By Clara Perelman, Brando Savioli, Edward Ramirez, and Carlo Orlandi

The Traditional Asset Management Model

In a rapidly evolving financial landscape, traditional asset managers are looking at alternative investments, seeking higher returns and higher market valuations as revenue streams face mounting pressure. Resource supervisors rely on a straightforward business model. They produce revenue through fees calculated as a percentage of assets under management (AUM). Fees typically average around 1.0% of AUM for actively managed funds. However, passive investment vehicles (like index funds) carry altogether lower expenses, often a couple of basis points. This fee-based model has proven profitable during prolonged bull markets, as rising asset values naturally boost income without requiring additional client acquisition.

Nevertheless, the traditional asset management model presently faces considerable challenges. Charge compression is fueled by strong competition, increasing regulatory scrutiny, and the rapid growth of low-cost passive investment options. It has relentlessly dissolved profit margins over the industry. As passive investing has gained popularity, large asset managers overseeing index funds and ETFs have been constrained to cut expenses to hold market share, often charging as little as 10 basis points (0.1%) on AUM.

In addition, the shift towards fee transparency and the growing emphasis on fiduciary duty have prompted clients to analyze the esteem they receive in trade for expenses. Subsequently, it is increasingly troublesome for traditional managers to legitimize premium charges without evident benefits. For example, institutional investors (like pension funds and endowments) are now more likely to compare administration expenses over distinct providers. Does paying higher fees for active management truly lead to better returns than lower-cost passive options? Firms such as Vanguard and BlackRock have capitalized on this drift by advertising ultra-low-fee index funds and ETFs, frequently charging as little as 3 to 10 basis points (0.03% to 0.1%). This shift pressures traditional asset managers. They must either diminish their fees to remain competitive or find ways to expand their offerings to illustrate additional value.

Therefore, numerous firms are expanding into alternative investments to meet clients’ requests for higher returns and reduced market correlation. BlackRock, for instance, has significantly reinforced its alternatives division, adding private equity, real estate, and infrastructure investments to its lineup. Now, they can charge higher management fees and offer products that provide unique risk-return profiles. It is appealing to clients who look for returns that are less dependent on stock and bond market fluctuations. In addition, firms like The Carlyle Group and KKR focus deliberately on private equity and other alternatives, where fee structures allow them to charge both a management fee and a performance incentive, known as “carry.” For example, Carlyle charges around 20.0% of profits on top of their management fee, making an income stream that far exceeds the returns of conventional AUM-based fees, specifically when their investments perform well.

Valuation Disparities Put Things Into Perspective

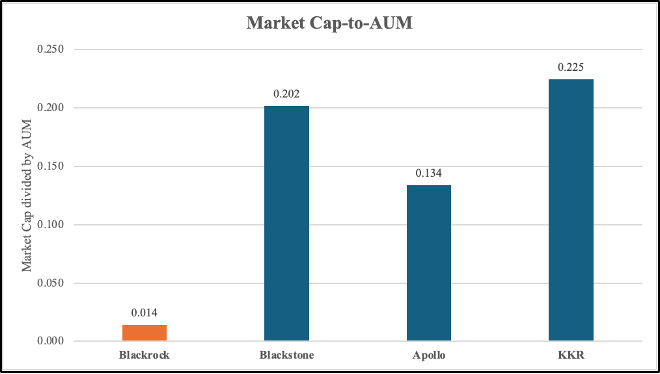

A striking valuation gap exists between traditional asset managers and alternative investment firms. Considering that, on average, Asset Managers charge 10 basis points as management fees for their different services, a valuation at 10 times earnings leads us to the conclusion that traditional asset managers are typically valued at around 1.0% of their AUM . On the other hand, alternative investment managers command valuations closer to 10.0% of their AUM (Matt Levine, Money Stuff), with cases below even much above that threshold. Clearly, this disparity creates a compelling case for traditional managers to diversify into alternative investments.

Consider BlackRock, which manages approximately $11.5tn in assets but maintains a market value of around $160bn. In contrast, firms like Blackstone, Apollo Global Management, and KKR manage substantially smaller asset pools yet command market valuations in a similar range. (Blackstone: $222bn, Apollo: $98bn, KKR: $135bn).

To put this better into perspective, we look at the Market Cap-to-AUM ratio, which further shows how alternative investment firms, in this case PE, are valued far more highly relative to their assets under management.

