By Armand Pjeci

Introduction

In recent years, the Italian private equity market has experienced notable transformations. A consistent element in this evolving landscape is the increasing engagement of foreign investment funds, drawn by several pivotal factors. Primarily, Italy possesses one of the largest and most diversified economies within the European Union, underpinned by a robust domestic market replete with opportunities. Furthermore, its strategic geographic positioning in the Mediterranean region establishes the country as a critical logistical nexus, enabling efficient access to markets across Europe, North Africa, and the Middle East. Equally compelling is the prevalence of small and medium-sized enterprises (SMEs) within Italy, many of which exhibit comparatively modest valuations and persistent undercapitalisation—a combination that renders them particularly attractive targets for foreign capital deployment.

As delineated in an analysis conducted by PE Insights, Italian enterprises exhibit pronounced undercapitalisation relative to their European counterparts, with equity constituting merely 42% of balance sheet structures—a figure markedly lower than the 50% observed in Germany, France, Spain, and the United Kingdom. These structural characteristics, when juxtaposed with Italy’s spheres of industrial excellence—notably within fashion, design, and the agri-food sector—render the nation a particularly compelling proposition for international investment portfolios. Whilst an expanding private equity (PE) market undeniably confers substantial macroeconomic advantages at the national level, it remains imperative to carefully evaluate concomitant costs, particularly those pertaining to competitive dynamics, which increasingly exert pressure upon domestic enterprises.

Current Trends of Foreign Players Entering the Italian PE Market

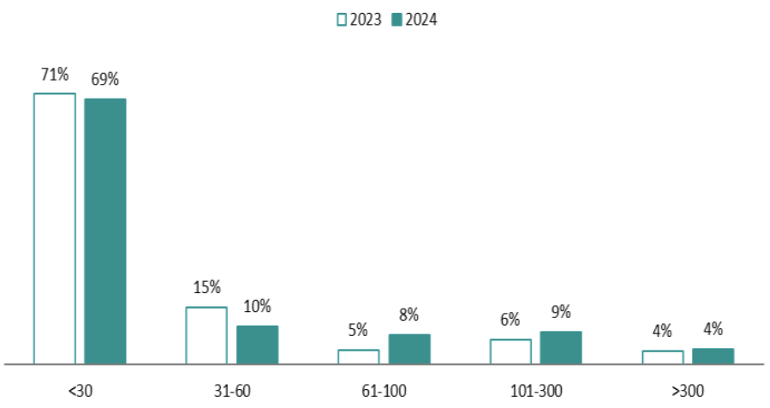

As previously mentioned, the prevailing market dynamic witnesses a burgeoning interest among foreign private equity (PE) entities in the domestic corporate landscape. This inclination is attributable to a confluence of factors, foremost among these being the valuation metrics of Italian small and medium-sized enterprises (SMEs), which present compelling investment propositions predicated upon comparatively subdued valuation multiples and modest operational scale (frequently exemplifying operational excellence yet persistently afflicted by undercapitalisation). Empirical estimates indicate that approximately 70% of acquisition targets within the Italian market generated annual revenues below the €30 million threshold in 2024.

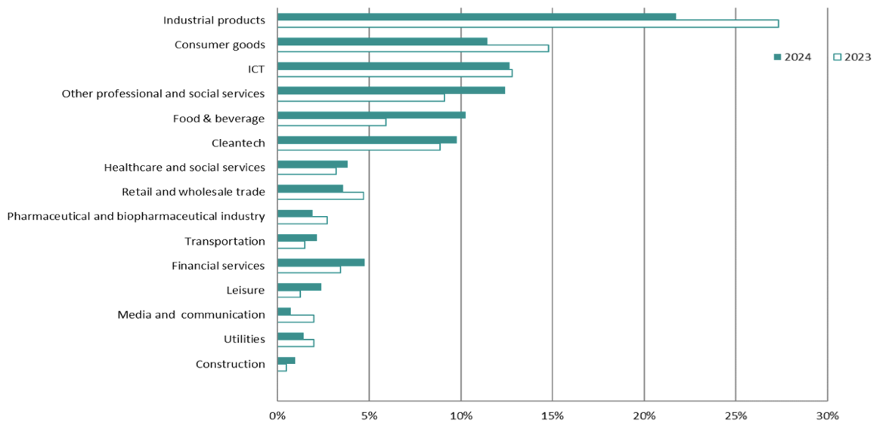

As delineated in prior analysis, two further critical determinants warrant emphasis: the governance frameworks characteristic of Italian small and medium-sized enterprises (SMEs) and the nation’s domains of industrial pre-eminence. The former pertains to challenges associated with generational transition—a pivotal variable in ensuring organisational continuity—whilst the latter underscores Italy’s internationally recognised primacy within specific industrial verticals, as delineated in the accompanying graphical representation, which enumerates the sectoral distribution of acquisition targets.

