by Michele Fanelli, Silvia Bochese, and Mathias Benoiton

Why is a business called Ethical Capital Partners acquiring MindGeek, the owner of Pornhub, a company that has been accused of nothing less than inciting abuse and child pornography?

According to Solomon Friedman, partner and co-founder of the Montréal-based private equity company, the business may make more sense than it appears at first.

Ethical Capital was created by a group of criminal lawyers, cannabis industry executives, and public relations experts; its approach is to “seek out investment and advisory opportunities in industries that require principled ethical leadership.” They want to add value by using their extensive legal and regulatory knowledge and banking on openness and accountability.

The company’s website states that ‘ECP’s philosophy is rooted in identifying properties that fit our responsible investment approach and have the potential to generate attractive returns […]’. Therefore, Mr Friedman’s investment in MindGeek is already beginning to make sense: Friedman may have identified Pornhub as a target in need of a more ethical and transparent management team. The co-founder intends to increase the value of the company by acquiring it at a bargain price, solving current legal problems and preventing future ones.

However, a company in desperate need of an ethical management team is not in itself a good investment, and the reason why Pornhub was so attractive to the managers of Ethical Capital was mainly due to the huge size (and revenues) of the porn industry. Let’s take a step back and assess this size, as well as the industry’s relationship with private equity in general.

Thanks to the advent of the Internet and the growing social acceptability of sexuality as a topic of broad interest, the adult content industry has experienced exponential growth in recent years and the porn market is now worth over $97 billion annually. It is essential to emphasise that although the huge size of the porn industry is attractive to investors, it has a complicated relationship with private equity. According to critics, private equity firms often prioritise profit over ethical considerations, resulting in exploitative activities within the company. Furthermore, the porn industry has faced several ethical and legal challenges, such as concerns about consent and exploitation of performers. Consequently, investing in the porn industry requires a careful assessment of both its financial and ethical ramifications.

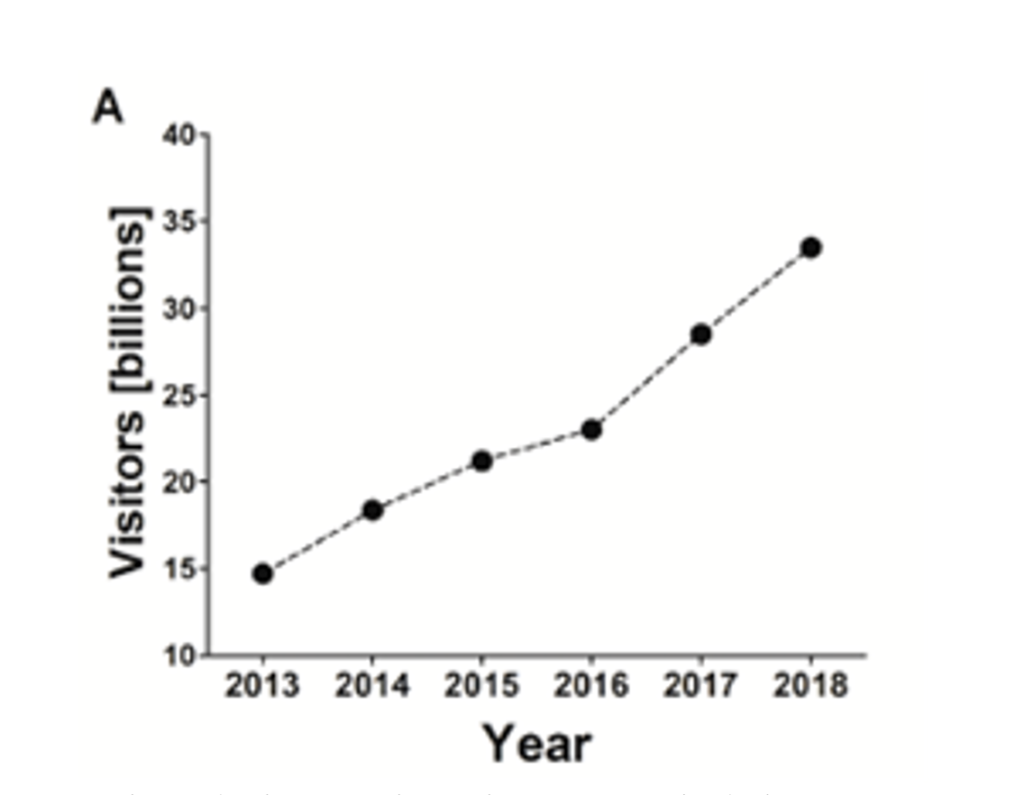

Twenty years ago, Internet pornography sites generated just under $2 billion a year, a figure far greater than that of any other online entertainment site, which has now grown fifty-fold.

