by Enrico Martinelli, Francesco Antonio Bargellini, and Francesco Puricelli

Introduction

Over the last twenty years, Private Equity firms (PEs) and companies in the Luxury Fashion industry have presented an interesting combination of forces. Indeed, Luxury Fashion (F&L) is an industry where PEs have seen an increasing amount of buying opportunities in the aftermath of the financial crisis. Analysing the history of Golden Goose, we can observe that it is an excellent example of growth in the F&L industry driven by PE sponsors. During its lifespan, Golden Goose has thrived under the approach to value creation employed by different PE-led initiatives, including international expansion, brand awareness, and digitalisation. On the other hand, Golden Goose has rewarded its PE investors by delivering outstanding financial results and exceptional returns. In the following paragraphs, the main sources of value creation by PEs in the F&L industry will be analysed, adopting the point of view of both the financial sponsor and the target company itself. Furthermore, a case-study on the rise of Golden Goose until its latest acquisition by Permira will be presented. The topics provided in previous sections will come together in analysing the value creation strategies adopted by PE funds as it relates to the Golden Goose case.

Sources of Value in PE-led Acquisitions in the Luxury Fashion Industry

PEs have not always been as interested in F&L companies as they are now. As stated by Marco De Benedetti, Co-head of Carlyle Europe Partners, the mishandling of the delicate equilibrium between creative development and investment management has led several deals into outright failure. In an interview with Pambianco, Andrea Guerra, the newly appointed CEO of Prada, noted that timing is where PEs have failed in the past. PEs have persistently failed to understand that the F&L industry has varied timelines for value creation compared to investments in more traditional sectors. Tamara Mellon, Co-founder and former Chief Creative Officer at Jimmy Choo, the brand that has passed through three buyouts, adds that PEs’ short-termism could affect the creativity process, undermining the brand and its potential for growth as well as the relationships with customers.

But once PEs realised that F&L requires longer-term attention to create perception, the industry has become a preferred target for investors, with returns seemingly more appealing than in other more saturated industries. The best slogan about PEs’ approach to value creation in the F&L industry has probably been best coined by Francesco Trapani, who, in an interview with the Financial Times, asserted that, when dealing with F&L companies, PEs don’t have to be magnificent in order to be satisfied with their investments, but if they succeed in fully understanding the business, then the returns can be incredibly high.

Francesco Trapani, former CEO and owner of Bulgari, and later Senior Partner at Clessidra, an Italian PE fund specialised in Luxury and Apparel, Tages, and VAM Investments, is one of the actors with an impressive track record in the segment. He has come to exemplify how PEs can support small companies, with a fragile financial structure and a very simple organisation to excel on the international stage by aggregating SMEs, while realising outstanding MoM and IRRs.

Over the last 15 years, most of the PE-driven investments in the F&L industry have proven to be great successes. Examples of recent deals include Partners Group acquiring a majority stake in Breitling, L Catterton acquiring a controlling stake in Etro, Permira acquiring a majority stake in Golden Goose, Blackstone taking a 20% stake in Versace, and Mayhoola’s buyout of Valentino from Permira, which had previously invested in Hugo Boss.

As in the other industries, PEs’ value creation stems from the typical three drivers, namely EBITDA growth, deleveraging, and multiple expansion. However, it may be more interesting to understand why the F&L industry and PEs are so complementary.

F&L companies attract the interest of PEs for several reasons.

- High pricing power, solid margins, and good cash conversion ratios constitute the most obvious reasons behind the interest of PEs. Indeed, according to a Deloitte report from 2021, producers in the luxury segment posted on average an EBITDA margin of around 22.3%. Furthermore, since PEs are always looking for low-development-risk projects with attractive returns, generational trends represent a powerful growth driver. Gen Y and Gen Z are expected to continue leading this growth, while spending among Gen Z and Gen Alpha is expected to grow three times faster than for the remaining generations over the next few years.

- Financial sponsors want to see businesses with defensive, category-leading brands that benefit from high barriers to entry and seismic shifts in consumer behaviour. Companies focused on intangibles represent a strategic, long-term play, and several empirical papers have demonstrated that brand-driven companies achieve superior financial returns and higher multiples. These brands, given their strategic positioning in the market and unique products, will be able to enjoy competitive advantages, growing against the tide of inflation, and proving the superior capabilities that position them for exceptional growth in more benign macro conditions.

- The attractive structural growth of the industry. According to a recent report by Bain and Altagamma, the global luxury market is expected to grow by 21% in 2022, reaching €353bn, and at least by 3%-8% in 2023, despite the global macro economic downturn.

All these factors could result in successful investments thanks to the opportunities offered both by organic and external growth in terms of profitability and cash generation, and the multiple expansion for those players that will be capable of building platforms or reinforcing brand identity.

