by Anastasia Nedorezova, Antonio Maude, and Leonardo Marangoni

Introduction

The following article will cover distressed debt investing by providing an initial overview of the current macroeconomic situation surrounding the rise in interest rates with the subsequent implications on Private Equity (PE) deals. Following this introduction the article will explore the concept of distressed companies and the investment strategies adopted by PE firms, finally examining a deal involving Carlyle Credit and Citrix to provide a practical example of the topic.

A Macroeconomic Perspective

According to the October 2022 inflation data and the contained CPI report, the disinflationary trend is real. However, inflation continues to prompt major central banks to keep rates at restrictively high levels, with the U.S. Federal Reserve having increased its benchmark policy rate by 0.75 percentage points at each of its past four meetings. The ECB has increased its deposit rate from a negative (0.5%) to 1.5% over the past months as inflation in the eurozone set new records after reaching 10.7% in October, far above the ECB’s 2% target.

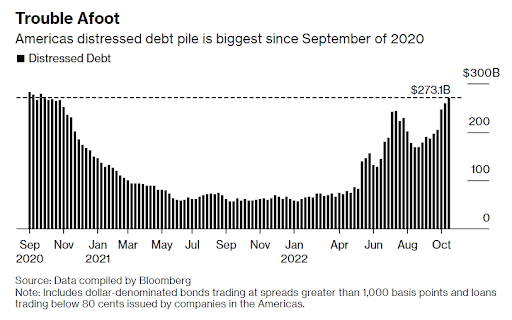

Moreover, the restrictive monetary policy is increasing the cost of capital making it more difficult for companies to refinance their liabilities or raise new funds. Over the past summer, the amount of distressed debt surpassed $240bn, nearly three times as much as at the start of the year. This is linked to a trend related to the growing volume of troubled debt, also reinforced by corporate bonds trading at yields at least 10 percentage points above those of U.S. Treasuries, or loans changing hands at less than 80% on the dollar.

PE and VC funds have historically relied on cheap packages of debt, spelling huge gains with some generating returns well above 20% with small investments in debt at bargain prices. Instead, now they may find themselves looking elsewhere for drivers of value: higher interest rates are increasing the cost of borrowing, making LBOs too expensive and leading to potentially lower returns for investors.

Distressed Debt Investing as an Alternative Investment Solution

When we refer to alternative investments, we are talking about supplemental strategies to traditional positions in stocks, bonds, or cash. There are several types of alternative investments including Private Equity, commodities, real estate and hedge funds. All of these are relatively illiquid, meaning they can’t be easily converted into cash and are unregulated by the SEC.

The alternative investment on which we want to focus on is distressed investing, defined as the process of investing capital in the existing debt or equity of a financially distressed company or public entity. In the US these companies have generally filed for Chapter 11 or Chapter 7 bankruptcy. In a nutshell, Distressed Private Equity is a hybrid model utilising the traditional LBO model to acquire ownership of the equity and distressed debt trading.

What is a Distressed Company?

A company is defined to be financially distressed if there is a reasonable likelihood that the company may reach a position, within the next six months, where it will no longer be able to pay its debt as it becomes due and payable. According to the definition of “reasonable likelihood,” there must be a valid reason to believe that the business won’t be able to pay its debts in full within the following six months.

The debt-induced stress, which is currently squeezing the companies, is mainly visible in debt-to-EBITDA and interest coverage ratios. These are two metrics closely followed by lenders, as they evaluate the creditworthiness of companies seeking to borrow money. Both ratios are currently rising to levels that suggest upcoming increased strain on businesses. When underwriting new deals, firms tend to structure an interest coverage ratio of at least 1.7x to 2x for cash-flow based loans. When the debt-to-EBITDA leverage ratio is 6x or 7x, and then LIBOR goes up all of a sudden, the EBITDA-to-interest coverage tightens; if a firm is 4.5x levered, its interest coverage ratio would go from three to two times. But if it is six or seven times levered as we are witnessing in recent times, it may just be barely able to cover its interests and would not be considered to be in a sustainable condition, and so a good investment.

