By Clara Carlhammar, Davide Franchini, Alessandro Bosco, and Nikolas Papadatos

Introduction

On 24 October 2024, the global investment firm KKR (Kohlberg Kravis Roberts & Co.) entered into an agreement to acquire a 25% minority stake in Enilive, a newly established company that is consolidating Italian Eni’s mobility businesses, including Eni Sustainable Mobility and its fuel retail operations. The objective of this strategic partnership is to facilitate accelerated growth in the sustainable mobility sector by leveraging KKR’s expertise as a long-term investor in the energy and infrastructure sector.

The minority stake held by KKR has an aggregate value of €2,938bn. The transaction will be financed through the subscription of a capital increase in Enilive, which is reserved for KKR, with a total value of €500m, and the purchase of Enilive’s shares from Eni, with a value of €2.438bn. This corresponds to a post-money valuation of €11.75bn of equity value for 100% of Enilive’s share capital. Prior to the completion of the transaction, Eni will undertake a capital increase of €500m, with the objective of establishing a debt-free company.

It is anticipated that the subsidiary will generate core earnings of approximately €1.2 billion in 2025, representing an increase from the €1 billion estimated for the current year. JP Morgan and Mediobanca acted as sell-side advisers for Eni, while Deutsche Bank and UniCredit served as buy-side advisers for KKR, with Kirkland & Ellis and Gianni & Origoni providing legal counsel.

The Players

KKR is a preeminent global investment firm with over $510 billion in assets under management. KKR oversees the management of a diverse array of alternative asset classes, including private equity ($149bn), real estate ($75bn), and credit ($237bn). With a focus on long-term value creation, KKR brings substantial capital and industry experience to its investments across various sectors. In 2008, KKR initiated its Global Infrastructure Strategy, which has positioned the firm as one of the most active global infrastructure investors, with over $73bn in infrastructure assets under management. In terms of geographical reach, the firm has a particularly strong presence in Europe and is actively seeking opportunities to expand its investments, with a particular focus on Italy.

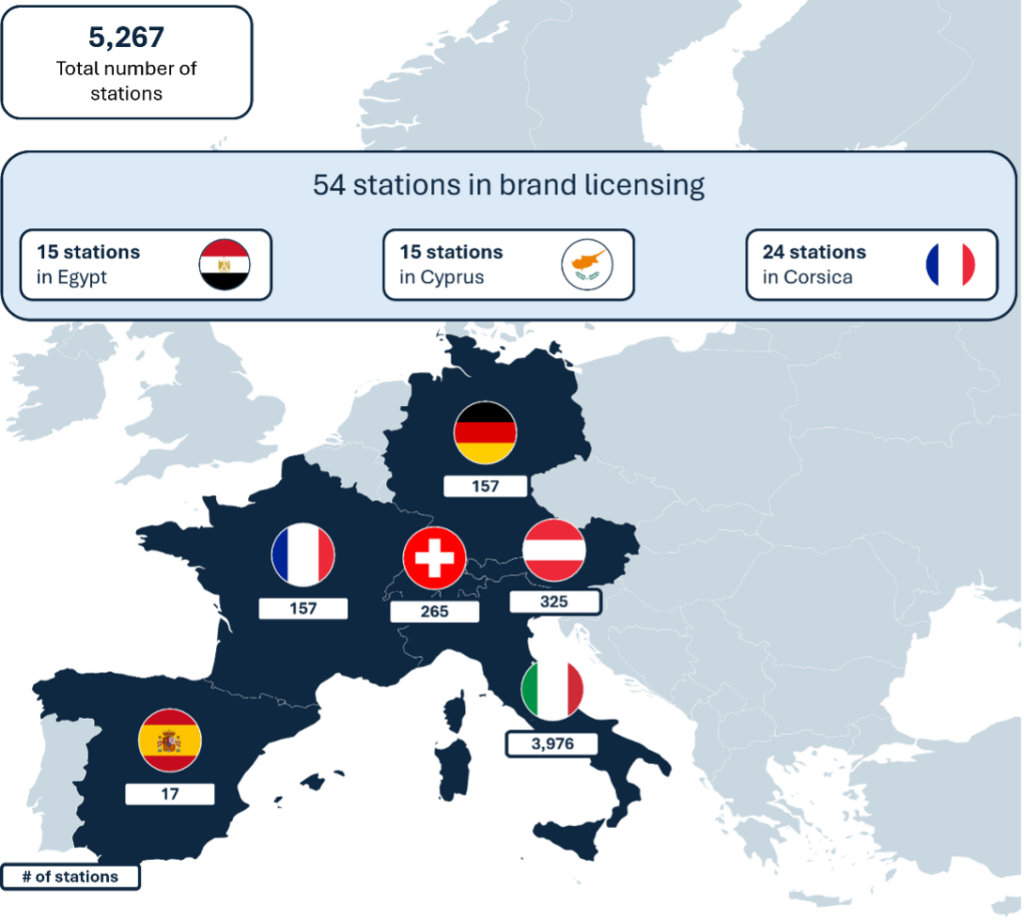

EniLive is a subsidiary of Eni, an Italian multinational energy company with a particular focus on oil and gas. Eni’s traditional fuel retail operations are integrated with its sustainable mobility initiatives, which include the production of biofuels and the development of electric vehicle charging infrastructure. The company offers innovative and progressively decarbonised services and products in support of a sustainability-driven transformation in mobility. Consequently, Enilive plays a role in Eni’s objective of attaining carbon neutrality by 2050.

