The PE M&A activity in EMEA in Q1 2021 is characterised by another increase in number of deals and deal value by 8% and 33%, respectively, compared to the previous quarter (Zephyr/ BvD, 2021).

In Europe, the IT sector accounted for almost 25% of deal value. In geographic terms, the UK/ Ireland and France/ Benelux accounted for the highest number of deals (PitchBook, 2021). Another trend that is increasing in Q1 2021 is the share of bolt-on transactions, which increased from 52% in 2015 to 60% in 2020 and surged to 71% in Q1 2021 (PitchBook, 2021).

Despite global uncertainty due to the pandemic and tense political relations worldwide, global Venture Capital investments were remarkably robust in 2020, with a value of $300.5 billion (KPMG, 2020). In 2021, this trend is expected to continue as confirmed by a strong first quarter with a record total deal value of 125 billion dollars (PrivateEquityWire, 2021). The majority of investments comprised late-stage funding in areas like fintech, healthcare and mobility.

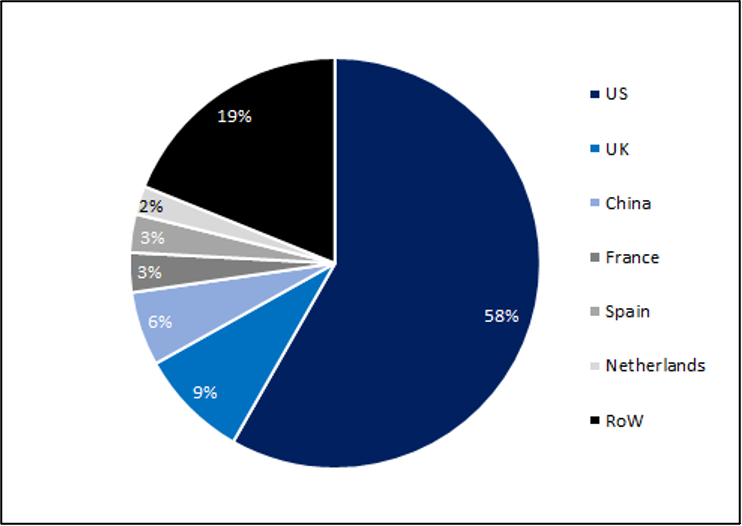

Beyond EMEA, the majority of deals in Q1 were done in the United States, with an aggregate deal value of USD234.4bn (58% of the global total) and 4,192 deals (65% of the global total). Compared to previous quarters, a smaller portion of the deals were located in Asia.

Deal Value and Count

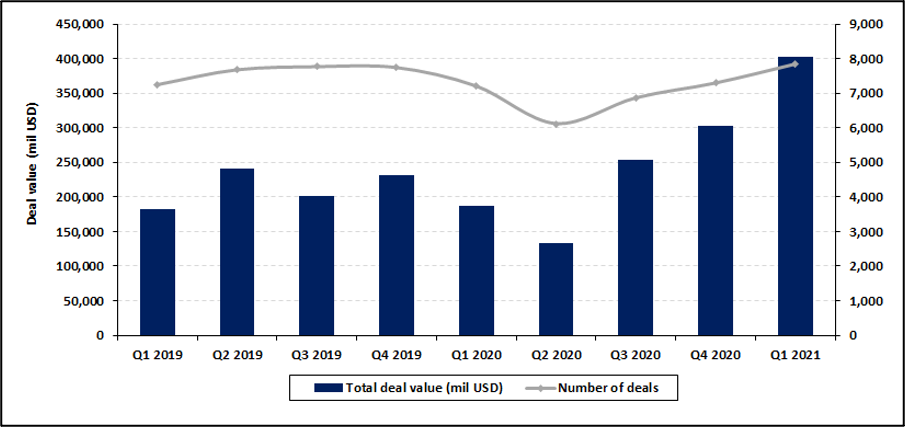

Q1 recorded both the highest quarterly deal value and number of PE-backed deals in the last two years. According to the Zephyr database published by Bureau Van Dijk, the total deal value in Q1 2021 amounted to USD402.5bn (+33% vis-à-vis Q4 2020) with a grand total of 7,849 deals (+8% vis-à-vis Q4 2020). This illustrates the great comeback of the PE-backed M&A market after a slow first half of 2020. Strikingly, the total deal value for the last four quarters to Q1-2021 amounts to USD1.09tn (+27% vis-à-vis LTM Q1-2020) with a total of 28,119 deals (-8% vis-à-vis LTM Q1-2020). This highlights also the strong performance of the PE-backed M&A market despite the ongoing global Covid-19 pandemic situation.

