved in 2014. The spike was short-lived, however, and funding dropped sharply in 2019 back to $1.1bn, from where it has seen consistent growth once again. One notable trend that can be observed, is that as the market matures and firms establish themselves, the number of deals on an annual basis decreases, yet the total funding amount increases. For example, in 2019 $1.1bn was funded through 118 deals, meanwhile, in 2014 only $900m was funded in more than twice the number of deals, 268.

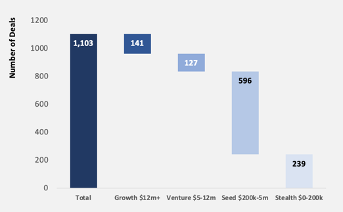

In VC, the greatest quantity of funding deals is found in the seed and early stages. The gaming market is no different. A total of 1,103 deals were made from 2014-2020, with 239 in the stealth phase and 596 in the seed stage. There is a sharp decline in deal volume at the later stages.

Figure 8: VC funding per stage (2014-2020); Source: White Star Capital

The funding does not distribute evenly among the 8 market segments discussed earlier. It can be broken down as follows:

| Gaming Market Segment | % of VC funding since 2014 |

| Developer Tools | 14.83% |

| Developers & Publishers | 48.01% |

| Distribution Platform | 6.99% |

| Access Point | 1.42% |

| eSports Talents and Sponsors | 1.71% |

| eSports Platforms | 4.14% |

| eSports Broadcasting | 0% |

| Streaming & Social | 22.91% |

Investors are most active in the following sectors: tool development, game developers and streaming services. These three sectors secured more than 85% of the VC funding in the period 2014-2020.

Recent deal

As a successful VC investment example in the gaming market, one can highlight Twitch, which we mentioned multiple times earlier. In 2007 the firm underwent an initial seed funding round, with subsequent series B and C rounds in the early 2010s. In its series B round, the firm raised $15m from 3 investors, with Bessemer Venture Partners as the lead. One year later they organized another funding round worth $20m from 6 investors, where Thrive Capital acted as the lead. Twitch is now valued at around $15bn, which will likely grow further as their viewers count and eSports fan numbers keep growing at a rapid pace.

Roblox’s March 10th, 2021 IPO, which was highly anticipated on Wall Street, also solidified VC’s success in the gaming market. The unicorn initially received funding through 9 rounds, to a sum of $855.7m, with the first rounds taking place more than 15 years ago. Roblox, a videogame developer with a game holding the same name, successfully used its community to consistently create value. Community created content has enabled them to grow their users to over 150m by 2020. Currently, the firm has a market cap of $37bn+.

Outlook

The gaming industry has undergone rapid growth over the past 10-20 years, establishing itself as a $159bn+ industry. The pandemic, forcing millions to stay at home and find alternative forms of entertainment, has been a key growth driver in the rising number of gaming/eSports fans. This fact combined with multiple public listings such as Roblox’s will lead to increased attention from funds ready to invest, followed by the rise of gaming-specialized funds.

Author: Justin Ashauer

Editor: Boris Mihaylov

References:

https://www.nfx.com/post/what-vcs-dont-see-why-were-bullish-on-gaming-startups/

https://newzoo.com/products/reports/global-games-market-report/

https://www.crunchbase.com/organization/twitch/company_financials

Photo by Igor Karimov on Unsplash

Comments are closed.