On the other side, from the perspective of F&L firms, PEs have proven to be the ideal partner for successful growth because of the support that competent portfolio managers can provide to achieve long-term objectives.

- Firstly, the combination of experts from the consumer, media, and retail segments with the existing management can create strong teams. To this extent, talents, cutting-edge capabilities in design, digital, merchandising, and M&A are paramount to sustainable growth and the successful management of momentum. Furthermore, PEs can bolster the narrative of a brand by carefully conveying the firm’s messages to investors, partners, media, employees, and customers, thus forging an emotional connection, and reinforcing brand loyalty.

- Secondly, internationalisation. In the new era of fashion, the deployment of an accelerated roll-out of retail channels to consolidate brand presence in the US and China is a game breaker. Indeed, according to the Fashion & Luxury Private Equity and Investors Survey by Deloitte, securing presence in the APAC region is one of the main priorities for fashion executives, since by 2025 almost 50% of luxury shopping will be carried out by Chinese consumers.

- Finally, new digital channels. E-commerce has become increasingly relevant to secure stable revenues growth. Companies are starting to use digital channels to communicate with their customers.

PEs can commit significant resources that standalone companies often can’t afford. In an industry in which creativity and soft factors are the elements around which success is built, significant sums must be invested in several initiatives. Customers are increasingly looking for unique experiences, and this entails the modernisation of shops and new openings to be as close as possible to people, offering a local format. Furthermore, to achieve customer-centricity, one of the new paradigms in the F&L industry, PEs can support the deployment of re-commerce strategies, pushing towards re-selling and the repair of products. Finally, a strategic element is supply chain management. In the aftermath of the pandemic, companies have overhauled their supply chain, moving closer to their suppliers to become more flexible and to ensure full compliance with all sustainability rules to protect the reputation of customer brands. But this often translates into establishing JVs with suppliers or acquiring them, as in the case of the deal involving Golden Goose.

The Golden Goose Growth Path

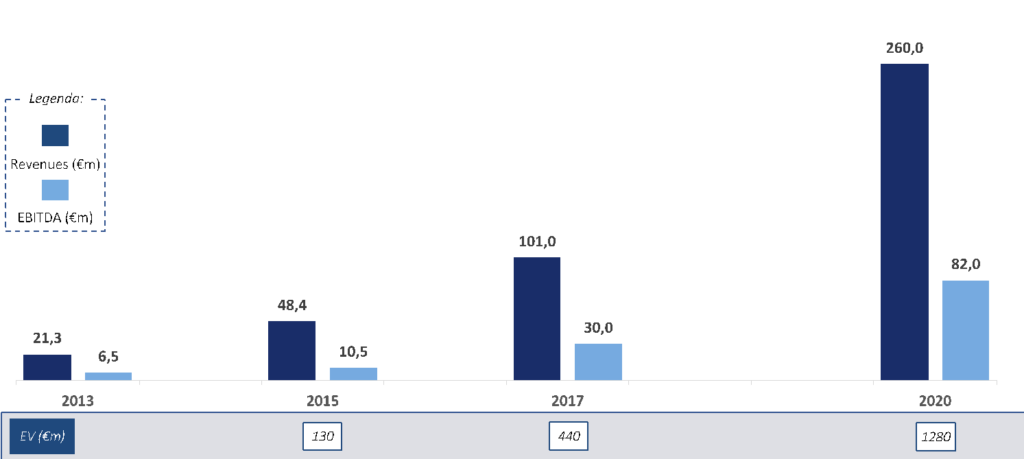

The 2020 deal between Carlyle and Permira is just the conclusion to a series of changes in ownership over 10 years, during which four PE funds brought Golden Goose to a €1.28bn valuation. It highlights how different PE funds, in terms of target dimension and geographical areas (domestic vs international), can all add value to the process.

Taking a closer look at the 2020 acquisition, the parties involved are The Carlyle Group Inc, a listed global investment firm with $369bn in AUM as of 2022, and Permira, a global PE firm with over €60bn in AUM as of 2022. The deal is the result of an auction process chosen by Carlyle as an exit strategy from its 2017 investment. While an IPO had been considered, physical expansion and fundamental growth were considered as more pressing priorities. As reported in a 2020 article by BeBeez, in 2019 Carlyle was able to receive an extraordinary €100m dividend from Golden Goose thanks to the achievement of remarkable financial results, including the reduction of debt exposure consequent to the 2017 LBO. As stated in the aforementioned article, Permira, beaten by Carlyle itself in 2017, was able to overcome four other PE Funds and one SPAC with a €1.28bn offer. The valuation was based on a 13x EV/EBITDA multiple and a €100m 2020 Expected EBITDA, with Permira holding 83% of the company, while management and other minority investors, including a Carlyle reinvestment stake, own the remaining 8% and 9% respectively.

