Introduction

Private Equity has gained huge traction in the last couple of decades and Central and Eastern Europe have not been an exception to this occurrence. Ever since the fall of communism in 1989, this European region has experienced serious development and Private Equity has played an important role in it. With a very sizeable population, the CEE (Central and Eastern Europe) region has a bigger GDP than the BENELUX and the Nordic region, hinting to the numerous possibilities there are for Venture Capital and Private Equity firms. Despite the region’s successful ongoing transformation to a €1tn plus economy with over 30 years of Private Equity activity behind it, CEE seems to have dropped out of the PE headlines and of some limited partners’ radars. This article aims to take a closer look to the Private Equity market in Central and Eastern Europe and discuss whether it deserves another look from investors.

A Region of Dynamic Growth and Development

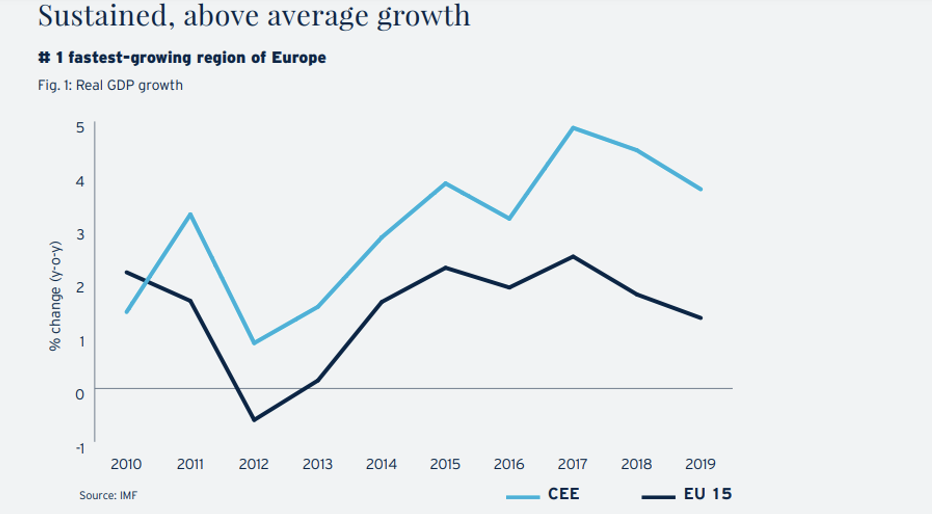

With a GDP four times higher than in 1995, the CEE plays a crucial role in the overall European political and economical landscape. The following factors are responsible for this circumstance. Firstly, the CEE is composed of 10 of the 27 EU member states (Bulgaria, Czech Republic, Estonia, Hungary, Lithuania, Latvia, Poland, Romania, Slovenia, Slovakia). These 10 countries represent 28% of EU’s land mass and contain 23% of EU’s population. Secondly, most of these countries are emerging economies, thus experiencing higher growth rates which we usually associate with more opportunities for development of new establishments. The graph below describes Real GDP Growth and the dominance of CEE is very clear.

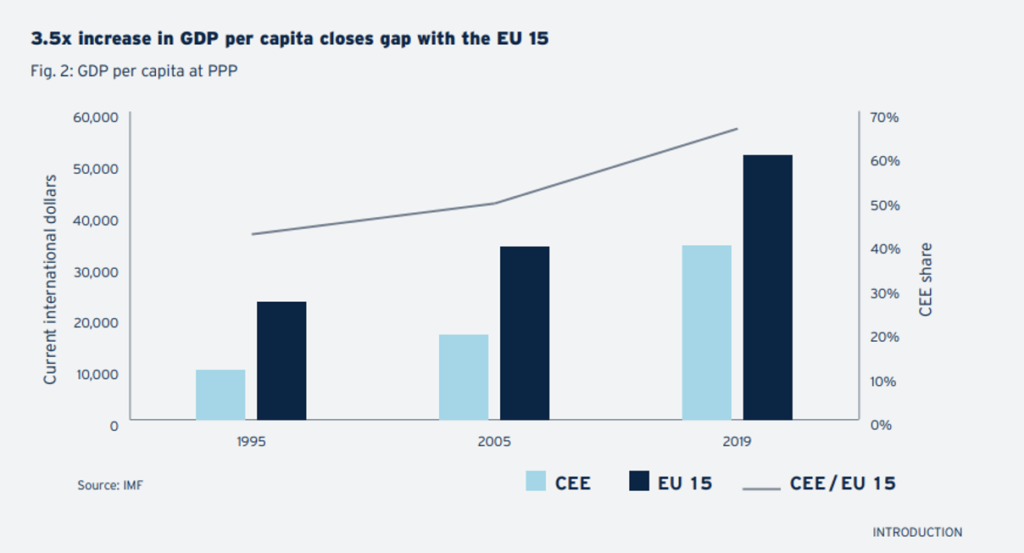

The following graph represents a comparison between the GDP per Capita of the EU 15 and CEE. It is easily noticeable that Central and Eastern Europe is closing the gap to EU 15 and projections are that they may even be equalized in the future.