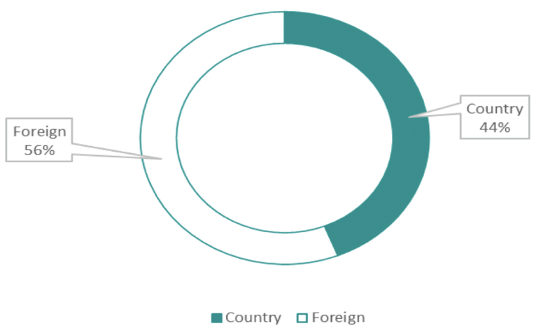

Over the past few years, the Italian private equity market has witnessed an increasing involvement of foreign funds, which currently constitute around 60% of the market. This substantial engagement underscores the vital role that international investors play in Italy’s private equity sector. In France, the private equity landscape is predominantly controlled by domestic investors. As per a report by S&P Global Market Intelligence, 85.3% of acquisitions were executed by French purchasers, accounting for 53.3% of the total capital invested. This indicates that the presence of foreign private equity funds differs considerably across European nations, shaped by the robustness of domestic private equity sectors, local economic conditions, and, in some cases, the lack of comparably larger domestic players, such as in Italy.

Advantages and Disadvantages of Foreign PE Operators

The presence of foreign players in a domestic market undoubtedly entails both advantages and disadvantages. The benefits can be broadly divided into three principal categories: an increase in capital, accelerated internationalization, and improved governance. Conversely, the main drawbacks include the rapid disposal of industrial assets, weakened local anchoring, and intensified competition for Italian funds. The subsequent sections of this article will provide a comprehensive explanation of all the aforementioned advantages and disadvantages.

Being an attractive nation for large investment funds brings several benefits, the first and foremost being a significant increase in investment capital. US and Pan-European private equity funds possess significantly greater financial resources compared to domestic players, which represents a considerable advantage in market sectors where Italian private equity funds may find it challenging to operate. This advantage primarily lies in their ability to undertake larger, more complex, and strategically significant transactions.

For example, CVC Capital Partners’ acquisition of Recordati, a leading Italian pharmaceutical group, in 2018 demonstrated the financial firepower of foreign funds. The deal, valued at approximately €3 billion, was one of the largest in Italy that year and exemplified the ability of international funds to execute high-value transactions that would be difficult for local players to match. Their access to larger pools of capital enables them not only to provide financial backing but also to offer managerial expertise and access to international networks, thereby facilitating business expansion and global growth. Moreover, these funds are often large and highly reputable institutions and their involvement can serve as a powerful signal of validation, indicating to other investors, partners, and the market that the acquired company has significant potential. Their operational expertise, particularly in areas such as governance, international supply chains, and global market strategies, can be instrumental in unlocking growth and driving long-term success. A case in point is Permira’s investment in Valentino, which helped the Italian fashion house expand its global presence before eventually being acquired by the Qatari group Mayhoola.

In addition to the increase in capital, foreign entities also significantly aid in the internationalization of Italian companies, supporting them in innovation, the adoption of international best practices, and expanding their focus from a local to a global market. This was evident in Bain Capital’s acquisition of Fedrigoni, an Italian paper manufacturer, which accelerated the company’s global expansion strategy, particularly into North American, Asian, and other emerging markets.

Finally, there is the enhancement of governance. When company founders, often prompted by advancing age—a trait particularly characteristic of the Italian market—or by other personal circumstances, seek to transfer control to a professional entity capable of ensuring the business’s long-term continuity, they typically turn to a private equity fund. This is because, in some cases, the original management lacks a successor generation to whom control can be passed, or the latter is not interested in continuing the family business. For instance, Investindustrial’s involvement in Ducati helped professionalize management and later facilitated the iconic brand’s acquisition by Audi, ensuring both continuity and global scale.