Total deal value and total deal count for Q1 2021 (Zephyr, 2021)

EMEA region

Europe

Throughout the first quarter of 2021, Europe has experienced a strong increase in both volume and deal value across Private Equity and Venture Capital, with a 79.9% year-on-year increase in the number of deals resulting in 1,936 transactions for a total of EUR158.8bn (Pitchbook, 2021).

The main driver behind this high number of deals has been, firstly, the increase in middle-market activity (deals between EUR100m and EUR500m in size) and the parallel increase in micro-cap transactions (deals under EUR25m in size). Secondly, the IT sector has been responsible for almost 24.7% of Q1’s deal value – the highest value ever recorded, according to PitchBook (2021). Further, the amount of dry powder has also remained at record levels and finally, bolt-on acquisitions have been the main buyout strategy accounting for 70.8% of Q1 buyouts. This is an indicator for the significance of buy-and-build strategies in the current PE landscape.

Much like Private Equity, European Venture Capital has also seen an impressive start to 2021 with startups raising USD21.4bn in Q1, representing a year-on-year increase of over 100% in funding (Crunchbase News, 2021). Another important record has been the creation of 16 new unicorns in a single quarter, compared to the 15 unicorns that emerged over the whole 2020 (Crunchbase News, 2020). The amount of seed funding has also reached new heights with a total amount of USD1.3bn – 26% more year-on-year and the highest ever recorded in Europe in a single quarter. Similarly, early-stage funding was at an all-time high in Q1 with USD5.8bn, up 62% year-on-year. In addition, late-stage and technology growth funding set a record for European-based startups with USD14.3bn, a 202% increase over the first quarter of 2020 (Crunchbase News, 2021). Furthermore, in the first quarter of 2021, nine companies in the European Venture Capital landscape have raised over USD100m in early-stage funding rounds. Among these, four operate in the grocery delivery sector, which has seen a rise in popularity during the current Covid-19 pandemic. The United Kingdom-based company Zapp has raised USD100m at Series A and, most impressively, Germany-based Gorillas has raised USD290m at Series B.

Middle East

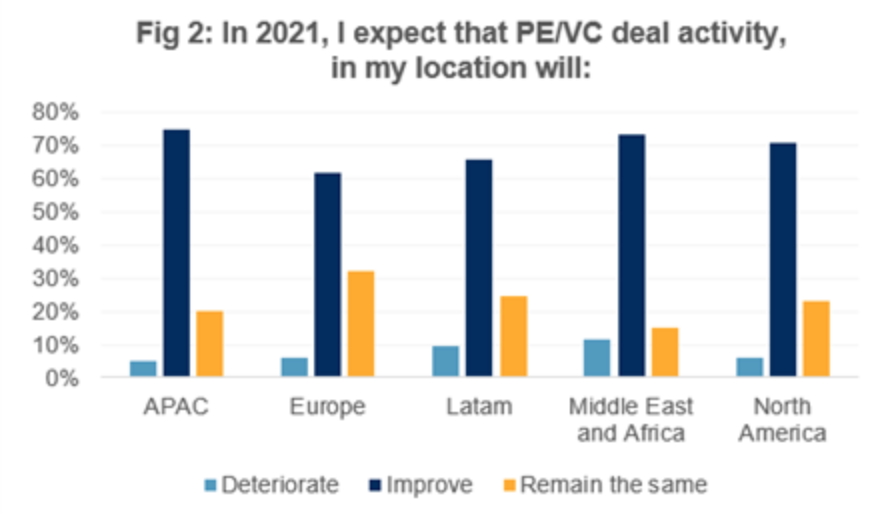

Although much of the Middle East is in turmoil, some nations have established themselves as investment hubs. Israel, Saudi Arabia and the UAE are all very active in both the PE and VC landscape, with more than 70% expecting deal activity to improve in their region for the upcoming year (S&P Global Market Intelligence, 2020). The primary sectors that are targeted by Middle Eastern funds are healthcare, fintech and education.

