Introduction

Established in 1981, CVC Capital Partners is among Europe’s largest and most reputable private equity firms; with operations across North America, Europe, and Asia, its investments focus on strategic opportunities, growth, and credit. Identified as an enticing opportunity, Multiversity owns Italy’s largest online university (Universitá Telematica Pegaso), as well as Mercatorum University and Università Telematica San Raffaele. CVC has extended its partnership with Multiversity through a transfer of the business from CVC Capital Partners VII (“Fund VII”) to a CVC-managed continuation fund.

Multiversity has demonstrated impressive performance since CVC Fund VII’s initial investment in 2019, underpinned by its ability to unlock an underserved and largely underpenetrated Italian undergraduate market. The business has also made significant investments in academic quality, student journey, and managerial talent, transitioning from a family-owned company to a professionalized corporate operator. From a broader perspective, this development is also an indication of the growing prevalence of continuation funds in the private equity markets.

Continuation Funds

In the wake of the 2008 global financial crisis, continuation funds, then known as restructuring funds, were originally designed to manage distressed assets amidst the severe economic turmoil. Although a key characteristic of private equity is the fund’s limited lifespan, by 2015, general partners (GPs) recognized that these funds could serve as an effective portfolio management tool not only for distressed assets but also for high-performing or trophy assets. By transferring the asset from the original fund to a newly created continuation fund, GPs can retain such assets beyond the fund’s original term. Furthermore, LPs from the legacy fund can choose to roll over their investment into the continuation fund, sell their stake (exit), or do a mix of both. Additionally, new LPs can join the continuation fund, enabling them to invest in more established, mature assets on a non-blind-pool basis.

According to the Evercore H1 2024 Secondary Market Review, in partnership with HEC, continuation funds offer comparable returns to buyout funds while offering lower return dispersion. In the study, simulated portfolios of 10 single-asset continuation vehicles (SACVs) were picked between 2019 and 2023 and buyout funds from the 2019 vintage. The SACVs in the report achieved an average total value-to-paid-in ratio (TVPI) of 1.499x, very close to the performance of the 2019 vintage buyout funds, which obtained an average TVPI of 1.513x. Remarkably, SACVs generated lower return dispersion compared to their buyout counterparts. The study suggests that the lower variability observed in SACVs could be attributed to the fact that these assets have, on average, already demonstrated strong performance. Following Oliver Gottschalg, professor of strategy and business policy at HEC School of Management, this naturally results in less extreme outcomes.

According to data from Evercore, SACV deals made up 44% of all continuation vehicles last year, and it’s expected that sponsors will continue utilizing these vehicles to retain their most promising investments. Advisory sources have raised concerns about a potential reverse selection bias in the future. High-quality portfolio companies might no longer be accessible in the traditional sponsor-to-sponsor market and could only be available within the continuation fund market. While some blue-chip sponsors have yet to explore continuation funds, recent deals, such as CVC’s, demonstrate that it may only be a matter of time before they do.

The Multiversity Deal

By extending its partnership with Multiversity, CVC will continue to support the business’s growth ambitions while providing continuity and stability. The private equity firm has enlisted Lazard and Morgan Stanley as financial advisors. Furthermore, the debt financing is arranged by Morgan Stanley, Goldman Sachs, and a group of additional underwriters.

CVC Capital Partners transferred Multiversity SpA from one of its funds to a single-asset continuation fund, in a transaction that added $1.1bn of debt to the group’s balance sheet, due 2031. The transaction has been closed for a total enterprise value of about $4.0 bn. When CVC acquired the remaining 50% of Multiversity in 2021 the EV was about $1.6bn. Multiversity will capitalize on its solid growth to deleverage in the future even though it could also take on more debt, within the actual debt documentation framework. Multiversity has demonstrated impressive growth, with adjusted EBITDA rising from $94m in 2020 to $222m in 2023, significantly surpassing initial projections. During the same period, undergraduate enrollment grew from approximately 87,000 in 2020 to over 151,000 in 2023.

Looking ahead, projections indicate that adjusted EBITDA will continue to grow annually by 20%-25%, reaching around $250m in 2024 and $320m in 2025. This growth is driven organically by an increase in student enrollment, supported by the rising popularity of online education, gains in market share, the addition of new courses, enhancements to the educational offering, and moderate tuition fee increases. Additionally, Multiversity is integrating several bolt-on acquisitions completed in 2022, including Università San Raffaele Roma, Aulab, and Sole 24 Ore Formazione SpA.

