By Matteo Ravera, Edoardo Valsetti

The Global Space Economy includes a wide range of opportunities that can create value and has multiple benefits to humanity based on the results achieved from exploration, research, and space utilization. In the recent years, the space sector has evolved significantly, thus increasing its importance to the economy, especially in sectors such as meteorology, telecommunications, energy, transport, and aviation. Regarding the composition of the space economy, we can identify 10 fundamental drivers of the space ecosystem:

- Satellite Launch: One of the largest subsectors. Companies focus on technology and infrastructure to send satellites.

- Satellite Internet: These companies focus on improved connectivity through satellites, wireless broadband, optical communications, etc.

- Deep Space Exploration: High-level missions to carry humans and cargo beyond the earth’s atmosphere.

- Lunar Landing: Missions to the Moon and products/infrastructure for moon missions.

- Earth Observation: Imaging, analytics technology, GPS, and more.

- Asteroid Mining: The exploitation of raw materials from asteroids and other minor planets, including near-Earth objects.

- Space Debris: These companies track and analyze human-made objects in space.

- Space Tourism: Developing space access for private citizens and space explorers.

- Space Research: Companies dedicated to space research and education.

- Manufacturing: Design, development of spacecraft, hardware, propulsion systems, engines, and other technologies.

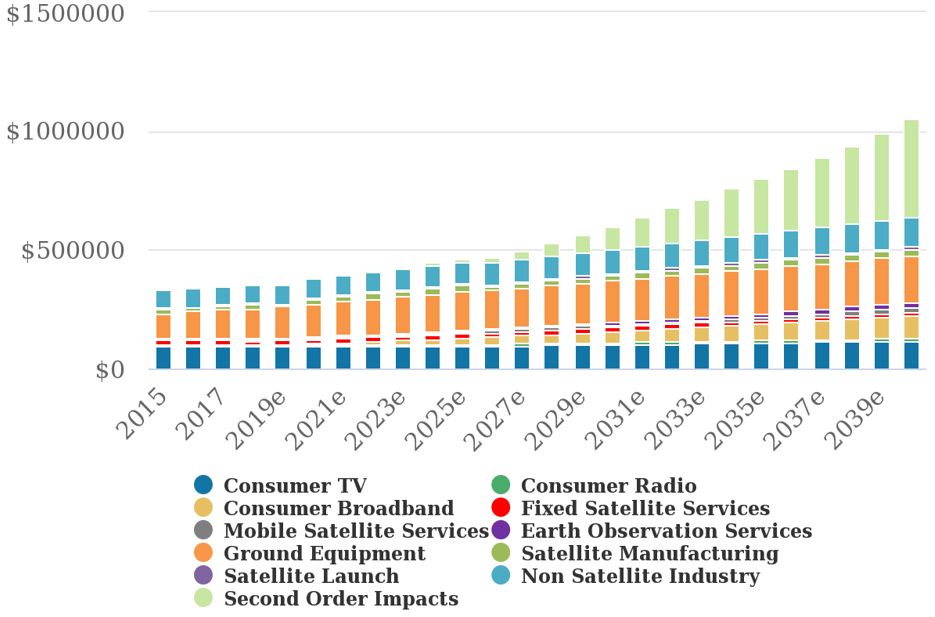

However, speaking in general terms, the space industry is deemed to be the next trillion-dollar industry by 2040, with revenues that may reach $1tn, according to many analysts. Particularly, declining launching costs and advances in technology will make reaching into outer space less expensive, providing opportunities in fields such as satellite broadband, high-speed product delivery, and perhaps even human space travel.

As we can see from Figure 1, satellite broadband will represent 50% of the projected growth of the global space economy. Indeed, launching satellites that offer broadband Internet service will help to lower the cost of data, whose demand continues to grow. It is estimated that the per-megabyte cost of wireless data will be less than 1% of today’s level. Furthermore, reusable rockets and mass production of satellites will help drive down launching costs from today’s $20m to $500,000.

Figure 1:Estimated Growth by subsectors. Source: Haver Analytics, Morgan Stanley Research forecasts

In addition, there will be significant opportunities associated with rockets. For example, packages now delivered by air could be delivered by rockets. Hence space travel could find a wide commercial application, which is not yet possible.