In terms of Private Equity, Israeli funds are very active. In Q1 Fortissimo Capital sold off their 65% stake in the wireless communication systems company Cardo Systems for USD97.5m (Fortissimo Capital, 2021). The buyer, UK-based EMK Capital, now has a controlling stake in the communications firm, that primarily provides wireless devices/systems for people in motion (motorcycle riders, skiers, site workers. etc.) in 80+ countries. The sale provides Fortissimo Capital a 4x return on their USD22m investment in 2016. Regarding local investment, the First Israeli Mezzanine Investors (FIMI) increased their stake in the Israeli-based Kamada with a USD25m investment. The latest increase brings their stake in the plasma-derived protein therapeutics company to 21%, at a 10% higher valuation than 2 months ago (FIMI, 2021). Private Equity is set to be very active in the upcoming year, with positive sentiment by investors and lots of free capital.

The VC landscape is similarly focused on healthcare and fintech, which is set to continue for the foreseeable future. Dubai’s Mindshift Capital invested in a Series C funding round for US-based OtoNexus Medical Technologies, which is developing ultrasound devices (Mena, 2021). This keeps in line with Dubai’s ambition to establish itself as a healthcare hub. One trend that does become noticeable, however, is that many of the funds are investing in foreign companies, as seen by the Saudi Arabian VC, Riyadh Valley Company (RVC) and a consortium investing USD21m in UK-based biotech company Prokarium. RVC is the investment arm of King Saud University in Riyadh (PrivateEquityWire, 2021). In Israel, many unicorns are established. With 1.58 unicorns per 1 million people, Israel has the highest unicorn ratio in the world. Recently, Rapyd (USD2.5bn) secured USD300m in funding to provide fintech services in apps. Melio, another fintech, raised USD100m to expand their reach across the US, which brings its valuation to USD1.335bn. DriveNets is a networking software company that gained its unicorn status after raising USD208m in their latest round (Israel21C, 2021). Of note is the upcoming November Middle East Investment Summit, which will provide a great insight into the landscape.

Africa

As can be reasonably expected, the economic recession caused by the pandemic has affected Private Equity and Venture Capital investments, especially in emerging economies such as those of African countries. In the context of a general downturn, African PE is faring pretty well, and its resilience is tied to businesses that operate in the now vital sectors of “essential” and “emergency services”. Sectors like healthcare, energy and food production haven’t stopped their operations, despite the lockdown and halt in global trade.

The single, most damaging problem for the PE sector in Africa is the lack of exit opportunities (Whitecase, 2020). Trade buyers represent over half of exits, with IPOs remaining disturbingly low in number (also due to a weak African secondary financial market and a general lack of liquidity). The stagnating number of exit opportunities continues to stunt the growth of Private Equity in the African continent.

In spite of the aforementioned issues, the first quarter of 2021 has seen some important deals. On January 8th, the company Gro Intelligence raised USD85m in a Series B funding round with participants like Intel Capital and Africa Internet Ventures, among others (AVCA – African Private Equity and Venture Capital Association, 2021). This money will be invested to further develop Gro Intelligence’s AI-powered platform, designed as a provider of tools and analytics to tackle climate risk and food security.

Another significant deal was struck on February 3rd between Alfa Medical Group and CDC Group (a UK-based impact investing group), whereby the former undertook a USD100m minority equity investment aimed at strengthening the laboratory services offered by AMG to underserviced regions in North Africa, in addition to financing the creation of a training academy for specialised personnel (AVCA, 2021).

The largest deal by value in this first quarter of 2021 saw the CDC Group and many other companies, like Novartis and IFC, pledging a combined USD300m to Adjuvant Capital fund and its project of supporting medical innovations that tackle the challenges faced by the African healthcare sector (Africa Global Funds, 2021).

