by Gustaf Cramer, Ludovica Mingarelli, and Lyann Djenabzadeh

Introduction

In the midst of a decline in M&A and IPO activity, Private Equity (PE) firms have experienced a shift in exit trends, largely due to changing market conditions and investor preferences. One trend that has emerged is a particular type of middle market strategic sale. A transaction in which the PE fund sells its portfolio companies to another fund within the same firm by creating what is called a continuation fund. At the end of the original fund’s life cycle, the PE firm pays back its investors as it would in any other case. It then creates a new fund which is then used to buy one or several portfolio companies of the original fund. In other words, it sells its well-performing portfolio companies to itself through a GP-led secondary transaction.

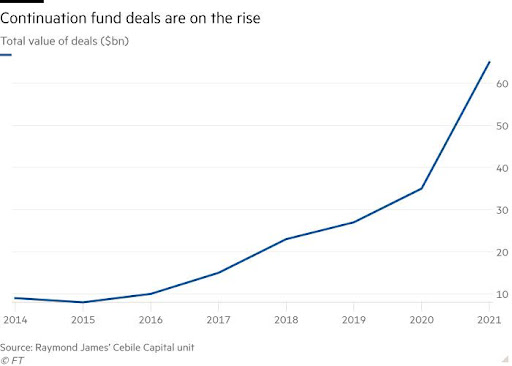

Such deals allow buyout groups to repay their investors without the need to list their companies or source buyers. As we move from an era of booming private market investments and low-interest rates to a slowing economy with more risk-averse investors, selling to yourself has become somewhat of a trend. The structural change of the Private Equity landscape suggests that this phenomenon is here to stay. In 2019, deals worth $27bn were carried out in this way and are up to $65bn in 2021.

In this article, we will look at how the current economic environment has affected the choice of exit strategy, and discuss the rise of GP-led secondaries in more depth.

Exit Strategies

There are several different exit strategies available to PE firms, and the choice of strategy depends on a variety of factors, such as the characteristics of the portfolio company, market conditions, and the firm’s investment objectives. Some common strategies include IPOs, strategic sales (M&A), and secondary buyouts, in which the company is sold to another private equity firm. Other strategies include dividends, recapitalizations, and liquidations. Ultimately, the goal of any fund is to maximise returns for the firm’s investors, which leads to the rise and fall of exit trends throughout economic cycles.

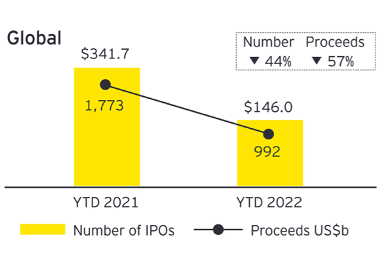

According to EY, in 2022, IPO activity in the US declined to its lowest levels in 20 years, with numbers decreasing by 72% and total proceeds down by 94%. A global 57% decrease in proceeds demonstrated that an IPO is currently not the most profitable or desirable exit strategy. Additional factors such as inflation, rising interest rates, and a stagnant M&A market have contributed to the growth in GP-led secondaries as an exit strategy for PE funds.

PE investors awaiting to claim their returns on 10-year funds maturing in 2023 are increasingly choosing to delay their exit. The possible reasons for this are that the portfolio companies may have fallen in value, or that buyers are looking for discounted deals and are unwilling to pay the fair value. Therefore, continuation funds allow GPs to keep their best-performing companies in-house until exit multiples are what they expected going into the investment.

In the current climate, GPs receive monetary and reputational rewards by selling their companies to themselves. One key benefit is the ability to extend the life of an existing fund, giving the GP more time to work with portfolio companies and realise returns, as opposed to being forced to sell in a buyers’ market. Secondly, continuation funds can help to alleviate pressure on GPs to raise new funds, which can be a time-consuming and challenging process. Overall, continuation funds offer GPs a valuable tool for managing their portfolios, generating returns, and maintaining relationships with investors, while also claiming higher fees.

Over a typical fund’s life cycle, GPs earn higher fees during the investment period which are then reduced over the holding period. With the cycle starting again after the transfer, the fees are brought back to the initial stage fees: a proportion of the amount invested. Additionally, PE funds usually receive a 20% share of profits at the sale of the portfolio company. With continuation funds, the GP will receive this payment twice, once when it is sold internally, and once when it is sold to the final buyer. Moreover, the PE fund owes investors around an 8% return before it can obtain its share of profits. If GPs don’t believe the fund will achieve this return rate, a continuation allows them to keep the investment going until it reaches that return, and consequently earns a profit.

