by Luca Deslondes, Jacopo D’Angelo, and Matteo Panizza

Introduction

CVC Capital Partners, Europe’s biggest Private Equity (PE) player and one of the most reputable firms in the industry, is planning to list on Euronext Amsterdam stock exchange. Goldman Sachs, JPMorgan, and Morgan Stanley are working on the proposal to take the PE giant public, which is expected to happen later this year leading into early 2023 at the latest. The company is aiming for a valuation of more than $20bn, which would make this initial public offering (IPO) one of the biggest in PE history.

The European Private Equity Champion

Based in Luxembourg, CVC Capital Partners is a global Private Equity and Investment Advisory firm established in 1981 as Citicorp Venture Capital, a subsidiary of Citigroup in London. Michael Smith, who was leading the unit, negotiated a spinout from Citibank in 1993 to establish the independent PE company we know today, managing around $133bn in assets.

As of December 2021, the firm employs more than 650 professionals in over 25 offices across the world. The funds administered and advised by CVC have invested in over 100 firms, primarily in North America, Western Europe, and Asia. Firms targeted by the PE giant are sound, well-managed and cash-generative businesses which operate in non-cyclical markets. They are characterised by defendable market positions, predictable cash flows and diversified customer bases, products and geographic footprints.

CVC participates in a vast variety of sectors such as healthcare, chemicals, construction, retail, sports and entertainment. Some of its current investments include Lipton, Breitling, Petco and Spanish clothing firm Cortefiel. Most strikingly, the firm has also cultivated a passion for sports with positions in rugby’s Six Nations as well as cricket, football and motorsport. In fact, among CVC’s most famous deals is its acquisition of Formula 1 in 2006 for $1bn, sold a decade later for $8 billion to Liberty Media Group, resulting in the most lucrative deal in its history. Recently, the buyout firm has jumped in to buy a €2.1 billion stake in the Spanish La Liga, giving it a share of broadcasting and commercial income for 50 years. CVC is expected to treble or even quadruple its investment in ten years time, prompting a rival football dealmaker to declare the investment as “the finest deal in the history of private equity.”

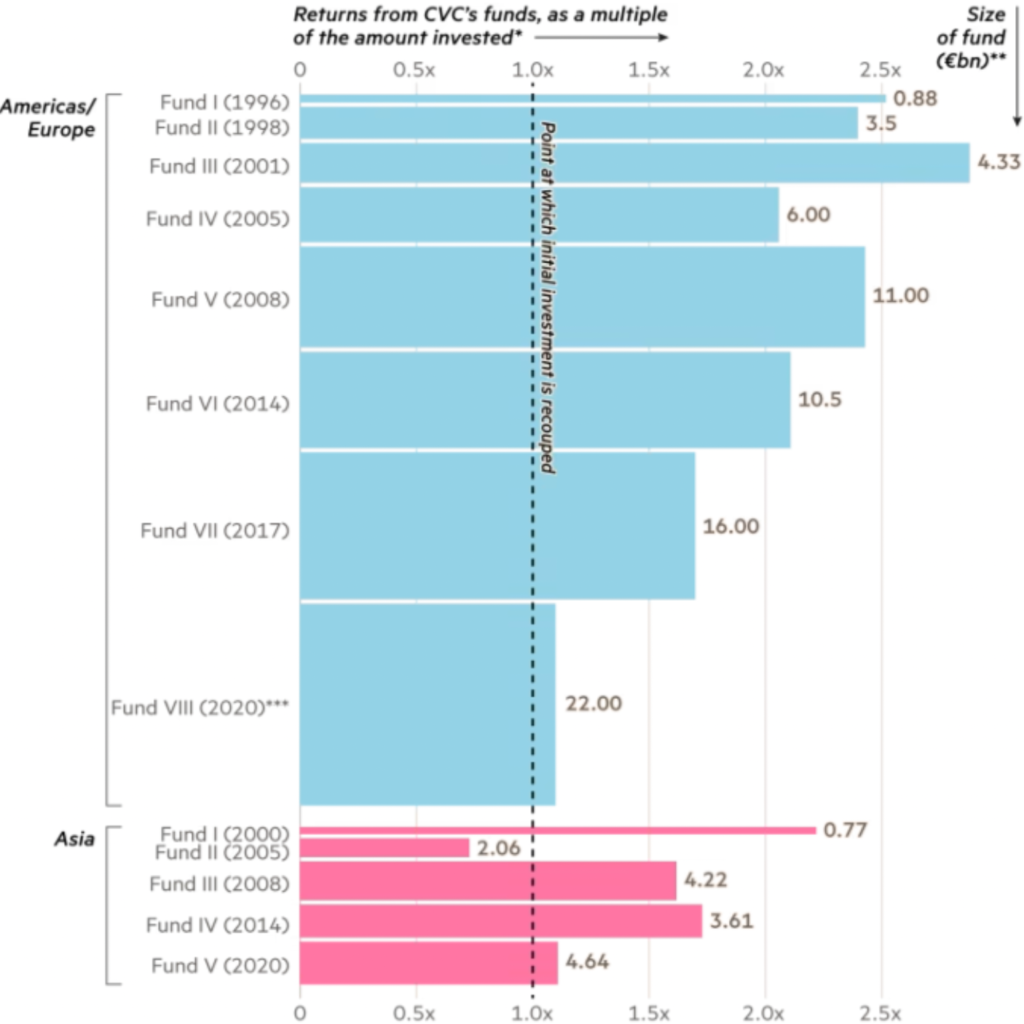

What is certain is that CVC has proved to be a top-tier player in the PE space following its over forty years of dealmaking. The company has achieved incredible profits for its investors with high returns on its multiple funds (see graph below) and has kept up with the pace of the larger US-based funds like KKR, Blackstone and the Carlyle Group.