This valuation disconnect highlights the premium investors place on alternative investment capabilities and their associated higher fee structures, despite the greater risk and illiquidity of investments within alternative investments. Taking an extreme point of view, considering the valuation of these alternative investment firms, if asset managers like Blackrock were to increase their exposure to the alternative investment industry, their market valuation would see an incredible rise (say closer to 10.0% of AUM), and potentially add hundreds of billions to its valuation.

The Economics of Alternatives

The financial rationale for this strategic shift is compelling. Taking BlackRock as an example, alternatives represented just 3.0% of total assets in the third quarter but generated 11.0% of total revenue. This outsized contribution to the bottom line demonstrates the lucrative nature of alternative investment fees compared to traditional investment management fees.

Alternative investments commonly employ a fee structure known as “2 and 20”: a 2.0% annual management fee on assets under management (AUM) and a 20.0% performance fee on profits exceeding a predefined hurdle rate, typically ranging from 6.0% to 8.0%. This structure ensures that general partners (GPs) are rewarded only after achieving a minimum return for investors, creating strong alignment. Notably, the hurdle rate is cumulative and compounded annually, meaning GPs can only earn their share of the profits after surpassing this benchmark throughout the fund’s lifecycle.

Beyond these fees, carried interest – the share of profits allocated to GPs – further incentivises performance. For example, in private equity, carried interest is structured to reward sustained results over multi-year horizons, often distributed via special limited partnership arrangements to team members, reinforcing both retention and motivation. The economics of these fees are designed to reflect the complexity and illiquidity of alternative assets. For instance, private equity funds often require long-term capital commitments, while hedge funds implement intricate strategies across diverse asset classes. This scarcity and complexity premium appeals to institutional clients seeking superior risk-adjusted returns and diversification.

Case Studies on the Transition from Traditional Asset Managers to Alternative Investments

Traditional asset managers are increasingly repositioning themselves as alternative investment platforms, a shift exemplified by BlackRock’s recent expansion strategy. The firm has made several strategic moves to expand its alternatives footprint, including acquiring a minority stake in Millennium Management, purchasing Global Infrastructure Partners, and acquiring Preqin, a leading alternative investment data provider. Additionally, Blackrock has engaged in discussions with HPS Investment Partners, a private credit manager, with aims of establishing a larger presence in the private credit sector. These moves represent a calculated strategy to capture higher fees and potentially unlock higher valuations. Other asset managers are likely to follow suit, recognising the potential for significant value creation through expansion into alternative investments.

Other major asset management firms have also accelerated their expansion into alternative investments, recognising the benefits of diversifying beyond traditional asset classes. Goldman Sachs, for example, has allocated significant resources to expand its alternatives division, especially in private equity, private credit, real estate, and infrastructure. By doing so, Goldman aims to capture higher margin business, and compete with alternative giants like Blackstone, whose valuation is ~20.0% of AUM, compared to ~1.0% for traditional managers. Similarly, JPMorgan Asset Management has enhanced its alternatives platform, attracting large institutional clients with its global infrastructure investments and diversifying into private debt, private equity, and hedge funds. This industry wide push into alternatives underscores a broader shift, as traditional asset managers like Blackrock, Goldman and JPMorgan aim to close the valuation gap with alternative investment firms by expanding their alternatives exposure and capturing the premium associated with higher fee sectors.

Looking Ahead

The transformation of traditional asset managers into hybrid firms with significant alternative investment capabilities is set to accelerate, driven by several key factors.

In a low-margin environment, the pursuit of higher profitability has made alternatives an attractive avenue. Firms that develop robust alternative platforms can enhance their market valuations, narrowing the gap with dedicated alternative managers. At the same time, institutional demand for alternative investments continues to grow, fueled by their potential to deliver diversification and superior risk-adjusted returns. Lastly, as competition within the industry intensifies, the ability to differentiate through alternative offerings becomes a strategic imperative.

This evolution could blur the distinction between traditional and alternative asset managers, potentially leading to a unified model where both operate seamlessly within diversified platforms. The success of this transformation will hinge on execution, particularly the ability to scale alternative investment offerings without compromising performance.

In conclusion, the industry’s transition into this hybrid model represents a paradigm shift that could redefine asset management in the coming decades, reshaping client relationships and market valuations.

Bibliography

Blackrock,

https://ir.blackrock.com/financials/annual-reports-and-proxy/default.aspx

La Stampa Finanza,

Moonfare,

https://www.moonfare.com/glossary/hurdle-rate-preferred-return

Dentons, https://www.dentons.com/en/insights/articles/2024/may/21/carried-interest-a-closer-look

Bloomberg,

https://www.bloomberg.com/account/newsletters/money-stuff?source=msweb

Comments are closed.