by Federica Guirguis, Mikel Herskovits, and Vedant Majmundar

Introduction

The sum of £4.25bn made headlines in May 2022, with Clearlake Capital, a Private Equity (PE) firm chaired by American billionaire Todd Boehly, exchanging it for 60% ownership of Chelsea Football Club in a deal worth €5bn at the time. This is despite the macroeconomic climate, dominated by persistent inflation and rising interest rates, which not only caused a slowdown in deal-making in 2022 but also poses an arduous year for PE firms in 2023. Following Clearlake’s take-over of ‘the Blues’, other teams such as Liverpool, Tottenham Hotspur, and Manchester United, have been identified as potential targets for Private Equity deals worth billions of euros. This prompts the question: Despite the external factors that caused a slowdown in deal-making, what makes a football club in the Premier League such an attractive investment?

The Premier League

KPMG’s Football Benchmark identifies economic capital as one of the four main motivations behind owning a professional football club. This class of owners is attracted by the financial gains and growth potential of this asset class, which have increased in recent years due to the introduction of Financial Fair Play Regulations, as well as soaring media broadcasting deals. This is especially the case in the English Premier League, which, by most financial metrics, is the biggest football league in the world. Deloitte’s Money League for 2023 reflected the financial dominance of Premier League clubs, as 11 out of the 20 highest revenue-generating clubs came from England. When increasing the scope to the top 30, 16 Premier League clubs (80% of the clubs in the league) make the cut.

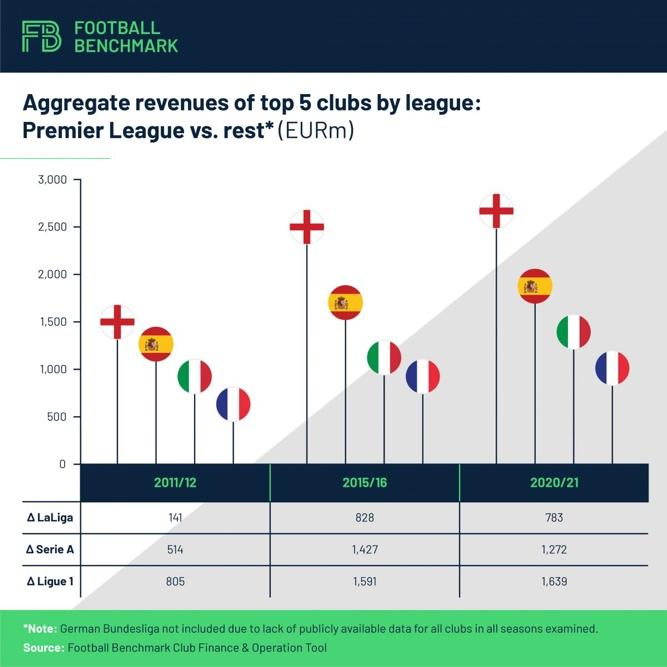

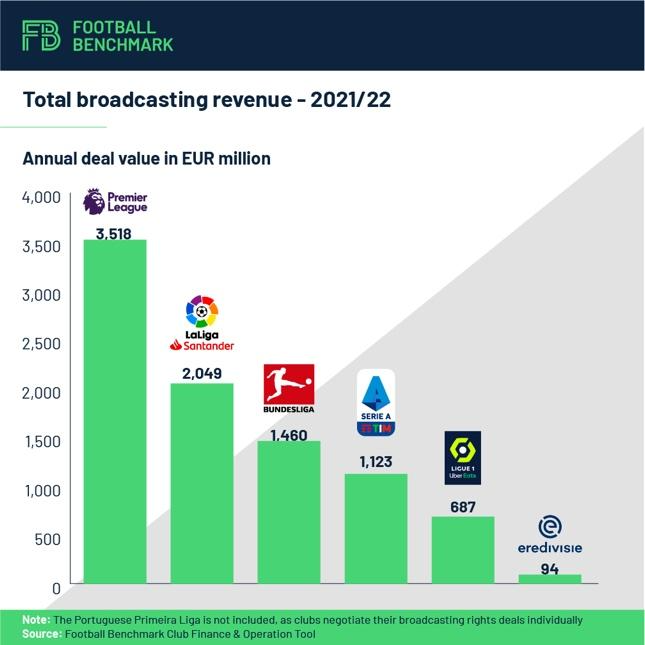

Furthermore, this gap in revenue-generating ability has only widened over the past decade when looking at the top clubs of each league. One of the driving factors has been the greater international appeal of Premier League clubs, especially in developing markets such as the United States and Southeast Asia. Breaking down the sources of revenue for the average club in the Money League, they have three main revenue streams: broadcast, representing 44% of revenue; commercial, corresponding to 41% of revenue; and matchday, the remaining 15%. As shown in Figure 2, broadcasting rights – the most significant revenue stream – are considerably larger in the Premier League.

