By Luca Gribaudo, Alice Finardi, and Luca Casali

Introduction

Global investment firm Permira announced that it has completed a strategic acquisition of a minority stake of 40% in the iconic Italian outerwear brand, K-Way, partnering with its parent company BasicNet. There is scope for Permira to reinforce its stake up to 60% during the first quarter of 2025, enabling it to play an increasingly important role in K-Way’s further growth. Mediobanca acted as exclusive financial adviser for BasicNet, while for Permira, there was Giliberti, Triscornia e Associati for legal, EY for financial, Maisto e Associati for tax, and Bain & Company for business strategy.

Overview on K-Way and BasicNet

K-Way was established in France in 1965, it positioned itself in the international market with the production of high-quality, packable waterproof jackets that married functional needs for outdoor adventurers and colorful designs appealing to urban trendsetters. In 2004, this iconic brand was acquired by Italian-based BasicNet, owner of other great brands such as Superga, Kappa, and Sebago. Based in Turin, BasicNet remodeled K-Way by combining classic elements with modern updates to capture the style and versatility desired for a broader and more diverse audience. Today, the K-Way collections include jackets, pants, bags, and accessories that are mainly sold in Europe, North America, and are growing in popularity in Asia. In 2023 the company posted EBITDA of €44.7m and was valued at €505m ($545.8m) at the time of its acquisition by Permira.

Overview on Permira

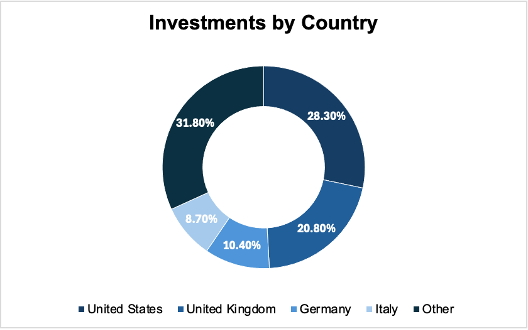

Since its founding in 1985, Permira has grown into one of the largest and most prominent private equity firms in the world, with $87bn (€82bn) in assets under management (AUM), with 16 active funds and an average fund size of $4.85bn. The firm currently has 83 active investments, belonging to different sectors such as technology, telecommunications, consumer products, and healthcare. The strategy of the consumer goods firm generally involves assisting brands in their transition into an omnichannel model, expansion into new regions, and renewal of digital and operational infrastructures. Additionally, Permira’s investments are geographically diverse, with Italy accounting for almost 9% of its overall investments. A breakdown of Permira’s investments by country is illustrated below:

Transaction Details

In 2023, K-Way achieved consolidated revenue (from direct sales, royalties, and sourcing commissions) of €147.7m and an EBITDA of €44.7m. For this transaction, K-Way is valued at an enterprise value of €505m, inclusive of IFRS 16 adjustments (leases), with an implied EV/EBITDA multiple equal to 11.3x. Subject to customary adjustments for the final calculation of net financial position and net working capital at closing, the proceeds expected at the completion of the transaction will be approximately between €180-190m for the 40% stake acquired by Permira. The consideration will be entirely paid in cash plus €10m in earn-outs.

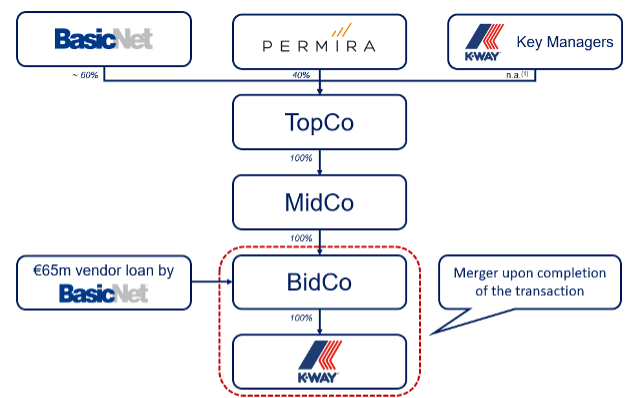

Moreover, BasicNet will grant a Vendor Loan amounting to €65m, with a term of 90 months, which can be refinanced, repayable in a single installment at maturity and remunerated with quarterly interest payments at an annual rate of 7.2%. The transaction is subject solely to the approval of the competent antitrust authority, and once such approval is obtained, it is expected to be completed in the first quarter of 2025.

Deal Rationale

Permira’s consumer team has an extended experience in the consumer discretionary sector having invested over €15bn, partnering with more than 40 companies worldwide, including some of the world’s most iconic brands such as Golden Goose, Reformation, Gruppo Florence, Hugo Boss and Valentino.

