By Daniel Semotan, Luca Zirener, and Jakub Penkiewicz

Introduction

Over the last decades, Poland emerged as a new dynamic hub for private equity in Central and Eastern Europe (CEE). Poland has been able to attract global interest due to its robust economy, strategic location, and favourable investment climate. Enabled by strong economic fundamentals, government support, and a growing pool of talented entrepreneurs, the Polish private equity market has been able to mature.

A great example of the transformative power of private equity in Poland is the success story of Velvet CARE. This leading producer of paper-based hygiene products underwent a remarkable transformation through the support of private equity investors. Through strategic investments and expansion initiatives, Velvet CARE has solidified its position as a market leader and a symbol of Poland’s growing economic ability. As we dive deeper into this article, we will explore the key trends shaping the Polish private equity market, analyse the challenges and opportunities facing investors, as well as examine the factors driving the country’s emergence as a global investment destination.

A Rising Star in CCE Private Equity

Poland’s transformation from a socialist state to a prosperous market economy has laid the foundation for its PE market’s expansion, making it a standout destination in the region. Since its economic liberalization in the early 1990s, Poland has been one of the fastest-growing economies in Europe, achieving sustained GDP growth of almost 4% since 1992. Today, it ranks as the largest economy in the CEE region, contributing approximately 25% of its GDP. Warsaw, Poland’s capital and financial hub, has become a magnet for global and regional investors, supported by a robust infrastructure, a skilled workforce, and a population of almost 2 million.

In 2021, Poland attracted 424 foreign direct investment (FDI) projects, an 11% increase from the previous year, with total capital inflows exceeding €10 billion. These investments have propelled growth in critical technology, manufacturing, healthcare, and renewable energy sectors. Poland’s strong economic fundamentals, geographic location between Western Europe and Eastern markets, and increasing consumer demand have created a fruitful environment for private equity activity.

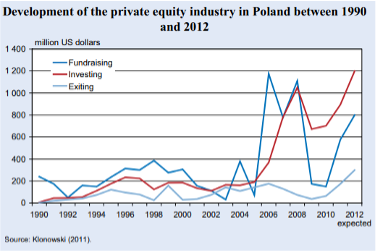

Transforming Poland’s Private Equity Landscape

Poland’s private equity market has matured significantly, evolving from small-scale investments in privatized state enterprises to high-value deals in diverse sectors. The country has witnessed record-breaking deal flows, including prominent transactions such as Enterprise Investors’ sale of Novaturas, the largest travel agency in the Baltic states, and PFR Ventures’ significant commitments to support venture capital in technology. Notable players in the market include Enterprise Investors, which has raised over €2.1 billion across nine funds, Mid Europa Partners, managing approximately €5.3 billion in assets, MCI Capital, with gross assets of around €640 million, and Innova Capital, which has invested over €1 billion since its founding. These firms have spearheaded investments in sectors such as e-commerce, logistics, and healthcare, contributing to the modernization and internationalization of Polish businesses.

Key Trends Shaping the Market

The Polish private equity market is increasingly defined by its strategic focus on high-growth sectors such as technology, renewable energy, and healthcare. The renewable energy sector has particularly captured investor interest as Poland transitions from coal to greener energy sources. With government policies favouring decarbonization and sustainable energy development, the sector has become a prime private equity and venture capital target. In 2022 alone, investments in renewable energy projects exceeded €500 million, demonstrating the strong momentum in this critical area.

Digital transformation also plays a pivotal role in Poland’s economic trajectory. Investments in fintech, software development, and IT services have surged, reflecting Poland’s reputation as a regional tech hub. This digital focus aligns with broader global trends as companies leverage technology to drive efficiency, innovation, and scalability. Furthermore, ESG principles are central to Poland’s private equity strategies, as investors prioritize companies in alignment with the European Union’s Green Deal objectives and seek to balance profitability with sustainability.

Looking ahead, Poland’s PE market is poised for more growth. The country’s ambitious green energy targets, digitalization initiatives, and consumer-driven economy present compelling opportunities for PE firms. According to PSIK (Polish Private Equity and Venture Capital Association), the average deal size in the Polish PE market is expected to reach $1.2 billion by 2025, underscoring investor confidence and solidifying its position as a leader in the CEE private equity landscape. However, challenges remain. Regulatory uncertainties require careful navigation, particularly in foreign investments and sector-specific policies. Additionally, increasing competition among PE firms for high-quality assets may lead to inflated valuations, necessitating innovative investment strategies.

Velvet CARE: From Struggling Spin-off to Global Player

Velvet CARE is a leading Polish producer of paper-based hygiene/care products, including tissues, toilet paper and kitchen paper towels. Velvet CARE enjoys widespread brand recognition in Poland, with its products being a staple in households across the country. Despite a strong brand, Velvet found itself struggling at one point but ended up being a model case of how private equity can add value and completely transform a business. The company in its current form was founded in 2013 when it spun off from Kimberly Clark, a listed American company, however, its roots date back to 1897. Kimberly Clark entered the Polish market in 2003 by acquiring a well-known brand, but since the results disappointed the American owners, they wanted to exit. The CEO believed strongly in his company and hence undertook a management buy-out, but due to lack of funds, they had to find a partner in Avallon – a PE fund dedicated to management buy-outs.