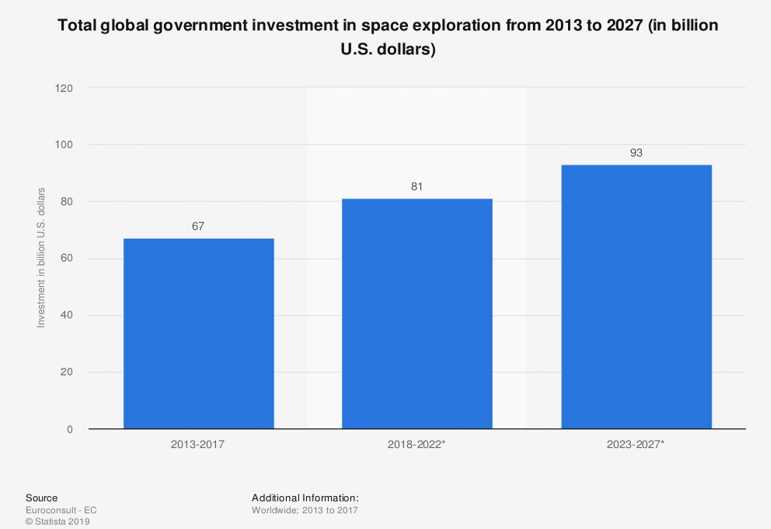

Focusing instead on space economy financing and investments, we can see how these have been the prerogative of the public sector (Figure 2), especially because space exploration requires huge investments without any guarantee of returns. However, the private sector has contributed significantly to its development. Starting from the year 2000 there has been a steadily increasing participation rate of private companies in the sector’s development. These have been building, launching, and monitoring satellites for many years, working closely with NASA and ESA. In 2011 there were only 100 companies, and their number grew to 1000 in 2016. In 2019, the size of the space economy reached $424 billion. Commercial applications took the highest part of the turnover (two-thirds), although military and institutional supplies still represent a significant part of the total profit (one-third). Two main factors contributed for this development. The first one is the development of AI which is based on the large amount of data gathered from satellites. Secondly, the significant cost reduction of satellite services. Nowadays the life of each human being is largely reliant on the presence and efficiency of satellites. The second significant factor refers to the costs of accessing space. For example, NASA has entrusted the transport of people and goods to private companies, thus developing public-private partnerships that are fundamental for further development and removing the monopoly of Lockheed Martin and Boeing. This resulted in lower production costs of launch vehicles, with a particular focus on reusability, e.g., SpaceX. Elon’s space company has developed a way to reuse the first stage rockets, which provide the initial thrust necessary to overcome Earth’s atmosphere. These rockets used to fall into the ocean as waste once their job was completed. SpaceX has successfully developed reusable first stage rockets, thus reducing the cost per kilogram of a payload by more than 50 percent. The company can certainly be considered one of the most disrupting in the sector as it became the first private company to launch NASA astronauts to the International Space Station. Moreover, SpaceX has reached the milestone of 100 launches of its Falcon 9 freighters, and it also added about 1000 satellites to its Starlink constellation. Some of the most innovative space companies are Leolabs, GhGsat, Slingshot Aerospace, Rocket Lab, Planet, Relativity Space, Capella Space, and Astroscale.

On the other hand, there are not many pure players in which retail investors can invest. Giants like Boeing, Lockheed Martin, and Northrop Grumman build rockets, spacecrafts, and satellites but revenue directly based on space is not significant in the overall performance of these companies. Indeed, very often the revenues are linked to defense projects. There are two pure players worth mentioning: SpaceX, already described above, and Virgin Galactic. The latter’s primary goal is to bring wealthy people into space, with space tickets costing $ 250,000 each. Tourists would have around 90 minutes of flight time. Virgin Galactic entered the NYSE in October 2019 with an $ 800m investment from a SPAC.

