By Nessa Ng

We have seen from our previous article “A look inside SPACs and into the future“, the rise of ‘Special Purpose Acquisition Companies’ (SPACs). This article aims at providing an update on SPACs offerings ever since the first quarter of 2021 closed and reviews the post-IPO deal making activity of SPACs thus far.

2021 Q1 SPACs Offerings

We see evidence of a SPAC boom during this quarter. In the US, which accounts for the large majority of SPAC activity, SPACs raised up to $26bn in 2021 January alone, almost a third of the global amount raised over the entirety of 2020. In 2020, according to SPAC-tracking company SPACInsider, 248 SPAC IPOs raised $83bn in gross proceeds, with an average size of $335m. Notably, the amount raised in 2020 was already six times the amount raised in 2019. This growth continues: by the end of February 2021, a cumulative 188 SPACs raised $58bn in the US. By the end of 2021’s first quarter (according to PrivateRaise), a total of 296 SPACs raised a collective $87bn in the market, surpassing the results of the whole year of 2020.

Within Europe, firms are also joining the SPAC boom. Amsterdam’s Euronext stock exchange is steadily becoming Europe’s prime spot for SPACs, supported by the Netherlands’ flexible listing rules which are ideal for SPACs. Amsterdam’s first SPAC listing for 2021 was ESG Core Investments, which represented a €250m offering for Euronext’s first ESG-based SPAC, focused on sustainable opportunities in the north-west of Europe. Big industry sponsors are also joining veterans within the European banking sector to launch a SPAC. For example, LVHM founder Bernard Arnault and former UniCredit chief Jean Pierre Mustier are partnering to create a $250m European financial SPAC, Pegasus Europe, to be listed on the Amsterdam stock exchange.

With the current traction, there is even talk that SPACs could outnumber traditional IPOs this year. Riding on this trend, one of the most prolific SPAC backers is ex-Citigroup banker Michael Klein, who has led another two SPACs this quarter: Churchill Capital Corp VI – which raised $480m after upsizing their offer from $400m –, and Churchill Capital Corp VII which raised $1.2bn above an initial $1bn planned. On a global level, we see a growth in investor interest which extends to sovereign wealth funds. According to the SWF Institute, sovereign wealth funds have committed $1.79bn to SPACs in 2020, more than a 26x increase compared with $68m in 2019.

2021 Q1 SPACs Pipe Deals

After a SPAC is launched, the search for a company begins, or the so-called Private Investment in Public Equity (“pipe”) deals. This is conducted typically within a two-year time limit, although extensions can be made with agreement of the shareholders. Investment banks are also active in the market, with dealmakers pitching business combinations on behalf of their clients to listed SPACs.

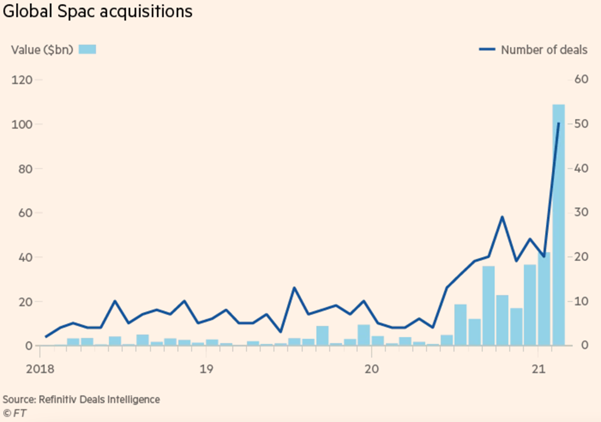

Figure 1: Financial Times, Global SPAC acquisitions

As seen in Figure 1, total deal values for global SPAC acquisitions have been on the rise since the last quarter of 2020, with a steep increase in February 2021 where blank-check companies signed a record $109bn across 50 transactions. A total of 117 deals were announced in the first quarter of 2021. In the US, the total value of SPACs combinations reached $172bn, more than 25% of the total value of all deals.

Some of the largest deals announced in this quarter include: a $24bn merger between electric vehicle developer Lucid Motors and a SPAC backed by Michael Klein; Blackstone-backed benefits provider Alight valued at $7.3bn in its merger with investor Bill Foley’s Foley Trasimene Acquisition; fuel-cell truck maker Hyzon Motors Inc valued at $2.7bn in a merger with Decarbonization Plus Acquisition Corp; and Digital advertising company Taboola raising $545 million at a $2.6bn valuation in a merger with Ion Acquisition.

Deals also extended to young rising sectors such as Agrifoodtech. In February, the indoor farming startup AppHarvest was valued at more than $1bn in a reverse merger with Novus Capital, a NASDAQ-traded SPAC, and became the first controlled environment agriculture (CEA) startup to go public in the US.

Will pipe deals be a challenge?

Within the 24 months’ timeline, SPACs need to identify firms to merge with, otherwise they risk being liquidated. Only about 25% of SPACs listed since 2019 have completed deals so far and at least 150 previously listed SPACs are still seeking a partner company. Coupled with almost 300 SPAC IPOs this year, according to Financial Times, there are currently 497 blank-cheque companies actively competing for pipe deals.

With limited quality targets, there is inevitable concern that some SPACs may bring back lower-quality assets. SPACs have not always been successful in the firms they take public, as in the case of electric truck startup Nikola. Three months after going public in June 2020, Nikola was accused of fraud by short sellers, Nikola’s founder resigned as executive chairman and its stock price has fallen to less than $15 today from its peak of almost $80 in June.

A pipe slowdown may also have implications on the pace of SPAC launches. In the first week of April, only four SPACs have gone public, as compared to 41 in the first week of March and 28 in the first week of February.

Conclusion

As with most investments, the results are mixed. After the fundraising success, SPACs must successfully acquire companies in order to deliver returns. Investors will have to weigh the risks and determine how a SPAC fits into their overall portfolio strategy. Nevertheless, SPACs continue to offer an attractive alternative route to a regular IPO. With numerous high-profile and experienced management teams, SPAC sponsors have skin in the game and are heavily incentivized to maximize returns.

Author: Nessa Ng, Tse Miang

Editor: Tiago Guardão

References:

AgFunder, AppHarvest completes SPAC merger to go public at $1bn+ valuation

https://agfundernews.com/appharvest-completes-reverse-merger-to-go-public-at-1bn-valuation.html

Financial Times, Spac boom fuels strongest start for global mergers and acquisitions since 1980

https://on.ft.com/3rA1iCN

Financial Times, Spac boom under threat as deal funding dries up

https://on.ft.com/3dKx0Ix

Financial Times, Spac dealmaking sets new record

https://www.ft.com/content/abcf1dad-833d-4620-ab57-96ea01d918ed

Harvard Business Review: The SPAC Bubble is about to burst

https://hbr.org/2021/02/the-spac-bubble-is-about-to-burst

Intertrust Group, Amsterdam gears up for SPAC boom

https://www.intertrustgroup.com/insights/amsterdam-gears-up-for-spac-boom/

Pitchbook, SPAC glut powers exit spree for PE- and VC-backed companies

https://pitchbook.com/news/articles/spac-glut-powers-exit-spree-for-pe-and-vc-backed-companies

Reuters, Michael Klein-backed SPACs raise $1.68 billion in IPOs

https://www.reuters.com/article/churchill-capital-corp-vi-ipo/michael-klein-backed-spacs-raise-168-billion-in-ipos-idUSL4N2KI1PL

The Deal, SPAC offerings, mergers hit fresh records

https://www.thedeal.com/spacs/spac-offerings-mergers-hit-fresh-records/

Comments are closed.