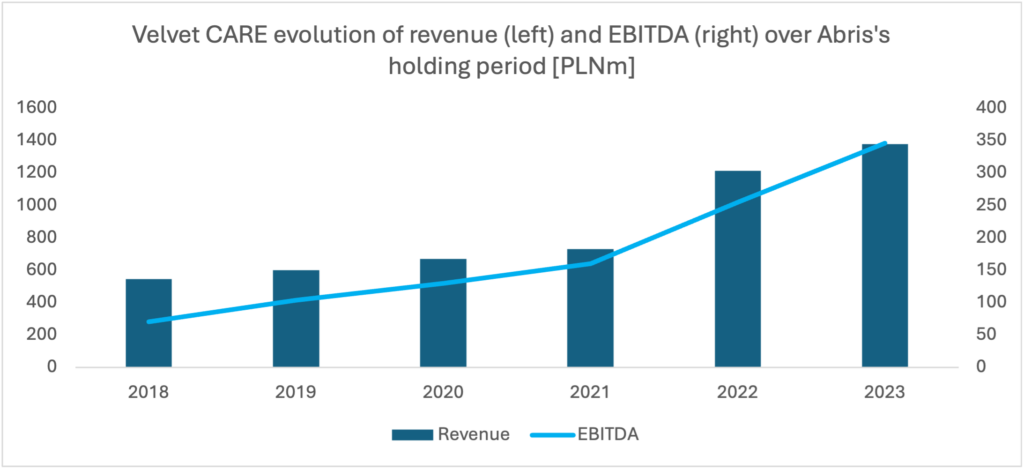

Avallon focused on transforming Velvet CARE from a corporate division into an independent company by launching new credit lines, introducing a new brand logo and corporate visualization, building a purchasing department, and developing computer systems. During the holding period, approximately PLN 250 million was invested in machinery, which allowed it to double production capacity and build a new paper machine – the company’s most important asset. By 2018, Velvet CARE’s employee count had grown from 320 to 530, its annual sales had surged from PLN 230 million to PLN 400 million and it became an undisputed market leader in the main product categories.

Avallon exited the investment in May 2018, selling Velvet CARE to Abris Capital Partners. Abris focused on scaling the business, investing in innovation and expansion. Abris helped Velvet conduct major capital expenditures increase, leading to new technology – one of the most modern paper machines in Europe. In 2020, Velvet CARE acquired Moracell, the leading manufacturer of paper hygiene products in the Czech Republic. This acquisition brought a modern machinery park, robust infrastructure, a well-known brand, and a strong presence in the Czech and Slovak markets. In 2022, after the pandemic, the company’s revenues grew substantially and hence Abris decided that it was time to prepare for an exit.

In December 2023, Abris signed an agreement to sell Velvet CARE to Partners Group, a global private markets firm. This acquisition highlights Velvet CARE’s strong financial fundamentals, resilience, and growth potential Partners Group aims to strengthen Velvet CARE’s market position, with an IPO being one of the potential exit strategies. Velvet CARE’s transformation from a corporate spin-off to a regional market leader underscores the critical role private equity can play in the CEE region. Velvet CARE’s success not only highlights the potential of private equity in emerging markets but also serves as a model for how businesses can achieve sustainable growth and resilience.

A Promising Future for Polish Private Equity

Poland’s emergence as a dynamic hub for private equity investment, coupled with the transformative power of private equity, as exemplified by Velvet CARE’s success story, underscores the significant potential of the Polish market. Velvet CARE, once a struggling corporate spin-off, has transformed into a regional market leader under the guidance of private equity investors. Through strategic investments, like the acquisition of Moracell, Velvet CARE has demonstrated the potential of private equity to unlock value and drive sustainable growth.

As Poland continues to attract global investment and drive economic growth, the role of private equity in shaping its future will be increasingly important. The Polish private equity market is poised for further growth, driven by strategic investments in high-growth sectors, supportive government policies, and a thriving entrepreneurial ecosystem. By understanding the key trends, and opportunities in this dynamic market, investors can position themselves to capitalize on the significant potential of Poland’s private equity landscape.

Bibliography

“M&A Activity in Poland,” Aventis Advisors, https://aventis-advisors.com/ma-poland/

“Poland: Europe’s New Key Player,” Le Monde, September 17, 2024, https://www.lemonde.fr/en/international/article/2024/09/17/poland-europe-s-new-key-player_6726374_4.html

“Optimism Remains in Europe as Foreign Direct Investment Declines,” EY, https://www.ey.com/en_gl/foreign-direct-investment-surveys/optimism-remains-in-europe-as-foreign-direct-investment-declines

“Private Equity Activity Report 2023,” Invest Europe, May 7, 2024, https://www.investeurope.eu/media/i4zpjz1m/20240507_invest-europe_pe-activity-data-2023-report.pdf

“Focus: Poland’s Economic Growth and Investment Trends,” Ifo Institute, https://www.ifo.de/DocDL/forum1-13-focus6.pdf

“Investment in Poland 2024 Edition,” KPMG, August 2024, https://kpmg.com/pl/en/home/insights/2024/08/investment-in-poland-2024-edition.html

“A Vision for Poland’s Clean Energy Transition,” Clean Air Task Force, https://www.catf.us/resource/a-vision-for-polands-clean-energy-transition/

“Private Equity in CEE: Creating Value and Continued Growth,” Deloitte, 2020, https://www.deloitte.com/ce/en/services/deloitte-private/research/report-private-equity-in-cee-creating-value-and-continued-growth.html

“Private Equity and Venture Capital in Central and Eastern Europe,” Bain & Company, November 2022, https://www.bain.com/insights/private-equity-and-venture-capital-in-central-and-eastern-europe/

“Private Equity in Central and Eastern Europe,” Aventis Advisors, August 2024, https://aventis-advisors.com/private-equity-in-central-and-eastern-europe/

“Velvet CARE Sp. z o.o. financial statements, KRS (National Court Register) database – 2018-2023“

“Velvet CARE Company website”, https://www.velvetcare.com/en/

“ABRIS Capital Partners – ABRIS sells Velvet CARE to Partners Group“, 2023 https://abris-capital.com/news/abris-sells-velvet-care-to-partners-group/

Comments are closed.