by Leonardo Costa, Nina Gabrizova, and Vaclav Klein

Introduction

Private Equity (PE) firms are considered to be very responsive to changes in interest rates, as they tend to use a great deal of leverage. Activity in the PE industry tends to slow when interest rates rise and prosper when they are low.

Over 2022, the global economy experienced a surge in inflation resulting in a record high over the past decade. Consequently, central banks around the world have implemented contractionary monetary policy, by increasing interest rates to prevent inflation.

The following article will outline how these macroeconomic measures have impacted Private Equity firms as well as the overall industry.

The Private Equity Market in 2021

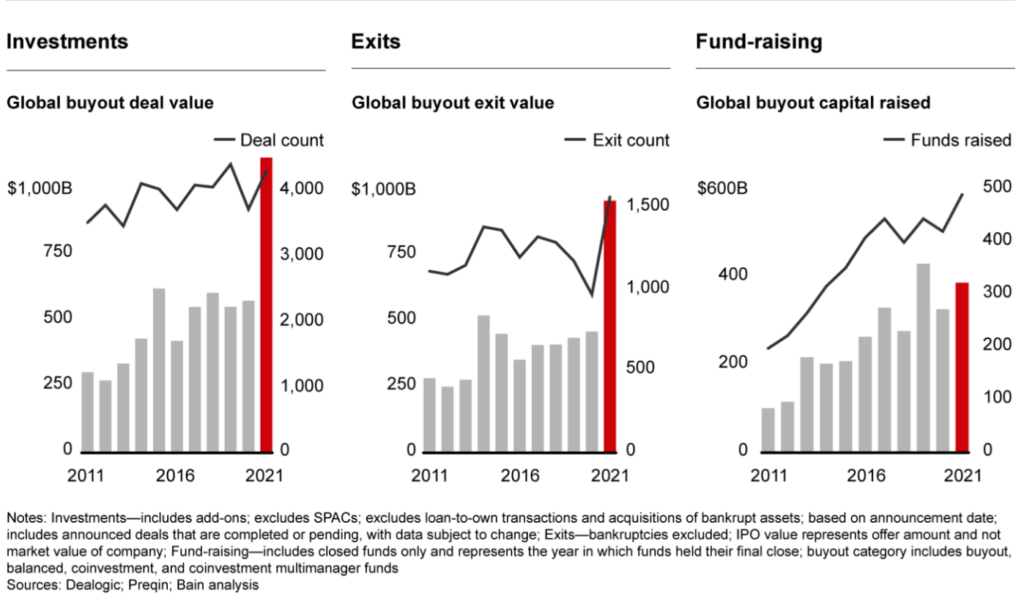

2021 was a record-breaking year for PE. Driven by trillions of dollars in pandemic-related stimulus funding, the PE industry experienced an enormous surge in dealmaking with an even larger number of successful exits taking place. PE firms were presented with ideal conditions to acquire and sell companies. This historical year was the second best in fundraising over PE’s history, netting $1.8tn in new buyout capital. The graphs below highlight the growth of investments, exits and funds raised over the past decade.

2022 came with new challenges for the economy, a surge in inflation and rising interest rates resulting from suppressed post-covid demand, issues with the global supply chain, and the war in Ukraine. Following increasing pressure on the consumer, Private Equity firms have also begun to suffer. After a record-breaking year, volatility has surged and PE deal activity has declined drastically. More specifically, a decline in volume took place during the first half of the year, with volume declining by 26% to 1,626 deals from 2,184 deals during the same period last year. What was the role of interest rates in this decline?

Over the past decade, rates have been at historically low levels with the incentive to stimulate economic growth after the financial crisis. According to Heather Hopkins, managing director of NextWealth, “Higher interest rates may indeed prove challenging for private equity-backed consolidators,” she said. “The rising cost of capital could mean some firms pull back from acquisitions and focus more on operational efficiency.”