A Significantly Underfunded Market

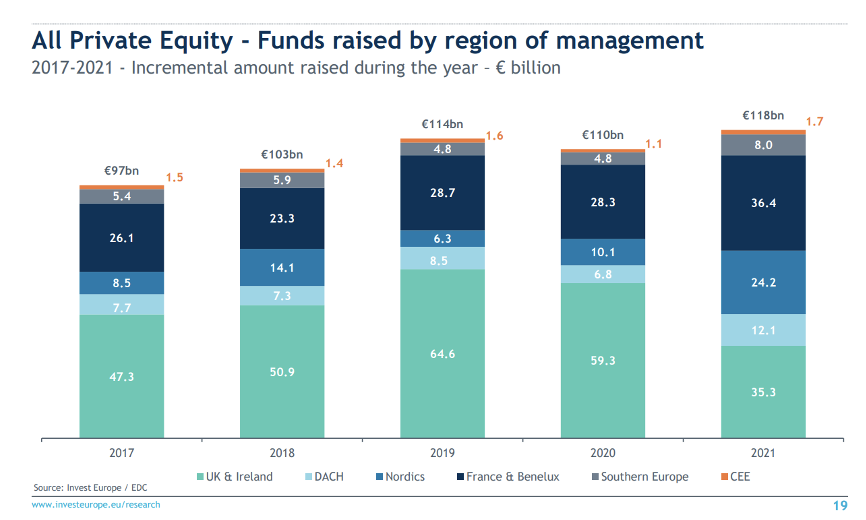

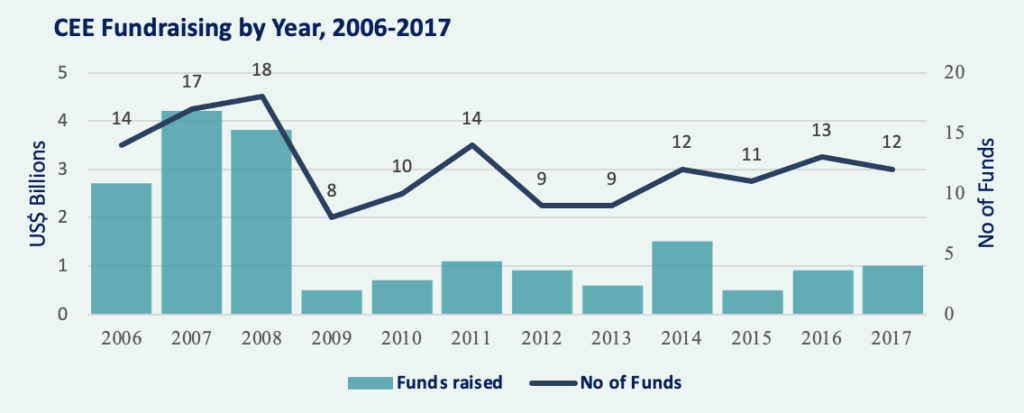

Even though there have been instances during which CEE fundraising was robust, in the past few years this number has been shockingly low compared to the other countries in Europe. It should be mentioned that prior to 2008 (The Financial Crisis) the CEE’s funds received were on the rise, however, after the crisis these amounts remained low up until today. Since 2009, limited partners, such as pension funds, institutional accounts and wealthy individuals, continued investing into other emerging markets while the fund for CEE lagged. The difference in fundraising today is quite astonishing as the CEE region can claim only 1% of the total sum funded on the EU market.

Another concerning fact is that the Central and Eastern Europe region has invested far more money than raised during the 2006-2017 period:

The Level of Maturity of CEE Private Equity Markets

Market maturity is fundamental for private equity markets and the risk that comes with them. Today’s CEE GPs have grown up in the region, logging a substantial number of deals, accumulating a truly local insight and gaining experience in navigating the specificities of the region’s markets. Similar to the region’s entrepreneurs, CEE’s PE fund managers have weathered the local impact of multiple global crises and are well positioned to use the insights gained in difficult periods in selecting future investments. The fact that the CEE region is still an emerging market as a whole while having this level of maturity and knowledge in the sphere can be recognized as a big competitive advantage as opposed to other private equity markets, both emerging and already developed ones.

Positive Environment for Private Equity in Central and Eastern Europe

Private Equity is not new to CEE. Since its economic restart in 1989, the countries in CEE have put in place a full ecosystem necessary to develop and support private equity investments. Three decades later, the system includes experienced banks, ready to lend to start-ups, new ventures and already established companies, and professional advisers in the sphere of legal and financial operations who are able to help implementing those investments well. Not only that but the system has created and developed laws and taxation regulations, favoring private equity and venture capital and giving it plenty of space to grow and be supported.

How Has Private Equity Performed in CEE?