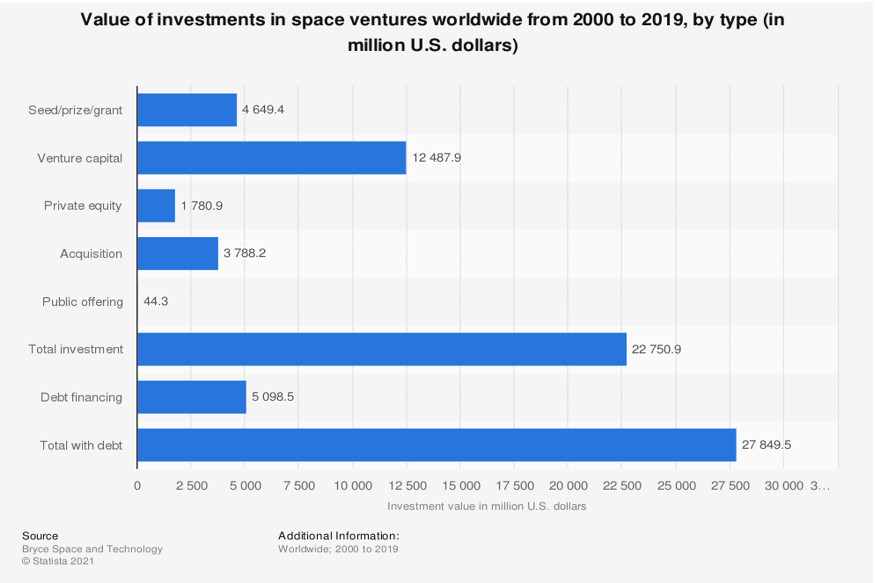

As evidence that we are at the dawn of a series of large private investments in the space economy, we can see how commercial space initiatives have experienced record levels of funding in the recent years. Total investments of venture capital increased by 95% reaching $ 8.7bn in the twelve months leading up to March 2021, according to the Seraphim SpaceTech Index. The increase involved SpaceX and OneWeb, with $ 4.2bn raised. Excluding these outliers, drones and flying taxi-related businesses, private funding for commercial space ventures jumped by 52 percent to $ 4.1bn. It is important to underline that since the Covid-19 pandemic, private investments in space have doubled. Space focused businesses are also finding strong support from investors in special purpose acquisition companies, known as SPACS. In the 12 months to March 31, 11 space SPACS have been announced, pledging an investment of more than $ 7bn into the sector and giving companies such as Rocket Lab, the New Zealand launch company, and Spire Global, the space data group, multibillion-dollar valuations. However, many space start-ups have yet to prove they can operate profitable businesses, and some critics recall the high-profile collapses of companies such as Iridium, GlobalStar, and Teledesic two decades ago.

In conclusion, we can underline that hundreds of start-ups have been created to take upon the opportunities in space infrastructure, satellite manufacturing, launch capabilities, IT hardware — and adjacent areas, such as space tourism, satellite broadband, media, and even asteroid mining. Although the sector requires significant investments the interest of angel investors, venture capital and private-equity firms is constantly growing. The space economy, however, requires patient investors and one sign of investors’ willingness to wait is the increasing reliance on permanent and long-term capital funds. To succeed, the space industry will need practical business cases and realistic profit models, which means a self-sustaining ecosystem. As rocket launches become more refined, cheaper, easier, and faster, it will allow for the rest of the ecosystem to grow.

Figure 2

Figure 3

THE ITALIAN ECOSYSTEM AND THE CASE OF PRIMO SPACE

Italy is also jumping on the space economy ship. It was the third country, after the US and Russia, to launch a satellite into orbit, in 1964; the second largest contributor to the European Space Agency; and one of the top ten nations globally in the space sector, counting companies active across all areas of the space value-chain.

Until recently this was a highly capital-intensive sector and was mostly reserved for governments and very large corporations. As the technological advancement has made satellites smaller, lighter, cheaper to build and operate, the barriers of the industries were lowered. Henceforth, smaller firms and even start-ups have the chance to enter this market and push innovation even further.

An Italian venture capital firm, Primomiglio SGR, launched Primo Space, the first Italian venture capital fund focused on space tech. The fund closed the first round of fundraising at €58 million and is planning to close a second one at over 80 million. Primo Space is backed by the European Investment Fund (with a commitment of about €30 million) and by CDP Venture Capital, the two key investors of the fund.