The Acquisition Rationale

The partnership between KKR and Enilive is driven by a shared commitment to advancing sustainable mobility solutions. One of the key motivations behind the acquisition is the expansion of sustainable offerings. KKR’s investment will accelerate the development and distribution of advanced biofuels and enhance Enilive’s electric vehicle charging infrastructure, thereby strengthening its sustainable product portfolio. Market positioning also played a significant role in this strategic move. KKR aims to deepen its presence in the European market, particularly in Italy, through targeted investments in key infrastructure and energy assets. This aligns with KKR’s broader strategy in Italy, where the firm has already demonstrated interest in the telecommunications sector through its acquisition of TIM, which was formally approved by antitrust authorities in July 2024. The investment in Enilive reinforces KKR’s commitment to expanding its footprint in Italy and capitalizing on the country’s growing sustainable energy and mobility sectors. Additionally, the partnership is expected to drive innovation and growth. By leveraging KKR’s financial strength and industry expertise, Enilive can accelerate product development, strengthen its competitive position, and drive long-term value creation.

Claudio Descalzi, CEO of Eni, stated:

“This agreement marks a significant milestone in our journey towards sustainable energy solutions. Partnering with KKR will enhance our ability to deliver innovative mobility services and accelerate our decarbonization efforts.”

Tim Franks, Partner and Head of EMEA Infrastructure at KKR, commented:

“We are pleased to collaborate with Enilive to promote sustainable mobility. This investment aligns with our commitment to environmental sustainability and long-term value creation in the infrastructure sector. Strengthening our presence in Italy is a strategic priority for KKR, and we look forward to supporting Enilive’s growth in this vital market.”

Potential Synergies

The acquisition presents a unique opportunity for strategic synergies between KKR and Enilive. One key area of collaboration is the integration of technology. By leveraging KKR’s portfolio companies in the technology sector, Enilive will be able to enhance its digital capabilities, particularly through the implementation of advanced data analytics to optimize the performance and efficiency of its electric vehicle (EV) charging networks. Additionally, operational efficiency is expected to improve through the transfer of best practices from KKR’s global investments. Drawing on KKR’s extensive experience across various sectors will enable Enilive to reduce costs and increase operational efficiency by capitalizing on economies of scale. Furthermore, the partnership will strengthen Enilive’s sustainability expertise. The combined resources of both firms will support further research and development in sustainable fuels and energy storage solutions, accelerating Enilive’s innovation pipeline and reinforcing its competitive edge in the sustainable mobility sector.

Potential Risks

Despite the considerable potential of this acquisition, it is not without inherent risks. One of the earliest potential risks arises from the Italian regulatory environment. The transaction is contingent upon obtaining regulatory approvals, and the introduction of more stringent environmental policies or market interventions could result in delays or challenges to its completion. Furthermore, Enilive’s ambitious plans to more than double its biorefining capacity by 2026 and achieve 5 million tons by 2030 present certain operational and execution risks. This level of expansion requires substantial investment from shareholders and exceptional project management of such investments.

Furthermore, market dynamics may prove to be a significant challenge to the success of this partnership. The renewable energy sector is characterised by intense competition, rapid technological advancement and pricing pressures that could impact Enilive’s profitability. Furthermore, geopolitical uncertainties and fluctuating energy prices, as exemplified by those currently in evidence, may also affect the demand for sustainable mobility solutions, thereby reducing the revenues and profitability of the company in the longer term.

Finally, the integration of the partnership may present certain risks, including the potential for cultural and strategic misalignments between KKR and Enilive, which could further impede the realisation of the business plan and projected synergies.

Conclusion

The acquisition of a 25% stake in Enilive by KKR represents a strategic move to accelerate growth in the sustainable mobility sector. The partnership is expected to make significant contributions to reducing carbon emissions and promoting environmental sustainability in transportation by combining Enilive’s expertise in energy and mobility and presence in the Italian market with KKR’s investment knowledge. This collaboration serves to enhance KKR’s exposure in the European market, whilst simultaneously confirming its commitment to investing in Italy’s evolving market, with a particular focus on low-competition sectors. The partnership is indicative of a growing trend of investments aimed at accelerating the transition towards greener energy solutions within the global mobility industry.

Sources

KKR, KKR Invests In Enilive To Accelerate Sustainable Mobility, https://media.kkr.com/news-details?news_id=e5ee83e3-1f32-4dae-9a85-329a1e0614c8

Enilive, Eni signs agreement for KKR to enter Enilive’s share capital, https://www.eni.com/en-IT/media/press-release/2024/10/eni-signs-agreement-for-kkr-to-enter-enilive-s-share-capital.html

Reuters, Italy’s Eni sees 2.5-billion-euro net proceeds from disposals in 2025, https://www.reuters.com/business/energy/italys-eni-sees-25-billion-euro-net-proceeds-disposals-2025-2024-10-25/#:~:text=The%20group%20announced%20on%20Thursday,cut%20its%20greenhouse%20gas%20emissions.

Mobility Plaza, Eni sells 25% stake in Enilive to KKR in €2.9 billion deal, https://www.mobilityplaza.org/news/39333#:~:text=Global%20investment%20firm%20KKR%20have,Enilive%20at%20%E2%82%AC11.75%20billion.

Ansa, KKR buys 25% stake in Enilive for 2.9 bn, https://www.ansa.it/english/news/general_news/2024/10/24/kkr-buys-25-stake-in-enilive-for-2.9-bn_cd161cda-aba4-4f8d-9f03-768e698bf3d4.html

Comments are closed.