In the United States alone, the pornography industry generates an annual revenue of $12-14 billion, which continues to grow as the number of people accessing porn sites increases. This number is a strong indicator of the enormous scale of the pornography business in the United States; it indicates the financial success of the industry and serves as a reminder of the far-reaching influence of pornography on our society.

Despite this, many financial firms and corporations avoid investing in this sector – but why is this so?

First of all, the adult content industry has always been considered dangerous, with legal uncertainty and market volatility making investment unattractive. Indeed, the creation of pornographic content often violates copyright laws and can be illegal in some countries, posing a danger to investors.

Furthermore, the adult content sector is very competitive and constantly evolving. Demand for certain types of material may disappear unexpectedly or be replaced by new trends. This makes it difficult for investors to predict returns on investment, discouraging them from participating in this sector.

Beyond financial considerations, the adult content market presents considerable ethical problems, which make it impossible for many companies and financial institutions to participate in this industry. The industry is often linked to exploitation techniques, objectification of the artist and harmful social and psychological consequences for customers. This ethical uncertainty can damage the reputation of investors and companies, with wider repercussions on brand identification and consumer loyalty. In addition, many organisations increasingly prioritise socially responsible investments that match their beliefs and mission, making it more difficult to justify investments in a sector that is often considered socially and ethically problematic.

Despite these challenges, the adult content industry is a profitable and expanding sector that might provide fascinating chances for investors prepared to take a risk, as Ethical Capital Partners did with its recent acquisition of Pornhub owner MindGeek.

The deal was reached only days after a new Netflix documentary revealed the company’s unscrupulous tactics. Pornhub is one of the most visited websites on the Internet, surpassing tech giants like Netflix and TikTok. It has also been accused, often by conservative organisations, of profiting from another type of trafficking: that of countless women and children who have been exposed to non-consensual sexual activity videotaped and posted on the web. This is just one of the many reasons why the recent acquisition of MindGeek by its parent company, Ethical Capital Partners, took many by surprise.

On 17 March 2023, the Ottawa-based private equity firm announced the acquisition of MindGeek for an undisclosed price, which is assumed to be around $1.5 billion. Along with the announcement of the purchase, the company stated that it intends to reposition MindGeek as a leader ‘in the fight against illegal content on the Internet’.

According to Solomon Friedman, a lawyer and co-founder partner of ECP, criticism of MindGeek stems from a misunderstanding of how the company protects its content, as well as a lack of openness on the part of its previous shareholders. The company was kept secret until a Financial Times investigation revealed the name of its previous owner: Bernd Bergmair, a former Goldman Sachs banker.

Who is the new owner of MindGeek?

Ethical Capital Partners is managed by cannabis entrepreneur Rocco Meliambro and criminal lawyer Fady Mansour (chairman and managing partner respectively).

ECP, founded just a year ago, promotes itself as a ‘different kind of Private Equity firm’ in that it prioritises ethical leadership and compliance in its investments, as well as expertise in private/public investment, compliance, communication and enforcement. It manages compliance proactively and specialises in areas such as online content development, digital space, payment processing, video-on-demand streaming and advertising platforms.

ECP’s ‘resources and extensive experience in regulation, enforcement, public engagement and finance’ will contribute to the company’s goal of establishing itself as an industry leader.

What are the figures involved in the transaction?

The rationale for Ethical Capital’s investment in Pornhub is convincing, but nothing is known about the acquisition price and other meaningful measures reflecting the profitability of the company or the porn industry in general.

According to unverified sources, Pornhub has an annual turnover of about $500 million, which seems very conservative considering that it is a major player in an industry worth billion; moreover, the takeover price is said to be $1.5 billion, which would make sense given the revenues and the high risk associated with the investment.

Sources:

https://www.ft.com/content/69c3295e-6f45-4b5f-8e7b-3b8d56ca46c8

https://blog.gitnux.com/pornography-industry-statistics/

https://www.theguardian.com/business/2023/mar/17/pornhub-owner-mindgeek-sold-to-private-equity-firm

https://forbes.it/2023/03/29/pornhub-piani-nuovo-proprietario/

Comments are closed.