For over a year, the pandemic nullified matchday income for clubs, as games were played behind closed doors. Whereas clubs in other leagues relied heavily on matchday income, the blow for Premiership clubs was cushioned by their superiority concerning broadcasting rights revenue. Whereas the top 5 clubs in the French and Italian topflight reported a combined loss of €575m and €271m respectively, their English counterpart produced an operating profit of €55m in the 2019/20 season.

Finally, financial success off the pitch translates to success on the pitch, perpetually making English clubs a more attractive investment. With more funds at their disposal, Premier League clubs can afford better players, build better teams, and produce more success in international competitions, leading to greater revenue-generating ability (due to higher prize money, more lucrative broadcasting rights, and a greater international appeal), fuelling the feedback loop. In fact, in the last 5 editions of European football’s marquee competition, the UEFA Champions League, 6 out of the 10 finalists were English clubs. Unsurprisingly, premier league clubs in 2022 represented 6 out of the 10 most valuable squads in terms of player values.

In the 2018/19 season, 12 out of the 20 clubs in the Premier League reported losses. The situation became even direr following the pandemic, with many teams still recovering. A few months ago, the president of La Liga (the Spanish topflight) Javier Tebas had the following to say: “All clubs lose money. The Premier League is not a financially sustainable model”. What can prospective owners of Premier League clubs make of this? Should they take Tebas’ comments as a warning, or do they present an opportunity to enact an operational turnaround strategy that makes them a sound financial investment?

The Chelsea Deal

In 2003, Russian billionaire Roman Abramovich bought Chelsea F.C. for £140m. Over the next 19 years, Chelsea transformed into a European success. Following Russia’s invasion of Ukraine, the UK’s government imposed strict sanctions on Russian oligarchs; consequently, Abramovich was forced to sell the Blues. On 25th of May 2022, the UK government approved the bid by the consortium led by Todd Boehly, and backed by Clearlake Capital, in a deal worth £4.25bn (€5bn).

To manage the sale, Abramovich hired the Raine Group, which received 11 other bids for the club in addition to Todd Boehly’s. Breaking down the deal’s figure, £2.5bn (€2.9bn) represented the sum to acquire Chelsea’s shares, and the remaining (€2.1bn) as a commitment to investment in infrastructure, players, and academy. The deal left many stakeholders wondering if the asking price was justified. According to Football Benchmark’s comparable analysis of Chelsea, the club’s enterprise value during the 2020 valuation was €2.2bn (the last pre-pandemic figure). Furthermore, in the 10 years leading to that valuation, the club sustained an aggregate net loss of €471m. For reference, this performance is in stark contrast to that of other large English clubs, such as Manchester United which reported a net profit of €176m over the same period.

Bearing this in mind, what made Chelsea an attractive investment for Todd Boehly’s consortium, and how did the agreed-upon figure balloon to £4.25bn? The prestige of Chelsea F.C., the scarcity of clubs of such calibre for sale at the time, and the wide array of potential buyers worked in Abramovic’s favour during the negotiations. Conversely, there was also tremendous pressure from the buy-side, ensuing from the sanctions imposed by the UK government; this urgency prompted Abramovic to write off the £1.6bn in loans that the club owed him.

Under the financial advisory of Deutsche Bank and Goldman Sachs, the new ownership group agreed to several conditions, including not being able to sell their stake in the club until 2032, earmarking £100m (€118m) to the development of Chelsea F.C. Women, not being able to take dividends, and refraining from injecting additional debt into the team. In addition, the new owners agreed to commit £ 1.75 billion in further investment for the benefit of the club, including investments in the Stamford Bridge academy, the Kingsmeadow stadium, and continued funding for the Chelsea Foundation. These conditions reflect a path of financial prudency under the new management, which would keep the club’s solvency within limits and will not burden the club by injecting exorbitant debts; therefore, leading to financial stability. This aims to fix the club’s aforementioned poor financial performance, where the trophy-hunting owner injected loans to cover losses.