2020 saw an increase in Venture Capital investments in Africa, and this trend has continued across this first quarter of 2021. Most likely, the recently reformed legislative framework has created a more startup-friendly environment, with countries in Francophone Africa passing Startup Acts that incentivise entrepreneurship and facilitate capital raising (Whitecase, 2020).

A notable Series A funding round of USD6m was closed by TLcom Capital and the local Kenyan business Pula, which supports small farmers through agricultural insurances (AVCA, 2021). Another important Series A funding was obtained by Owl Ventures, which invested USD7.5m in the Nigerian company uLesson, a technology platform that promotes education throughout Africa.

Selected deals EMEA

In the table below, we summarise some of the top PE-backed deals by value that took place in EMEA in Q1 2021.

| Company name | Company country | Deal size in million USD | Deal type | Investor |

| Birkenstock | Germany | 4,820 | Buyout/ LBO | L. Catterton, Financière Agache |

| Automobile Association | United Kingdom | 3,895 | Buyout/ LBO | TowerBrook Capital Partners, Warburg Pincus |

| Cedacri | Italy | 1,812 | Buyout/ LBO | ION Group, The Carlyle Group |

| eToro | United Kingdom | 650 | PIPE | Fidelity Management, ION Group |

| Winter- botham Darby | United Kingdom | 624 | Buyout/ LBO | Addo Food Group/ PAI Partners |

| Cint Group | Sweden | 621 | PE-backed IPO | C World Wide, Danica Pension, Handelsbanken Fondbolag-förvaltning, Swedbank Robur Fonder, TIN Forder |

| Total Quadran | France | 600 | Buyout/ LBO | Banque des Territoires, Crédit Agricole Assurances |

| Refinitiv | United Kingdom | 27,000 | Buyout/ Share deal | Blackstone, Thompson Reuters |

Birkenstock, a leading German footwear group with roots back to 1774, was acquired in a leveraged buyout lead by L Catterton, the Private Equity firm backed by LVMH, for USD4.8bn (EUR4bn). The family owners (Christian and Alex Birkenstock) will keep a minority stake in the company. Financière Agache, Arnault’s family office, will also invest in the deal. UK-based Private Equity firms CVC Capital Partners and Permira had shown interest in acquiring the business, but L Catterton won out over CVC because of its experience with family-owned consumer brands and its track record in Asia. L Catterton has previously invested in the e-commerce group Everlane, the Peloton indoor cycling group and Build-A-Bear Workshop. Birkenstock posted EUR721.5m of revenue in the fiscal year through September 2019 with an EBITDA margin of 28.9% coupled with high top-line growth and increasing EBITDA-margin in recent years (Pitchbook, 2021).

Automobile Association (AA), the leading of roadside assistance in the UK, was acquired by Warburg Pincus and Towerbrook Capital Partners in a public to private transaction. The company agreed to the 35p-a-share deal despite only having been listed for 6 years as it seeks to pay down on the massive debts of GBP 2.6bn that are a legacy from the previous time buyout groups owned the business. The deal valued the company’s equity at GBP 219m and an enterprise value of GBP 2.8bn. The Private Equity groups will also invest t about GBP 378m to cut the company’s debt burden by refinancing bonds that are due for repayment in 2022. Prior to the restructuring the company had GBP 128m of annual interest payments, which alone amount to more than half of the company’s entire equity value. Shareholders of AA approved the transaction in January 2021. According to Pitchbook (2021), the company is seeking another GBP 450m of development capital from the acquiring shareholders (TowerBrook and Warburg Pincus).