Secondary Markets Outlook & Predictions

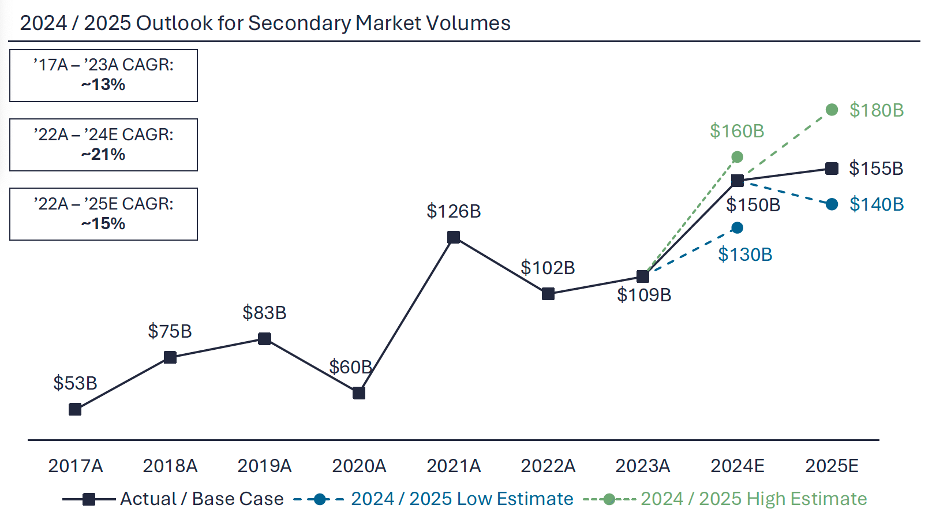

The secondary market performed exceptionally well in the first half of 2024, with volumes surpassing $70bn, setting a new high for H1 secondary transaction volumes on record. Despite some encouraging trends in the M&A market, delayed distributions have prompted sponsors and limited partners to turn to GP-led and LP-led secondary markets to unlock liquidity. On the demand side, an influx of new participants in the secondary market, coupled with the significant growth in the AUM of 1940 Act Funds, has increased the available capital for deployment. Additionally, traditional secondary investors have raised substantial capital for specialized strategies and flagship funds, boosting demand for transactions and leading to improved pricing across nearly all strategies.

GP-led transaction volume reached $28bn in the first half of 2024, a 56% increase compared to the same period in 2023. This growth reflects sponsors’ ongoing reliance on the GP-led market to develop innovative liquidity solutions for their portfolio companies amidst a challenging M&A and IPO environment. GPs are increasingly retaining their top-performing businesses, while the continuation fund market solidifies its position as a viable alternative liquidity route, now accounting for a record 14% of total sponsor-backed exit volume.

Continuation funds have demonstrated their versatility as a reliable exit strategy in both high-activity M&A periods, like 2021, and times of lower deal volume. As sponsors grow more comfortable with this approach, they increasingly see these transactions not just as an alternative exit, but as a tool to provide interim liquidity while retaining ownership of highly attractive companies for longer. Many sponsors have already completed their first and even second continuation funds and believe that each flagship fund could include at least one or two single-asset continuation fund candidates.

While private equity remains the leading asset class in secondary market volume, other asset classes are expected to surpass their 2023 levels and experience significant growth in the coming years. Asset classes such as credit and infrastructure are projected to see modest year-on-year increases of $1bn to $2bn, according to PJT’s report. In contrast, venture secondaries are expected to experience the most substantial growth, rising from $17bn in 2023 to an estimated $22bn by the end of 2024. PJT further forecasts that deal volumes for credit, infrastructure, real estate, and venture secondaries could potentially triple by 2030.

Conclusion

A key characteristic of the traditional private equity model is the fund’s limited lifespan. Once the fund reaches the end of its term, its assets are liquidated, and the proceeds are distributed to the limited partners. However, this approach might not maximize returns, as the asset could still have the potential for further growth, value creation, and future returns. This model has proven to be an increasingly attractive way to exit investments, as demonstrated by the case of Multiversity, which highlights how continuation funds not only provide a means to extend the holding period for high-performing assets but also create a structured mechanism for GPs and LPs to maximize value. Such transactions illustrate the growing appeal of continuation funds as a flexible and strategic exit route within private equity, and the broader growth of private equity secondaries.

Bibliography

https://www.cvc.com/media/news/2024/cvc-extends-its-partnership-with-multiversity/

https://www.lazard.com/research-insights/lazard-interim-secondary-market-report-2024/

https://disclosure.spglobal.com/ratings/en/regulatory/article/-/view/type/HTML/id/3187108

Comments are closed.