by Marco Neri

Introduction

In Private Equity (PE), one of the primary challenges investors face is accurately assessing the risk associated with an investment. Equity investments are typically characterized by a high degree of volatility, which can make it difficult for investors to project future performance accurately. This volatility can be caused by various factors, including changes in the broader economic environment, shifts in consumer preferences, or fluctuations in commodity prices. Since the price of private investments is calculated periodically, and is not consistently updated, the issue of volatility laundering may emerge.

Volatility Laundering

Volatility laundering is a term popularized by Cliff Asness, CEO and founder of the hedge fund AQR Capital Management, when talking about volatility in PE investments. The term “laundering” is used because it implies a process of cleaning or obscuring the true nature of something; in this case, it is the level of volatility, or risk, associated with an investment. It can be achieved through various means, such as using complex financial instruments or manipulating valuation methodologies.

In the context of PE, volatility laundering can occur when the actual level of volatility of an investment is not accurately recorded or communicated to investors. For example, mark-to-model accounting, a common valuation methodology used in the PE industry, can make the value of the investment seem relatively stable, as if drawing a smooth line on a graph, even if the actual intrinsic or market value of the investment is highly volatile. This can result in a false sense of security for investors, who may not be aware of the actual level of risk associated with their investments, leading them to take on more risk than they would otherwise be comfortable with, which can also lead to unexpected losses or lower returns in the case of market downturns. For example, during the global financial crisis of 2008, many PE funds experienced significant losses, despite their supposed immunity to market volatility.

There are several factors that can contribute to this questionable practice. One of the primary factors is the lack of transparency that exists within the industry. Investments in PE are typically made through limited partnerships, which are not subject to the same level of disclosure requirements as publicly traded companies. Another factor is the use of complex financial instruments, which can be challenging to understand even for sophisticated investors.

Finally, the incentives that exist within the PE industry can also induce volatility laundering. Managers are typically compensated based on the performance of their investments, typically through carried interest, which can create a conflict of interest, as they could act towards their own financial gain instead of the best interests of investors. In some cases, managers may also be incentivized to engage in volatility laundering to attract more investors or justify higher fees, even if it ultimately leads to lower returns for investors.

So, what can be done to address the problem of volatility laundering in the PE industry? One solution is to increase transparency and improve reporting requirements. This can be achieved by requiring managers to provide more detailed information about the underlying investments in their portfolios, including the level of volatility and risk associated with each investment. Additionally, investors should be provided with more information about the valuation methodologies private equity firms use, including any assumptions or estimates made in the process. In this sense, some firms have begun to use more transparent valuation methodologies, such as mark-to-market, which can provide a more accurate picture of the true volatility of their investments.

Regulators are also playing a role in resolving this matter. Indeed, in the United States, the Securities and Exchange Commission (SEC) has increased its focus on PE funds, requiring them to disclose more information about their investment activities and risk management practices.

Another solution is to increase education and awareness among investors. Indeed, many investors may not fully understand the level of risk associated with PE investments and may be more susceptible to the false sense of security created by volatility laundering. By increasing education and awareness, investors can make more informed investment decisions and better assess the level of risk associated with their investments. However, most jurisdictions do require that one be designated as an accredited investor in order to invest in private vehicles. Additionally, this approach may increase barriers to entry, leading AUM to decline overall.

At this specific point in time, with public equity investments performing poorly and suffering from sudden changes in value, investing in the private market may seem more attractive and cause the premium required to hold illiquid investments to fall or even become negative, as investors that seek price stability might prefer them.

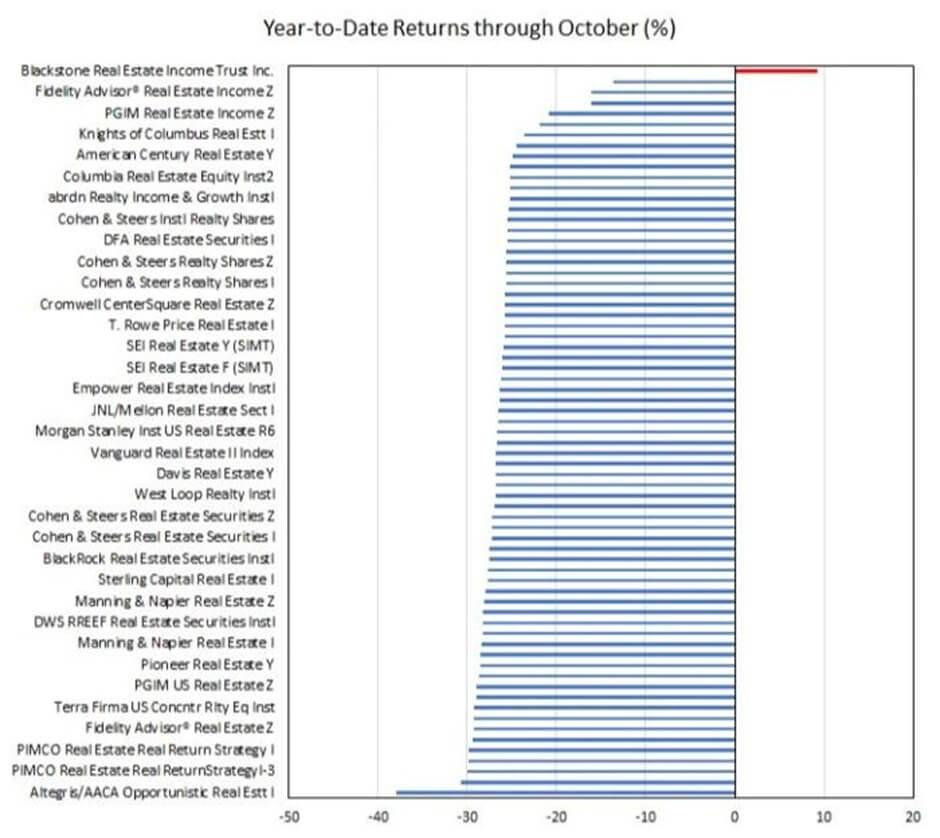

A highly debated event related to this was Blackstone Real Estate Income Trust (BREIT) 2022 performance. In October, they published a 9.3% YTD return, while most of its public peers, Real Estate Investment Trusts (REITs), suffered losses between 20% and 30%.

Blackstone argued that these abnormal returns resulted from different and better allocation than usual REITs, but the market did not fully believe this story and many clients tried to withdraw their money, reaching the 5% quarterly limit set to avoid having to sell its assets at a discount. However, one must note that a large portion of these withdrawals were linked to liquidity issues in the APAC region, thus one cannot completely suggest a lack of transparency on performance by Blackstone.

In conclusion, volatility laundering is a serious problem, especially in the PE industry, and can have a significant impact on the returns of investors. Disguising or hiding the accurate level of volatility and risk associated with an investment can create a false sense of security, which can lead to unexpected losses or lower returns. It is crucial to address this problem to increase transparency and reporting requirements, education and awareness among investors, and regulatory oversight. By taking these steps, we can help ensure that investors are better informed and better protected against the risks associated with private equity investments.

Sources

https://www.ft.com/content/d20a750b-9544-4927-88a4-72050c658967

https://seekingalpha.com/article/4561985-blackstone-breit-closes-the-gates

https://citywire.com/pro-buyer/news/why-is-blackstone-gating-its-70bn-real-estate-fund/a2404269

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4244467

https://www.ft.com/content/d20a750b-9544-4927-88a4-72050c658967

Editor: Marco Peyre

Comments are closed.