By Guillaume Eelbode, Pedro Calixto, and Marzio Bonizzi

Introduction

The Private Equity landscape is undergoing a profound transformation, a theme consistently emphasised by thought leaders like Oaktree’s founder Howard Marks and echoed in the analyses of the world’s biggest asset managers. As central banks around the globe tighten their monetary policy to address inflation, the era of low interest rates, which fuelled the growth of the Private Equity industry for more than a decade, has come to an end. This turning point is reshaping the industry, which has long relied on low borrowing costs and consistent asset appreciation.

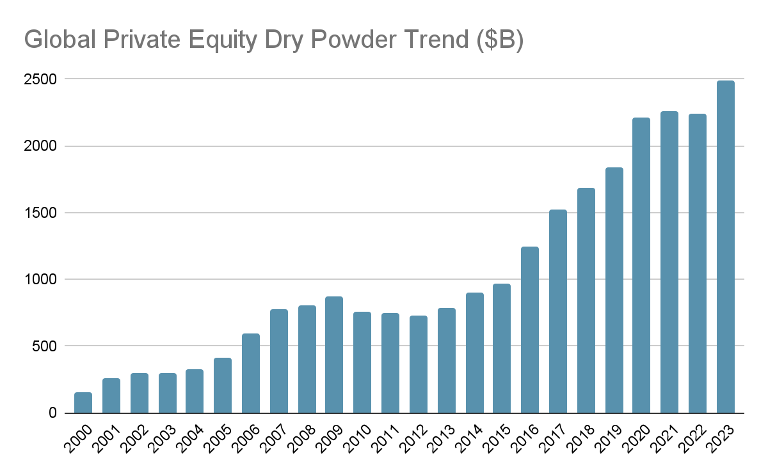

To the informed narrative of Private Equity’s transformation, we must append the latest data indicating a record accumulation of dry powder, which reached $2.5tn in mid-2023. Private Equity funds continue to grow their reserves of uncommitted capital, recording an 11% increase from December 2022. This reserve is set against a backdrop of uncertain global economic conditions, high interest rates, and intense regulatory scrutiny, which is further complicating deal execution and therefore impacting valuations.

Source: Preqin

In contrast, investments that were made in the context of a more favourable economic environment are currently undergoing a durability assessment. As Private Equity stakeholders chart a course through an altered economic terrain marked by higher interest rates and looming default risks, the call for a strategic reassessment is clear. The complex and challenging environment demands innovation and adaptability from Private Equity professionals, urging a re-evaluation of long-standing investment paradigms and a pivot towards Private Credit. The future of Private Equity will likely be defined by the strategic foresight of its participants and their ability to embrace these changes.

Private Credit raised its voice in the aftermath of the 2008 Global Financial Crisis (GFC), as newly proposed capital rules and fear of a non-soft landing heavily constrained commercial banks in their lending activity, giving Private Credit the opportunity to offer borrowers speed in cash raising as well as more certainty in prices. The evolution of this sector is consistently linked to the shifting dynamics post-GFC, where stringent capital rules for banks created a lending vacuum. Private Credit aptly stepped in to fill this void, catering to borrowers left underserved by traditional banking channels. The shift of borrowing from banks to asset managers and the demand for increased returns among investors have further expedited the surge of Private Credit. As per Morgan Stanley, the Private Credit market grew at a CAGR of 10% over the past 10 years and presently comprises $1.5tn.

The Shift towards Private Credit

There are two main ways through which non-listed companies can raise money without giving up equity. For decades, the more common of the two has been the usage of traditional bank loans. In recent years, given higher interest rates and investors’ search for yield, another financing instrument has rapidly gained popularity: Private Credit.

Generally speaking, Private Credit comprises debt financing from non-bank institutions. Most Private Credit funds are targeting small and mid-cap companies, which need funding for their potential buyouts. Typically, the loan duration of Private Credit deals ranges from 5 to 7 years, although those loans are frequently paid back within 3 to 4 years, since the Private Equity owners aim to sell the company. Moreover, Private Credit solutions are highly customisable to meet the borrowing company’s needs in terms of size, type, and timing of the loan.

Private Credit solutions can be divided into Direct Lending, Mezzanine Debt, Distressed Debt, and Special Situations. Direct Lenders are non-bank creditors that give out regular loans to companies, whilst Mezzanine is a form of debt which allows the creditor to convert the issued debt into equity in the company under certain conditions. Distressed Debt refers to loans for companies that find themselves in financial distress, while Special Situations deals with loans issued to companies that face certain non-recurring events like spin-offs or carve-outs, creating a need for tailored debt solutions.