PE Value Creation in the Golden Goose Case

Before international PEs took the lead in 2015, Golden Goose ran as a wholesale business of less than 100 employees. While the business already had a strong domestic foothold and generated more than €100m in revenue in 2016, there was a clear opportunity to expand even further into markets like the US and China.

When The Carlyle Group acquired Golden Goose in early 2017, the business was well-positioned for growth and uniquely placed to capitalise on its strong momentum. A customer survey confirmed Golden Goose had a brand awareness greater than 70% in existing European markets, and around 50% in the US and China despite limited penetration. This is a recurring pattern in the luxury industry that signals the high potential for expansion, as previously seen in several deals executed by Permira, including the buyouts of Valentino Fashion Group and Dr. Martens.

Golden Goose needed a trusted partner that could support the company in becoming one of the fastest growing and most distinctive luxury global lifestyle brands. Carlyle represented an ideal sponsor, given decades of experience in partnering with luxury consumer brands. On the growth path, the contribution of Carlyle was essential to bring important resources within Golden Goose, including global network, deep operational expertise, and understanding of technological innovations changing the luxury fashion landscape.

Carlyle contributed to develop the business following a traditional value creation route, namely expansion by rapidly opening new POS, from seven directly operated stores to almost 100 stores, with direct-to-consumer sales increasing from around 10% to 45% from 2017 to 2019. Leveraging its global network, Carlyle accelerated Golden Goose’s international expansion and established local partnerships that were key to helping the brand penetrate the Chinese, South Korean, Japanese, and American retail markets. These achievements have deeply impacted the financial results of the company, showing a nearly three-fold increase in both Revenues (CAGR 17-20: 37.1%) and EBITDA (CAGR 17-20: 39.8%).

Improving the online channel is usually an opportunity to grow the business when PE funds work to transform a company with a strong domestic foothold into a global lifestyle brand. Carlyle provided the company with the operational expertise needed to expand Golden Goose’s digital retail capabilities and e-commerce channel, accelerating its shift towards a direct-to-consumer platform.

When a PE fund acquires a company with an ambitious growth trajectory, the first duty is to build a solid infrastructure that can sustain the organisation in a period of rapid expansion. This can be considered a value creation route on its own, as structuring the organisation is not only a way to implement strategies adopted by the management. Effectively, a company with a solid infrastructure, a shared vision, and strong corporate management culture, has a higher value than its peers, all other things being equal. After the recent acquisition of Golden Goose by Permira in 2020, Maureen Chiquet (ex-CEO of Chanel) was elected non-executive president of the company. Her vision and experience will be crucial to help Golden Goose in the next growth phase.

Conclusion

Andrea Bonomi, Founder and Chairman of the Industrial Advisory Board at Investindustrial, whose portfolio includes a minority stake in the NYSE-Listed Ermenegildo Zegna Group and that has recently disposed of its majority stake in Sergio Rossi, has perfectly summarised the topic. He stated that several F&L entrepreneurs are capable of building successful mid-market companies by developing their products, but most of them need the support of PEs to define a strategic roadmap with precise guidelines and activities to achieve their aspirations, enlarge their scale and create value. The Golden Goose case is an ideal example of this successful symbiosis between PEs and F&L companies. Overall, the strategies put in place together with Carlyle and other PE sponsors contributed to the transformation of Golden Goose’s business model to sustain and support long-term growth. Effectively, the company passed from a wholesale business to a direct-to-consumer platform adopting an omnichannel approach. Looking at the evidence of this value creation process, Golden Goose has obtained a CAGR from 2015 to 2020 of 39.9% and 50.9% for Revenues and EBITDA respectively. Furthermore, the Enterprise Value of the company has grown from €130m to €1.28bn in just 5 years, an extraordinary 10x increase which shows how valuable the cooperation between PEs and F&L firms really is.

After the debt refinancing round in 2021, the future appears still bright for Golden Goose, with some sources mentioning a potential IPO in New York. The only certainty is that whatever challenge the company will face, PEs will support it with their financial strength and operational capabilities, using their experience to create value for all stakeholders.

Sources

https://bebeez.it/private-equity/permira-indossa-le-sneaker-golden-goose/

https://bebeez.it/private-equity/golden-goose-scalda-i-motori-per-lipo-a-new-york/

https://www.carlyle.com/global-insights/golden-goose

https://www.ft.com/content/d1a01d6e-20a0-11e5-ab0f-6bb9974f25d0

Editor: Ludovico Bellandi

Comments are closed.