Real estate private equity (REPE) firms raise capital from outside investors, called Limited Partners (LPs), and then use this capital to acquire and develop properties, operate and improve them, and then sell them to realise a return on their investment. REPE firms usually focus on commercial real estate – offices, industrial, retail, multifamily, and specialised properties such as hotels – rather than residential real estate. If they do operate in residential real estate, the strategy is usually to buy, hold, and rent out homes to individuals.

The real estate industry, including real estate private equity, has not been exempted from the impact of the Covid-19 pandemic. Infection prevention measures and the resulting acceleration of technological change have put many business models under pressure, and the prevailing uncertainty has not made strategic planning and risk management any easier. Thanks to the massive government and central bank interventions, however, the real estate market demonstrated to be surprisingly resilient.

Funding

This resilience is also observable in terms of fundraising. In the first half of 2020, managers raised $55.1bn and are once again on track to surpass the $100bn yearly mark. We should point out that the market continues to consolidate, also because large, well-positioned managers have proven more successful in adapting to the new situation. Regionally, North America remains the most attractive market, followed by Europe and Asia. Especially in Asia, very positive trends can be observed, with $9.3bn collected in the first half of 2020 alone, compared to the $10.4bn raised in the entire year 2019.

Geographies

Latin America and Africa remain not rather unattractive for international funds. This is mainly due to the economic and political uncertainty that prevails in these regions (with some exceptions). Legal barriers to international investment, such as those in Brazil, do not make investments any easier. Therefore, these regions remain particularly interesting for smaller, local funds. This does not mean, however, that international investors remain completely inactive. In Venezuela, for example, one can observe funds that are quite willing to take risks in buying up distressed assets and hope for significant profits when the situation in the country improves.

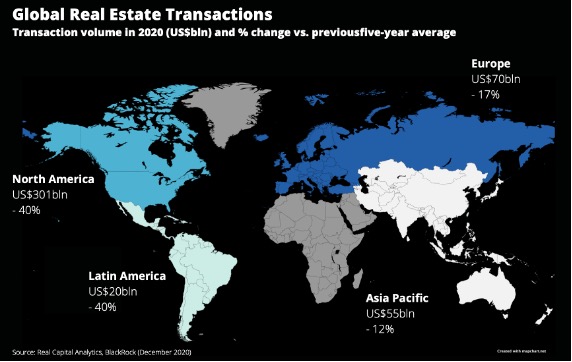

Despite the surprising resilience and low impact of the pandemic on fundraising, the crisis and especially the prevailing uncertainty in the market is noticeable. This is reflected above all in the transaction volume, which dropped significantly compared to the five-year average. The decline is directly related to the response to the pandemic. North and Latin America, where the annual deal volume fell by 40%, saw the biggest declines, which is due to the tedious struggles against the pandemic. Europe fared slightly better, seeing a 32% decline, thanks to effective measures taken by some countries, such as Germany. The best-performing region was APAC, where the pandemic was best-contained thanks to efficient contact tracing and targeted lockdowns, with total deal volume declining by only 12%.

Notwithstanding the better performance, there is a trend in APAC for international, especially American, investors to adopt a wait-and-see approach. This is mainly because, in such situations, investors act more risk-averse and that distressed situations in the US open up very interesting prospects, especially for opportunistic investors. Nevertheless, India for example offers numerous such opportunities especially in the residential sector, where IRRs of up to 23% can be expected, due to the implosion of non-bank finance companies.

The same holds for Europe, where one investor said “if you want US capital, you have to be able to offer them that extra incremental return”. Analysts expect distressed situations to be particularly interesting for private equity in the coming quarters to provide this extra return. As one private equity player in Europe said: “There is no sign of rents going up. There’s no sign of demand increasing. If anything, both of those are going in the opposite direction. There’s a lot of asset classes that are in trouble because of the crisis.” As a result, there already were some transactions in Europe in 2020 where hospitality players were forced to sell some assets to recapitalise. The trend is also reflected in fundraising, with €11.8bn, or 43% of the €27.5 billion raised by Europe-focused PE funds in the first three quarters of 2020 being raised by opportunistic funds. However, as a report by PWC shows, the pandemic has not triggered a radical change in the industry, but rather an acceleration of trends previously noticeable.

Residential

The COVID-19 crisis has highlighted the relative resilience of the multifamily sector. Multifamily displays robust levels of occupancy and rent collection underpinned by the basic need for housing, with tenants prioritising rent payments. It has also been supported by government interventions, such as job support schemes, that have protected incomes during the COVID-19 crisis.

