by João Mota and Zhenzhou Du

Introduction

This article was concluded on the 15th of April 2022. Thus, several predictions may have already occurred according to our projections or not given the recent macroeconomic changes. Certain trends resulting from an increase in global interest rates will also affect some of the following assumptions made.

As the American Private Equity Audax Group raised $1.7bn for their new continuation fund in January of 2022, it was following suit on a large list of equally renowned Private Equity groups that had utilised their own portfolio companies to generate liquidity.

This article will explore the concept of continuation funds, and the reasons behind their growing popularity. Over the past years, the Private Equity sector has expanded at a continuous rate, with capital rounds marking all-time highs. Funds are finding different ways of increasing their returns, and today we are breaking down an approach that has seen particularly significant growth. We will look into the investor rationale behind the choice of continuation funds, the advantages, and the cause of its sudden rise in popularity following the pandemic and the associated economic climate.

Moreover, we will examine the possible drawbacks of such a strategy, specifically the potential conflict of interest between funds and investors.

The Trends of Continuation Funds

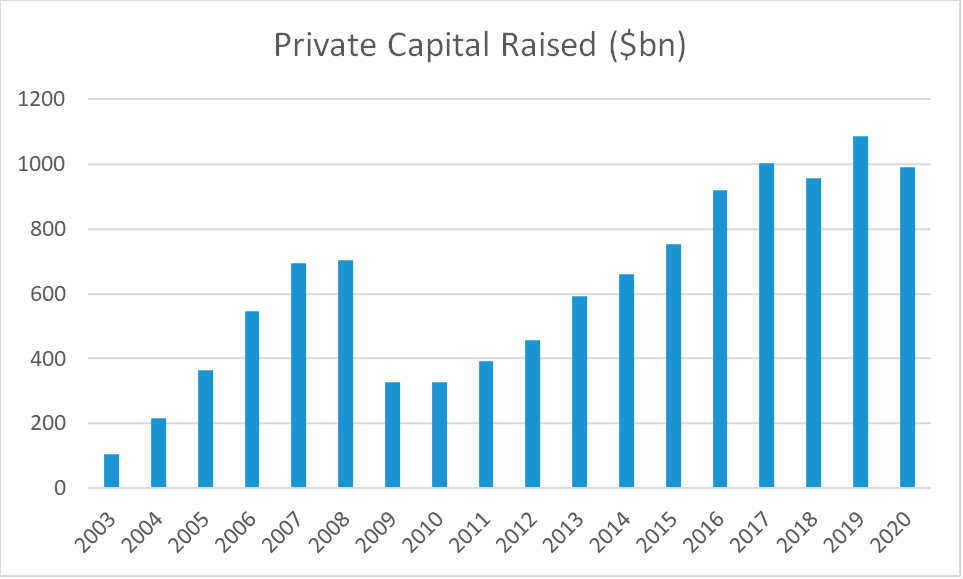

Over the past years and even with the COVID-19 pandemic, the Private Equity sector has remained active. However, the ongoing trend of the past decade features an increase in deal size and a decrease in the number of deals. Meanwhile, the size of raised capital has reached all-time highs.

The scale of fundraisings indicates the robustness of the deal-making process, whilst boosting dry powder in investors’ hands. Buyout funds currently possess the highest level of dry powder when compared to other types of funds, compelling General Partners (GPs) to seek targets to deploy the dry powder and generate returns for the Limited Partners (LPs). Consequently, valuations in M&A deals are generally pushed up by excessive capital.

In this regard, the GPs may need to extend the holding period for firms with good perspectives, to fully capitalise on their potential. The fundamentally valuable yet weaker assets that suffered from high volatility, as was the case during the COVID-19 pandemic, also need more time to grow. A typical 7 to 10 year timespan in the investment contract between GPs and LPs may not be ample. The continuation fund, in this context, is gaining popularity as a successful portfolio management tool for Private Equity sponsors to hold on to their assets for longer.

