By Bianca Proverbio and Marc Weigand

Introduction

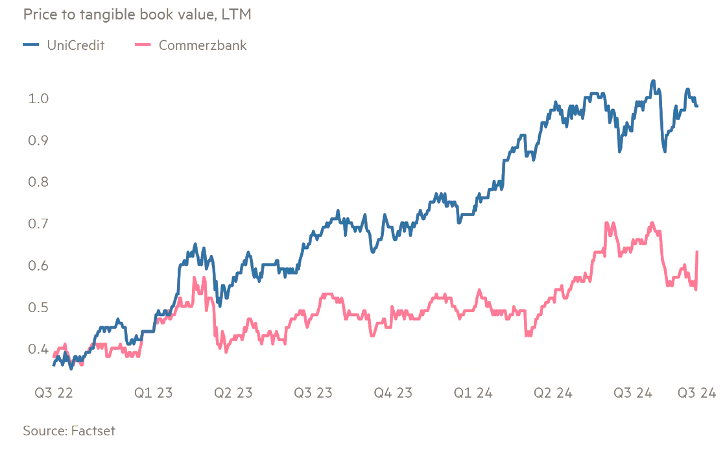

Following the 2008 financial crisis, dealmaking among banks in different European countries came to a halt. Recently, however, the Italian bank UniCredit disclosed that it had built up a stake in the German Commerzbank, sparking conversations about a potential merger. After years of draconian clean-up, UniCredit is an internationally diversified group, experienced in restructuring itself and other banks, and it is currently outperforming most European peers. It already owns an important mortgage unit in Germany, which would generate synergies. Commerzbank, on the other hand, with a cost ratio well above UniCredit’s and profits a tenth of the size, can benefit from some internal cure. Both banks have sound capital and liquidity positions.

EU policymakers and politicians believe this type of cross-border deal could revitalize European banking and its global competitiveness. In a recent report, Mario Draghi called for banking integration in the Eurozone, even suggesting special legislation is needed to reach this objective. This deal would mark a remarkable step towards Draghi’s vision. Be that as it may, the deal is receiving pushback from politicians and policymakers alike.

Deal Structure

Speculations about Andrea Orcel, UniCredit’s chief executive offer and his interest in another German deal have been long ongoing, especially following UniCredit’s merger with German lender HypoVereinsBank in 2005. Given UniCredit’s strong financial position, for instance, through a notable excess of capital only reinforced by their recent Q3 earnings, it appears that the right point in time for Orcel to initiate a long-awaited deal has come. The German government announced that it was looking to sell some of its 16% crisis-era holdings which they acquired following the 2008 financial crisis. This granted UniCredit a window of opportunity to initiate its strategic move into a greater position in Commerzbank, which unfolded on three key dates.

On September 11th, 2024, UniCredit increased its stake in Commerzbank by 9%, acquiring 4.5% in a block trade from the German government itself. This marked a surprising move, with UniCredit the sole purchaser outbidding the rest with a purchase price of around €700m. Additionally, UniCredit purchased a further 4.5% stake in the open market, spending up to €1.4bn in total. These acquisitions in quick succession made UniCredit one of the biggest shareholders of Commerzbank. The very same day, Orcel approached the Commerzbank management board to instigate talks about a potential merger.

One important peculiarity in this transaction is how UniCredit strategically navigated the regulatory thresholds that come with an increased stake. Specifically, the ECB enforces regulatory approval for stakes in financial institutions with thresholds of 10, 20, 30 and 50%. Clearly, by acquiring a stake just below this threshold, Orcel narrowly avoided this approval and the media attention and controversy around such a deal that comes with it.

UniCredit’s intention to become Commerzbank’s greatest shareholder was made apparent on September 18th. On this day, it was reported that UniCredit was preparing to file for approval from the ECB to acquire a stake in Commerzbank up to 30%, which would respond within 60 to 90 days. Under German law, this could trigger a full mandatory takeover. Shortly after, on September 23rd, UniCredit reported that it entered further financial instruments. Through this move, UniCredit increased its aggregate position in Commerzbank to 21%, with physical settlement awaiting approval from the ECB.