However, demand will continue to come under pressure in 2021, so operators will need to review strategies to maintain lease-up rates (% occupied of a property that’s in lease, and all communities try to work on signing as many leases as possible as quickly as possible), occupancy and rent collection. Incorporating flexible workspace into developments and offering work-from-home furniture packages are measures that will be welcomed by tenants, although they will also add cost for operators.

The continuing impact of the pandemic will require an even greater focus on the tenant, operational efficiencies and incorporating flexible space into new development. This will:

- Enhance communities and maintain occupancy

- Boost lease-up rates

- Maintain income and improve cost-efficiency

Furthermore, there is an opportunity for private investors to diversify the location of portfolios and deliver single-family and affordable/social housing to:

- Capitalise on emerging trends

- Address the undersupply of social housing

- Create a more defensive and diversified income stream

Office

Leasing demand has been severely impaired by the impact of economic weakness and lockdown measures. Through the first three quarters of 2020, overall take-up across the main office markets is 40% down against the same period in 2019. The tendency of some occupiers to extend or renew in situations where viability will remain a limiting factor for leasing levels, but overall CBRE expects a rebound in leasing activity in the range of 10-15% next year, likely skewed towards the second half of the year.

Vacancies rising, but not uniformly

The supply side of office markets will continue to loosen in 2021, with overall vacancy rates rising. This trend is already evident, with the EU-28 vacancy rate up to >8.6% in Q3 2020 from 7.25% at the end of 2019. CBRE expects this figure to rise by a further 1-1.5pp in 2021. On the face of it, this will reduce or remove upward pressure on rents and expand occupier choice, but there are some important nuances. Firstly, before mid-2020, vacancy levels had been falling for several years, in some cases to levels that constrained occupier choice. Secondly, total market vacancy rates are mostly far higher than corresponding figures for core, prime space: occupiers with short-term expansion needs and tight search criteria will still face limitations on choice.

Pursue for quality

Based on evidence from a CBRE survey, a high proportion of corporates are looking to reduce their office footprint, support increased remote working and start to shift towards more agile choice-based work patterns, including greater use of flex space. The impacts will not be immediate, and clear trends may not emerge until post-vaccine, but they will represent a headwind to overall leasing demand. They will also favour higher quality, wellness-capable and tech-enabled buildings. Secondary, and more particularly tertiary, assets will face accelerated obsolescence and mid-range rents look more vulnerable than prime.

Lab space got premium from COVID-19

Leasing activity for lab space has shown tremendous growth with consistently lower vacancy rates and higher asking rents when compared to the traditional office market. As the life sciences industry continues to see record levels of corporate R&D spend, public and private research capital, and employment, the necessity for building and outfitting dedicated lab space has increased.

With steep costs and hidden complexities involved with building and managing space that has lab-grade ventilation, plumbing, and gas delivery systems, the average purchase price per square foot of commercial lab space is also significantly higher than traditional office space in cities like Boston ($750 vs. $515) and San Diego ($486 vs. $300).

Logistics

Logistics is in continuous expansion, driven by changing consumer patterns. Demand drivers are no longer correlated to GDP but related to the growth in E-commerce, which was accelerated by COVID-19. However, industrial assets can differ greatly – logistics yield spreads are still significant compared to office, especially when CAPEX-adjusted.

Last Mile Logistics

Consumers are increasingly expecting deliveries to arrive within days and as such we see an emerging trend in last-mile logistics, the final part of the supply chain. Compared to other industrial asset types, proximity to large urban areas is important – the lack of available land mitigates the risk of supply surpassing demand and driving returns down. On the other hand, last-mile supply cannot keep up with demand because, in these limited spaces, other high-value assets might be more appealing still, such as residential. Moreover, currently, only gateway markets have the density and customer base to pay for such delivery solutions.

Autonomous Vehicles and Logistics

Several companies are experimenting today with autonomous vehicles. It might be some time before they are used to transport people, but transport of goods might see a faster implementation. It would be a safe way to test the quality of such vehicles, routes from warehouse to pick up points are easier to program, and it would be profitable and efficient for companies.

From an ESG viewpoint, autonomous vehicles might decrease congestion and pollution by creating a centralised and efficient delivery system. Such an infrastructure will mitigate delivery vans blocking roads with their engines idling. Some companies are already capitalising on this emerging trend. UK grocery retailer Ocado is working with a start-up to deliver goods through underground tunnels, while Skyports US is working to allow drone deliveries to residential and commercial rooftops in Los Angeles, Singapore and London.

Autonomous deliveries represent both an opportunity and a challenge that will affect not only the logistics infrastructures but also the way residential and commercial assets are built and valued to integrate these changes.

Data Warehouses

The world moved online during COVID-19 and the need for data warehouses surged. Between February and April 2020, internet traffic increased globally by ~40%, driven by the usage of services such as streaming and video conferences.