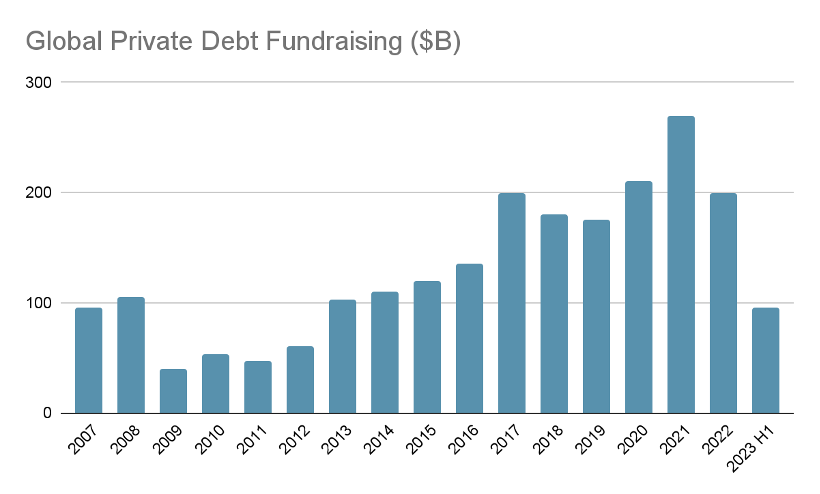

Source: Pitchbook

Private Credit is especially useful for private companies that tend not to have credit ratings and which are therefore forced to seek financing through debt rather than through equity, at the same time avoiding a loss of ownership. Because of the strong asymmetric information between them and potential lenders as well as inadequate collateral, these companies are not a good fit for traditional debt financing provided by banks. In such scenarios, private funds are more likely to issue a loan because their activity is not subject to public scrutiny and financial regulations.

For those willing to accept a high level of illiquidity, Private Credit holds promise as a valuable addition to conventional fixed income portfolios. Moreover, its emergence this year has provided a welcome opportunity for diversification amidst a challenging landscape for Private Equity.

The Reshaping of the Financial Industry

Earlier this year, Blackstone’s president, Jonathan Gray, coined the surge in Private Credit as a “golden moment”, drawing parallels with the 1848 California Gold Rush. The shift has been notable in other major Private Equity firms like Blackstone and Apollo as well, signalling a seismic move towards embracing business within the Private Credit sphere. Moreover, investment banks such as Citi and Nomura have also adopted the trend, announcing their entry into the Private Credit market. Additionally, Goldman Sachs and JPMorgan have established Private Credit trading desks, all catalysed by the influence of higher interest rates.

Like other alternative investment strategies, Private Credit attracts investors with a long-term investment horizon, like pension funds and sovereign funds. These investors prioritise the asset class’s stable returns over liquidity. Investors are drawn to the offered diversification, low volatility, and attractive risk-adjusted returns offered by Private Credit, especially in the current high interest rate environment.

While Private Credit might not match the eye-watering 18% average return of traditional buyout firms during periods of low interest rates, it now offers 12%-13% return associated with minimal risk due to loans being secured against corporate borrowers’ assets. However, challenges loom: economic slowdowns and fluctuating interest payments could strain borrowers, potentially leading to increased default rates. Nonetheless, historical data reveals that recovery rates in Private Credit have historically surpassed those of equivalently rated publicly traded bonds, providing a glimmer of hope amid concerns.

But the ascent of Private Credit is not just about reshaping investment portfolios; it also carries the potential to mitigate systemic risks. By diverting longer-term lending away from banks reliant on short-term deposits exposed to runs, Private Credit could even bolster the financial system against vulnerabilities.

The trends driving the robust growth of Private Credit are here to stay, a statement supported by KKR Partner and Co-Head of Credit and Markets, Chris Sheldon. He suggests that Private Credit will evolve into a permanent asset class that stands out due to its resilience and its ability to hedge against the volatility of equity markets. Projections from Preqin, a major alternative assets data and analytics provider, echo this sentiment, forecasting the Private Credit market to reach $2.3tn by 2027, underscoring its escalating importance.

Conclusion and Future Outlook

In essence, the prospects for Private Credit seem robust. The asset class is positioned to continue its trajectory to become a cornerstone in investment portfolios and a key player in reshaping the financial ecosystem.

Source

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-equity-dry-powder-swells-to-record-high-amid-sluggish-dealmaking-76609335#:~:text=The%20global%20dry%20powder%20total,Market%20Intelligence%20and%20Preqin%20data.

https://www.bloomberg.com/news/articles/2023-10-17/blackrock-says-private-credit-shift-from-banks-is-here-to-stay

https://www.oaktreecapital.com/insights/memo/further-thoughts-on-sea-change

https://www.lombardodier.com/contents/corporate-news/investment-insights/2023/september/a-new-era-for-private-credit-wha.html

https://www.reuters.com/breakingviews/private-credit-partygoers-reach-hard-stuff-2023-10-11/#:~:text=Private%20credit%20assets%20swelled%20460,party%20has%20now%20wound%20down.

https://www.morganstanley.com/ideas/private-credit-outlook-considerations

https://www.lombardodier.com/contents/corporate-news/investment-insights/2023/september/a-new-era-for-private-credit-wha.html

https://www.axios.com/2023/09/26/private-debt-fundraising-2023-report

https://www.morganstanley.com/ideas/private-credit-outlook-considerations#:~:text=Private%20credit%2C%20which%20can%20offer,%242.3%20trillion%20market%20by%202027.

https://www.lombardodier.com/contents/corporate-news/investment-insights/2023/september/a-new-era-for-private-credit-wha.html

https://www.ft.com/content/84409cde-1197-49c9-bf88-dbe371e44313

https://www.ft.com/content/42297b43-7918-4734-b6d5-623c6d6fa00f

https://www.bloomberg.com/news/articles/2023-03-29/jpmorgan-goldman-plan-to-start-trading-private-credit-loans?sref=kGkORAYH#xj4y7vzkg

Comments are closed.