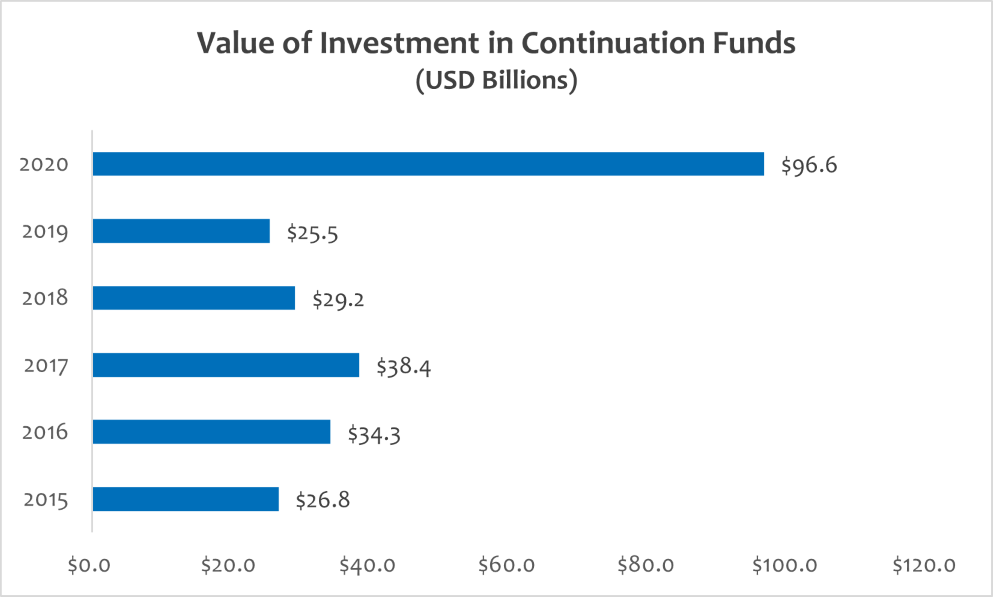

A recent spike in GP-led (also called Sponsor-led) secondary transactions has been fuelled precisely by the continuation funds. It is also worth noticing that a large proportion of newly established funds in the secondary market are continuation funds. According to Pitchbook, $96.6bn was raised for new secondary funds in 2020, with Ardian and HarbourVest Partners, two of the largest players in the industry, raising funds of $19bn and $14bn respectively. Furthermore, overall secondary deal volume in 2021 was $132bn, greatly above the previous high of $88bn established in 2019, and continuation funds contributed to 84% of GP-led secondary deals ($68bn).

Structure of a Typical Continuation Fund

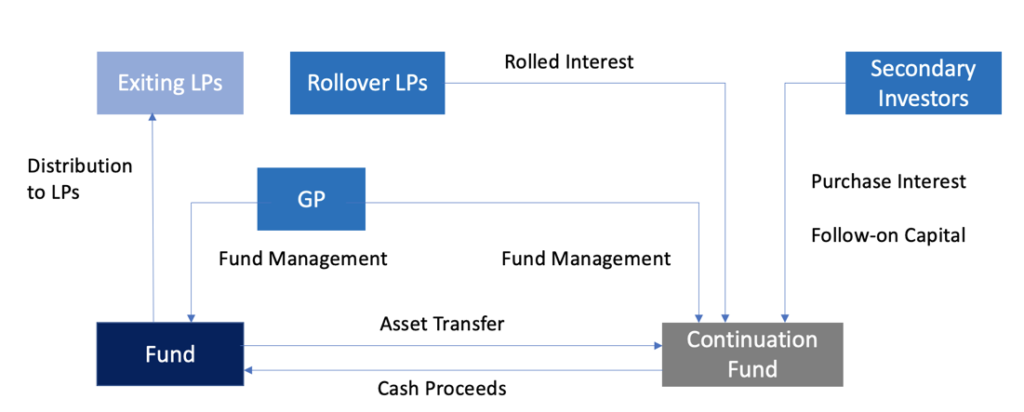

Continuation vehicles are investment funds raised by GPs to buy one or more of their best portfolio companies out of existing funds. A continuation fund can assist in resolving the conflict that arises when a GP desires to keep an investment, while the limited partners wish to liquidate. This scenario may arise after the initial intended holding time has passed, or the original fund is reaching its maturity.