Cedacri is the leading Italian player within IT Outsourcing services for the banking sector with over 100 clients including banks, financial institutions, industrial companies and service companies. The group has over 45 years of experience in the banking sector and over EUR400m in turnover in 2020. In January 2021, Ion Investment Group reportedly reached an agreement to buy the group for EUR1.5bn including EUR320m in net debt, after the auction process was launched in 2020. Prior to the deal, Cedacri was owned 27% by the Italian state-backed fund FSI and 14 other financial institutions including Unipol and Mediobanca. Both strategic buyers such as Accenture and Engineering as well as a consortium led by the buyout fund Apax were involved earlier in the auction process, but eventually dropped out. FSI, having invested in Cedacri 3 years prior to the deal, gained a 3x return on its invested capital over the period. The Italian state-backed fund will reinvest around EUR200m in the buyer’s capital, while the banking shareholders completely sold their position (Pitchbook, 2021).

EToro, a leading Israel-based digital trading platform, announced in March 2021 that it would go public in a merger deal with the special-purpose acquisition company (SPAC) FinTech Acquisition Group. V, valuing the company to about USD10.4bn. Additionally, the company raised USD650m in gross proceeds from a fully committed private placement in public equity (PIPE) at USD 10 per share from both strategic and institutional investors including ION Investment Group, Softbank Vision Fund 2, Third Point LLC, Fidelity Management & Research Company LLC, and Wellington Management. The SPAC and PIPE deal was set to close concurrently, resulting in eToro having a net cash position of about USD800m on its balance sheet to support future growth (Pitchbook, 2021).

Winterbotham Darby, founded in 1962, is the largest supplier for olives, antipasti, and continental meats, such as chorizo, in the UK (Winterbotham Darby, 2021). Three years ago, Winterbotham Darby launched its first plant-based products. The company covers the whole supply chain from the production over warehousing and marketing. Since 2012, it was majority-owned by Equistone Partners Europe. Equistone helped Winterbotham Darby ‘to expand its supplier network, customer base and product range’ (PrivateEquityWire, 2020). In a USD623m deal, Winterbotham Darby was sold in January 2021 to Addo Food Group, sponsored by PAI Partners. Winterbotham Darby is intended to be integrated into Addo’s chilled food platform (Pitchbook, 2021).

Cint Group, a formerly PE-backed software company from Sweden, was not subject to a recent M&A deal, yet the company represents the largest PE-backed IPO in Q1 2021, raising USD620m in the public sale of roughly 52% of its shares. The company is focused on data insights gathering and generated USD112m in revenues in 2020. In January 2016, Nordic Capital acquired Cint for an estimated USD117m, a tenth of the current post-IPO valuation (USD1.2bn) (Pitchbook, 2021).

Total Quadran, a French developer of renewable energy plants, sold an asset consisting of nine wind farms, 44 solar power plants and eight solar farms via an LBO to Crédit Agricole Assurances and Banque des Territoires. The farm down transaction was completed in February 2021 at an estimated value of USD600m (PitchBook, 2021).

Refinitiv, a provider of financial market data, was sold by Blackstone (majority) and Thompson Reuters in an all-share transaction to London Stock Exchange Group plc (LSEG). The transaction (USD27bn) has been approved by the European Union regulators and the new group formed by LSGE and Refinitiv will trade under the ticker symbol LSEG. The aim of the group is to become a significant rival to Bloomberg in the data and analytics sector in the financial services world. (Reuters, 2021)

Beyond EMEA

PE-backed transactions and the M&A market was strong across the globe in the first quarter of 2021. The majority of deals in the quarter was done in the United States, with an aggregate deal value of USD234.4bn (58% of the global total) and 4,192 deals (65% of the global total). Compared to previous quarters, a smaller portion of the deals were located in Asia. China had an aggregate deal value of USD23.5bn (6% of the global total) and 413 deals (6% of the global total), while India and Japan had a total deal value of USD5.2bn and USD4.8bn respectively (~2.5% of the global total combined) in Q1 2021 (Zephyr, 2021).