Regarding the disadvantages, the primary concern that arises when discussing the opening of the market to foreign operators is the potential rapid disposal of the national industrial heritage. This issue is particularly sensitive in the context of the ‘Made in Italy’ brand, as many Italian businesses take great pride in their history and heritage—elements that are not only central to their identity but also to their global appeal.

The fear that companies might become mere short-term profit vehicles for foreign funds often leads to the rejection of equity entry by operators perceived to follow a short-term logic. Consequently, many companies choose to remain small and avoid the capital of large funds. While this is not necessarily a disadvantage in itself, it does represent a significant barrier to foreign private equity investment—limiting access to promising opportunities and potentially slowing the broader development of the private equity market in Italy. This is partly due to the biases surrounding the world of private equity and the lack of information and knowledge that small investors have about the subject.

Another disadvantage is the loss of local anchoring. While private equity expertise can undoubtedly bring value, this becomes more complex in the context of small and medium-sized enterprises (SMEs)—particularly those rooted in heritage and tradition. In such cases, it is legitimate to question whether foreign operators can truly understand and preserve key elements such as craftsmanship, local supplier networks, production inputs, and long-standing customer relationships. The experience of Investindustrial (backed by Andrea Bonomi) in its partial acquisition of Aston Martin—though not an Italian company—raises concerns relevant to Italy as well: global expansion strategies led to production relocations, and tensions arose around local operations. Similar dynamics could emerge in Italian SMEs with strong territorial ties. A foreign fund may not fully understand local dynamics and needs, and, combined with a short-term profit orientation, it may implement strategies aimed at expanding the business at the national and global level, thereby losing sight of local needs.

Finally, the expansion in terms of the number and value of deals by international operators naturally leads to more intense competition with national funds, placing the latter in significant difficulty, as they may be forced to lose an important market share given the vastly different financial resources compared to their foreign counterparts. This potential decline of national funds is particularly concerning, as domestic investors are often better equipped to appreciate and preserve the heritage, tradition, and local nuances of Italian SMEs—elements that foreign operators may overlook or undervalue.

Direct Comparison with Local Players

On the one hand, local operators possess several advantages over their European or international counterparts, including an in-depth understanding of the territory, established relationships with local companies or institutions, and a profound comprehension of the domestic market. On the other hand, they are hindered by limited resources and challenges in achieving local expansion. A market divided between national and non-national operators presents a range of advantages and disadvantages for both parties. Nevertheless, in the contemporary international market, the diversity of operators of varying natures constitutes a persistent feature of the current economic and social framework. Consequently, the sharing of the domestic market can yield numerous benefits and synergies if pursued through a healthy and enduring collaboration. While foreign funds can offer access to a global market and substantial liquidity, Italian operators contribute by integrating their extensive market knowledge and established connections with local entrepreneurs.

Conclusion

Private equity is assuming an increasingly central role in Italy, assisting companies in accessing the capital necessary for innovation, growth, and international expansion. As previously discussed, the selection of an appropriate investor is of paramount importance, given the temporary yet significant nature of the relationship between a private equity fund and a company. While the growing presence of foreign funds brings capital, expertise, and international reach, it also elicits legitimate concerns regarding the preservation of Italian industrial heritage and the equilibrium of power within the market.

Looking to the future, the continued development of a robust, balanced, and competitive private equity environment in Italy will hinge upon collaboration, judicious regulation, and the capacity of both domestic and international players to adapt to evolving economic conditions.

Bibliography

AIFI, https://www.aifi.it/visualizzaallegatodocumenti.aspx?chiave=886aV6x1775HU2mT3sl5077Q983723

PE Insights, https://pe-insights.com/how-private-equity-can-boost-italys-future-growth/

PEM (Private Equity Monitor), https://www.liucbs.it/osservatori/private-equity-monitor-pem/

S&P Global Market Intelligence, https://www.prnewswire.com/news-releases/sp-global-market-intelligences-annual-private-equity-and-venture-capital-outlook-indicates-optimism-amid-macroeconomic-caution-302416162.html

Comments are closed.