by Liam Fitzgerald, Georg Giulini, and Jorvis Marxsen

Introduction

In a bidding round on October 25th, 2021, the RPSG Group and Private Equity giant CVC Capital Partners secured the rights for two new Indian Premier League franchises. The Indian Premier League (IPL) is India’s national cricket league, which takes place on an annual basis in the form of a two-month-long tournament that attracts the attention of billions of viewers. As a result of its popularity, the IPL is characterized by ever-increasing valuations and high revenues from the sale of its media rights and the league’s sponsorship rights, making it attractive to investors. The following article takes a deeper dive into the involvement of private capital in the IPL. Firstly, the format of the IPL is briefly explained, then the financial situation and monetization strategies are elaborated upon. Finally, the article concludes with an extensive analysis of the recent auction held in Dubai for the league’s newest franchises along with the significance behind the players involved.

Format and Popularity of the Indian Premier League

The Indian Premier League (IPL) is a competition for Indian cricket teams and is played in a shortened game format of cricket called Twenty20. The IPL is organized and supervised by the Board of Control for Cricket in India (BCCI) during a two-month-long tournament. The Twenty20 structure has played a critical role in the successful development of the IPL, as a match lasts only about three hours, i.e. two innings lasting a maximum of 90 minutes each. The game’s length is intended to be comparable to other popular team sports such as football, creating a faster-paced game and making it more attractive for spectators in the stadium and on television. The IPL was founded in 2007 with eight franchises and follows the American league model with guaranteed places in the league for its franchises. After various changes in the participating franchises, two additional IPL franchises licenses were given to CVC Capital Partners and the RPSG Group in 2022 for the Ahmedabad and Lucknow-based teams. Since the beginning, the tournament has been held annually. In 2022, the IPL will start on the 2nd of April, and the finals will be held on the 3rd of June. Thanks to the establishment of the IPL, players are finally being paid lucrative salaries, causing a massive influx of talent, and making the IPL arguably the most attractive cricket tournament worldwide. A study conducted in 2020 by YouGov India showed that the IPL is the most popular sports league/tournament in India, topping the likes of the FIFA World Cup and the ICC Cricket World Cup.

Monetisation of the Indian Premier League

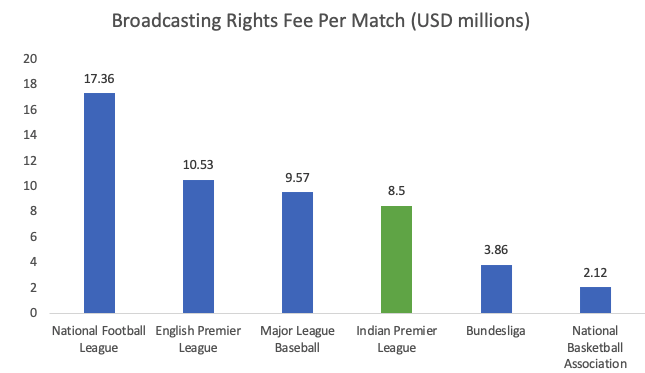

The Indian Premier League derives its value from several factors, first and foremost through the sale of its media rights. During the first auction of its media rights for the 2008 tournament, Sony Entertainment Television and World Sport Group were the highest bidders for the global broadcasting rights for a duration of 10 years, with a winning bid of $1bn. The capital went towards franchises, the IPL, and the tournaments´ prize money. Fast forward to 2017: Due to its increasing popularity, especially in India, the second auction of the IPL media rights for the tournaments between 2018 and 2022 attracted large international companies trying to further break into the Indian market to bid for the media rights. Star India, a subsidiary of 21st Century Fox and part of Disney, won the media rights auction, outbidding Sony with a record winning bid of $2.6bn. The per-year value of the media rights thus experienced a 5.2x increase, going from $100m to $520m. The broadcasting rights fees per match of the IPL are comparable to those of the MLB (Major League Baseball), exceeding many other major leagues, including the Bundesliga and the NBA, as depicted in the figure below.