The rationale of the deal is that Permira will support K-Way’s growth with a particular focus on direct-to-consumer channels, bringing the resources and expertise needed to accelerate the development plans. Together, Permira and K-Way will aim to strengthen the brand’s leadership in France and Italy, open new stores, expand the product range and drive international growth (Il Sole 24 Ore).

Technicalities of the transaction

The transaction involves the creation of a holding company (TopCo), which will be directly owned by BasicNet, Permira, and certain key managers of K-Way, along with two other entities: MidCo (directly owned by TopCo) and BidCo (indirectly owned by TopCo). BidCo will hold 100% of K-Way’s share capital and a merger between BidCo and K-Way is planned upon completion of the transaction (BasicNet press release).

Furthermore, a shareholder agreement will be established among BasicNet, Permira, key managers, TopCo, MidCo, and BidCo, covering the governance and ownership structures of K-Way and its holding entities.

The shareholder agreement includes a two-year lock-up period for shares held in TopCo, as well as Permira’s exit rights. Permira will have the option to request BasicNet to transfer its shares in K-Way in any transaction involving Permira’s complete exit, on the same terms and conditions.

Additionally, if the total voting rights held directly or indirectly by Marco Boglione, founder and president of BasicNet, drop below 40%, Permira will have the right to sell its entire stake to BasicNet, which will be required to purchase it at fair market value on a proportional basis.

In any divestment scenario (whether through a third-party sale, sale to BasicNet, or an IPO), Permira will be entitled to additional shares, without any disbursement, to ensure its investment meets an agreed minimum internal rate of return (IRR), provided that BasicNet’s stake in K-Way remains above 51% (Il Sole 24 Ore).Moreover, if Permira exits its investment, BasicNet will receive an earn-out of €10m if Permira achieves a minimum return multiple on its invested capital.

Market reaction to the deal

Interestingly, Permira’s interest in BasicNet had a positive effect on BasicNet’s stock, which surged by 40% following the announcement, a reaction rooted in investor belief that Permira’s expertise could unlock BasicNet’s untapped potential. This jump signals renewed investor interest, particularly as BasicNet’s market capitalization had fallen below its book value before the deal. Such a discount suggests that investors may have perceived BasicNet’s assets as undervalued relative to their tangible worth.

The reasons behind this undervaluation could include lingering uncertainties about BasicNet’s scalability and competitive positioning in the global retail landscape. Some investors may be cautious about the costs and risks associated with BasicNet’s intended international expansion, questioning whether Permira’s involvement will sufficiently boost revenue and profits to justify a higher valuation. Additionally, broader economic factors like inflation and fluctuating consumer demand could be dampening market enthusiasm, keeping the stock price below its potential.

As of October 24, 2024, before Permira announced interest in the company, the price-to-book (P/B) ratio for BasicNet was approximately 0.53 (with a stock price of €3.6 and book value per share of €6.8). This means the market was valuing BasicNet at less than half of its book value, which may suggest that investors perceived the company to be undervalued or faced challenges affecting its market perception.

As of today, November 22, BasicNet’s stock price is €6.9, yielding a price-to-book (P/B) ratio of approximately 1.02. This increase shows the confidence that investors have in Permira’s ability to re-launch the company.

In fact, Permira’s track record in scaling consumer brands could represent a powerful catalyst for BasicNet’s growth. This deal could position the brand to capitalize on new markets and optimize operational efficiencies, potentially closing the gap between BasicNet’s market and book values. From an investors’ perspective, this undervaluation presents a possible buying opportunity.

Conclusion

Permira’s acquisition of a 40% stake in K-Way underscores its strategic approach to investing in high-potential consumer brands. With its proven expertise in scaling iconic companies such as Dr. Martens and Reformation, Permira is uniquely positioned to drive K-Way’s growth by enhancing its direct-to-consumer channels, expanding its product range, and strengthening its presence in key markets like Italy and France. The potential to increase its stake to 60% by 2025 further reflects Permira’s confidence in K-Way’s global prospects and its commitment to long-term value creation.

The market’s positive reaction, as evidenced by a 98% surge in BasicNet’s stock price since the initial announcement, highlights investor confidence in Permira’s ability to capitalize on K-Way’s iconic status and underutilized potential. With its extensive experience in the consumer discretionary sector and substantial resources, Permira is poised to transform K-Way into a global powerhouse, reaffirming its position as a leader in private equity-driven growth in the fashion industry.

Bibliography

BeBeez,

Il Sole 24 Ore,

FactSet,

Mergermarket,

https://mergermarket.ionanalytics.com

Pavesio Associati,

https://pavesioassociati.it/wp-content/uploads/2024/10/BasicNet-Cominicati-stampa-1.pdf

Yahoo Finance,

Comments are closed.