Chelsea Under New Management

Just under a year since the deal was finalised, the new ownership has had a substantial impact on the Blues. Todd Boehly’s consortium went on a frenzy during the 2022/23 transfer windows, spending €610m which resulted in a net deficit of over €540m. Notably, Chelsea resorted to contract amortisation to comply with Financial Fair Play rules; some contracts even extended to eight years, which is unusually long for football players. Such was the extent of Chelsea’s stunts in the transfer windows that it prompted the governing body UEFA to rethink its FFP regulations. This spending prowess hasn’t been fruitful, as Chelsea is heavily underperforming in its first season since the takeover, which will affect its financial performance.

As tumultuous as Chelsea’s situation might be, Todd Boehly hasn’t lost focus of the timescale of a PE deal. They could find guidance in a deal where a strategy was perfectly integrated, such as Elliott’s turnaround of Italian club AC Milan. Like Chelsea’s situation, their first focus was on stabilising finances by clearing debts and injecting equity before it generated cash flows. Notably, Elliott aimed to boost revenues through three paths. Firstly, by strengthening commercial streams via more lucrative sponsorships. Next, boosting media rights by winning major competitions. Finally, by capitalising on the stadium and real estate. To achieve these goals, the firm performed extensive staff rotations and restructured its management over the years along with aggressive cost-cutting through reducing hefty player salaries, non-renewal of expensive contracts when they were about to expire and recruiting younger players to save on costly contracts. The firm has also emphasised the ability to monetize the stadium and plan to build a new modern stadium with leisure facilities further diversifying their revenues apart from traditional matchday revenues. The results were noticeable through its 22% rise in revenue in 2022 and reduction of net debt from €101m to €28m in 2021.

Akin to AC Milan at the time of Elliott’s acquisition, Chelsea has a considerable amount of untapped potential, which if exploited properly could drastically improve profitability. In line with the clauses stipulated, development plans for Chelsea’s stadium are said to increase capacity from 42,000 to 62,500, expected to boost annual matchday revenues from £70m to £200m, as well as paving the way for lucrative naming rights deals. There are also rumours surrounding their shirt sponsor, as their current agreement with ‘Three’ expires at the end of the current season, presenting an opportunity to find a more attractive partnership. Finally, growth expectations regarding the Premier League and Champions League broadcasting deals drove up Chelsea’s price, which continues to increase with the sport’s international growth in developing markets. Since both competitions have some sort of compensation based on merit, Chelsea’s on-pitch performance would be reflected in the club’s finances.

Finally, an argument could be made that the clauses stipulated in the takeover could make Chelsea a more profitable deal for Clearlake. The rumours surrounding a limit on how much debt the club can take on could prompt the ownership to rethink Chelsea’s strategy. No longer able to place outrageous bids in the transfer market, the club could instead trust its youth team players.

Having produced some of the biggest names in world football, the Chelsea Academy is renowned as one of the world’s best. Clubs such as Benfica have shown just how profitable the development of academy players can be, with a net profit in the transfer window of €690m in the last 13 seasons. Moreover, Chelsea would have to follow the footsteps of Elliot’s turnaround of AC Milan and conduct more sensible business in the transfer window, buying prospects like Rafael Leão and growing them into stars, and trimming the squad size.

A New Wave of Takeovers

The sale of Chelsea FC has seemed to trigger a new wave of takeovers in the Premier League, as there are speculations of the sale of some of England’s most notable clubs: Liverpool, Tottenham Hotspur, and Manchester United. The latter, known as the ‘Red Devils’, has attracted numerous bids after the Glazer family had outlined their interest in selling the club. PE has a real potential to drive a culture change for positive returns and strike a balance between on-the-pitch success and engineered financing. The key difference also lies in the fact that for a private equity firm, there is always a return on investment and exit plan in mind, this would imply better cost-effective control and revenue generation strategies. The influence of the Buy-side in the sports industry has been aggressively increasing and this is only the beginning of PE takeovers in football.

Conclusion

Despite the hostile macroeconomic environment, the acquisition of Chelsea Football Club was finalised because of how unique this opportunity was. At a time when the Premier League fights to continue asserting its commercial dominance over other domestic leagues, UK-sanctioned sale of assets, and doubts surrounding the sustainability of the financial model, Todd Boehly’s consortium finds themselves in an unprecedented situation. The success of Clearlake’s plan to stabilise debt, boost revenue and invest in its infrastructure, could mark the start of a new era of takeovers and turnarounds in the world of football. Needless to say, football fans and finance enthusiasts alike will closely monitor the outcome of Chelsea’s takeover.