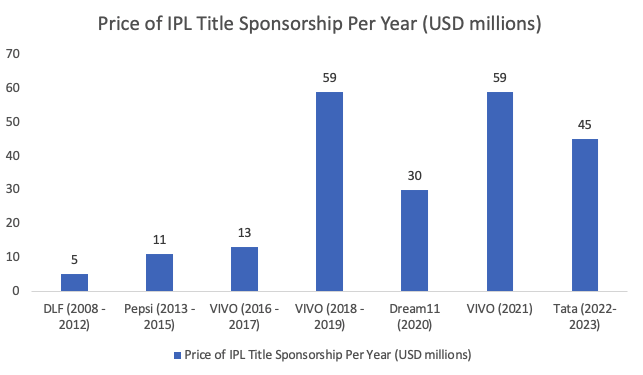

In addition to Star India, firms such as Facebook, Yahoo, and Amazon showed interest in the media rights during the most recent bidding round and are expected to submit a formal bid in the upcoming e-auction for the 2023 to 2027 rights. The 2023 to 2027 media rights will be unbundled into television and digital rights to maximize profits for the IPL and its teams. Prices for the media rights are expected to be more than double the $2.6bn paid by Sony for the 2017 to 2022 rights. The dramatic increase results from the growth in the number of teams and the number of games in the upcoming tournaments. Moreover, the league is financed through the sale of its title sponsorship rights. Chinese mobile handset manufacturer VIVO retained the IPL title sponsorship for the 2018, 2019, and 2021 seasons but pulled their support in 2020 because of geopolitical tensions between China and India, resulting in a one-year sponsorship by fantasy sports company Dream11 for almost half of what VIVO paid. As seen in the graph below, prices of the title sponsorship rights have risen since the beginning of the IPL in 2008. For the upcoming 2022 and 2023 tournaments, the Indian company Tata replaced VIVO as the title sponsor.

The high prices paid by broadcasting companies for the media rights of the IPL and the title sponsorship can be explained by the tournament’s increasing popularity across India and advertisers’ scramble to promote their brands during games. The IPL represents the largest sporting event in India, with up to 200 million viewers per game, and thus the chance for broadcasters to gain numerous new subscribers. Definitive evidence in this regard comes from the comparison of Hotstar (Disney+) and Netflix subscribers in India. Even though both platforms offer similar content to viewers, only Hotstar has the rights to stream the games of the IPL and has approximately nine times as many subscribers as Netflix does (45 million vs. 5.5 million). As the Indian economy is set to boom in the next five years, advertisers are scrambling to promote their brands during IPL games. Especially for relatively young companies, the IPL presents an invaluable opportunity to gain instant brand recognition. For foreign companies, advertisement during matches can serve as a means to establish themselves in the Indian market. This results in advertisement rates increasing by as much 25-30% to around $24,000 for ten seconds of screen time. Although it pales in comparison to the costs of commercials during national sports league tournaments in America, the considerable growth exemplifies the attraction of the IPL market, which continues to develop.

Private Equity Involvement in the Indian Premier League

On October 25th, 2021, there was an auction to own and operate two new IPL franchises. The auction was held in Dubai and organized by the Board of Control for Cricket in India (BCCI). The auction was set up as the following: The top two bidders would be granted ownership of two new IPL franchises and choose their team’s base from a predetermined selection of cities. In the end, Dr. Sanjeev Goenka’s RPSG Group and CVC Capital Partners were the top bidders and chose the cities Lucknow and Ahmedabad, respectively. RPSG had a winning bid of 70.9bn Rupees, the equivalent of $949m, while CVC bid around 56.3bn Rupees, the equivalent of $753m. Other less fortunate attendees included several leading industrial groups, such as the Adani Group, Aurobindo Pharma, Torrent Pharma, HT Media, and some well-known Bollywood celebrities.

