By Abdullah El Haddad and Lorenzo Mazzotta

State of the private equity industry

Although tech valuations have experienced corrections, especially in VC-backed startups, sectors like software as a service (SaaS), cybersecurity, fintech, and healthtech remain a vibrant area of interest for PE investors due to their relatively predictable and scalable revenue streams. Data confirm this trend: in 2024, from Q1 through Q3, 30% of worldwide completed acquisitions targeted technology and communication companies. Additionally, technological advancements in AI, machine learning, and blockchain are becoming increasingly integral to strategic operations and operational efficiencies, which also explains the keen attention to software and digital companies as potential new entries in portfolios.

A notable transaction that exemplifies the substantial interest in technology is Thoma Bravo’s recent acquisition of Darktrace, a leader in cybersecurity AI, for approximately $5.3bn. The deal, closed in October 2024, highlights the value placed on cutting-edge technology firms and reinforces the importance of tech-oriented strategies in the current financial landscape.

Overview on Darktrace

Darktrace is a global leader in cybersecurity artificial intelligence, specializing in advanced threat detection and autonomous response technologies. Founded in 2013 and headquartered in Cambridge, UK, Darktrace has developed the Darktrace ActiveAI Security Platform, which leverages self-learning AI to defend against cyber threats: within seconds, the platform can autonomously spot and respond to known and unknown in-progress threats across an organisation’s entire ecosystem, including cloud, apps, email, endpoint, network and operational technology.

The main catalyst to Darktrace’s growth and competitive advantage has been its proactive approach to cyber resilience. Darktrace’s AI-driven cybersecurity solutions continuously adapt to evolving cyber threats, updating their knowledge base to provide customers with advanced security levels capable of neutralising both known and unknown vulnerabilities. What is more, this self-learning AI features defense mechanisms that require minimal manual intervention, setting Darktrace apart from competitors.

The company’s financial health has shown a remarkable improvement over the past four years. Although Darktrace experienced significant challenges and operational inefficiencies in 2020 and 2021, as indicated by a negative EBITDA of -$2.21m and -$7.26m respectively, the company managed to transition from a distressed position into a stable growth path. The inflection point occurred in 2022, when the company turned around and EBITDA entered a positive trajectory at $35.89 million, further increasing to $63.92 million in 2023 and accompanied by an EBITDA margin of 14.10%. Such an impressive growth was mainly driven by Darktrace’s success in scaling operations while effectively controlling costs: indeed, revenues grew from $158.12m in 2020 to $453.47m in 2023, while Free Cash Flow (FCF) moved from a deficit of -$0.5m in 2020 to $97.9m in 2023, highlighting Darktrace’s ability to generate cash to sustain operations and capital expenditures.

A disciplined and meticulous financial management inevitably resulted in an improved capital structure and reduced leverage. Indeed, despite Darktrace being heavily reliant on debt in 2020, as evidenced by a D/E ratio of 149%, the company shifted towards an equity-driven structure by 2023. The D/E ratio fell to 21.86%, while capital ratio dropped from 51.59% in 2020 to 16.42% in 2023. In addition, the company even enhanced its ability to meet financial obligations, as shown by an interest coverage ratio rising from a worrying -10.51 in 2020 to 10.30 in 2023.

Such a successful turnaround, underpinned by operational efficiency, profitability, and reduced leverage, undoubtedly contributed to the company’s appeal for Thoma Bravo. Revenues are now expected to reach ~531m in 2024 (+17%), supporting the trend of continued growth and value creation.

Overview on Thoma Bravo

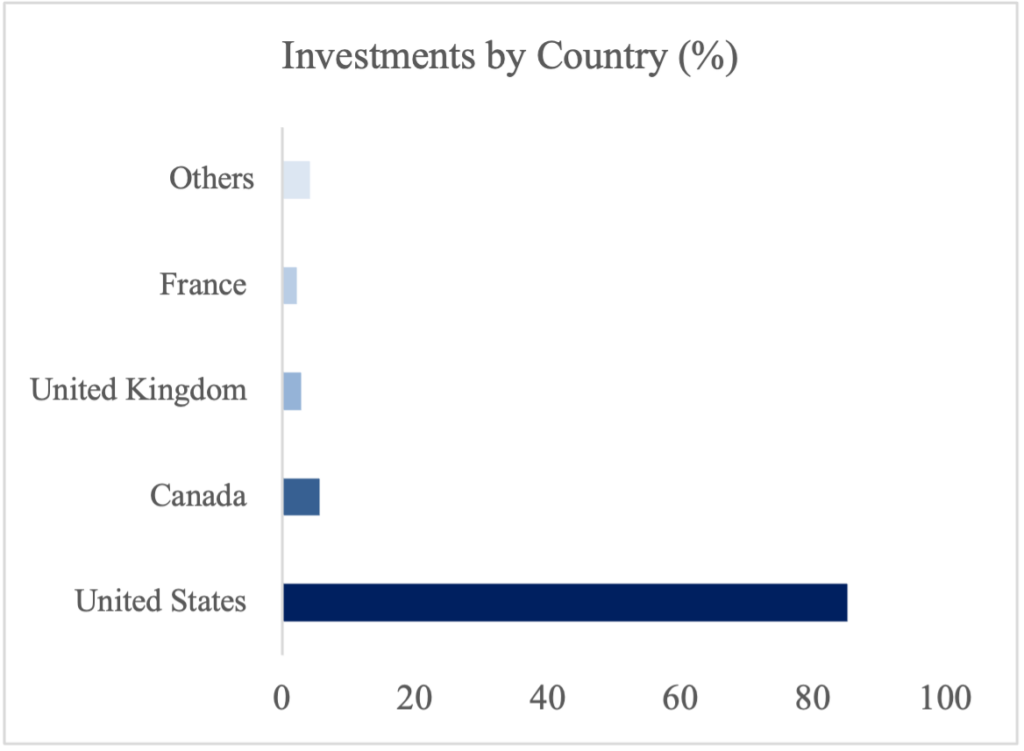

With a robust portfolio of 78 companies and over $160bn in AUM, Thoma Bravo stands out as one of the largest software-focused investors in the world. The firm leverages its 30-year track record and expertise to drive growth and operational efficiency in its investments and is known for its unique investment approach, which often involves taking companies private, investing in growth initiatives, implementing operating best practices, and making accretive acquisitions intended to accelerate revenue and earnings.

