By Donatella Aggazio and Francesco Congedo

Introduction

Since the spring of 2022, most central banks in the developed world have hiked interest rates to levels unseen before, reversing a decade of almost 0% rates and fleeting liquidity. This change in monetary policy, became popular as “Higher for Longer”, has inflicted permanent changes in the financial landscape, where more capital-intensive industries like Private Equity (PE) feel the pressure. From more expensive costs of capital to more challenges in obtaining credit to depressed asset valuations, PE cannot raise funds, achieve returns, and liquidate now more than ever.

Diminished Deal Volume and Deal Multiple

Higher interest rates and a stricter lending environment impact the volumes and terms of a deal severely. PE deals rely on leverage to an overwhelming degree; therefore, not only is the volume of deals down but also the multiple. Increasing discount rates are compressing valuation multiples, meaning PE companies are less able to rationalize buying companies at historical valuations. In addition, common exit strategies—IPOs and secondary buyouts—are not as remunerative as they were throughout the past decade, which was the “golden era” of PE.

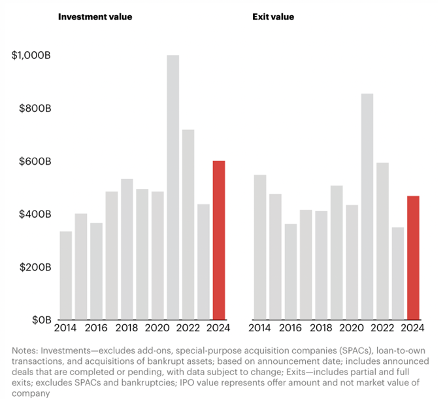

As shown in Figure 1, until 2020, the values of investments and exits are quite balanced, oscillating between $400B and $550B, then in 2021, both values explode, with $1,000B+ in investments and almost $900B in exits, due to low financing costs, sufficient liquidity, and high company valuations. From 2022 onwards, a growing gap opens up: investments hold up better, and exits drop more sharply. This decreasing trend will continue in 2023. In 2024, the gap opens up again: $600B+ of investments against $450B of exits, signalling a persistent difficulty in divesting at satisfying valuations.

Financial Engineering Tools

To combat these economic obstacles, however, PE funds have implemented financial engineering tools to still provide returns and optimize capital structure—for better liquidity without large asset sales. These tools include Dividend Recapitalizations, NAV Loans, Margin Loans, and Continuation Funds.

Dividend recapitalizations (or dividend recaps) are used to raise the leverage of a portfolio company to provide cash distributions to investors. This enables PE firms to return capital without a full exit of the entity. In January 2024 alone, there was $8.1 billion in junk-rated loans raised for dividends—a 6x increase from December 2023 (FT, February 5, 2024). For example, Apollo acquired Univar Solutions for nearly $8.1 billion and then, only six months later, raised $450 million in debt to pay equity holders. Raising dividends increases liquidity and immediate cash availability yet also increases leverage and default risk — especially in a stressed economy where debt service payments become costlier.

NAV (Net Asset Value) Loans are another liquidity-generating option, that consists of the fund borrowing money using its holdings in the companies it owns as collateral. The people who manage these funds can also take on additional debt, introducing an additional level of leverage. This type of loan, used to prop up a struggling company, has been used by big names such as Vista Equity Partners, Carlyle and Hg Capital. They are considered controversial because, in addition to increasing leverage, they clearly “cross-collateralize” the fund’s holdings, meaning they tie the fates of the companies together: if one goes bad, it can jeopardize the fund’s entire portfolio and its overall returns.

Private equity’s woes, coupled with the IPO crisis, are prompting many funds to resort to a controversial exit strategy: selling assets to “continuation funds” they set up, instead of achieving an exit at potentially lowball valuations. Continuation funds typically last about seven years and are seen as a way to defer the recognition of losses by selling their holdings to themselves rather than attempting to list them. This trend has been most prevalent in Asia, with five continuation funds created in the region in 2023, the most in a year since 2010, according to data from Preqin. The problem with continuation funds is that private equity firms are, actually, both buyers and sellers of the same assets, which creates an undoubted conflict of interest, raising questions about how fair prices for these transactions can be set.