Top five global target countries/regions by deal value in Q1 2021 (Zephyr, 2021)

Selected deals beyond EMEA

Furthermore, we want to give an overview of the largest deals beyond the EMEA region. We selected the seven largest deals outside EMEA by deal size, five of which relate to companies based in the United States. Beyond America, we selected two more deals, one from Asia (Japan) and one from Oceania (Australia) for our deal overview.

| Company name | Company country | Deal size in million USD | Deal type | Investor |

| BlueTriton Brands | United States | 4,300 | Buyout/ LBO | Metropoulus & Company, One Rock Capital Partners |

| Precisely (Burlington) | United States | 3,500 | Buyout/ LBO | Clearlake Capital Group |

| Northrup Grumman | United States | 3,400 | Buyout/ LBO | Peraton |

| Endurance Int. Group | United States | 3,000 | Buyout/ LBO | Clearlake Capital Group |

| Innovyze | United States | 1000 | Buyout | EQT |

| Arinamin Pharma- ceuticals1 | Japan | 2,225 | Buyout/ LBO | Blackstone |

| Culture Kings2 | Australia | 600 | Buyout/ LBO | a.k.a. Brands, Summit Partners |

BlueTriton Brands is a US subsidiary of Nestlé, formerly known as Nestlé Waters North America. The re-branding follows an acquisition of this subsidiary by One Rock Capital Partners and Metropoulos & Co. through a USD4.3bn LBO in March 2021. According to the investors, the new name reflects “the Company’s role as a guardian of sustainable resources and a provider of fresh water […]” (Beveragedaily, 2021). BlueTriton has more than 27 water bottling facilities, employs more than 7,000 people in the US and Canada and owns a portfolio of eight brands totalling USD3.8bn in revenue. Dean Metropoulos, the co-investor, is also the owner of the brewery Pabst Brewing and the bakery firm Hostess Brands. The acquisition is estimated to be financed with USD2.5bn of debt, according to Pitchbook.

Precisely is a US-based IT-firm that has been acquired by Clearlake Capital in March 2021. Clearlake owned a majority share in the company already from 2015 to 2016 (then called Syncsort) and sold it in 2017 together with shares in other IT-companies to Centerbridge Capital for USD1.2bn. Now the company is estimated to be worth USD3.5bn with revenues of USD600m in 2020, compared to USD75m in 2015 (Pitchbook, 2021).

Northrop Grumman agreed to sell its federal IT and mission support business to Veritas Capital, a leading Private Equity firm in critical products and services to government and commercial customers, in a sale that was completed in February 2021. The purchase price amounted to USD3.4bn in cash and will be incorporated into Veritas Capital’s portfolio company Peraton, a leading provider of technology-focused services and solutions to various federal government agencies. The business unit had about USD2.3bn in revenues in 2020 (Pitchbook, 2021).

Endurance International Group (EIG), founded in 1997 and based in the United States, is a cloud-based platform services provider for small- and mid-sized customers. The firm offers services related to web presence, domains and e-mail marketing and operates mainly in the United States. In February 2021, EIG was acquired by Clearlake Capital Group in a USD3bn public-to-private LBO (Pitchbook, 2021).

Innovyze, was established in 1996 to provide wet infrastructure software solutions. In 2017, Innovyze merged with XP Solutions to become the leading global provider of smart water infrastructure software solutions designed to meet the technological needs of water / wastewater utilities, government agencies and engineering organisations worldwide. As the largest pure-play water-focused software provider, Innovyze offers a full suite of water-focused products that span the infrastructure lifecycle. Autodesk is set to acquire Innovyze from the Swedish PE firm EQT. (EQT Press release, 2021) With the transaction (USD1bn) EQT stands to obtain 4x its investment when the terms are finalised. (WSJ, 2021)

Arinamin Pharmaceuticals is a subsidiary of the Japanese firm Takeda Pharmaceutical that has been acquired by Blackstone in March 2021. Takeda sold the business because it is currently focusing on its core business and selling non-core over-the-counter assets. Takeda recently acquired Shire PLC, another pharma company with more than USD15bn in revenues, and is expected to use the proceeds from the Arinamin sale to reduce debt. The Arinamin deal has an estimated value of USD2.23bn (Pitchbook, 2021).