The current economic climate may further increase the chance for funds to not find any viable buyers for their companies. This might force the management to use liquidation as an exit strategy, which takes proceedings from the individual sale of all balance sheet assets. Often, liquidation generates low returns, therefore it is very likely to not produce any sales profits for the fund. Meanwhile, the sale to a GP-led secondary avoids this unprofitable alternative.

The Issues Linked to GP-Led Secondaries

A potential issue with the emergence of GP-led secondaries is the lack of transparency associated with the structuring of the new deals. The process will require the re-negotiation of a number of different factors; the sale of the assets to the continuation fund; the structure of how management fees are paid; the evolution of carried interest into the new fund; and the organisation of different classes of LP’s, are all areas where information can be lost in communication to partners. This presents a significant issue for any LP who may lack the resources or expertise to participate in the GP-led secondary.

The most significant concern is that GP-Secondaries introduce a very apparent conflict of interest for the General Partners. Whilst they have a fiduciary duty to act in the best interest of their LP’s, the process of creating a continuation fund provides many opportunities for them to improve their own upside at a cost to the investors. GPs are clearly incentivized to inflate valuations as this will allow them to levy higher management fees and carried interest, this has become apparent in a number of deals which have peaked public interest due to their enormous valuations.

One example is BC Partners’ continuation of their portfolio holding Acuris, a company specialising in providing financial news and data. After their initial acquisition in 2014 at a reported value of $1.1 Billion, in 2017 BC Partners offered to sell Acuris to a continuation fund at a value of $1.5 Billion, suggesting a return of 36% in just 3 years. This sparked debate where many LPs were sceptical of how strong Acuris’ growth prospects truly were, thus highlighting how a conflict may be the reason for such a valuation. However, when the GP-led secondary did take place, the continuation fund was oversubscribed, suggesting a consensus of this being a fair valuation.

We look at the case of Access Group to better understand this particular pitfall of GP-led secondary transactions. Access Group is a UK-based software and IT services company that has been involved in a valuation controversy in recent years. The company’s valuation has risen an eye-watering 3,800 per cent since 2015, and over the past year, investors have given it a valuation that places it among Britain’s biggest companies.

The company was acquired by Hg in 2019 in a deal that valued the company at £1.4 billion. The acquisition was controversial due to concerns about the high valuations it received and the level of debt that Hg took on to finance the acquisition. Some industry experts and investors have questioned the sustainability of Access Group’s growth and the long-term outlook for the IT services industry, suggesting that the company may struggle to generate the returns necessary to justify its high valuation.

In addition, the acquisition process was criticised for being opaque and lacking transparency. There were concerns about the role of advisors in the deal and the level of due diligence that was conducted, which raised questions about the accuracy of the valuation. Finally, there were also reports of executive turnover and cultural clashes following the acquisition, which further fueled concerns about the company’s long-term outlook.

Despite these criticisms, Access Group has continued to perform well in the years since its acquisition. The company has continued to expand its offerings and invest in new technology and services, which has helped to drive growth and generate cash flow. However, the controversy surrounding the Access Group valuation highlights the importance of conducting thorough due diligence and evaluating the long-term prospects of a company before making investment decisions.

Conclusion

To conclude, the Private Equity industry is experiencing a shift in exit strategies intensified by the need to navigate the current economic climate with volatile public markets and contractionary monetary policies. A solution which is becoming apparently popular is the GP-led secondary. Continuation funds allow GPs to repay investors without going to increasingly volatile and poor performing public markets. Private valuations allow Private Equity firms to take a more long-term outlook on intrinsic value and growth prospects. The benefits to GP’s are obvious; prolonging the length of the investment; generating great returns; and claiming higher fees. However, the lack of transparency and potential conflict of interest associated with GP-led secondaries present significant issues for investors. Despite these concerns, the rise of GP-led secondaries appears to be here to stay, as investors are seeking ways to achieve returns amid slowing economic growth and risk-averse market conditions.

Editor: Matthew Gleeson

Comments are closed.