Sources

Deloitte Annual Review of Football Finance. (2022, August). Retrieved April 3, 2023, from: https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/sports-business-group/deloitte-uk-annual-review-of-football-finance-2022.pdf

Deloitte Football Money League 2023. (2023). Retrieved April 5, 2023, from: https://www2.deloitte.com/uk/en/pages/sports-business-group/articles/deloitte-football-money-league.html

Is the English Premier League the European Super League already? (2022, June 14). Retrieved April 5, 2023, from: https://www.footballbenchmark.com/library/is_the_english_premier_league_the_european_super_league_already

Khajuria, S. (2023, February 27). What private equity means for football. Retrieved April 4, 2023, from: https://www.ft.com/content/8ee61c1e-ae8b-4aa6-97e3-9c72fb09bfcb

MacArthur, H., Burack, R., Rose, G., Vusser, C., Yang, K., & Lamy, S. (2023, April 10). Private equity outlook in 2023: Anatomy of a slowdown. Retrieved April 4, 2023, from: https://www.bain.com/insights/private-equity-outlook-global-private-equity-report-2023/

Player valuation update: Young talent dominate the ranking of most valuable football players. (2023, January 24). Retrieved April 5, 2023, from: https://www.footballbenchmark.com/library/player_valuation_update_young_talent_dominate_the_ranking_of_most_valuable_football_players

Newson, A. (2023, January 27). Todd Boehly Vision Clear as Chelsea aim to avoid Roman Abramovich Blindspot. Retrieved April 8, 2023, from: https://www.football.london/chelsea-fc/news/todd-boehly-chelsea-january-window-26082644

Chelsea FC 2021/22 Financial Results. (n.d.). Retrieved April 9, 2023, from: https://www.chelseafc.com/en/news/article/chelsea-fc-2021-22-financial-results

Nalton, J. (2023, March 02). Chelsea transfer spending spree derails season for Potter and Boehly. Retrieved April 8, 2023, from: https://www.forbes.com/sites/jamesnalton/2023/03/01/chelsea-transfer-spending-spree-derails-season-for-potter-and-boehly/?sh=5927d9833ff3%E2%80%AF

Kumar, A. (2022, May 25). Chelsea’s £4.25 billion sale approved: How much did Roman Abramovich pay to buy the club in 2003? Retrieved April 10, 2023, from: https://www.wionews.com/sports/chelseas-ps425-billion-sale-approved-how-much-did-roman-abramovich-pay-to-buy-the-club-in-2003-482138%E2%80%AF

What is the value of Chelsea FC? (2022, April 4). Retrieved April 11q2023, from: https://www.footballbenchmark.com/library/whats_the_value_of_chelsea_fc

Panja, T., & Smith, R. (2022, May 24). Inside the Chelsea Sale: Deep Pockets, private promises and side deals. Retrieved April 10, 2023, from: https://www.nytimes.com/2022/05/24/sports/soccer/chelsea-sale-abramovich-boehly.html

Clark, D., Germano, S., Gara, A., & Agini, S. (2022, August 31). Chelsea’s New Era: Boehly and Clearlake Bet on a booming premier league. Retrieved April 9, 2023, from: https://www.ft.com/content/f7385ebc-d657-4116-be0f-96497e5f8d99

McCarthy, S. (2023, March 10). Why Elliott’s AC Milan Turnaround is a blueprint for PE bosses piling into football. Retrieved April 19, 2023, from: https://www.fnlondon.com/articles/why-elliotts-turnaround-of-ac-milan-is-a-blueprint-deal-for-pe-bosses-piling-into-football-20230310?mod=topic_privateequity

Kleinman, M. (2022, May 07). Chelsea FC Sale: Dividend ban and debt limits feature in ‘anti-glazer’ takeover deal. Retrieved April 19, 2023, from: https://news.sky.com/story/chelsea-fc-sale-dividend-ban-and-debt-limits-feature-in-anti-glazer-takeover-deal-12606482

Perez, A. (2022, January 29). Why sports teams are welcoming private equity ownership. Retrieved April 19, 2023, from: https://frontofficesports.com/why-sports-teams-are-welcoming-private-equity-ownership/

Ranson, J. (2022, December 07). Chelsea owner Todd Boehly ‘commits to massive redevelopment of Stamford Bridge’. Retrieved April 19, 2023, from https://www.dailymail.co.uk/sport/sportsnews/article-11513459/Chelsea-owner-Todd-Boehly-commits-massive-redevelopment-Stamford-Bridge.html

Law, M. (2023, February 07). Chelsea expect lucrative new shirt sponsorship to replace £40m-a-year deal with three. Retrieved April 19, 2023, from: https://www.telegraph.co.uk/football/2023/02/07/new-chelsea-shirt-sponsorship-deal-three-40m-year/

Editor: Avi Agarwal

Comments are closed.