As we previously discussed, the region is tremendously underfunded, however, there have still been some private investors involved in the CEE landscape. It is fair to say that most of these investments have actually outperformed some private equity markets over the long-term. According to the European Bank for Reconstruction and Development (EBRD), CEE’s largest private equity investor, there has been a 2.09x gross return in euros from CEE investments. Moreover, the institution indicates 2.29x gross return in euros on partially realised portions of portfolios, indicating that there can be more good news to come for future exits. For the years between 2010 and 2019 almost 3200 companies have benefited from an PE/VC ownership. Finally, a hefty 9.95% (in €) net returns in 10-year investments fortify the positive data.

Indicators of Possible Successful Development

In the latest years, more and more companies see no benefit of going public and exiting the company with an initial public offering so they stay private and search for a buy-out via private investors. This remark is fully in force for the Central and Eastern European countries. Another factor in play is that the region has already experienced a bulk of privatization, so there are plenty of options on the private market. Furthermore, some counties in CEE, especially after the Covid crisis, have found themselves in massive amounts of debt. Good examples would be Croatia with 91.3% Debt-to-GDP ratio and Hungary with 81%. It is generally not ideal for emerging countries to hold a massive amount of debt so it is possible that we see a future privatization in some of these countries which will further boost the size of the private equity sector. Another crucial component of a promising private equity investment is the level of entrepreneurial start-ups and the attitude towards entrepreneurial risk which in this region is very positive and growing. To fortify this statement, we can list a few of the start-ups that originated from the CEE area that have turned into massive companies :

Unique Deal Flow

Many positive aspects have been mentioned regarding the future of CEE’s Private Equity markets. Nevertheless, one of the biggest precedents for a bright future for PE and VC markets here is definitely the unique deal flow. With the renewal of the economy in this region in 1990s the private businesses started appearing. Approximately thirty years later, we find ourselves in a region with a great number of private businesses, aged between 20 and 30 years, who have established themselves on the market. Most of them belong to first-generation owners who, after years of hard work and success, are looking to “cash in” their long-year effort. Another crucial factor comes into play – the culture and mindset in Central and Eastern European countries. In contrast to other countries in Europe and worldwide, here lacks the “keep it in the family” culture : business owners do not force their children or relatives to take the family business but are rather prepared to sell their business when it is time. Thus, it is very reasonable to expect many privately-owned businesses going on the private equity market looking for a buy-out, which would increase the pool of investment opportunities in the CEE region tremendously.

ESG and Its Impact on the PE Market

Its 2022 and environment, social, and governance play a crucial role in all areas of business, let alone Private Equity, so it would be unfair not to observe this side of the puzzle as well. Central and Eastern European GPs are superior to all other European regions in terms of employment and percentage of jobs created. In 2018, private firms reached more than 316,000 workers, signaling for a growth rate of 10.7% year to year in labor force. Compare this to the marginal 0.7% growth of the overall employment market in the same period and you can notice why the CEE PE markets have such promise in them. Furthermore, CEE has had a long history of building ESG into its investment processes. For instance, CEE managers were tasked to deal with extensive environmental challenges and constraints in the 1990s, and since then they have consistently integrated these issues into their post-investment activities as key sources of value creation.

Conclusion

Although the Central and Eastern European region seems to combine great attributes from both emerging and developed markets, the region remains overlooked by Private Equity investors and struggles to raise funds for private firms. Worldwide emerging private equity markets are usually being underserved and CEE is not much different. For example, the United Kingdom and the United States both boast private capital to GDP ratios of above 1.5%, whereas the rate of CEE is mere 0.12%, on par with other emerging markets globally like China and Brazil, with the remark that currently more and more investors find China an attractive investment. According to investment professionals who are actively engaged in CEE PE markets, the problem is not connected to the region’s fundamentals, but rather a lack of LPs willing to invest in the area. Value4Capital’s Watson puts it:

“My biggest problem is not selling the story of private capital in CEE, but rather finding an audience for the story.”

As he insists that only few limited partners are familiar with the region. However, with all the above stated arguments, we believe that there exists the possibility for bright future for private equity markets in Central and Eastern Europe as this area is full of talented people with new and creative ideas, already established small, medium, and big private businesses, a market with experience and maturity which has been through crises and pandemics, and a growing economy, which stimulates the whole business field.

Sources

https://invest-europe_private-equity-in-cee_report_final.pdf

https://www.jstor.org/stable/43503376?seq=5

https://www.statista.com/statistics/1135336/debt-of-cee-countries/

https://www.globalprivatecapital.org/app/uploads/2018/05/EMPEA-Briefs_CEE_FINAL_WEB.pdf

http://www.ceeprivateequity.com/TIME_FOR_ANOTHER_LOOK.pdf

https://www.globalprivatecapital.org/app/uploads/2018/05/EMPEA-Briefs_CEE_FINAL_WEB.pdf

https://invest-europe-activity-data-report-2021.pdf

Editor: Tara Morgan

Comments are closed.