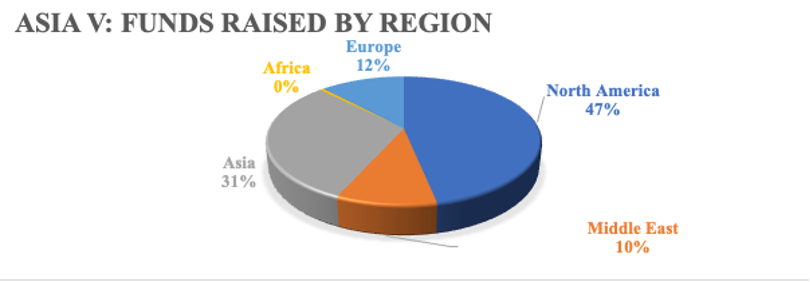

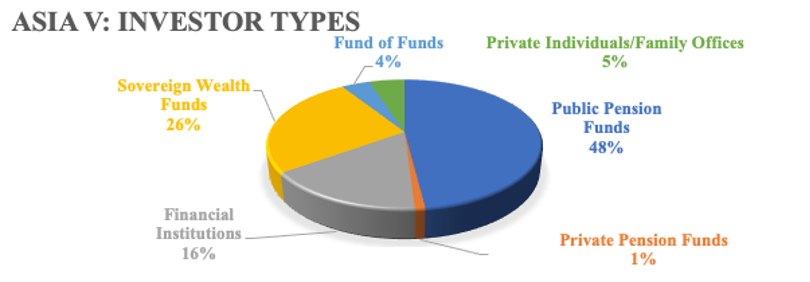

RPSG, with roots dating back to the early 1800s, was founded by Dr. Sanjiv Goenka in July of 2011 in Kolkata. The group has a $6bn asset base and $4bn in revenue, with businesses in over 35 countries spanning various sectors, including power and energy, carbon black manufacturing, retail, media, and entertainment. Before their bid for the IPL team, the “Lucknow Super Giants,” they owned the “Rising Pune Supergiant” from 2016 to 2017. However, the “Rising Pune Supergiant” was not dissolved due to a lack of success; they came in second in the 2017 IPL Final – losing by only one run. In fact, the team was only allowed to be in the league for two years, from 2015 to 2017. Their purpose was to serve as two-season replacements for IPL teams suspended because of their owners’ alleged involvement in illegal betting. Despite paying almost $1bn and outbidding the next competitor by $200m, Dr. Sanjiv Goenka, the Chairman of RPSG, said that it is a good investment over the next ten years. During an exclusive interview with India Today TV, he said that based on his team’s calculations, “the net difference… is close to half” of what he paid due to the broadcasting rights from the BCCI.CVC Capital’s ownership of an IPL team is unlike their previous sports investments in Rugby, Moto GP, Formula 1, and La Liga. The globally bullish sports investor is now the first-ever western Private Equity group having outright ownership of any IPL or sports team in India – a significant milestone regarding the trend of alternative finance’s investments into sports leagues and sports teams worldwide. CVC Capital Partners, based in Luxemburg and established in 1981, is a world leader in Private Equity and Credit with $125bn of assets under management, $165bn of funds committed, and a global network of 24 offices across Europe, the Americas, and the Asia Pacific region. Their Private Equity platform manages $97bn of assets across four different sectors: Europe/Americas; Asia; Strategic Opportunities; and Growth Partners. Of the four sectors, the Asian fund of CVC Capital was responsible for the bid of the Ahmedabad-based IPL team. More specifically, Asia V, the fifth Asian fund, which fundraised over $4.325bn in 2020 across five different regions and six different investor types, as depicted in the figures below.

The distinction between the capital from CVC’s Asian fund making the bid versus the conglomerate’s European fund was critical due to the portfolio companies Tipco and Sisal. Both companies are listed under the portfolio of the European fund and are related to the sports betting industry. The connection kept the BCCI wary due to the Public Gambling Act of 1867, which only allows betting on games of skill – ruling out cricket, designated as a game of chance. In other words, due to this link, the future of the CVC’s ownership of their IPL team was in question, meaning that the BCCI could then award the third highest bidder, Adani, with the IPL team instead. Fortunately, the BCCI then laid CVC’s worries to rest as the Asian fund was designated “clean,” as the companies were only linked to the European fund. The BCCI then gave the all-clear a couple of months later in December, officially, with a Letter of Intent.

Although there have been other notable PE involvements in the IPL before, including Redbird Capital Partner’s minority-stake investment in the Rajasthan Royals, the outright ownership by CVC provides a more substantial example of Private Equity’s entrance into sports leagues with large international audiences across the globe. Regarding the IPL, investors are looking to capitalize on the growing popularity as its audiences reach up to 200m for a single match. The ever-increasing amounts being paid for the media rights of the IPL highlight the possibility for team owners to create value, as the revenues from the media rights are mainly distributed across the league’s teams. Further ascertaining the increasing valuations of the league, the IPL follows the model of American sports with guaranteed places in the competition each season. As Brijesh Patel, chairman of the IPL, said on the new franchise buyers, “The level of interest among the interested parties prove that IPL is among the most sought-after sporting leagues in the world.”

Outlook

As delineated above, the IPL presents a lucrative opportunity for investors; additionally, CVC’s involvement further illustrates Private Equity’s expansion into unprecedented markets. Although the popularity of the IPL is mainly concentrated within India, the considerable revenues from the media rights and the closed format of the IPL with guaranteed places for the franchises, limiting risks for investors, will continue to allure outside investors. For that reason, regarding future expansions of the IPL or sales of existing franchises, it is likely to see more PE players making bids for teams.

Sources

https://thecapitalquest.com/2021/10/25/cvc-capital-wins-bid-for-ipl-cricket-team-for-nearly-750-mn/

https://www.sportspromedia.com/news/ipl-expansion-franchise-cvc-rspg-glazers-lucknow-ahmedabad-bcii/

https://www.vccircle.com/cvc-capital-partners-now-bats-for-ahmedabad-ipl-franchise

https://www.ft.com/content/d251ebc2-4b24-407c-975d-719e6ad89218

https://en.wikipedia.org/wiki/Twenty20

https://en.wikipedia.org/wiki/Indian_Premier_League

https://www.espncricinfo.com/story/sony-and-world-sports-group-bag-ipl-television-rights-330881

https://www.espncricinfo.com/story/vivo-retains-ipl-title-rights-till-2022-after-massive-bid-1106833

https://www.ft.com/content/309e2588-5cc9-4347-8989-88ad263fd3b5

https://www.ft.com/content/99438da6-9156-11e7-a9e6-11d2f0ebb7f0

https://www.ft.com/content/a4546682-8bec-4c52-87f0-4c793073ed49

Editor: Tara Morgan

Comments are closed.