Strategic Rationale for a potential UniCredit-Commerzbank Merger

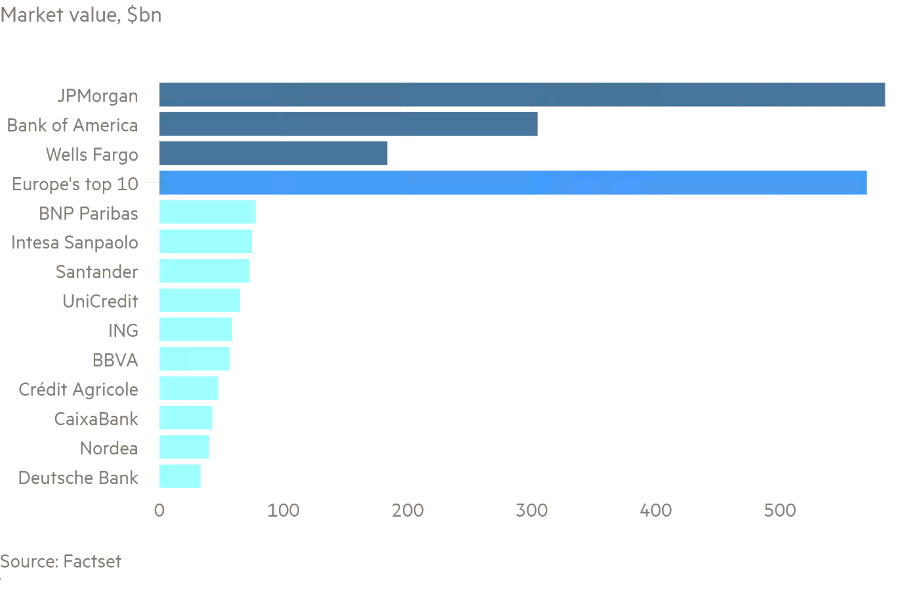

Europe is acknowledged to suffer in terms of global competitiveness due to its fragmented banking market, with lenders that lack scale. Due to its strong operations and rising market valuation, UniCredit was always likely to lead the next wave of bank consolidation in Europe. Thanks to its excess capital, UniCredit can easily afford the acquisition, also given the undervaluation of Commerzbank. The Italian lender already owns HVB in Germany and therefore has the potential to achieve synergies from the deal. If HVB’s cost-income ratio (15 percentage points lower than Commerzbank’s) can be considered a valid indication, UniCredit is expected to be able to improve the management of the German peer. If HVB and Commerzbank were to combine, it would create Germany’s second-largest bank and the largest foreign-owned subsidiary in Europe, with total assets of $889.3bn.

Furthermore, the UniCredit-Commerzbank deal is a test case for the ECB which will have significant consequences on the future of the European banking industry, and it represents an opportunity for its supervisory board to affirm its independence. “The assessment on the deal should be based only on the solidity of the entity which would be formed through the merger rather than national interests” the ECB policymaker and Governor of the Bank of Italy Fabio Panetta declared.

Navigating Backlash: UniCredit’s Bold Move Through Germany’s Lens

Considering UniCredit’s merger with HypoVereinsBank in 2005, this potential deal highlights a further strategic move through which UniCredit could enhance its presence in Germany’s banking sector. However, this comes at the expense of German financial sovereignty, which has received backlash, particularly on the political side in Germany.

Olaf Scholz labelled Orcel’s move as “unfriendly” in a time of political uncertainty in Germany. Commerzbank provides essential financial services for the German Mittelstand, German SMEs, which are relied on to drive growth in a period of weak economic performance in Germany. UniCredit’s holding of high-yield Italian government bonds, raises red flags on the safety of money in UniCredit’s hands, sparking questions among local German news outlets on the extent to which it is still safe to have deposits at the Commerzbank. In the face of a collapsed Ampel coalition in Germany, the German outlook on this transaction is likely to remain critical in a new government. Friedrich Merz, leader of the opposition, the Christian Democratic Union (CDU), titles the merger as a “disaster” for the German banking market. Considering the likelihood of the CDU’s return to power in February’s snap elections, the result of Merz’s and Scholz’s takes led to a substantial fall in UniCredit’s and Commerzbank’s share prices, 5.9% and 3.3% respectively.

A stronger competitor in Germany through a UniCredit-Commerzbank synergy poses serious implications for Deutsche Bank, which could lose a significant portion of their market share. Therefore, talks about the Deutsche Bank trying to intervene with a potential deal come as little surprise. In early September of this year, it was reported that the Deutsche Bank was contemplating the acquisition of the remaining 12% of the German government’s stake in Commerzbank.

Whether this deal will come to life and to what extent these implications will become observable largely comes down to the regulatory process and ECB’s decision. Although regulators have generally shown themselves to be in favour of banking consolidation, the decision of whether to approve has proven to be more nuanced than initially assessed. In an environment of geopolitical uncertainty, such a shift would affect not only national banking influence but also strategic economic interests within an already unstable Germany. Therefore, a successful merger for all parties involves calls for necessitating a careful balance between fostering financial integration in the EU and maintaining control over critical domestic institutions.

A Test for Europe’s Banking Future

The potential merger between UniCredit and Commerzbank highlights the multifaceted opportunities and challenges that come with cross-border banking consolidation within Europe. While UniCredit’s strong financial position and track record suggest operational synergies, political resistance in Germany underscores the tension between European financial unity and preserving national interests. The outcome of this deal hinges on the ECB’s regulatory decision, which must navigate a fine balance between enabling consolidation and safeguarding the stability and sovereignty of Germany’s domestic banking sector. Amidst geopolitical and economic uncertainty, this debate exemplifies the broader challenge of building a unified banking union.

Bibliography

Reuters, How UniCredit swept a stake in Commerzbank in bid to grow Germany https://www.reuters.com/markets/deals/how-unicredit-swept-up-stake-commerzbank-bid-grow-germany-2024-09-11/

Politico, Berlin livid as UniCredit tightens its grip on Commerzbank

https://www.politico.eu/article/commerzbank-unicredit-germany-italy-olaf-scholz-friedrich-merz/

Euronews, UniCredit seeks ECB approval for larger stake in Commerzbank https://www.euronews.com/business/2024/09/18/unicredit-seeks-ecb-approval-for-larger-stake-in-commerzbank

Financial Times, UniCredit’s artful pitch to be Europe’s bank consolidator: https://www.ft.com/content/f55d3645-784c-412b-a33b-6bb41071a38d

Financial Times, Letter: UniCredit-Commerzbank deal is test case for ECB: https://www.ft.com/content/26f6f7b5-7ec2-440a-a50d-97ccd794b46e

Reuters, UniCredit-Commerzbank deal should be judged on financial strength – Bank of Italy : https://www.reuters.com/markets/deals/unicredit-commerzbank-deal-should-be-judged-financial-strength-bank-italy-2024-10-23/

The Banker, Explainer: What Unicredit’s move for Commerzbank says about European banking https://www.thebanker.com/Explainer-What-Unicredit-s-move-for-Commerzbank-say-about-European-banking-1726216584

Comments are closed.