Cut-throat Culture

As a private company, CVC enjoys various benefits that aren’t shared by its public counterparts. Since its separation from Citi in 1993, chairman Michael Smith has fostered an individualistic and arguably brutal pay structure that rewards success while punishing loss. This resulted in young members making extensive sums of money at CVC compared to elsewhere in the sector and indeed the finance industry as a whole, albeit only under the condition that their deals succeed. CVC itself makes a margin of 20% on its fund’s profit, with the other 80% going to various investors. Of this 20%, the founders, 70% goes to covering expenses and paying external investors, while a whopping 30% gets allocated directly to the team in charge of the respective deal. With the deal captain getting 25% of the team’s earnings. Furthermore, if the members of the deal team also play an administrative role at CVC, they may also receive an additional share of the 70% on top of their existing earnings. However, this heavy emphasis on meritocracy can become an immense burden when a deal goes south. A notable example is Nick Clarry, an important member of CVC who worked on the lucrative Formula 1 and La Liga investments, who’s deal involving British company Autobar resulted in the loss of CVC’s entire investment. He was made to cover millions in losses with his personal funds, eating into a large portion of the earnings he had previously made. Ultimately, the risky pay structure and hyper-individualistic culture have proven successful for CVC. However the increased scrutiny CVC will face post-IPO raises concerns about the model’s sustainability.

A Paradoxical IPO

The question is why a fiercely private firm would put itself at risk of comprising its unique model that has proven to be so successful? The answer lies in the challenges the firm is facing. Going public would enable the firm to keep ahead of rivals EQT, who had their IPO in 2019, while challenging larger rivals Blackstone, KKR and Carlyle. It would also let the company co-founders and outside shareholders, most notably the Kuwait Investment Authority, Hong Kong Monetary Authority, Singapore’s GIC and Blue Owl, to realise their investments. The management, who’s going through a generational shift with co-chairman Steve Koltes stepping down, looks set on going public to grow larger and to position itself at the forefront of the industry.

However, it would bring with it a new degree of publicity, putting in jeopardy the high-risk, high-reward model that is central to the CVC ethos, exposing an extremely secretive firm to public scrutiny. To get around this, CVC has opted to list on the Amsterdam Euronext stock exchange, in a blow to its British roots. The Dutch exchange has more lenient regulations on disclosure of executive pay, fulfilling management’s desire to keep out of public criticism. Additionally, just like Sweden’s EQT, it is likely that the company will opt for a structure that will let it keep most of the profits coming from their 20% performance fees while sharing with investors the income derived from periodical management fees (around 1.5%). This will satisfy market demands due to the regular and predictable nature of management fees, while preserving CVC’s incentive-driven culture.

The firm has already been preparing financially to ensure the success of its IPO. It brought in outside capital by selling a minority stake to Blue Owl’s Dyal Capital unit and increased its asset base by acquiring asset manager Glendower Capital. Both moves are widely considered as precursors to stock market listings in the industry. It is also planning to launch a new fund with a targeted $25bn in assets. During its previously mentioned minority stake sale, the firm was valued at $15bn, in line with rival EQT’s market cap, but its valuation could rise much higher if the IPO successfully convinces markets, as most analysts predict.

CVC is under pressure to raise capital, as they struggle to compete against listed rivals. Especially since they’ve grasped that even smaller rivals are catching up to them. When comparing their estimated IPO valuation of around $20bn with competitors who have already listed, CVC’s IPO could potentially be the largest of all time among PE firms. The most recent one being EQT’s worth over $15bn. Other firms such as Blackstone

($4.1bn), Bridgepoint ($3.9bn) and KKR ($3.56bn) came in much lower. Despite these lower initial valuations, these listed firms have grown at an unimaginable rate since then, with Blackstone, who listed the earliest in 2007, reaching a market cap of $109.18bn, while EQT’s is still a mere $15.79 billion. Highlighting that despite their high estimated valuation, CVC still has to play catch-up to compete with these US giants.

Volatile Markets Interrupt Anticipated Listing

As a result of the volatile market conditions caused by the war in Ukraine and the rising global inflation, CVC has held off on announcing its IPO. However, we can expect CVC to list before the end of the year or in the first quarter of 2023, especially if market conditions show signs of improving following decisive action by central banks. It would be one of the only major IPOs of the year, with companies reluctant to list in light of turbulent market conditions following the pandemic. Nevertheless, the firm has captivated investors’ interest and with its established reputation as a profit-maker, we can expect it to go public successfully.

Sources

https://www.ft.com/content/872b42a8-7685-4684-ac0c-c3c8f5f0be8e

https://www.ft.com/content/f159072f-175a-40f9-9268-a1aacc4233ad

https://www.ft.com/content/088b897e-1ab2-4fe9-aa76-50065a256e11

https://www.ft.com/content/d4afe8b2-284e-4b97-b04c-41c3e910d14f

https://www.ft.com/content/86ce59dc-8625-4000-a52f-603046354d19

https://www.ft.com/content/831a0d91-ee4d-476c-bd69-8d87c533065f

https://www.reuters.com/article/cvc-ipo-idUSKCN2MW28N

https://www.ft.com/content/38ba7219-362d-49a4-a976-180f10ff1770

Editor: Tara Morgan

Comments are closed.