Prior to its acquisition of Darktrace, Thoma Bravo completed a total of 26 acquisitions in 2024, both directly and indirectly, with 24 of these deals focused on technology companies. Darktrace will now join the firm’s existing portfolio of 11 other cybersecurity companies, further strengthening Thoma Bravo’s presence in the cybersecurity sector.

Deal Structure

Thoma Bravo’s acquisition of Darktrace was structured as an all-cash transaction, offering $7.75 per share to each shareholder– a 20% premium over Darktrace’s closing share price of 517 pence on the last trading day prior to the announcement. The valuation implies an EV of around $4.99bn, or 34x Darktrace’s adjusted EBITDA of $146 million for the twelve months ended December 31, 2023.

The acquisition was financed through a combination of both equity from Thoma Bravo’s funds and debt financing from Darktrace, with the debt portion structured across a $1.735bn first-lien term loan and a $410m second-lien term loan. The first-lien tranche, with a seven-year maturity, was priced at a spread of 325 basis points over the Secured Overnight Financing Rate (SOFR), featuring a 0% floor and an original issue discount (OID) of 99.5. The eight-year second-lien term loan carried a spread of 525 basis points over SOFR, also with a 0% floor and an OID of 99.5. The whole debt structure was supported by Goldman Sachs acting as the lead arranger.

Following the acquisition, Darktrace’s ordinary shares ceased trading and the company was delisted from the FTSE100 Index on the London Stock Exchange.

Deal Rationale

In the view of Thoma Bravo, this acquisition was more than just an attempt to make its mark in an ever-expanding cybersecurity market – but to do it with a company such as Darktrace who, with the right investment and time, have the chance to become a key player in this market. Furthermore, Thoma Bravo recognized Darktrace’s unique strength of using a variety of AI technologies to effectively combat cybersecurity threats for its 9,400 customers, giving more reason for Thoma Bravo to complete this acquisition. Lastly, Thoma Bravo’s view for delisting is to be able to facilitate the development of Darktrace effectively, using its history in growing software and technology companies without the risk of shareholders votes coming in the way of development.

The advisors, providing financial advising, to Darktrace are Jefferies and Qatalyst Partners, considering the terms to be adequate. The advisors to Thoma Bravo were Goldman Sachs and FGS Global.

In the view of Darktrace, it has ambitions to scale globally and believe that Thoma Bravo’s intentions for its company, including ensuring an incentive is provided to employees to support long-term growth. Moreover, the opportunity to levarage Thoma Bravo’s operational practices built with extensive experiences in acquiring and growing companies ensure that Darktrace can build upon its organic growth momentum and expand in an ever-growing and fragmented cybersecurity market, allowing them to become a key global player. The subsequent delisting comes because of Darktrace’s belief that it’s shares were trading at a significant discount compared to competitors such as Crowdstrike, despite Darktrace’s expertise and success. This delisting provides an opportunity for Darktrace’s shareholders to receive a fair value for their shares at this time in its evolution.

To get a grasp of whether the company’s valuation is accurate, we can use the comparable companies method, using the EV/EBITDA multiple. This was conducted using 3 companies of similar valuations, with the exception of Palo Alto, who also specialize in the use of AI in cybersecurity.

Looking at this group, we can see that companies with significantly higher sales, such as Palo Alto with $8.2bn in sales compared to $1.9bn of McAfee, comparably have much higher EV/EBITDA than the remaining firms in the group standing at 90.65x – suggesting a higher valuation. Furthermore, we must not overlook the role of Palo Alto in influencing the average. Despite its much larger size, at a market capitalization of $127bn, they are a direct rival of Darktrace in the in the use of AI for cybersecurity, namely through their Cortex XDR

To continue, the average EV/EBITDA multiple for FY is 39.38x. Given the reported 34x multiple for the Thoma Brava acquisition of Darktrace, we can say that compared to similar companies, Darktrace is undervalued. However, we mustn’t overlook the role of Palo Alto’s multiple, as this greatly increases the multiple. More appropriate is the median from a similarly sized company and direct competitor in McAfee, which suggests to us that Darktrace is overvalued in this deal, with a FY multiple of 15.59x.

Conclusion

To conclude, the acquisition of Darktrace by Thoma Bravo in an all-cash transaction represents a capitalization of an opportunity to expand into a fragmented cybersecurity market with an expertise-filled company in Darktrace. Their acquisition represents Thoma Bravo’s belief that taking Darktrace private can facilitate the necessary long-term growth needed to mould them into a key global player in the cybersecurity market.

Bibliography

Thoma Bravo,

https://www.thomabravo.com/press-releases/thoma-bravo-completes-acquisition-of-darktrace

Darktrace,

https://darktrace.com/news/darktrace-announces-formal-completion-of-its-acquisition-by-thoma-bravo

James Sharp & Co,

https://www.jamessharp.co.uk/market-news/darktrace-plc-results-for-fy-2023/

FactSet

Yahoo Finance,

https://finance.yahoo.com/news/thoma-bravo-closes-5-3-085430172.html

Comments are closed.