Current Interest Rates

Following the COVID-19 pandemic, the Federal Reserve has aggressively raised interest rates at a rate not seen since the 1980s, with rates having been increased by 3.75 percentage points in one year. In November 2022, the Federal Reserve announced the highest interest rates since early 2008, setting it to a target range of 3.75-4 percent. Similarly, following the ECB’s monetary policy meeting in Frankfurt at the end of October 2022, a hike in interest rates has been announced to bring down inflation in the eurozone. All three key interest rates have been raised by 75 bps to 2.00%, 2.25%, and 1.50% respectively. Additionally, the Bank of England raised interest rates to 2.25 percent, its highest level since 2008.

The Impact of Rising Interest Rates on Private Equity

The two investment strategies utilised by PE firms that are impacted greatly by increased interest rates are growth equity and leveraged buyouts (LBOs). The prolonged period of low-interest rates at the beginning of 2022, saw great amounts of borrowing particularly from small companies which led to frequent mispricing.

LBOs are depended on borrowed money as PE firms attempt to take over companies using a greater amount of debt over equity. This is due to the fact that debt tends to be less expensive and the acquired company’s assets are often used as collateral for the transaction. If the LBO is carried out using floating-rate loans, this implies that the company in question is required to make constant cash payments, meaning if the interest rate is higher, the cost of the buyout is increased.

Furthermore, the interest coverage ratio of a company will be negatively affected by rising interest rates. The interest coverage ratio is one of the main indicators of a company’s performance in relation to converting its outstanding debt into equity. It is calculated using the formula below and it is used to evaluate the riskiness of investing in a company in relation to its current debt. A lower or decreasing interest coverage ratio can signal to investors that the company may be having to exhaust its cash reserves to repay interest payments rather than for investment in capital assets.

An increase in interest rates causes investors to turn to fixed-income investments or lower-growth stocks where the risk is greatly decreased. Therefore, fundraising becomes difficult, and investors have a diminished desire to conduct IPOs. Moreover, rising interest rates decline the value of a company’s assets which is troublesome for PE firms that had planned their exits around the same time. However, it is advantageous for PE firms seeking undervalued firms and assets. These companies can invest the wealth they have accumulated throughout the low-interest period. An increase in interest rates could also decrease competition in the market and slow down economic activity.

As a result of an increase in interest rates, new methods for value creation other than being predominantly debt-focused need to be considered. Operational improvements, multiple expansions, deal structuring, and better pricing strategies all present ways in which investors can evaluate firms to acquire on the market. As exemplified by the McKinsey article, pricing improvements can allow PE firms to differentiate and create value at any point in the cycle from the acquisition to an eventual exit.

In PE, ideal candidates have minimum CAPEX requirements. This means they use the steady free income the firm generates to service the debt. What’s leftover is accumulated until exit or paid as dividends, essentially the return to the PE firm and other owners. The impact of interest rates on PE firms may be a double-edged sword: it affects buyouts and exits differently. PE firms meaning to sell and people meaning to buy have contrasting reactions to a change in interest rates.

Looking to 2023

As we look to the year 2023, we can expect the slowdown to continue, especially in the first quarter. Currently, we expect governments to continue hiking interest rates to higher levels as the fight against inflation continues. However, the interest rate is not the only factor that affects PE and thus when the market stabilises, we can expect PE activity to start growing again. As valuations are currently at their lowest, we will probably see many companies struggling to maintain profits in upcoming months, while PE funds may seize this moment to acquire companies at a discounted price. Additionally, we can also expect institutional money to continue flowing into PE; prolonging the decade-long trend. However, as the fear of a prolonged economic recession increases, and we come to the end of so-called “easy money” we can expect PE firms to undergo dramatic changes in their operations.

Conclusion

In conclusion, the rise in interest rates has had a clear negative effect on the PE industry, which resulted in a decline in the volume of deals in the second half of 2022. Since PE firms use great amounts of debt to finance their activities, with higher interest rates the debt becomes more expensive. Additionally, high-interest rates, the War on Ukraine, and the fear of the economy coming into a recession resulted in a drop in company valuations. This had a negative impact on fundraisings and especially IPO activity, which dramatically dropped in comparison to previous years.

Sources

https://www.bankrate.com/banking/federal-reserve/how-much-will-fed-raise-rates-in-2022/

https://delano.lu/article/high-interest-rates-a-disrupti

Editor: Matthew Gleeson

Comments are closed.