Investment Strategies Adopted by PE Firms

Distressed Debt Trading:

Distressed debt trading involves purchasing debt obligations that are trading at a distressed level in anticipation of reselling those securities over a relatively short period of time at a higher valuation, generating a trading profit.

Distressed Debt Non-control:

In this strategy, PE firms still look for debt trading at huge discounts, but they buy the debt to gain influence in the restructuring or bankruptcy process of troubled companies. They’re betting that they can negotiate the terms in their favour such that the market value of the debt rises significantly.

Distressed Debt Control:

A fund manager has the ultimate goal of buying debt to convert into equity to effectively buy control of the target company. By then PE firms will take control, manage and operate the company, and then sell it or take it public.

Turnaround:

In this case, the firm acquires equity rather than debt, with the scope of restructuring the whole company and turning it into a profitable business. Usually, since most distressed companies cannot take any more debt, PE firms won’t involve leverage in turnaround deals.

Because distressed debt investments have high risk/high reward, it is advisable to spread out the risk. It is typically included by PE funds as a small component of a bigger investment portfolio. Another significant advantage of distressed debt investments is that debt holders receive payment first if a company cannot be restructured and must instead liquidate assets.

Carlyle Credit Bets on Citrix and Nielsen Buyout Debts

The following deals will provide a practical representation of what a distressed deal looks like, the main players and their roles in the trade.

In January 2022, Citrix was sold to Elliott Management (a Hedge Fund with $55.7bn in AUM) and Vista Equity Partners (a PE firm with $86bn of AUM) for $104 a share and was set to be merged with Tibco Software, one of Vista’s portfolio companies which helps integrate business management. The $16.5bn deal, which included the assumption of about $4.4bn in debt, marked the first buyout of 2022 worth more than $10bn and took place before borrowing costs started to surge following higher interest rates.

In March 2022, Elliott Management collaborated with Brookfield Asset Management in the acquisition of the television rating group Nielsen for $16bn, including debt, and paid $28 per share in cash to Nielsen shareholders, counting a 60% premium to the company’s value. The consortium injected $5.7bn in equity and the remaining $10.3bn was provided by large banks and private lenders like Ares Management, some of whom were the same financiers of the Citrix buyout mentioned in the previous paragraph.

Problems related to both debts started arising in September when after subsequent increases in interest rates (that is after the debt became unsustainable for the companies and too risky for banks’ balance-sheet) bankers started working on retooling the financing package to make it more appealing to possible buyers. At the time Citrix Systems debt was already selling at discount prices and institutions were having ever-increasing problems selling the loans.

In this climate of uncertainty Carlyle Credit, an arm of the homonymous PE company with $143bn in AUM, placed a significant wager on both the buyouts, getting the banks to accept a $700m loss to finalise the sale of the $8.55bn in loans and bonds used to finance the Citrix LBO whilst buying roughly $750m of the $2.15bn of second-lien debt backing the buyout of Nielsen.

Carlyle’s credit arm invested around $750m in the Citrix buyout, split about evenly between the secured debt portion that banks sold at steep losses previously, and a preferred equity piece that was arranged at the start of the year.

Currently, after accepting big losses on Citrix loans a group of lenders including Bank of America and Barclays are still funding $8.35bn of debt themselves to support the Nielsen acquisition rather than attempt to sell the debt to third-party investors at significantly discounted prices.

We want to highlight that Carlyle is now claiming to be putting their total resources behind the deal, leveraging Carlyle’s Global Credit platform, as well as the resources of the Carlyle network to accelerate business objectives and make a profit on the results.

Conclusion

Twelve months after the end of a super-cheap money era, Carlyle’s wager is interesting for arriving at a particularly turbulent time for credit markets: increasing inflation and fears of a recession have prompted investors to pare back risk and forced banks to take huge losses on tens of billions of dollars of loans they had arranged to provide for the LBOs early in the year. The struggle the banks have had in offloading the Citrix debt is likely to influence their willingness to fund future PE leveraged buyouts that have already become significantly less frequent.

Sources

https://www.ft.com/content/ceff8fd1-a3ef-4bce-9955-59a74bc0d226

https://bankingprep.com/distressed-private-equity/

https://online.hbs.edu/blog/post/distressed-debt-investing

Editor: Noah Halbritter

Comments are closed.