Data centres are an attractive investment because migration is complex and costly and thus occupancy periods are usually 10-30 years, offering a secure long-term income stream. On the other hand, this asset class faces high barriers to entry because of high costs, specialisation and technological obsolescence. Nonetheless, the market is maturing rapidly, and we can expect yield compression soon. By 2026, the size of the global data centre market is expected to reach $251bn, growing at an average annual rate of 4.5%.

Retail

Retail has seen a difficult year with tenant insolvencies, store closures, and rent reductions, with some geographies having been impacted more than others. In Europe, retailer sales information is used to set the rent or make the decision to replace the tenant, making European retail rents more resilient when compared to the UK, where company voluntary arrangements allow retail tenants to relinquish lease liabilities.

Some investors, however, see a brighter picture for the future of retail, comparing it to the 2008 global financial crisis. Retail prices are currently at an all-time low, creating discount buy opportunities – similarly, 12 years ago, investor confidence in real estate was very low, but the ones who took advantage of the investment opportunities are the winners today.

Repurposing Retail

The uncertainty caused by COVID-19 has paved the way for repurposing of assets and mixed-use. The main target for such changes is retail, reflecting the increase of goods being purchased online as opposed to in-store. Some are repurposing shopping centres into mixed residential and office, while others convert them into last-mile logistics facilities.

Hospitality

Travel restrictions and work-from-home policies have caused a dramatic decline in the hotel market. Another aspect to factor in is that hotels are both CAPEX-intensive, requiring frequent renovation, as well as OPEX-intensive. However, confidence in a hospitality recovery is significantly greater than for retail. Reports suggest that $24.5bn in the capital were raised by closed-end funds for hospitality assets globally in 2020, similar to 2016 levels.

Work-from-hotel

Consumer preferences post-pandemic are driving changes in the designs of hotel rooms. Travellers are showcasing preferences for sizeable, individual private accommodations which they can use to work remotely. Contactless services such as room service and check-in are seeing increased demand as well. Finally, the preference towards this new type of hotel product, vacation homes and alternative accommodations will result in increased competition in the industry.

2021 Outlook

Promising economy: Near-term weakness but robust recovery in 2021, especially the second half

- Robust growth in 2021 following the availability of vaccines

- Risks still tilted to the downside

- Country differences caused by a combination of policy and industry mix

Supportive policy environment: Low-interest rates

- Low inflation – both current and expected – and significant asset purchases mean lower interest rate environment for longer

- Short-term interest rates not expected to rise until 2023

- Debt servicing is comfortable and debt sustainability is not a near-term risk

- Attractive property spreads on the risk-free rate will continue to drive interest in real assets, including real estate

Gradual recovery of investment in RE: CBRE forecasted investment volumes to grow by about 8.5% in 2021, and a return to pre-COVID norms by H2 2022

Gradual recovery of investment in RE: CBRE forecasted investment volumes to grow by about 8.5% in 2021, and a return to pre-COVID norms by H2 2022- As general uncertainty in the market subsides and travel restrictions are lifted, investors will return to investment markets

- Investor appetite for logistics, multifamily and prime office assets, especially in major markets, should continue through 2021

- Distressed sales in hotel and secondary retail assets will likely materialise in the near term

- As market floors are formed across non-prime sectors, equity investors will be well-positioned to capitalise on discounts

Authors:

Huiying Song, Ioana Gavrilescu, and Janpaul Pescollderungg

Editor:

References:

- https://thelawreviews.co.uk/title/the-real-estate-m-and-a-and-private-equity-review (The Law Reviews)

- https://www.pwc.com/gx/en/industries/financial-services/asset-management/emerging-trends-real-estate/europe-2021.html (PWC)

- https://www.blackrock.com/institutions/en-us/insights/investment-actions/global-real-assets-outlook(Blackrock)

- https://www.cbre.it/en/research-and-reports/2021-EMEA-Real-Estate-Market-Outlook (CBRE)

- https://www.ai-cio.com/news/forget-offices-invest-life-sciences-real-estate-report-says/ (Willis Towers Watson)

- https://pitchbook.com/news/reports/2020-annual-private-fund-strategies-report (Pitchbook)

- https://pitchbook.com/news/reports/h1-2020-real-assets-report (Pitchbook)

- https://go.preqin.com/eisneramper (Preqin)

- https://seic.com/sites/default/files/SEI-IMS-Future-of-Real-Estate-Investing-Whitepaper-US.pdf (SEIC)

- https://www.savills.com/impacts/Impacts_Mar_update/Impacts_Mar_DataCentres_v2.pdf(Savills research)

Photo by Jason Dent on Unsplash

Comments are closed.