Generally speaking, the asset of the preceding fund is transferred into the continuation fund and the cash proceeds flow backwards to provide distribution to the previous funds’ LPs. In turn, LPs may decide whether to roll over their interest to invest in the continuation fund, or to cash out on the preceding fund upon its maturity. For the case in which multiple LPs are involved, they are free to make different decisions. To raise sufficient capital for the continuation fund, GPs may also invite other secondary investors to join and inject capital into the continuation fund. In some cases, the GP itself may increase its own investment in the continuation fund. Note that the holding term for a continuation fund is typically shorter than that of a regular fund.

Change in Perceptions: More Favourable After the Pandemic

Not all continuation funds are the product of the unusual volatility witnessed over previous years. The significant change regarding the perceptions of GP-led secondaries is noteworthy. Prior to the pandemic, continuation funds were seen as a dubious method of reorganising ailing private funds. Following the pandemic, said stigma has faded, and continuation funds are now considered a viable instrument for proactive fund management. GPs work to catch up with the market and capitalise on the secondary market’s additional value to the portfolio.

Generally, there are five reasons to use a continuation fund: managing LP base, optimising portfolios, extending a fund’s life, managing risk, and managing GP interest.

A continuation vehicle allows a GP to hold on to their investment in a new fund under their management, whilst providing liquidity to certain LPs who intend to cash out. Other LPs may elect to roll over their investment and recommit assets to the continuation vehicle for a (presumably) multi-year holding term. The increasing continuation funds allow LPs to choose between taking liquidity or rolling their capital into known, low-risk assets that have the potential to outperform less-seasoned assets. Hence, LP base and portfolio risk can both be under proper management by the GP. Aggregating trophy portfolio companies into a continuation fund can help optimise GPs’ portfolios, while enabling participants to obtain their desired carry upon the maturities of preceding funds.

When continuation funds are used with a higher frequency, we must be alert to the risks associated with them. In the next section, we discuss the risk of establishing continuation funds and the possible solutions.

Conflict of Interest

Conflicts of interest naturally arise in these continuation funds, as the selling fund and the buying fund share the same GP. While, in theory, they represent different clients, the existing fund (which is trying to sell) and the designated continuation fund (which is trying to buy) are constituted by the same GPs.

As an investor, the reasoning is straight-forward: is the GPs valuation biassed to the fact that the party wants to hold on to a great portfolio company or are they just trying to divest from a poorly performing asset? The solution comes through the creation of governance processes that the GP should resort to within the adequate time. The processes are as follows.

- Funds can resort to hiring a third party to value their financial assets through a formal price discovery process or even by soliciting independent bids from other market players outside of the fund. Here the same conflict of interest arises, since if a fund is hiring an independent advisor, the advisor should be representing the interests of the contracting, not working against it.

- The GP may also choose to have a formal investment committee review completed when considering a continuation vehicle transaction. The committee would follow the same due diligence process carried out by the GP to ensure that the transaction was conducted properly. In this process, the committee is responsible for providing a detailed review of the historical portfolio company financial performance, expectations of future performance, growth opportunities, and risk factors. The purpose of this parallel analysis would be to provide an independent and fair opinion to help augment the GP’s own due diligence, and provide evidence and comfort that the transaction has undergone every single step in the review process.

- Early engagement is key, the sooner the GP involves the LPs, the better the chances the fund closes successfully. GPs should also carefully consider the impact of fees, transaction costs and dilution with respect to any LPs on both sides of the deal.

Outlook

Continuation funds provide liquidity to Private Equity investors, they also offer faster access to some of the best-performing Private Equity assets. These characteristics make this strategy an essential component of a developing asset class, and a tempting investment proposition for individuals that fit a certain profile. Thus, secondary fund growth is projected to continue.

While bigger asset managers presently lead this trend, it is likely to spread to mid sized asset managers. This will occur thanks to the increasing flow of capital into Private Equity across the size range, as the types of investors seeking exposure to private equity continue to increase and diversify. However, the current economic conditions associated with higher rates will likely lead to a reduction in flows across Private Equity.

Sources

https://www.privateequityinternational.com/story-of-the-year-continuation-funds-on-the-rise/

https://www.wsj.com/articles/investors-see-both-promise-and-risk-in-continuation-funds-11642680002

https://pitchbook.com/news/articles/continuation-funds-secondaries-gp-buyouts

Editor: Noah Halbritter

Comments are closed.