It is also worth mentioning that private equity firms have recently been trying to insert clauses into financing agreements that allow them to take on more debt, drawing harsh criticism from lenders: it is the so-called “high-water EBITDA provision”, that allows a company to use the maximum amount of earnings generated in any 12 months to pass tests that determine the maximum debt the company can take on or the amount of dividends it can distribute, even if earnings have decreased compared to that given period. Firms such as KKR, Brookfield, Clayton Dubilier & Rice and BDT & MSD Partners have attempted to insert this clause into loan agreements but have met with strong opposition from potential lenders. In almost all cases, the provision has been removed from the final documents, but it has survived into at least one deal, a $2.1bn term loan for a commercial laundry operation, Alliance Laundry. According to S&P Global and Moody’s, the company planned to use the proceeds to refinance debt and pay a $890mn dividend to its owner.

The Belron Case Study

Belron is a company operating in the automotive services sector with a specific focus on vehicle glass repair and replacement. It is backed by major private equity investors including Clayton, Dubilier & Rice, Hellman & Friedman, BlackRock, and GIC. In September 2024, this group of investors took out an additional €8.1 billion in debt through a mix of bonds and loans. A significant portion of this liquidity was used to finance a €4.4 billion dividend payout to its investors, which includes the private equity firms, asset managers and Singaporean sovereign wealth fund. This distribution is the largest recent debt-funded dividend payout attempted by a private equity firm and pushed Belron’s net debt from just under €5 billion to just under €9 billion. Additionally, Belron’s Debt/EBITDA went from 3.3x to 5.8x. This sharp increase in leverage triggered a downgrade of Belron’s credit rating to below investment grade by Moody’s and S&P. At this specific point in time, the dividend recap was the most practicable strategy that allowed private equity owners to extract liquidity from their investments.

Belron’s transaction is a clear example of how private equity firms are exploiting financial engineering tools to adapt to a tighter credit environment. These strategies offer flexibility and early returns but may expose the firm to high financial risk, as evidenced by Belron’s increased leverage and consequent credit downgrades which reflects a broader scepticism around the sustainability of such transactions in a high-interest rate environment where the cost of debt is significantly higher. Critics argue that these financial engineering tools, while effective in the short term, may jeopardize the long-term financial stability of portfolio companies.

A further deterioration of market conditions may weaken the underlying asset since PE firms are prioritizing distributions over deleveraging. Indeed, strategies based on dividend recaps, NAV loans, and continuation funds raise important questions about long-term sustainability and systemic risk. Furthermore, in 2021, CD&R and its co-investors had already utilized a continuation fund to realize partial returns on their investment while retaining ownership in a high-performing portfolio company. If more firms follow similar paths, the private equity sector could face pressure from rating agencies and regulators since they would demand clear disclosures and more cautious leverage management.

The large scale of the transaction may lead analysts to consider Belron an outlier but the logic behind the deal is becoming very common in the sector. Since the current economic context prevents private Equity firms from pursuing traditional exit routes like IPOs and secondary sales, private equity firms have the incentive to rely on strategies such as dividend recapitalizations and continuation funds to generate liquidity without full exits. As interest rates remain high, the balance between short-term liquidity and long-term financial health will become increasingly important in assessing the sustainability of such strategies.

Conclusion

The common denominator of these strategies is the attempt to increase the leverage of the companies in the portfolio. This involves risks: companies loaded with extra debt could have difficulty repaying it in case of an economic slowdown and if rates do not move downward. This would increase the risk of default, not only for the individual company but also the risk of contagion between companies in the same portfolio.

Now more than ever, there is great uncertainty. The Trump tariffs turmoil is upsetting international markets, affecting growth and inflation estimates, and consequently forecasts of the next moves by the main central banks, so it’s difficult to make predictions, and funds must take into account all these uncertainties.

Bibliography

Bain. (2025). Global Private Equity Report 2025. [online] Available at: https://www.bain.com/it/insights/topics/global-private-equity-report/?epsremainingpath=/insights/topics/global-private-equity-report/

Gara, A., Livingstone, I. and Louch, W. (2024). Private equity groups hunt for new exit strategies as cash piles up. [online] www.ft.com. Available at: https://www.ft.com/content/079ccde6-3c3d-4791-953b-6e3e8203ef12

Louch, W. (2023). Private equity firms pivot away from traditional buyouts. [online] @FinancialTimes. Available at: https://www.ft.com/content/84409cde-1197-49c9-bf88-dbe371e44313

Platt, E. (2024). Private equity firms seek new terms to increase payouts on deals. [online] @FinancialTimes. Available at: https://www.ft.com/content/03061bdc-d880-4e82-b401-b4d92f51800b

www.ft.com. (2024). Private equity owners pile on debt to pay themselves dividends. [online] Available at: https://www.ft.com/content/956c1f0a-bb53-4982-9c07-b839f3446c2c

Comments are closed.