EIF Chief Executive, Alain Godard, said: “Primomiglio’s affiliation with the Italian Space Agency, combined with the support of the EIF constitutes a unique collaboration that will give the Fund immediate international exposure. The Fund is the first investment executed under the new InnovFin Equity Space initiative and will contribute to the creation of a new player dedicated to the aerospace sector, one of the priority focus areas of the European Union. We are very excited to be moving decisively into this space. “

In an interview for Scale-up Italy Matteo Cascinari, Partner, Primo Ventures explained very clearly the fund’s investment strategy and the key features of the start-up that Primo Space is looking to invest in.

“Primo Space aims to develop the Italian space economy, and will target start-ups in three segments:

- Upstream – technology that builds space infrastructure to be launched into orbit: rockets, satellites, materials for satellites, communication systems for satellites, AI software, electronics, robots, etc.

- Downstream – earth-based applications enabled by space technology: communications, cryptography, geolocation, earth observation, and many more.

- Space-related – activities developed thanks to the available space technologies. Some examples include analysis from the space of irrigation levels in agriculture, analysis of the speed and routes of cargo ships, etc.

Primo Space targets approximately 25 investments into technology spin-offs, start-ups, and SMEs, split into to two different investment ticket categories: a smaller ticket for early-stage companies and technology spin-offs and a larger investment ticket, between € 1 and 5 million, for financing companies in their scaling-up phases. The geographic focus will be Italy, but a maximum of 20% of the capital could be invested in companies based in the rest of EU, the USA, and Israel.

A statement delivered by Raffaele Mauro, General Partner of Primomiglio SGR perfectly synthesizes the mission of the fund: “The full operation of a fund like Primo Space represents an important step for Italy. Today we have an instrument able to support companies with high technical-scientific intensity, able to create the conditions for the economic growth of the future, attract talent, and capital.”

Some of Primomiglio’s promising investments include Leafspace and Aiko.

LEAFSPACE

Leafspace is a high-tech company, cataloged as an SME, providing services tailored for microsatellite operators. The company is based near Milan and is mainly active in the ground segment. The ground station network is crucial for every player that needs to operate a space infrastructure, collect and elaborate data from satellites for purposes that may vary from earth climate observations to military and security controls. Ground stations play the role of the Houston base as their job is to allow communication between the earth and the devices orbiting around it.

The company offers ground services from launch and early orbit phase (LEOP) all the way to decommissioning, but also in supporting launch vehicle operators. At the very beginning of 2021, the company closed an A series funding, €5 million of which was committed by Primo Space, thus bringing the total funding to €10 million.

Giorgio Minola, general partner at Primo Space said: “We believe that the ground segment is one of the most interesting sectors in the space economy and Leaf Space has already demonstrated its abilities to successfully operate in this area. The funding provided to the company is aimed at enabling a significant global scale-up of its service capabilities.”

AIKO

Aiko is a Turin-based deep-tech start-up focusing on the development of artificial intelligence applications for satellite operations both in the flight segment and in the ground segment.

Aiko is the first company in Europe to have demonstrated deep learning algorithms in orbit.

The mission is to optimize space activity through a completely automated process that can cut the share of useless data collected by satellites, minimize the missed opportunities of gathering relevant data, allow fasted decision making, and improve the management of the satellite infrastructure. The result for the target client (satellite manufacturers, software providers for mission management, and spacecraft operator companies) will be increased performance, scaled-up efficiency, and significant cost savings.

In early December 2020, Primo Space led a €1.5 million funding round for Aiko and will act as a key partner in the growth of this very promising start-up.

“We are extremely motivated by having received this investment and by the support that Primo Space will give to AIKO, this will allow us to position AIKO as a leader in the development and supply of cutting-edge technologies for the automation of space missions. These technologies, thanks to the contribution of Artificial Intelligence, have reached complexities and capabilities unimaginable a few years ago, and the space sector can benefit enormously from this technological transfer. We want to create something very rare in the space sector, a deep tech startup focused on solving a very complex and specific problem, but with a huge impact on the sector.” declared Lorenzo Feruglio, CEO and Founder of AIKO.

The Italian space industry is, however, not only about start-ups, but there are also many other companies in different stages of their development, operating at various levels of the space value chain: Start-ups, SMEs, and mature players that could attract the attention and the capital of PE investors who want to get a piece of the pie. We cannot wait to see that happen and witness where the development of this exciting industry will take us.

Authors: Matteo Ravera, Edoardo Valsetti

Comments are closed.