Culture Kings, founded in 2008, is an Australian premium streetwear retail and e-commerce company at the intersection of music, culture, and fashion. The company’s stores frequently host live music from DJs and interactive games to achieve a unique shopping experience. Culture Kings was acquired in March 2021 by a.k.a. Brands via its sponsor Summit Partners in a USD600m LBO (Pitchbook, 2021). The goal of the transaction is to grow the company’s business globally and especially in the United States. The portfolio of a.k.a. Brands consists of a other trend-fashion companies like Princess Polly, Petal & Pup, and Rebdolls, that are leaders in digitally-native direct-to-consumer sales. Therefore, the Culture Kings acquisition is another example for the recent popularity of bolt-on transactions.

Outlook

In Q1 2021, both deal value and deal count increased significantly, mainly due to increased middle-market and micro-cap transactions. Among the main reasons are the recovery of the economy as Covid-19 numbers decrease and a larger population who gets vaccinated. This goes hand in hand with expanded stimulus programs from governments and a revival of lending markets (Pitchbook, 2021). According to Roland Berger (2021), target industries in 2021 are especially technology, media and software, pharma and health, and services and logistics. The geographic regions with the largest increase compared to 2020 are expected to be Germany (+4.6%) and Scandinavia (+2.8%) (Roland Berger, 2021). With the economic recovery well underway, economic activity has rebounded and Private Equity funds are becoming more proactive in managing the crisis. As seen in the graph below, fund managers in

all regions overwhelmingly expect PE/VC activity to improve:

Expected PE/VC deal activity change (S&P Global Market Intelligence, 2020)

Authors: Erlend Brevik, Tim Tesdorff, Iacopo Dante Giachetti, Jakob Jones, Justin Ashauer

Editor: Jakob Müller

Sources

http://www.ffcapital.com/fortissimo-capital-sold-cardo-systems-for-150-million-to-emk-capital/

https://finance.yahoo.com/news/cloud-services-provider-box-receives-112014808.html

https://home.kpmg/xx/en/home/campaigns/2021/04/q1-venture-pulse-report-europe.html

https://mena.news/mindshift-invests-otonexus-medical/

https://pitchbook.com/news/reports/q1-2021-european-pe-breakdown

https://pitchbook.com/newsletter/l-catterton-strikes-48b-deal-for-birkenstock-Xiy

https://www.africaglobalfunds.com/news/private-equity/deals/

https://www.avca-africa.org/newsroom/member-news/

https://www.birkenstock-group.com/de/en/company/about-us/

https://www.dubaibeat.com/indexNews.php

https://www.eqtgroup.com/news/Press-Releases/2021/eqt-private-equity-to-sell-innovyze/

https://www.ft.com/content/0475dc4f-f195-49f2-b58e-deedbca046a2

https://www.ft.com/content/5d511022-46db-403e-9784-eb3807f918f9

https://www.ft.com/content/d3a00785-5591-4b9d-8e7d-328c822eccb8

https://www.ft.com/content/f18461ce-2e10-4a0e-9850-d26e9eea64fe

https://www.globes.co.il/news/article.aspx?did=1001315639

https://www.israel21c.org/2021-opens-with-record-investments-for-israeli-startups/

https://www.itjungle.com/2021/03/08/clearlake-re-acquires-precisely-in-3-5-billion-deal/

https://www.penews.com/articles/buyout-firms-team-up-on-more-than-15bn-kpn-bid-20210408

https://www.privateequityinternational.com/news-analysis/deals/

https://www.reuters.com/article/cedacri-ma-ion-group-idUSL8N2K259I

https://www.reuters.com/article/uk-refintiv-m-a-lse-idUSKBN29O29Z

https://www.reuters.com/article/us-netherlands-telecoms-tmobile-idUSKBN2BU0R0

https://www.reuters.com/article/us-softbank-group-autostore-idUSKBN2BS1YC

https://www.theaacorporate.com/about-us/at-a-glance

https://www.veritascapital.com/portfolio-info/peraton

https://www.winterbothamdarby.com

https://www.wsj.com/articles/etoro-group-to-go-public-in-merger-deal-with-spac-11615906920

PitchBook. (2021). European PE Breakdown Q1 2021.

Zephyr/ BvD. (2021). Database. Accessed May 2021.

Photo by Artem Kniaz on Unsplash

Comments are closed.